This is why one takes drastic monetary measures during a balance sheet recession. And why Chinese macroeconomic policy has gone so wrong in keeping real interest rates high. ANZ with the note.

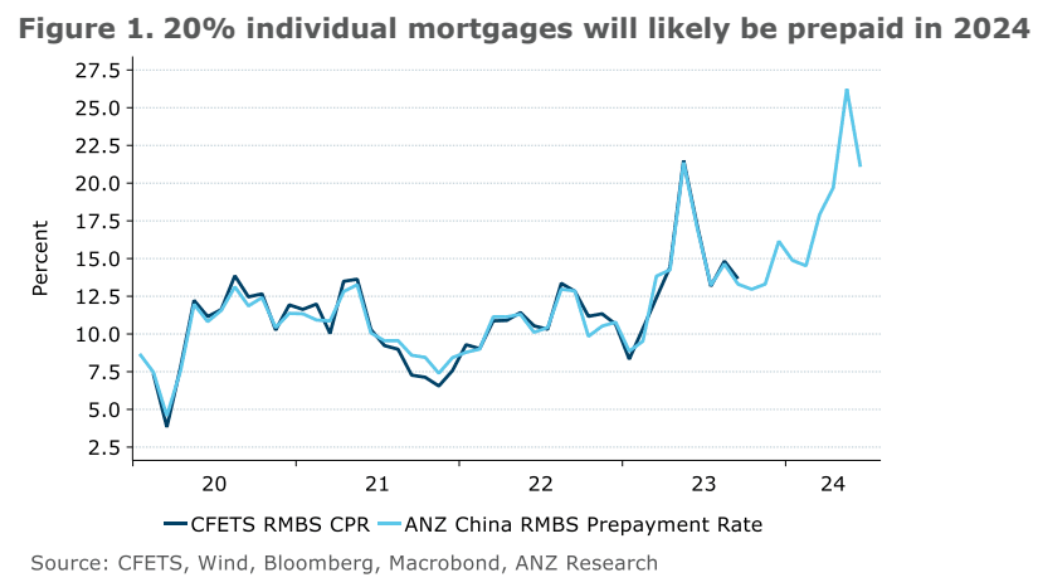

We calculated the weighted average prepayment rate from the monthly reports of more than 200 residential mortgage-backed securities (RMBS) as a substitution to the discontinued conditional prepayment rate (CPR) released by the China Foreign Exchange Trade System (CFETS).

Chinese householders paid off mortgages prematurely by CNY450bn per month in 2023 and CNY600bn per month in the first seven months of 2024, equivalent to 15% retail sales or 12% disposable income.

Advertisement