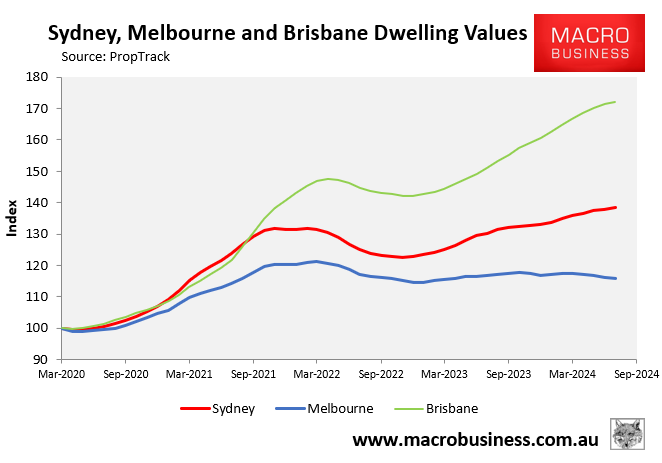

According to PropTrack’s home values index, Brisbane dwelling values have climbed by 72% since the start of the pandemic, easily outpacing Sydney’s 39% gain and Melbourne’s 16% rise:

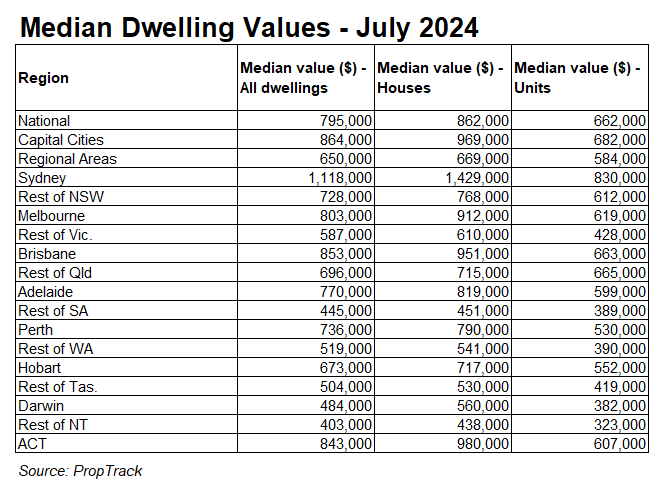

PropTrack also showed that Brisbane’s median dwelling value of $853,000 was $50,000 higher than Melbourne’s in July, with both houses and apartments valued higher than Melbourne’s:

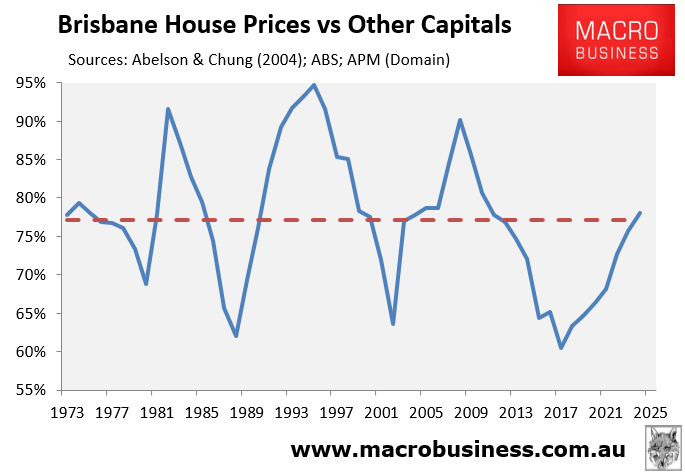

Separate data from Domain shows that Brisbane’s median dwelling value drifted into “overvalued” territory against the other capital cities in the June quarter:

Sydney’s excessive median house price, which raises the average for national capital cities, distorts the above chart.

Regardless, the extreme growth in Brisbane dwelling values has raised the possibility that it could be primed for a price correction., according to Eliza Owen, CoreLogic’s head of research.

“Brisbane is starting to mirror what you see in the Sydney and Melbourne market where the high interest rate environment and affordability constraints start to put downward pressure on growth at the high end”, Owen told The AFR.

“I think in the near term, Brisbane is the most vulnerable of those three capitals because not only is this market becoming less and less affordable, it’s becoming one of the most expensive cities in Australia”.

“Economic conditions there are softening, and already you’ve got more suburbs moving into a decline, so it’s clear that Brisbane is starting to hit a bit of a limit, particularly in the high end”.

“Brisbane, I think, is where it’s getting close to crunch time”, Owen said.

AMP chief economist Shane Oliver gave a similar assessment of Brisbane.

“The signs of a slowdown, which at this stage are more evident in Brisbane, likely reflect property prices starting to run into affordability constraints after very strong increases relative to incomes in those cities”, Oliver said.

“The incentive to relocate there is fading and this will weigh on interstate migration to Queensland”.

Brisbane has already lost its affordability advantage over Melbourne and is narrowing the gap with Sydney.

We are approaching the point at which Brisbane housing may resemble a ‘bubble’ reminiscent of Perth a decade ago.