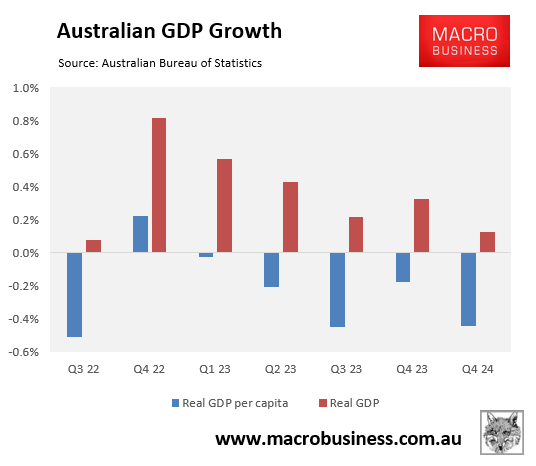

Australia is already experiencing a prolonged per capita recession.

As illustrated in the following chart, Australia’s per capita GDP has fallen for five consecutive quarters and six times in the last seven quarters:

Next week, the Australian Bureau of Statistics (ABS) will release the Q2 national accounts, which will show that per capita GDP fell for a sixth consecutive quarter.

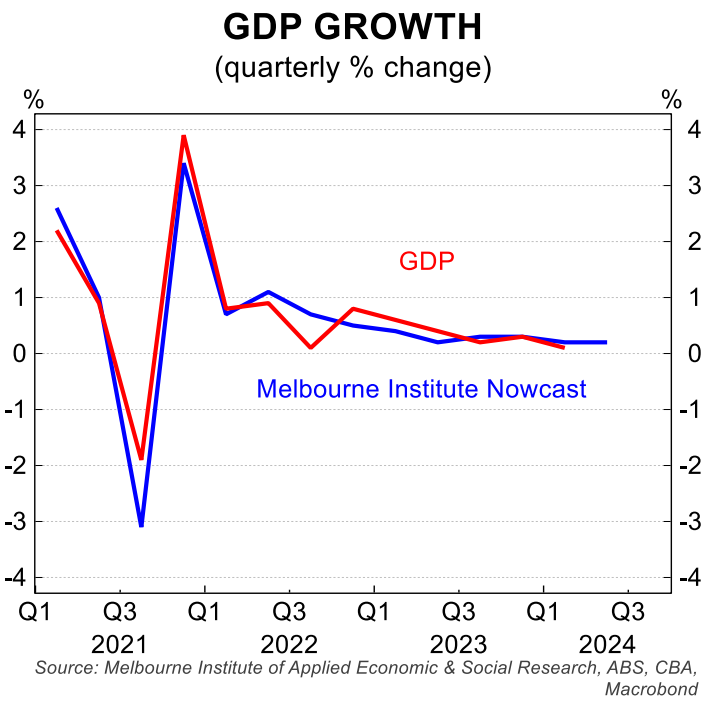

The latest GDP nowcast from the Melbourne Institute, plotted below by CBA, suggests that Australia’s GDP growth remained at just 0.2% in June quarter:

Given that Australia’s population increased by 0.65% in Q2, as implied by figures from the retail trade release, this suggests that per capita GDP declined another 0.45% over the quarter.

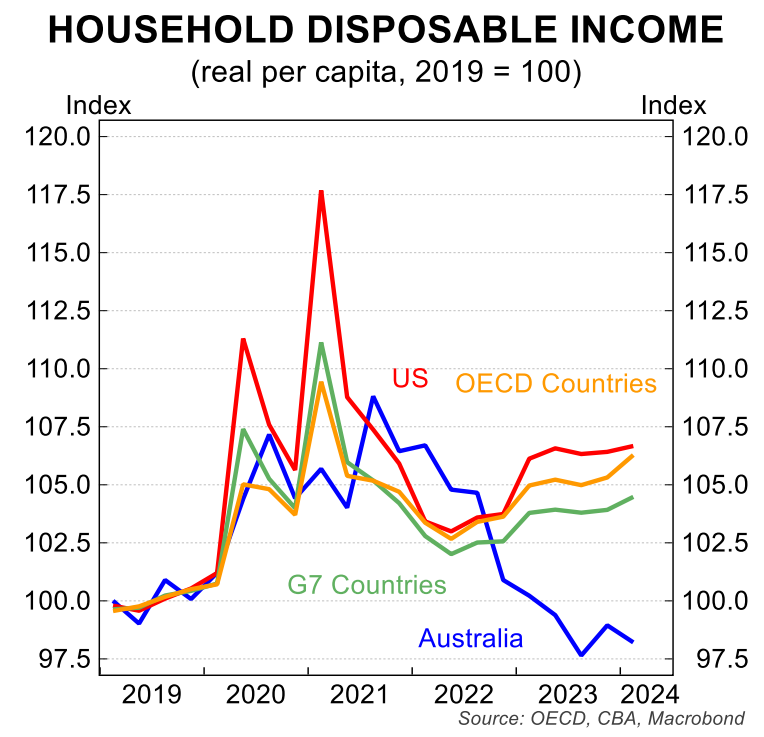

CBA also shows that Australia has experienced one of the world’s largest decline in real per capita household disposable incomes:

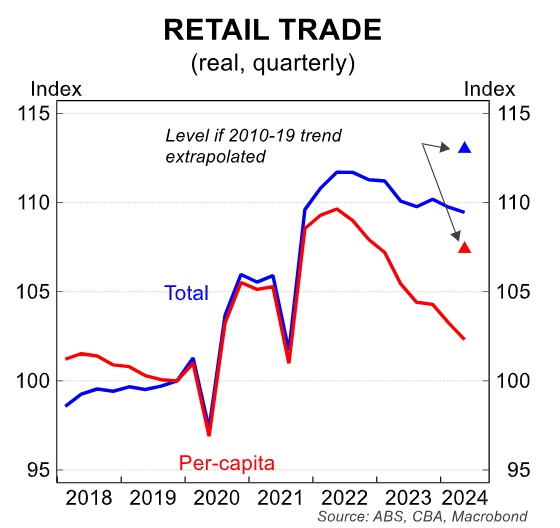

The retail sector, in particular, is feeling the effects of the recession.

Retail sales volumes have plummeted due to rising mortgage rates and cost-of-living concerns, with discretionary sellers hit especially hard.

The annual change in retail sales has been negative for five consecutive quarters. Aside from the pandemic, only four quarters have shown negative yearly growth since the 1980s.

Retail volumes per capita (-0.9%) fell for the ninth consecutive quarter in Q2, dropping 3.0% from the previous year.

Deloitte Access Economics cautioned that retail conditions won’t ease anytime soon amid reduced spending by households due to mortgage rates and cost-of-living pressures.

Deloitte Access Economics partner David Rumbens described the retail sector as an “economic horror show” given the high cost of living, increasing insolvencies, elevated interest rates, and the deteriorating job market.

“The period from now to Christmas is still expected to be a difficult one for retailer”, he said.

“As with most horror sequels, the characters are generally more prepared, and the plots generally more predictable”.

Deloitte noted that real per capita retail spending had contracted for the past eight quarters and was now tracking 2.5% below June 2023 and 6.3% below June 2022.

“This sits against a backdrop of poor conditions across the economy more generally, with the labour market weakening and business insolvencies rising”, Rumbens said.

In addition to the macroeconomic factors mentioned above, retailers are also facing intense competition from global online platforms, which are stealing market share.

I wouldn’t want to be a smaller specialty retailer in the discretionary space. The cards are stacked heavily against their survival.