DXY firmed last night:

AUD softened:

North Asia too:

The warmongers of the European fringe lifted oil:

Metals mostly eased:

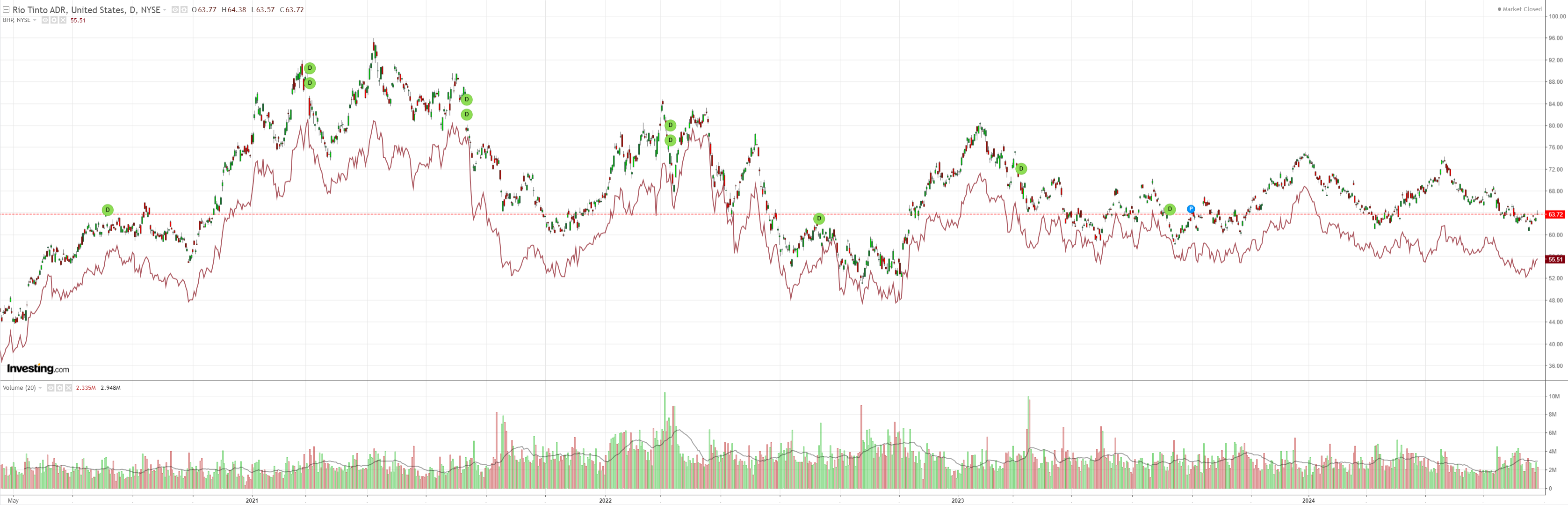

Miners up:

EM down:

