The Australian Bureau of Statistics (ABS) has released its CPI indicator for July, which came in a little above expectations.

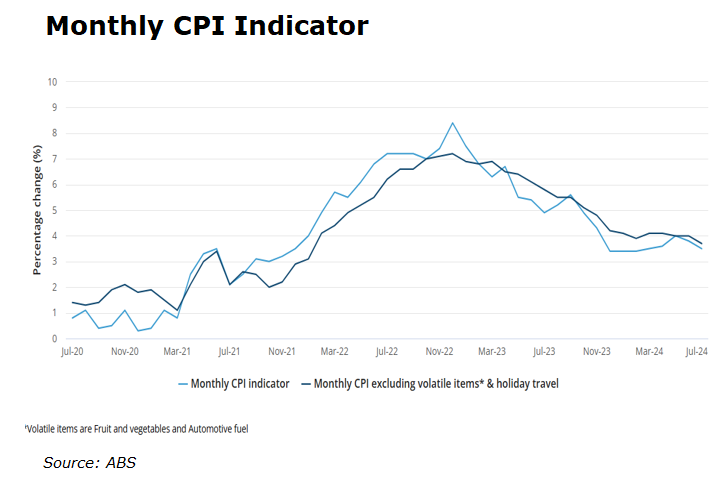

The CPI Indicator rose 3.5% in the 12 months to July 2024, down from 3.8% in June. Economists had tipped a 3.4% increase.

