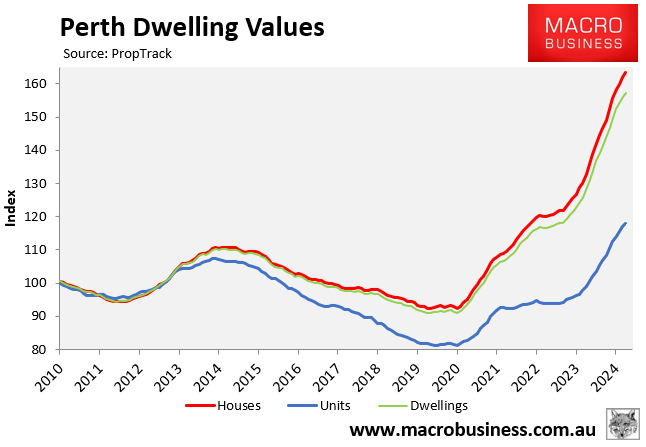

Perth’s housing market has experienced an enormous price boom, with values rising by 72% since the beginning of the pandemic in March 2020, according to PropTrack:

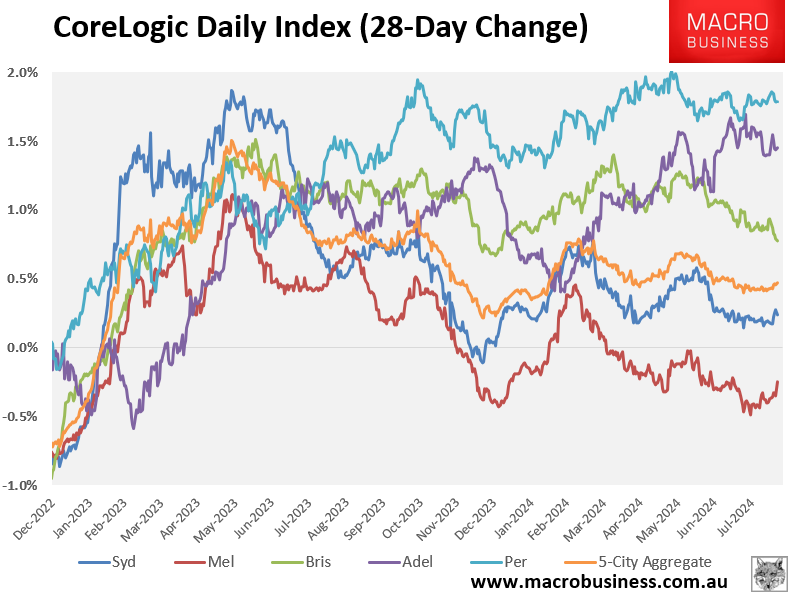

CoreLogic’s daily dwelling values also show that Perth dwelling values continue to rise at a strong pace, up 1.8% over the past 28-days:

In his latest housing market update, SQM Research managing director and founder, Louis Christopher, predicted the “boom times” to continue:

“Perth is easily going to come in at 20%+ gains [this year]”, Christopher wrote this week.

“A combination of ongoing strong employment growth, strong interstate migration flows, ongoing underbuilding and a very, very favorable GST receipts deal with the Federal Government all ensures it remains boom times in the West”.

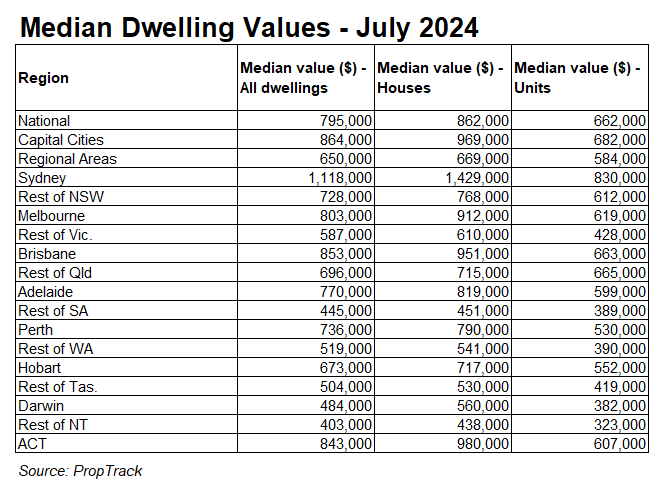

Despite recent strong price growth, Perth median values remain relatively affordable, as illustrated below:

Perth’s median dwelling value was $736,000 in July, significantly less than the capital city average of $864,000. This suggests that Perth has a lot of headroom for further growth.

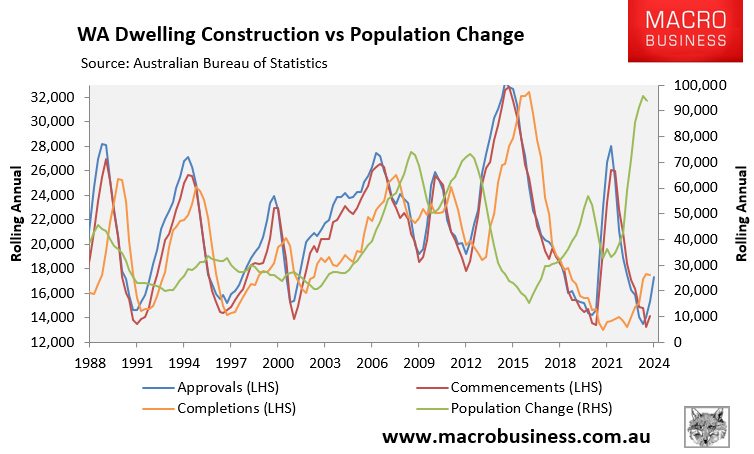

Moreover, Western Australia (Perth) is suffering from an extreme housing shortage, as illustrated below:

Western Australia’s population grew by 93,800 in the 2023 calendar year, against a dwelling increase of 17,500 in the year to March (latest available data).

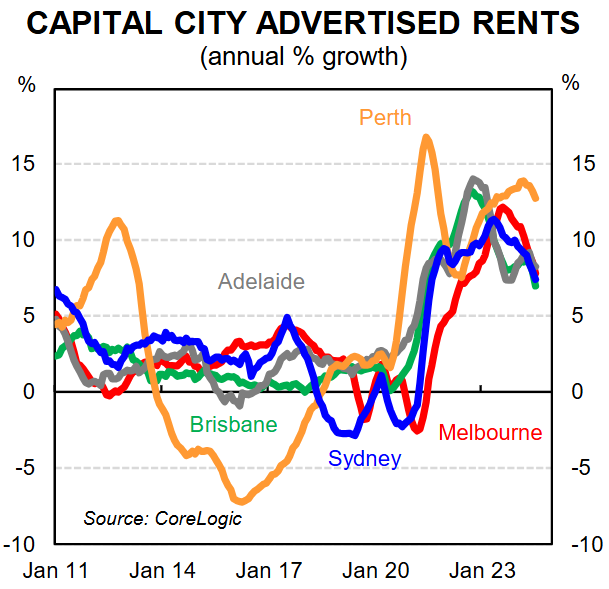

This shortage has driven rents through the roof, creating extreme FOMO (‘fear of missing out’):

That said, Louis Christopher warned that “commodity prices, particularly iron ore prices, have been falling of late” and that “a major rout on global commodity markets would likely put an end to the current WA boom”.

This analysis is spot on. When commodity prices tanked last decade, so too did Perth prices and rents, as illustrated in the charts above.

Perth’s housing market is a boom-and-bust volatility machine.