These are dark times for Australian retail.

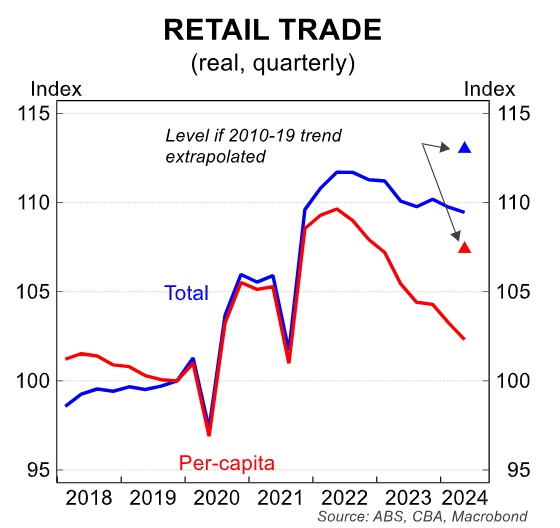

Retail sales volumes have plunged amid rising mortgage rates and cost-of-living concerns, with discretionary retailers impacted especially hard.

The annual change in retail sales has been negative for five straight quarters. Aside from the pandemic, only four other quarters have experienced negative annual growth since the 1980s.

Retail volumes per capita (-0.9%) declined for the ninth consecutive quarter in Q2, down 3.0% from the previous year.

The pain being felt by retailers was encapsulated over the weekend by The AFR, which reported that large numbers of specialty retailers are closing down across Melbourne’s CBD:

The retail sector has become a brutal scene…

ARA chief executive Paul Zahra said homewares, furniture, and electronics retailers were doing it particularly tough.

“Small businesses are a crucial part of the retail community, and a bellwether for the health of our sector,” he said.

“Unfortunately, many are struggling to cope with rising inflation, steep interest rates and the cost-of-doing-business crunch”…

“Small-business owners are really hurting. Everyone I know is working so hard, with many people not even paying themselves”, [Chelsea McIntosh, who will shut down her gift shop in Melbourne’s CBD this week after 15 years in business, said]…

“People are really hurting financially at the moment. They’re spending less, and they’re not impulse buying any more,” Ms McIntosh said.

The sad reality is that traditional bricks-and-mortar discretionary retailers are facing a perfect storm of headwinds that are threatening their viability.

In addition to the obvious macroeconomic factors like higher interest rates, general cost-of-living concerns, and falling real household disposable incomes, retailers are also facing intense competition from global online platforms.

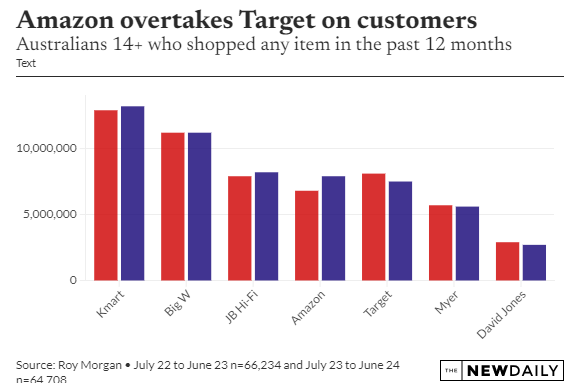

Leading the pack is global giant Amazon, which entered the Australian market in December 2017 and has continued to expand its footprint.

Amazon Prime provides competitive prices and unparalleled convenience, with most items delivered free to your door within 48 hours.

Roy Morgan estimates that Amazon’s client base increased by 16% last financial year, with 1.1 million more customers using the platform than in 2022-23.

Amazon has already announced that it will expand its operations and delivery network in Australia, meaning more competition for traditional Australian retailers.

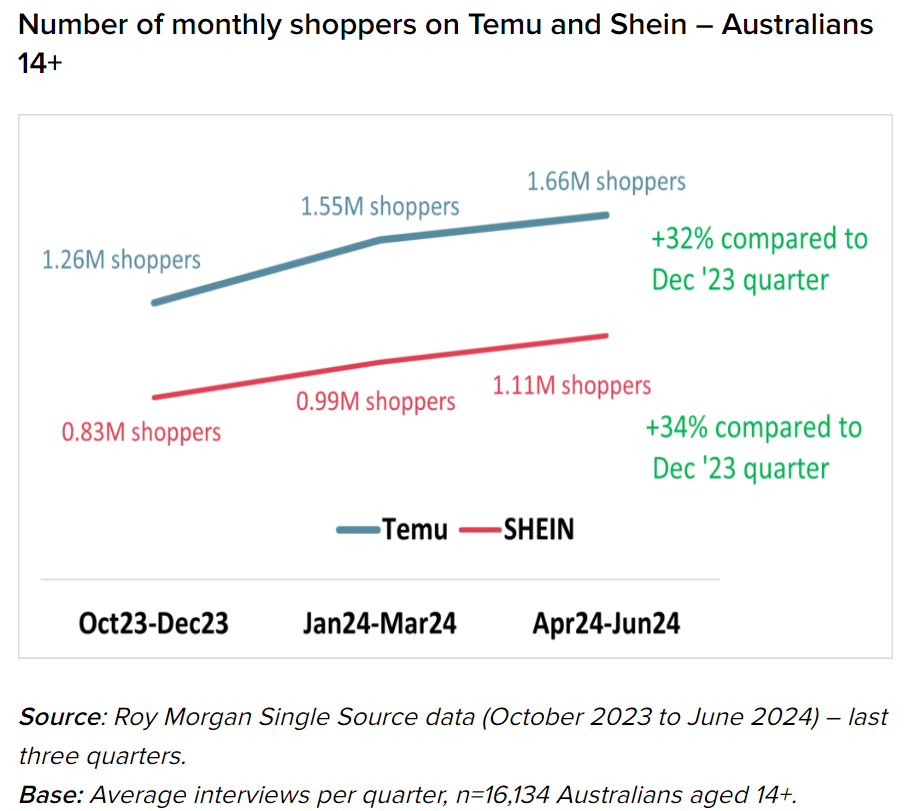

Chinese giants Temu and Shein are also rapidly growing their market share in Australia, concentrated at the budget end of the retail market.

Roy Morgan estimated that 5.8 million Australians used either platform last financial year, around 80% of whom were repeat purchasers.

The monthly sales growth rate of Temu and Shein has been astonishing, as illustrated in the following chart from Roy Morgan:

Sadly for Australian retailers, online competition will only intensify in the period ahead. We are nowhere near saturation point.

As a result, traditional bricks-and-mortar retailers will continue to lose market share and will close down.

The impact is currently concentrated in smaller specialty retailers. However, it is only a matter of time before larger players like department stores rationalise their operations to meet the changing economic environment.