When inflation and population growth are taken into account, Australia’s retail sector remains stuck in a deep and protracted recession.

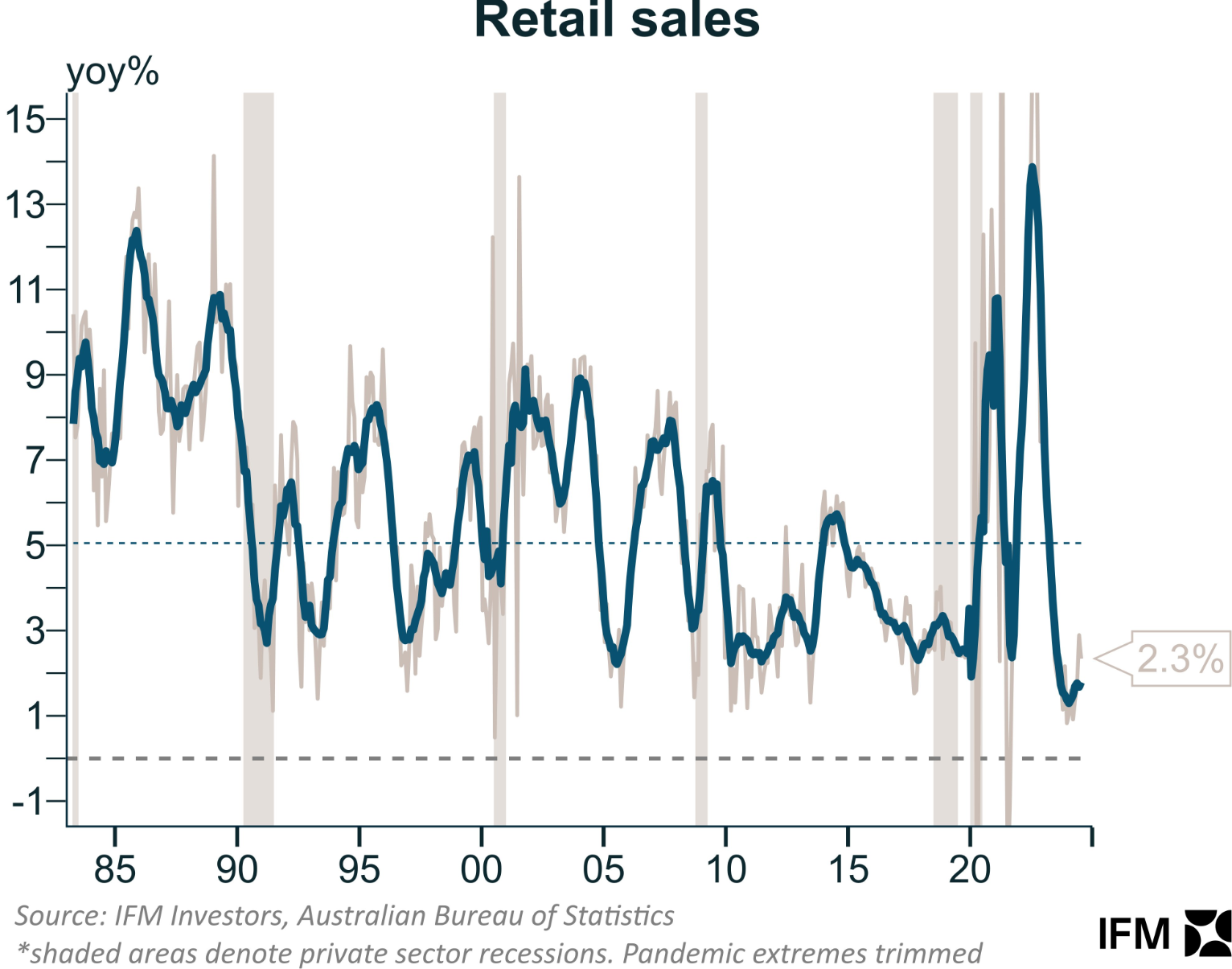

On Friday, the Australian Bureau of Statistics (ABS) released retail trade data for July, which showed that turnover in nominal dollar terms was flat for the month and rose by only 2.3% year-on-year:

The poor result suggests that most of the Stage 2 tax cut boost to incomes was saved rather than spent in July.

