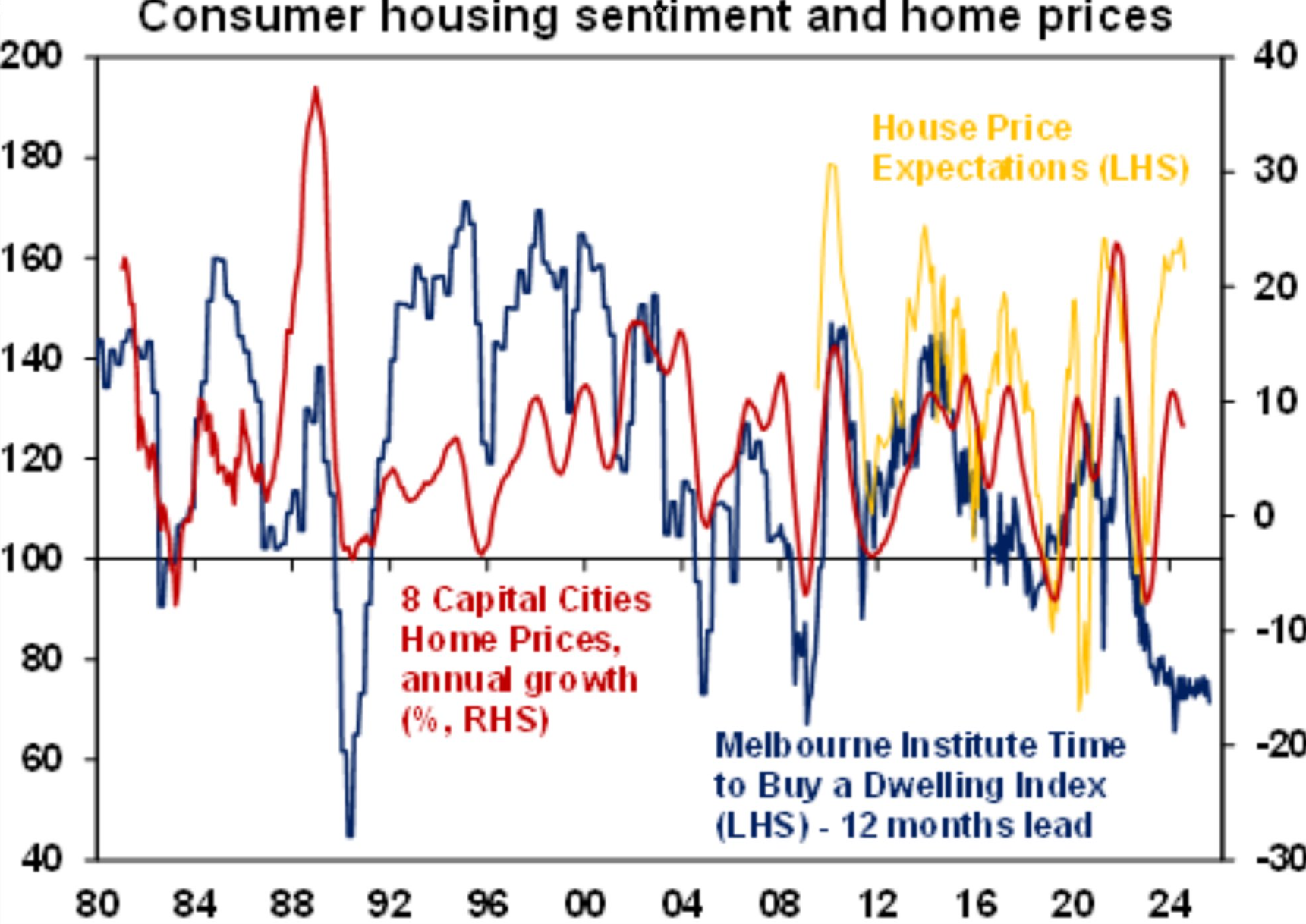

The Westpac-Melbourne Institute consumer sentiment index was released on Tuesday and revealed a massive gulf between Australians’ sentiment about property prices and their purchasing appetite.

Source: AMP

The ‘time to buy a dwelling index’ remained at record lows, whereas expectations for house price appreciation remained bullish, indicating future appreciation in home values.