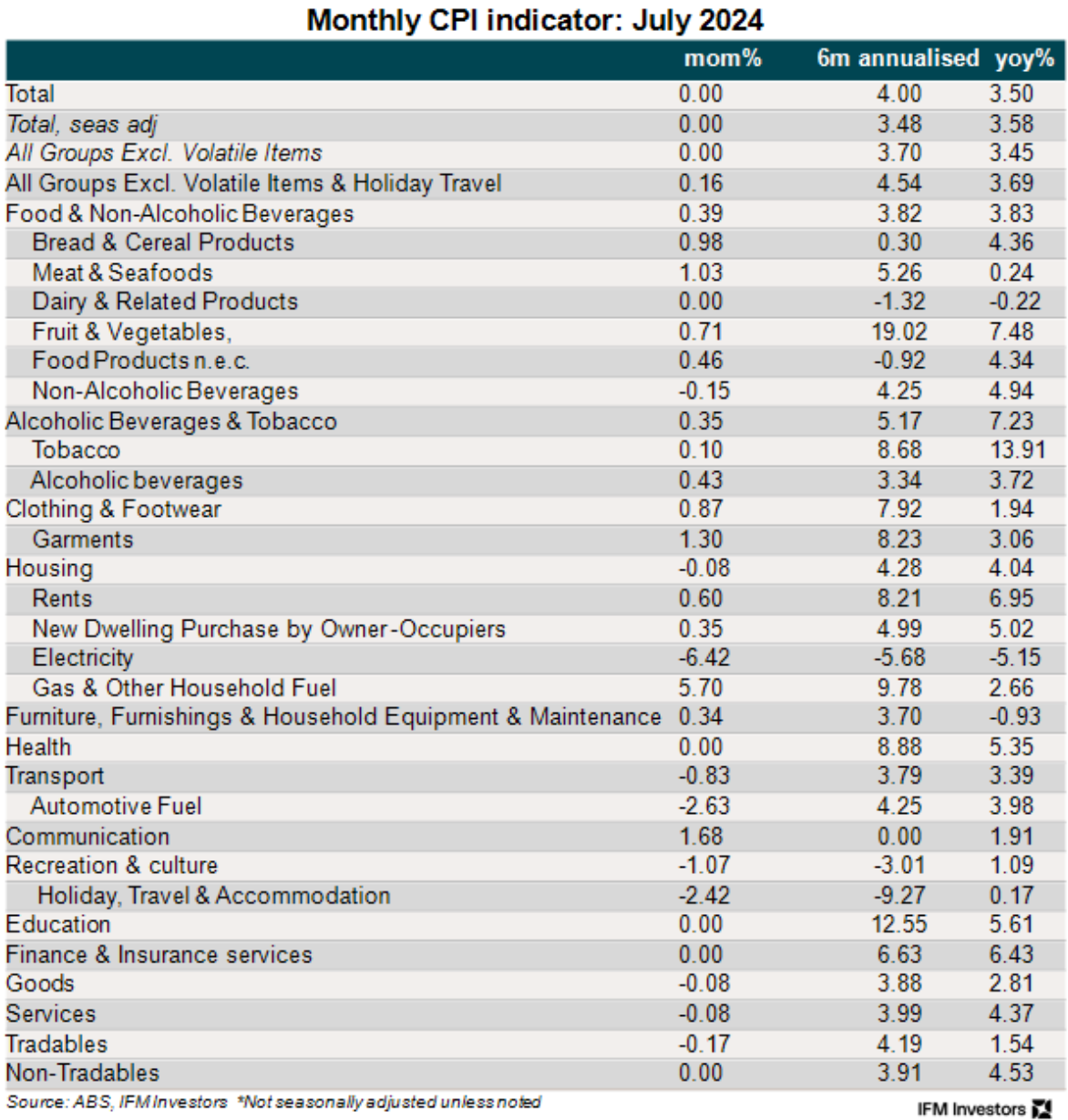

The following graphic from Alex Joiner at IFM Investors breaks down the changes by component:

The most significant contributors to the annual rise were Housing (+4.0%), Food and non-alcoholic beverages (+3.8%), Alcohol and tobacco (+7.2%), and Transport (+3.4%).

Underlying inflation, which excludes volatile items, was 3.7% in July, down from 4.0% in June.

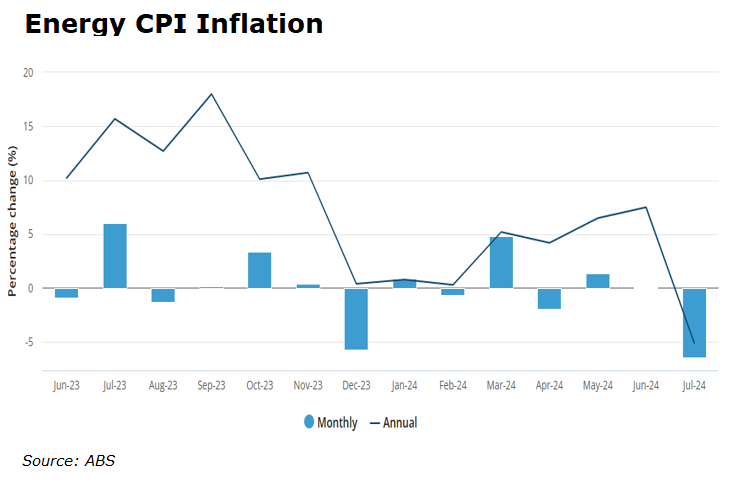

The introduction of new Commonwealth and State rebates drove energy inflation lower in July and will have a bigger impact next month.

Electricity prices fell 5.1% in the 12 months to July, down from a rise of 7.5%:

“The first instalments of the 2024-25 Commonwealth Energy Bill Relief Fund rebates began in Queensland and Western Australia from July 2024 with other States and Territories to follow from August”, Leigh Merrington, ABS acting head of prices statistics, said.

“In addition, State-specific rebates were introduced in Western Australia, Queensland and Tasmania. Altogether these rebates led to a 6.4% fall in the month of July. Excluding the rebates, Electricity prices would have risen 0.9% in July”.

