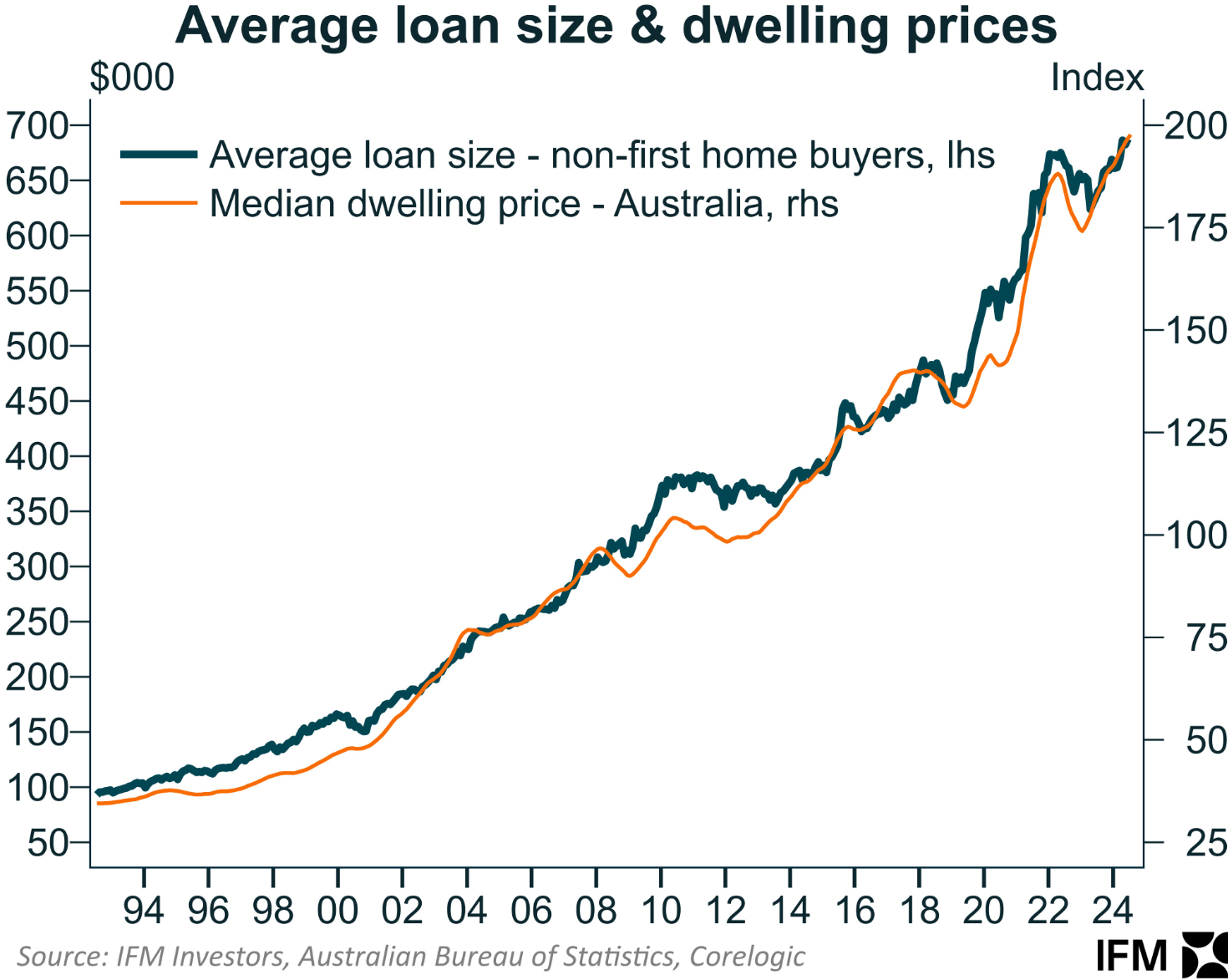

Last week, the Australian Bureau of Statistics (ABS) revealed that the average mortgage size had hit a record high of $636,600, matching the surge in home prices:

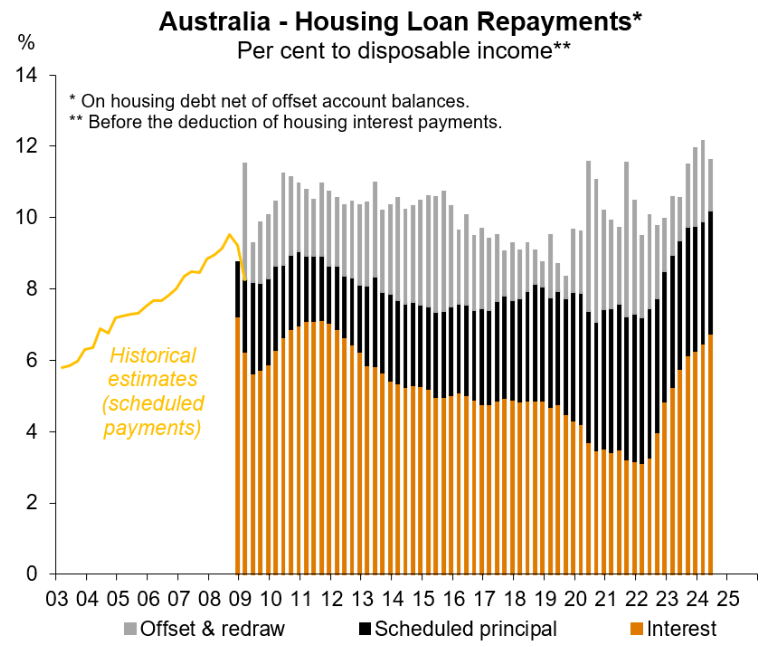

Not surprisingly, new data compiled by Justin Fabo at Antipodean Macro shows that “Australian households devoted a record-high share of aggregate disposable income to scheduled housing loan repayments in Q2”:

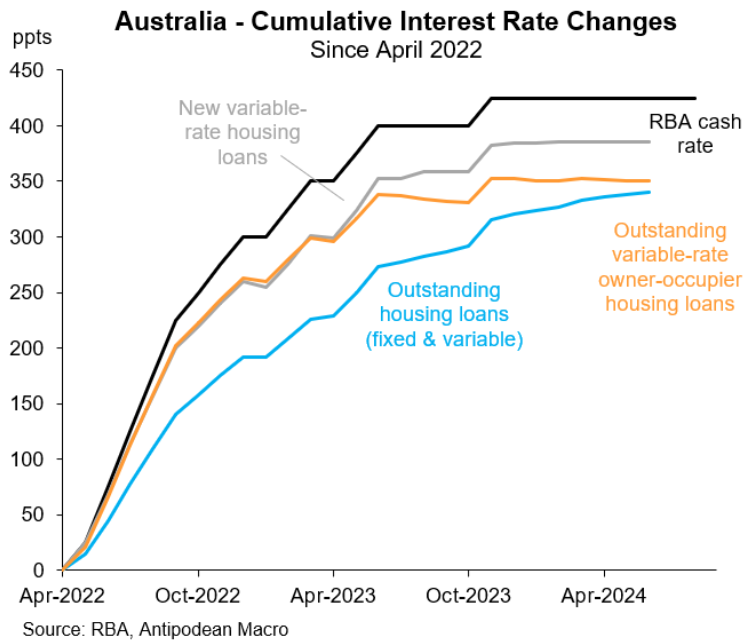

The increase in scheduled repayments is in response to higher average mortgage rates, which continue to edge higher as cheaper fixed-rate mortgages expire and revert to higher variable rates:

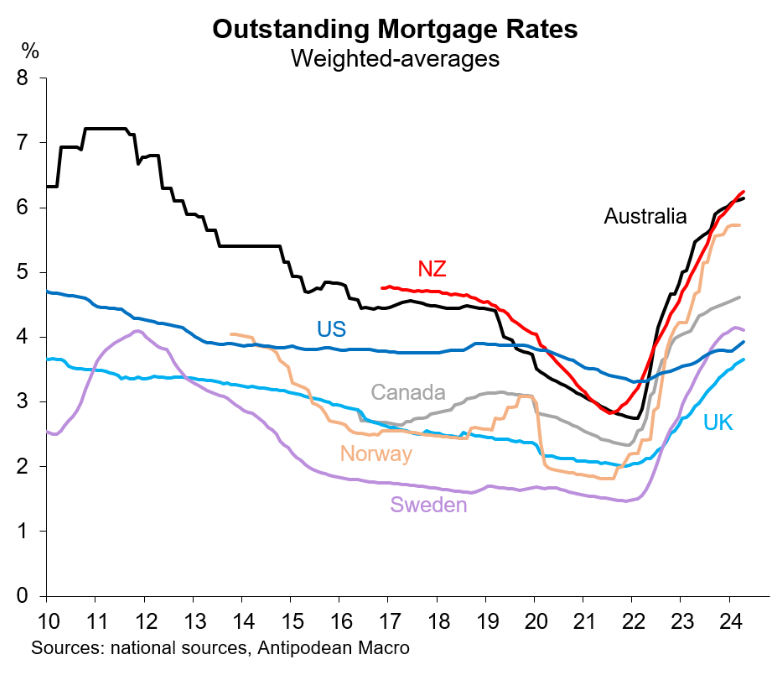

Australia, alongside New Zealand, has some of the highest mortgage rates in the world, as illustrated below:

The above charts explain why the Reserve Bank of Australia (RBA) is so reluctant to lift the official cash rate further.

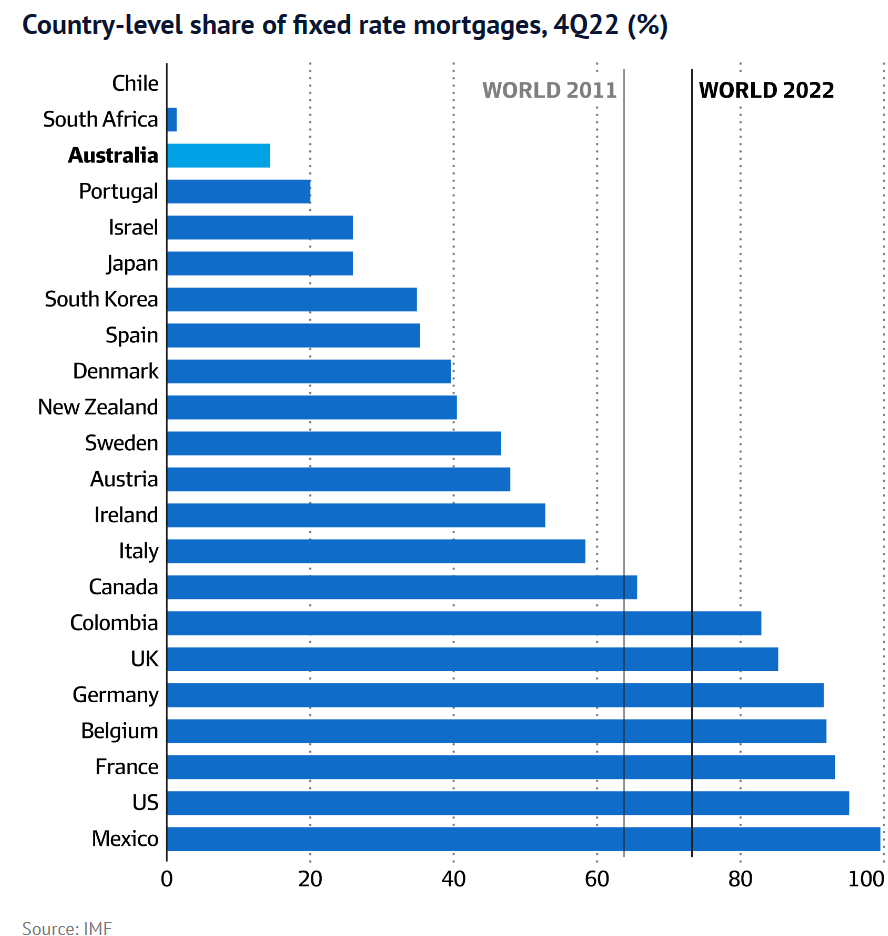

Australian monetary policy is already highly restrictive relative to the rest of the world, owing to Australia’s high share of variable rate mortgages:

Although the RBA has lifted official interest rates by less than many other central banks, the RBA’s monetary tightening has been passed on more aggressively to Australian borrowers.

Moreover, average mortgage rates are continuing to rise slowly amid the expiration of fixed-rate mortgages, representing a de facto tightening of monetary policy.