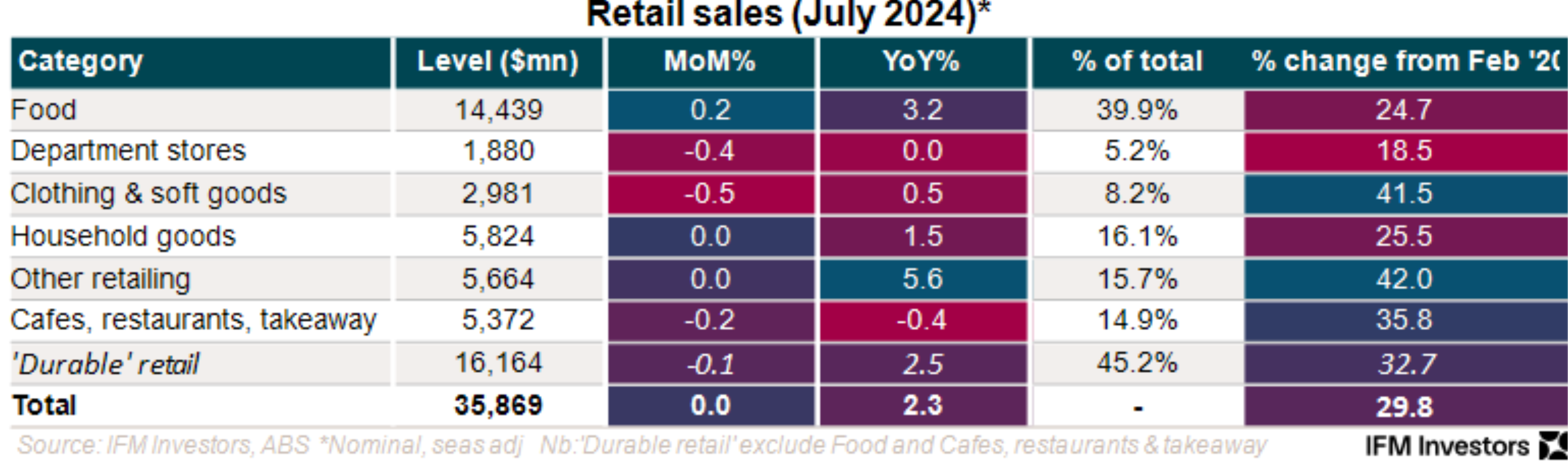

The following table from Alex Joiner at IFM Investors shows the breakdown in retail sales by major component:

Subtracting 3.5% CPI inflation (July monthly indicator) and circa 2.5% population growth suggests that retail sales fell by around 4% year-on-year in real per capita terms.

