Ignore the hawks, for they are wrong again.

Former RBA board member Warwick McKibbin and former RBA senior official Jonathan Kearns are two economists who think the elation – the S&P/ASX 200 hit a record before a Friday plunge on softer US employment data – may have been overdone.

McKibbin says financial market participants this week were “very short-sighted” about “dodging a bullet” on an imminent rate rise.

“Inflation is 3.9 and the target is 2 to 3. It’s still way off target,” he says.

McKibbin says the 4.35 per cent cash rate should have been raised sooner and faster last year to around 5 per cent, further into restrictive territory above the bank’s so-called neutral cash rate where policy is neither stimulatory nor expansionary.

But with the economy now softening and the government preparing for an election, the Australian National University economics professor says the bank is now in a tricky spot.

“Rates should be well above where they are, but the bank has backed itself into a corner. It’s up against a potential election and there is a fiddle by the treasurer to statistically get inflation lower by the end of the year.”

The “fiddle”, as McKibbin puts it, is Treasurer Jim Chalmers’ electricity bill rebates and other subsidies that Treasury estimates will mechanically reduce headline inflation by 0.5 of a percentage point this year.

McKibbin is nearly always hawkish and mostly wrong, including throughout the lowflation period prior to COVID.

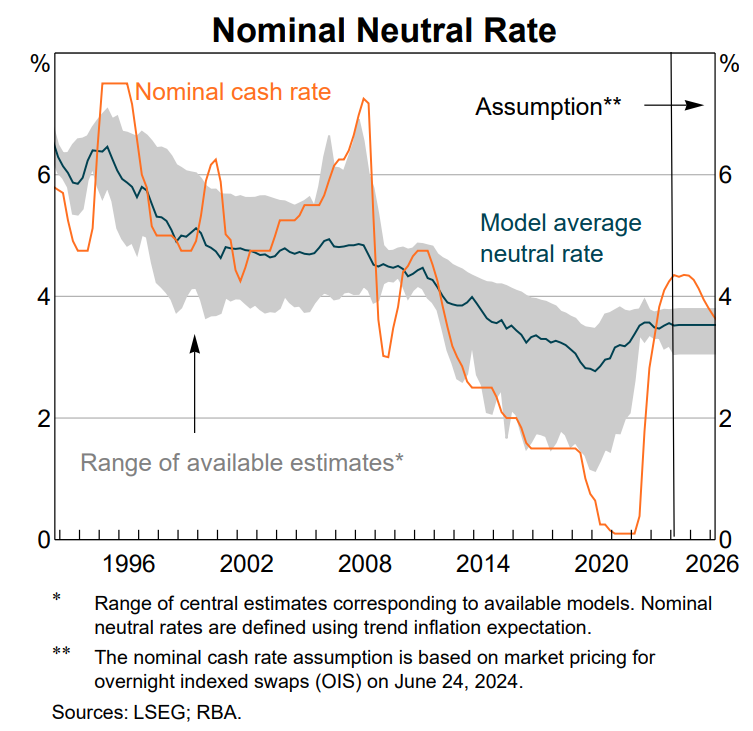

His calculations here make no sense. Nobody but Wazza sees 4.35% as a neutral or below neutral interest rate:

We can debate the merits of the electricity price rebates “fiddle”. But it is not temporary. Such things become permanent budget features.

Hence, they will be disflationary for core inflation in due course as well.

Yet, even this is not the real issue. One only needs to look out the window to see how a faltering China is driving a global growth scare.

This is already manifesting a terms of trade shock with much more to come.

Given that Albonomics has already destroyed household income, tightening into a national income shock is not just stupid; it is irresponsible.

Deeper rate cuts than anybody currently expects are on the way in 25/26.