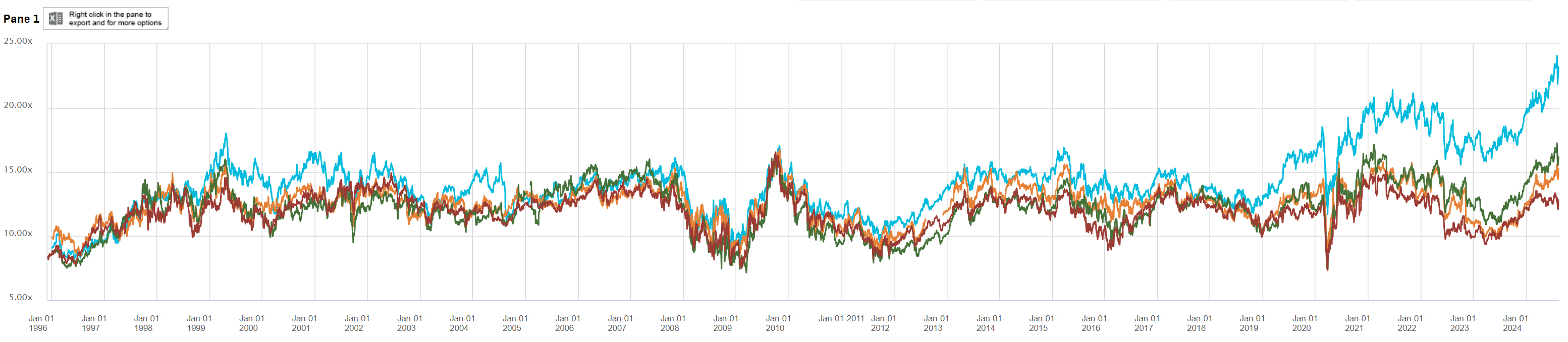

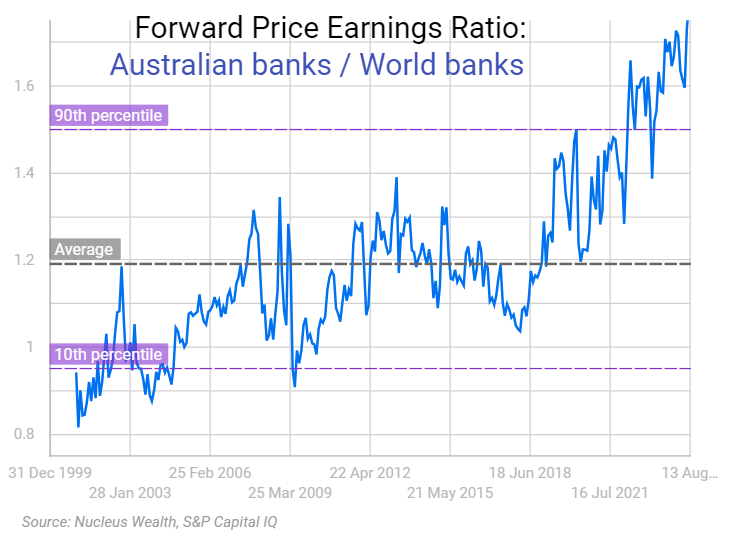

The bank bubble is well understood. No earnings growth has met expanding multiples:

To create the world’s most expensive banks:

Now the bubble has turned from silly to hilarious, as NAB warns:

Operating performance

Compared with the 1H24 quarterly average, underlying profit declined 2%. Key drivers include:

• Revenue declined 1%. Excluding Markets & Treasury (M&T) income, revenue rose 1% reflecting volume growth and higher other operating income including business lending fees;

• Net interest margin (NIM) was stable, with small reductions from lending competition and deposit mix, offset by benefits of a higher interest rate environment. There was no NIM impact from M&T and liquids;

• Expenses increased 1% mainly reflecting higher salary-related costs, partly offset by productivity benefits.

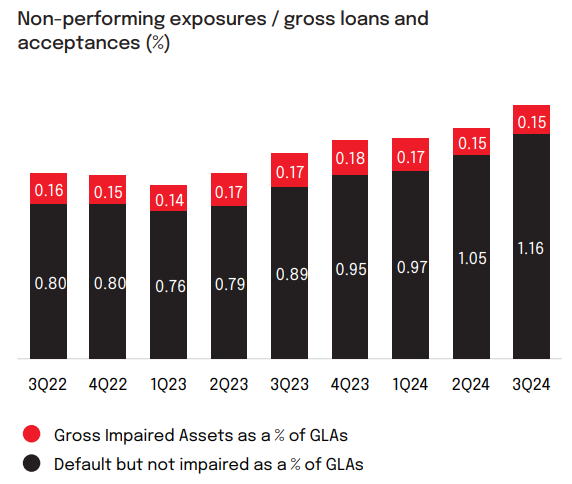

Asset quality

• Credit impairment charge (CIC) of $118 million primarily reflects a further deterioration in asset quality across the Group, partly offset by methodology refinements which have reduced the Economic Adjustment. While individually assessed charges increased, they remain at low levels.

• There have been no changes to the economic assumptions or scenario weightings used in the Economic Adjustment or the sector specific assumptions used in the Forward Looking Adjustments during the quarter.

• Compared with March 2024, the ratio of collective provisions to credit risk weighted assets increased by 4 bps to 1.51%.

• The ratio of non-performing exposures to gross loans and acceptances increased by 11 bps from March 2024 to 1.31%. This mainly reflects continued broad-based deterioration in the Business & Private Banking business lending portfolio, combined with higher arrears for the Australian mortgage portfolio. The ratio of gross impaired assets to gross loans and acceptances remained flat at 0.15%.

Rising arrears with greater impairments tipping into falling profits and shrinking net interest margins as interest rates fall is not a reason to buy banks.

But that’s what’s happening with them all soaring today!

Because rate cuts are at least three hours away.