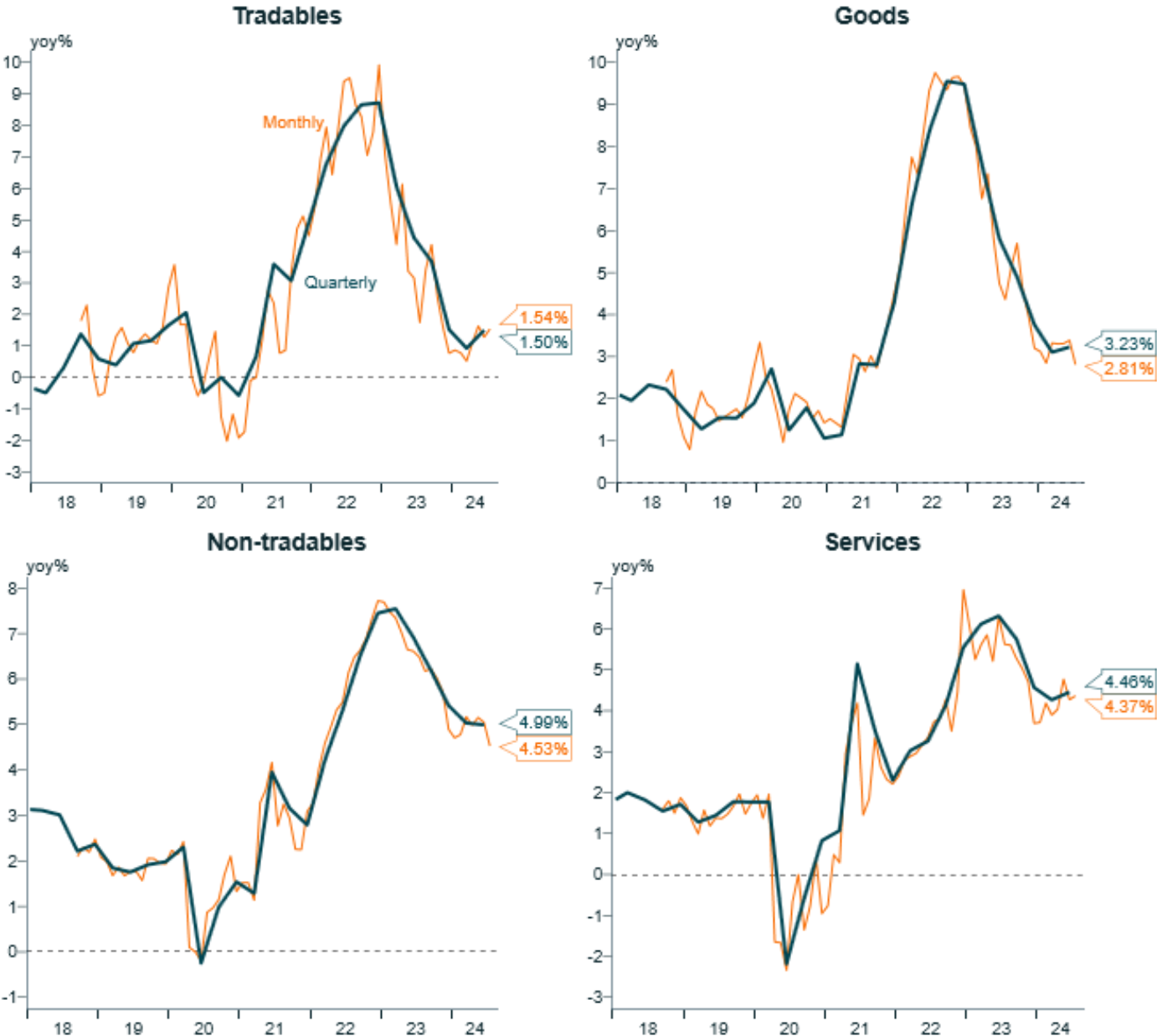

As noted by Alex Joiner on Twitter (X), “disinflation in tradables has seemingly run its race, further progress on the services heavy non-tradables side needs to occur to get overall inflation lower”:

Based on this result, the RBA will keep rates on hold.

Progress on returning inflation to target is slow and bumpy.