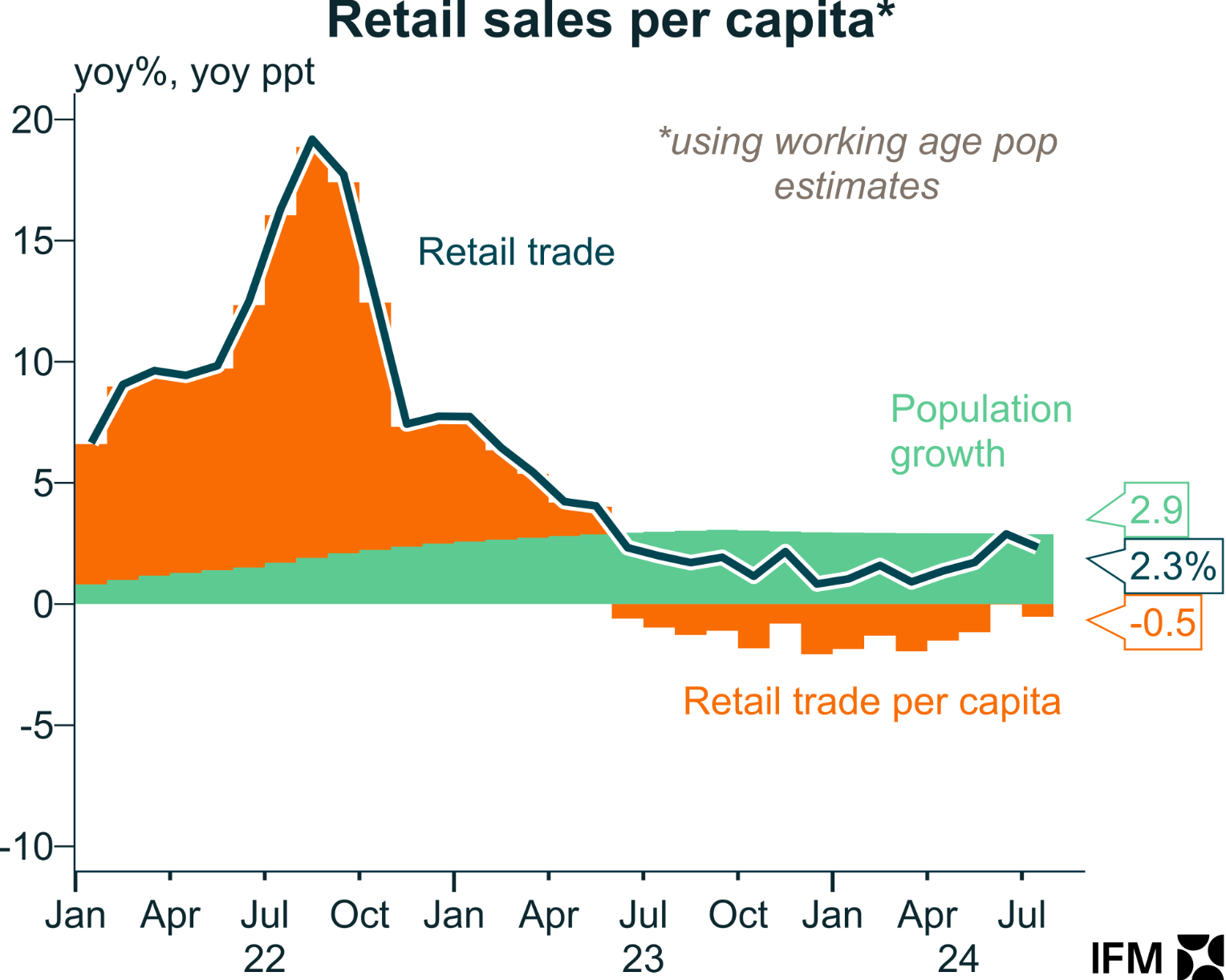

Alex Joiner posted the following chart on Twitter (X) showing that per capita retail sales have been negative in year-on-year terms for 14 straight months when using the working-age population as a proxy:

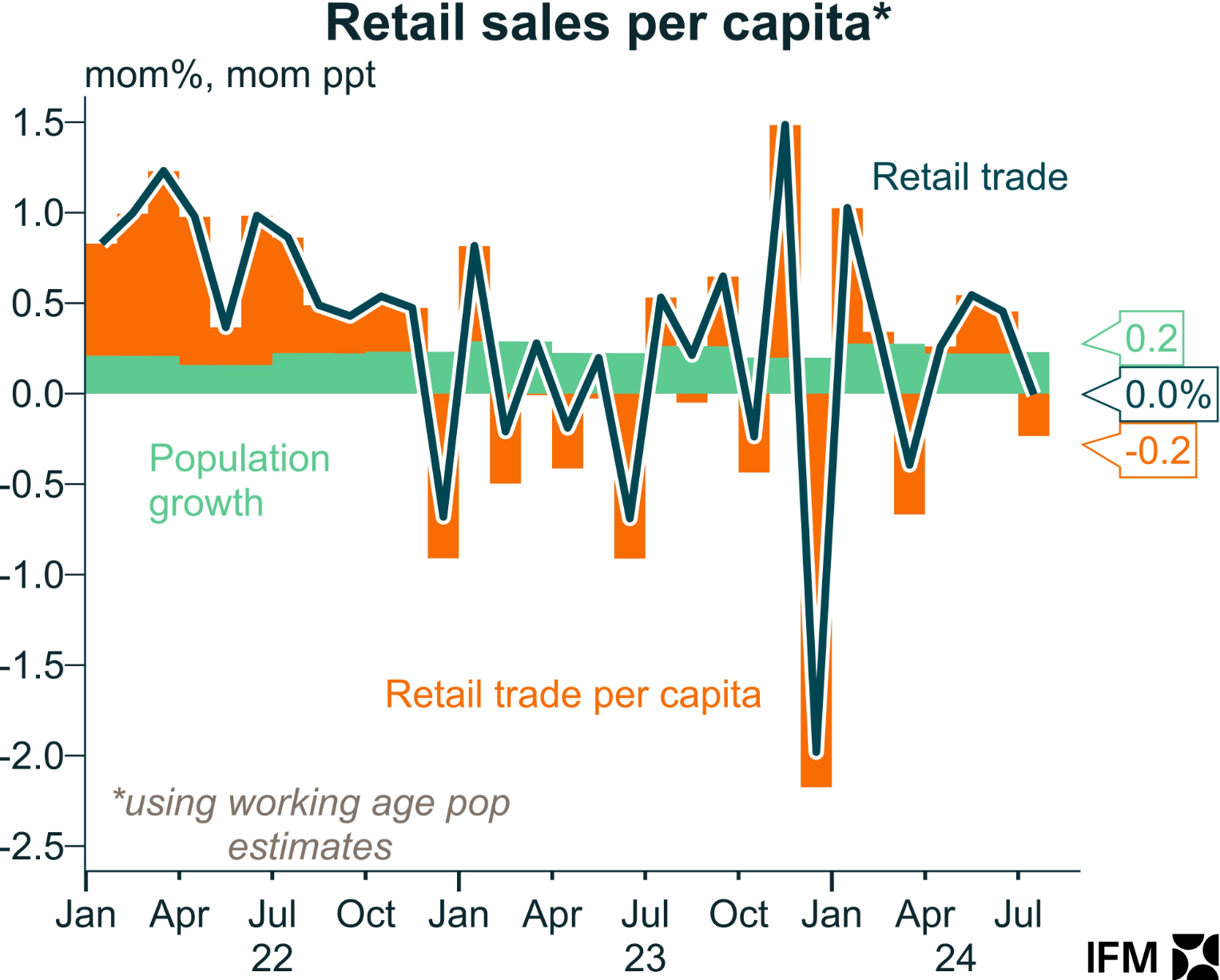

Joiner also noted that Australians are willing to spend a bit more in sales periods and for big events and then pullback spending sharply in other months:

The Q2 national accounts, which the ABS will release next week, will reveal that the household sector led a sixth consecutive quarter of declining per capita GDP.

The weakness of the household sector will dissuade the RBA from hiking rates.