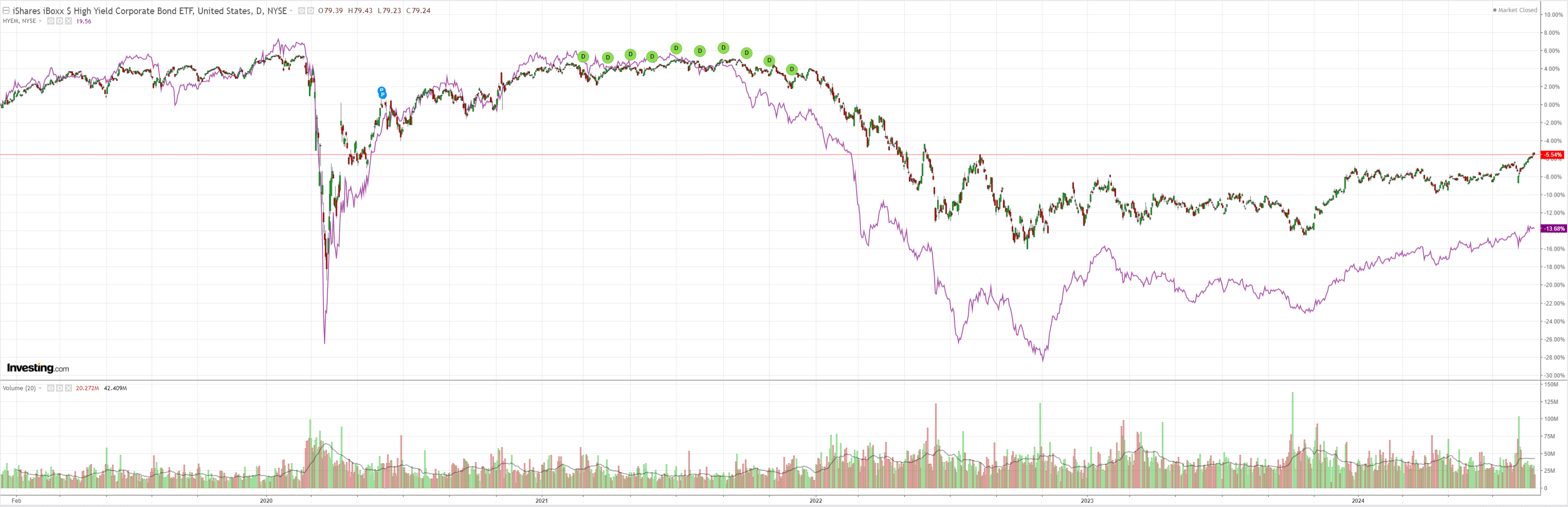

Junk has cooled its jets:

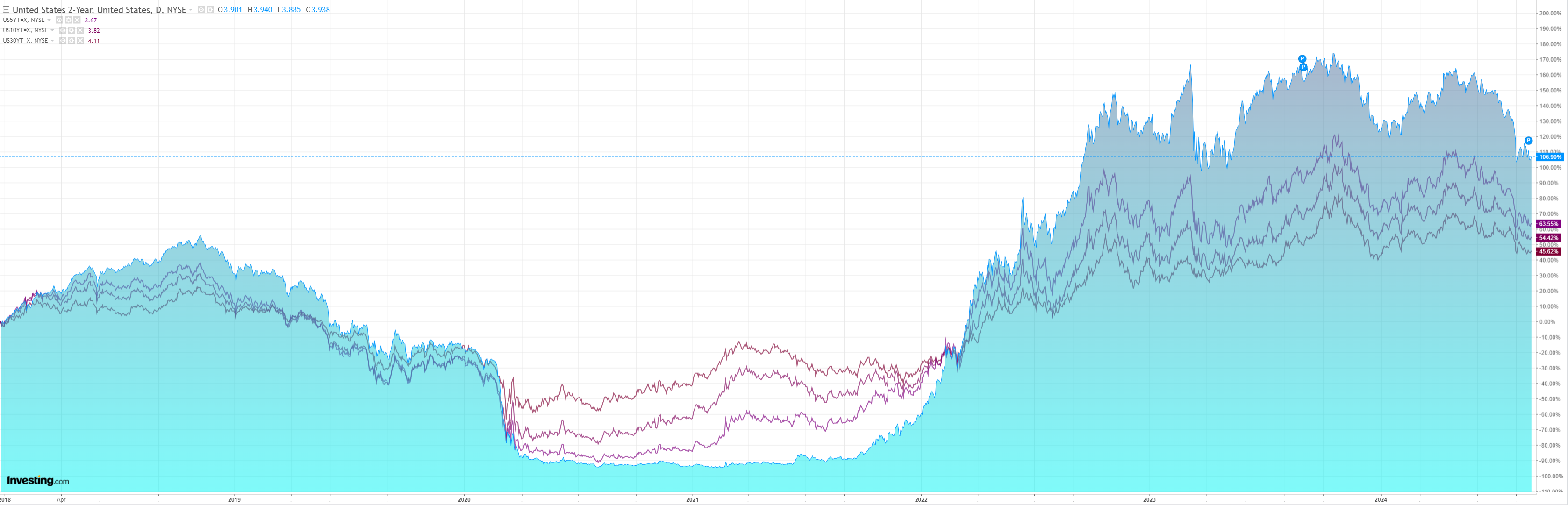

Yields firmed:

Stocks eased:

BofA sums my views pretty well:

AUD: rates tailwind…

We continue to see the AUD gradually higher over the next few quarters (year-end’24 forecast: 0.69/ year-end’25: 0.72) but near-term upside is likely to be capped by the weak outlook for Australia’s iron ore exports.

The divergence between economic outcomes in Australia and the US islikely to become more pronounced with narrowing rate differentials the primary tailwind for AUD in our forecasts.

The Reserve Bank of Australia (RBA) has sounded especially hawkish since its August meeting, and recent data suggests the Australian labour market remains resilient while inflation is still too high for the RBA to contemplate rate cuts….

A 0.70 handle in AUDUSD looks unlikely without improvement in China’s outlook, of which there is little evidence yet.

Lead indicators of China’s imports from Australia, such as new home sales and credit growth, remain anemic.

That said, with China sentiment already at bearish extremes, it is unlikely to be a prominent driver of AUD depreciation either, in our view.

We favor AUD longs vs. non-USD crosses, which tend to have a lower beta to China risk.

Flows & Positioning: lighter but long, room vs EUR, USDAUD positioning is the longest in G10 based on our metrics but lighter vs. end-Q2.

We see it far from stretched vs. USD & EUR, but we do see risks around AUD/NZD longs.