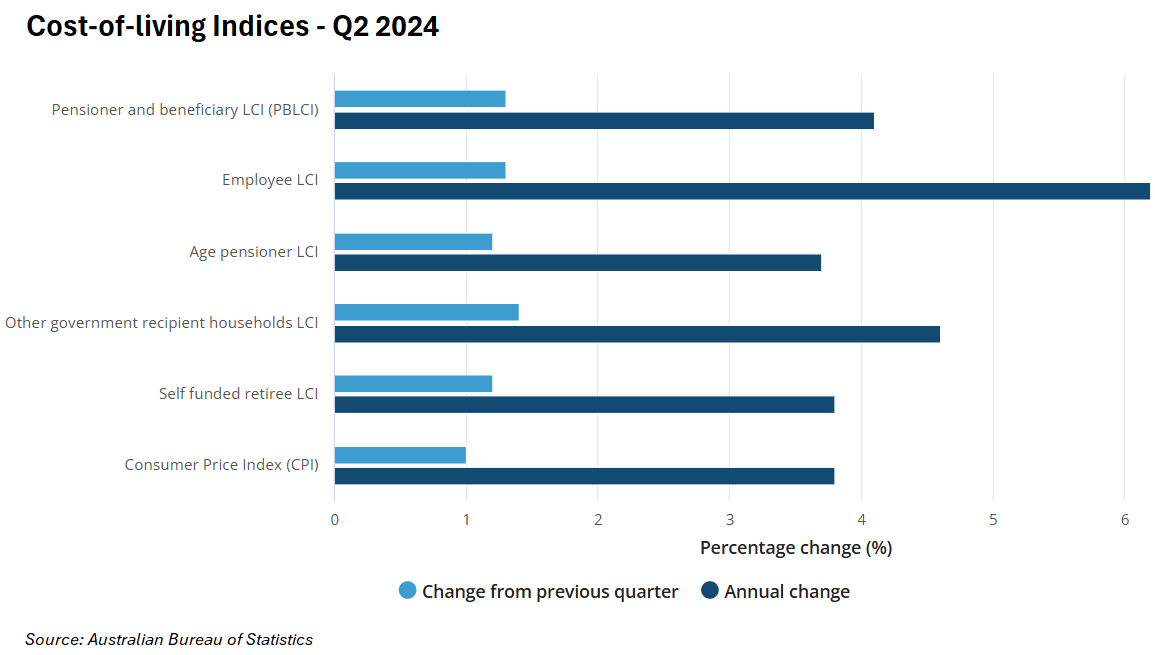

The Australian Bureau of Statistics (ABS) has released its cost-of-living indices for the June quarter, which showed that employee households have been hardest hit.

Employee cost of living rose by 6.2% in the year to June 2024, well above the 3.8% increase in CPI inflation.

The 6.2% increase in living costs also easily exceeded wage growth of 4.1% in the year to March (the most recently released data).

The ABS noted that “insurance and financial services, which includes mortgage interest charges, and Food and non-alcoholic beverages were the main contributors across all household types”.

“Housing also contributed to higher living costs for all household types except Self-funded retirees”.

