Meet Karen Fermin. She is an occupational therapist, which is a highly sought-after profession. She spent years at the university, gaining her degree, yet all she can afford is a micro-apartment for herself and her daughter that is barely large enough to swing a cat.

The ABC’s article on Ms Fermin’s situation should be centred on the absurdity of a university-qualified professional being forced to live in a micro-apartment. Instead, it is presented as a triumph, cheered on by the NSW housing minister:

Walking into her new studio apartment for the first time, Karen Fermin breaks into a wide grin.

“I can see it’s going to work,” she says giving her daughter a nod…

It doesn’t take long for Ms Fermin and her daughter to complete the tour. All up, their studio is about 25 square metres: space for a bed and perhaps a small table and chairs, a kitchenette, and a bathroom…

NSW Housing Minister Rose Jackson saw potential in the Nightingale model.

“We do want to see more of them,” Ms Jackson said…

This gaslighting was from March. The AFR is now promoting micro-apartments with an average size of around 25 square metres as a key solution to the housing crisis. And they are again being cheered on by NSW Housing Minister Rose Jackson:

Record low vacancy rates, a cost-of-living crunch and demand for more flexible living options from digital nomads and Millennials are driving plans by developers and fund managers to build thousands of micro apartments in big cities across Australia…

The average apartment size would be around 25 square metres – less than half the size of a typical 55-square-metre serviced apartment and equivalent to modern student accommodation – but will include a kitchenette, toilet and bathroom…

“We see flex-living as one of the fastest growing sub-segments of the multifamily [or build-to-rent] sector as councils globally see the offering of smaller and more flexible accommodation solutions a way to take pressure off more people wanting to be in urban environments,” said Sabine Schaffer, Pro-invest co-founder and Europe CEO.

“We are working with local government about how we can look at expedited planning pathways and planning approvals and waived developer charges to make these projects more viable,” said NSW Housing Minister Rose Jackson.

We all understand why this is happening. The federal government’s mass immigration policy is forcing Sydneysiders to live in high-rise slums.

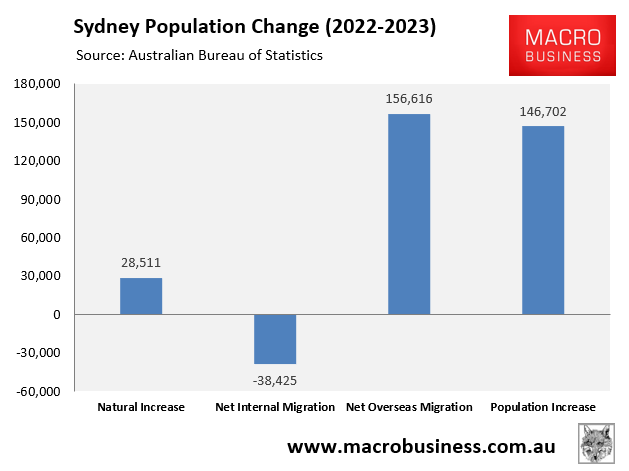

Sydney received 156,600 net overseas migrants in 2022-23, while 38,400 existing residents departed the city:

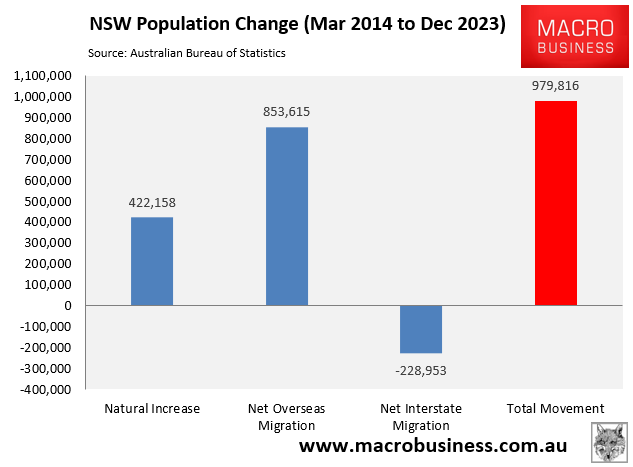

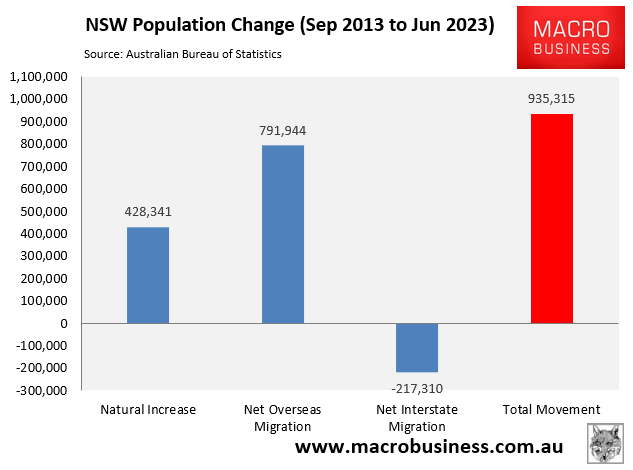

In the decade to December 2023, New South Wales’ population grew by around 980,000 people, with net overseas migration accounting for 853,600, or 87% of this increase.

The majority of this net overseas migration arrived in Sydney, where the population has increased by around 1.5 million people this century, almost completely via net overseas migration.

Instead of putting a curb on migration, politicians, the media, and most economists continue to mislead the public into believing that Sydney’s housing woes are a supply issue rather than an excessive immigration problem.

Some charlatans, like Peter Tulip, even try to gaslight that this extreme immigration is lifting living standards:

Sydney residents are being told that they must surrender to high-rise, shoe box living in order to accommodate a future population of around nine million people.

According to the Urban Taskforce, high-rise living will become the standard, with only 25% of dwellings in Sydney being detached by 2056, down from 55% in 2016.

The Australian Dream has died, and micro-apartments and lies have taken their place.

And the developer lobby is laughing all the way to the bank.