SQM Research has released an update on Australia’s housing market, based on its Boom & Bust Report released in November 2023.

Author Louis Christopher is especially bearish on Melbourne home prices, tipping price falls this year and no quick turnaround.

“Melbourne is indeed falling at present”, Christopher notes. “This is the city we are most confident that our base case forecast is going to be correct”.

“The base case forecast for Melbourne was that the market would fall between minus 5% to minus 1%”.

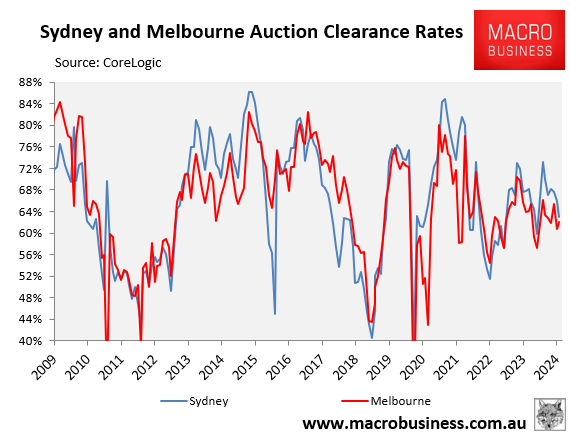

“After a stronger than expected start to the auction year, Auction clearance rates have been weakening since February”. Stock for sale levels have been increasing and are now running above long-term averages. And rents are now on the decline”.

“It’s not exactly a happy time for Melbourne property owners and there is nothing in the current data to suggest a turnaround is imminent”, Christopher wrote.

Louis Christopher’s statements are backed-up by the data.

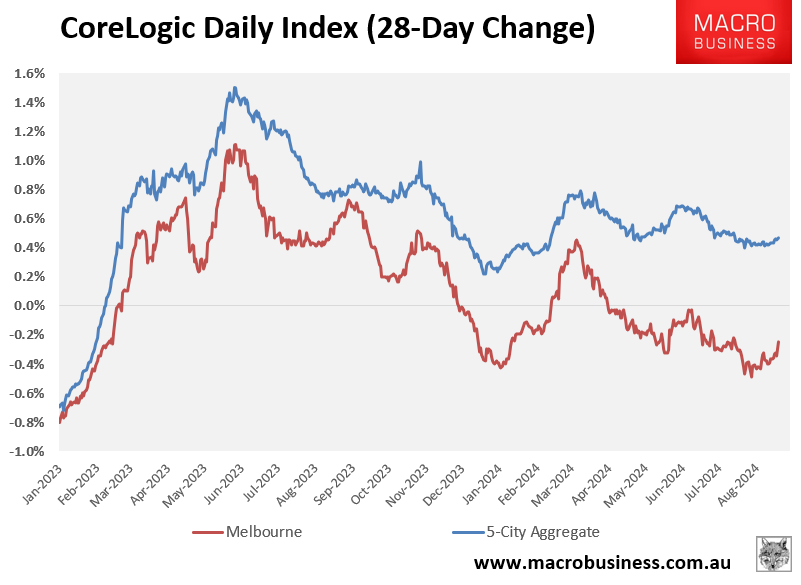

According to CoreLogic’s daily dwelling values index, Melbourne home prices have fallen for most of 2024:

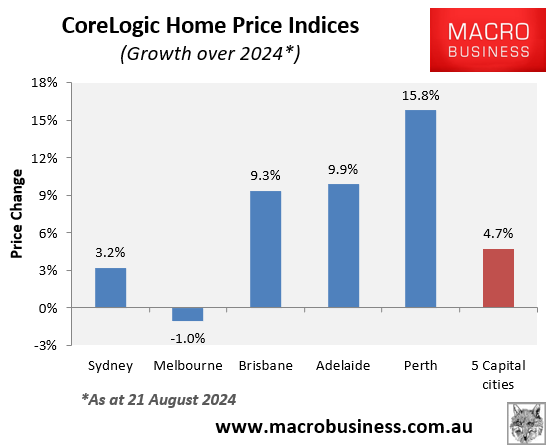

CoreLogic currently has recorded a Melbourne dwelling value decline of 1.0% for 2024:

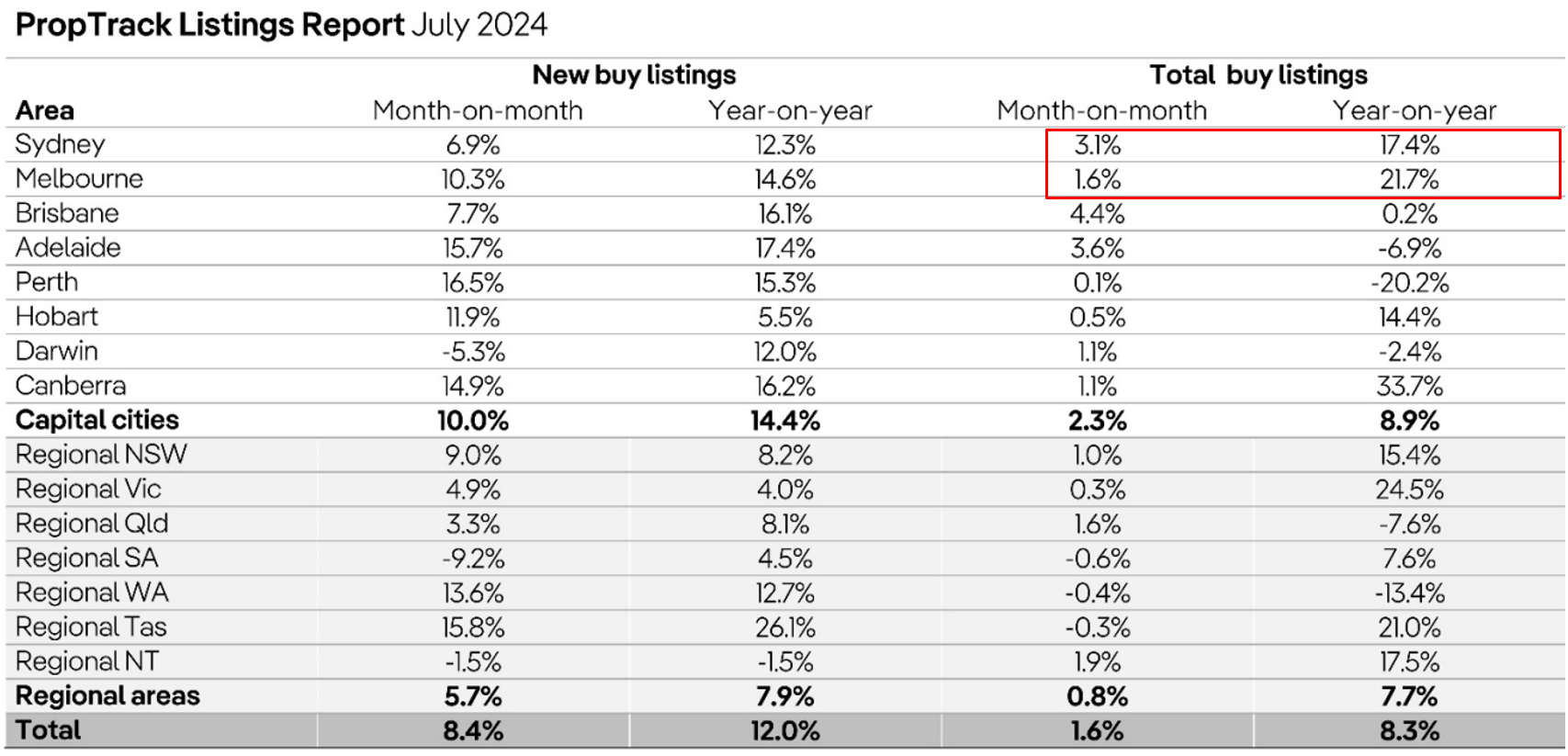

Melbourne has also recorded the largest year-on-year increase in listings out of the states, according to PropTrack:

And Melbourne’s auction clearance rates have softened throughout the year:

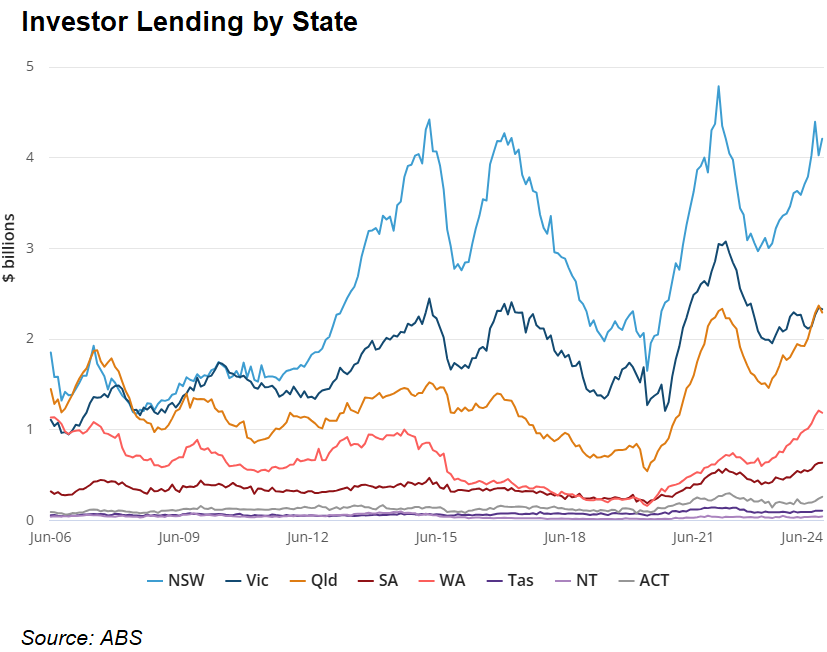

Part of Melbourne’s weakness relates to the fact that investor demand has declined following tax hikes and deleterious policy changes by the state government:

The upside is that housing has become more affordable to purchase for first home buyers.