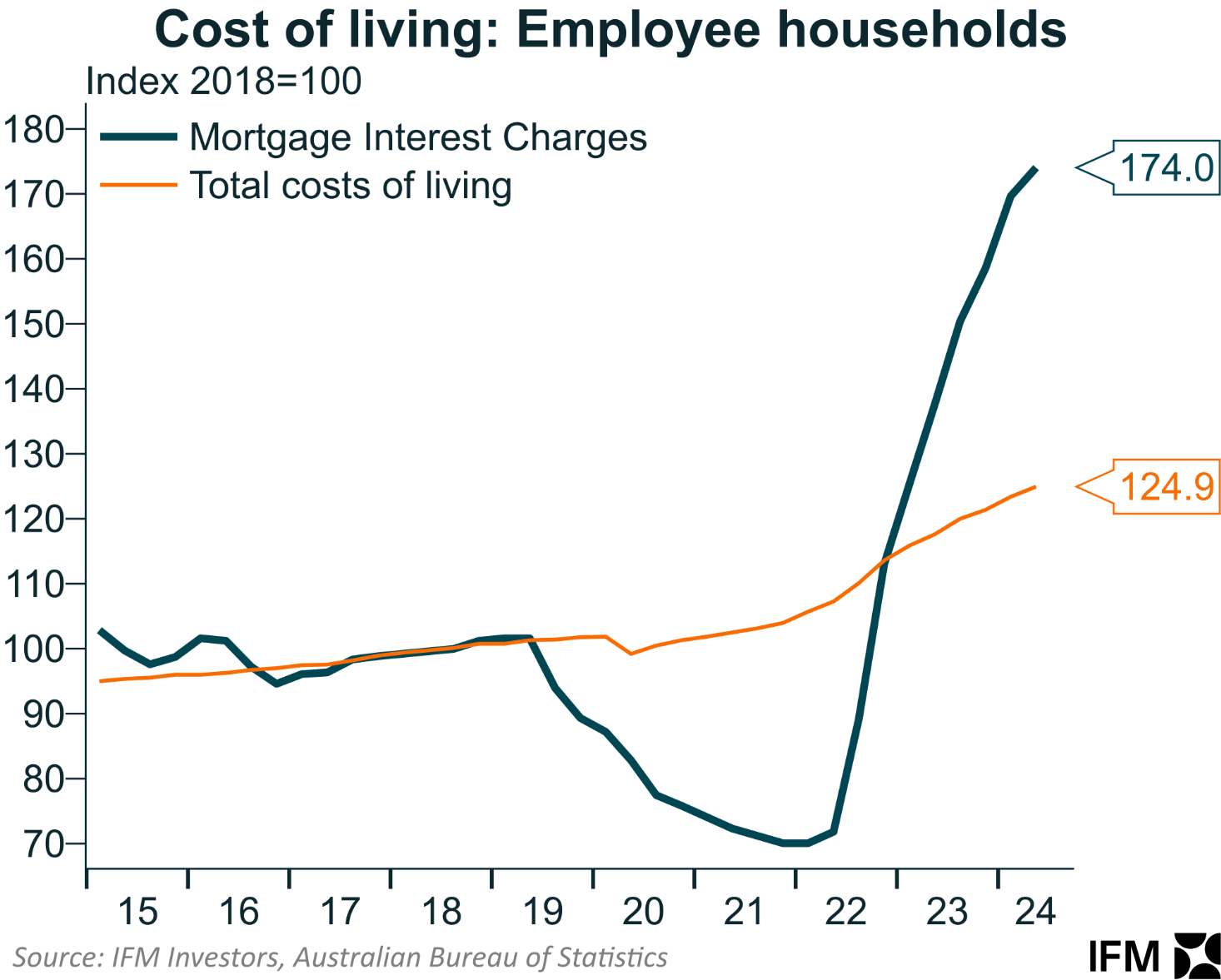

The larger increase in employee cost of living was a result of rising mortgage interest rates, which comprise a larger share of their spending than for other household types.

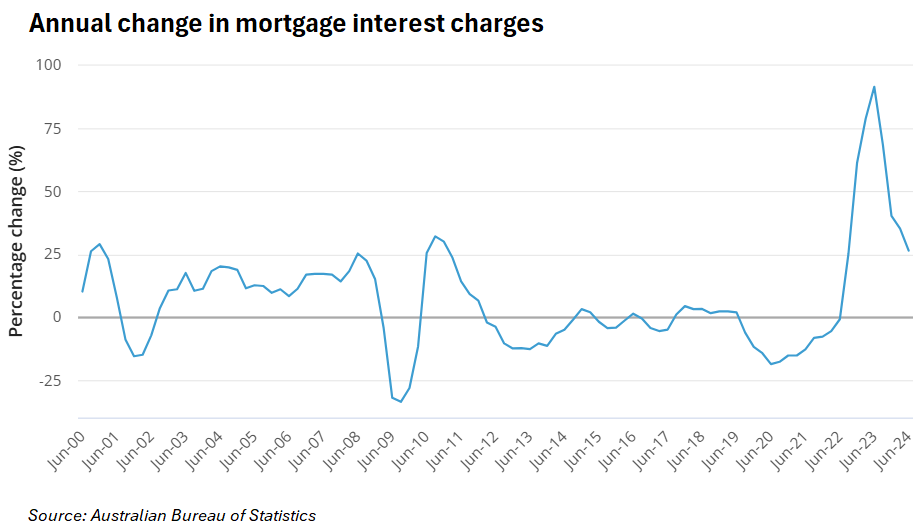

“Mortgage interest charges rose 2.6% in the June 2024 quarter, driven by the continued rollover of some expired fixed rate mortgages to higher variable rate mortgages”, Michelle Marquardt, ABS head of prices statistics, said.

“Mortgage interest charges rose 26.5% annually, continuing the moderation seen since the peak of 91.6% in the June 2023 quarter”.

The increase in employee cost of living can be attributed, in part, to ‘Alboflation’, or juicing demand by operating an immigration program well above the supply-side of the economy (particularly the housing market).

Alboflation is directly increasing the cost of living and the CPI (for example, through rents), necessitating the RBA to keep interest rates higher than otherwise in order to constrain demand and bring inflation down.

Self-funded retirees and old-age pensioners, who mostly own their homes outright, are the segments of the population that have been relatively unaffected by rising mortgage repayments, rents, and income taxes.

As a result, they experienced the lowest cost-of-living increases in the year to June—3.8% and 4.1%, respectively—which was in line with or slightly above the headline inflation rate (3.8%).