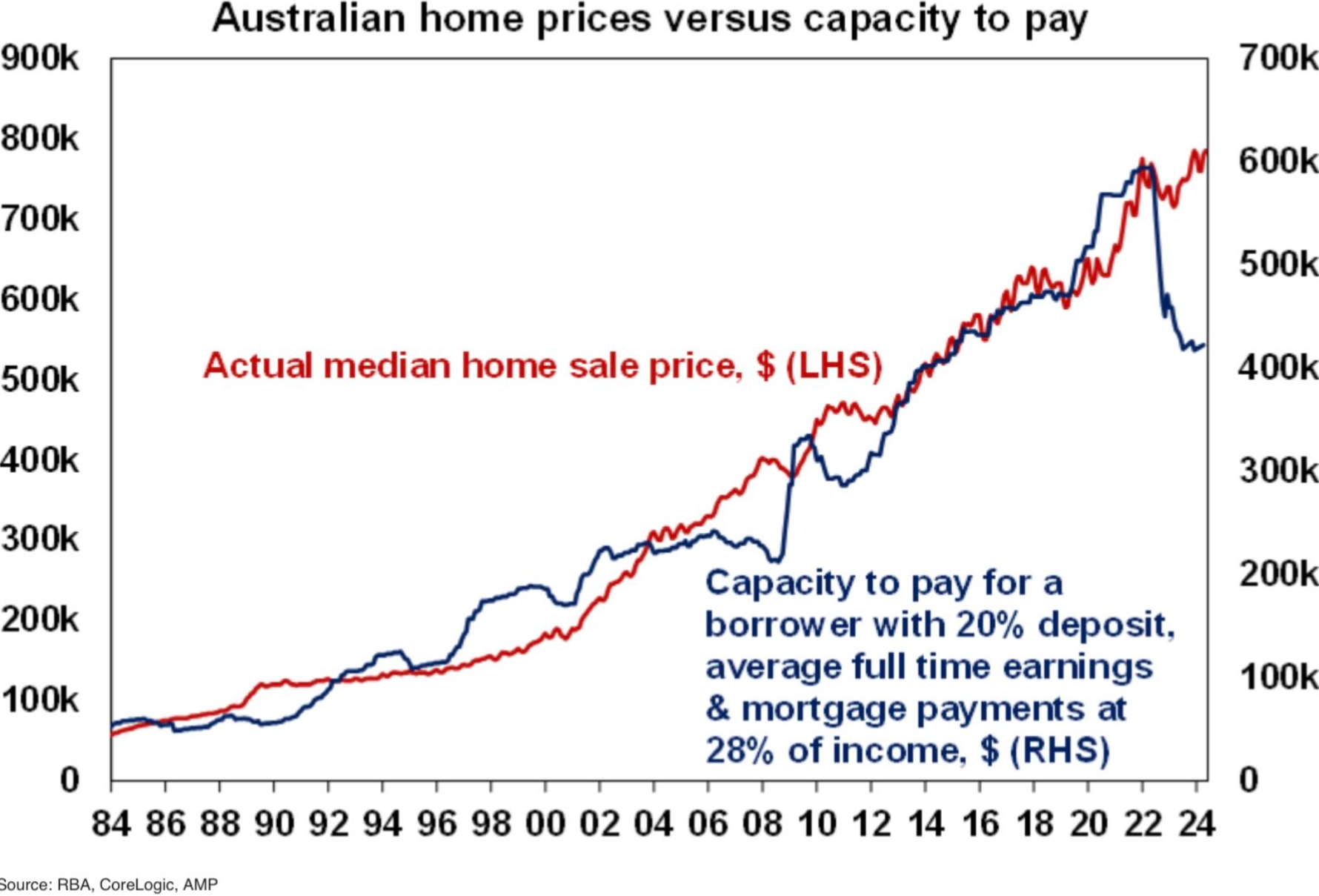

Rising prices, along with the highest mortgage rates in more than a decade, have sent home affordability and ability to pay tumbling:

Yet, Australians continue to pile into the housing market, driving both prices and average mortgage sizes to record highs:

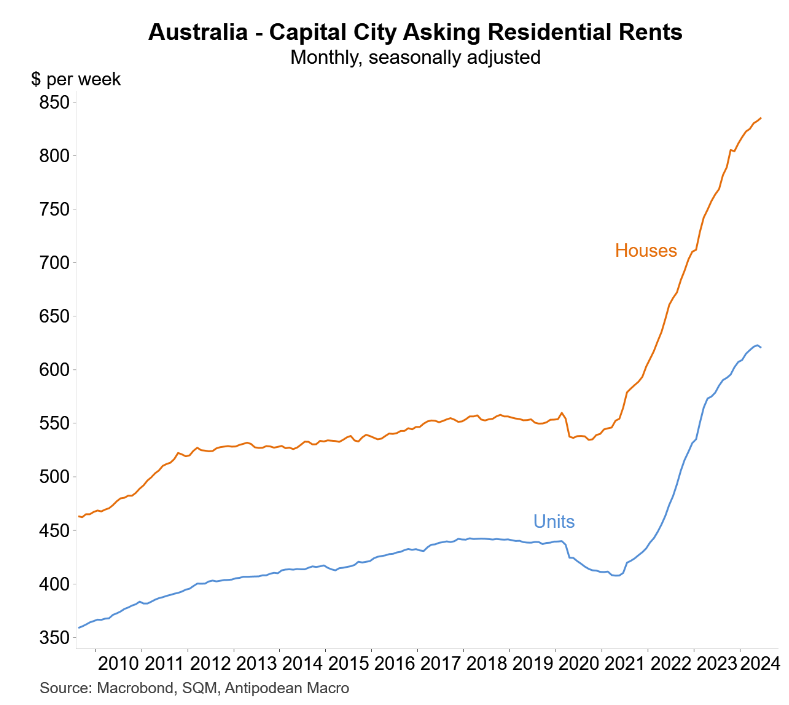

The housing ‘Hunger Games’ has gripped the nation, with Aussies feeling obligated to enter the market amid strong rental inflation and the fear that prices will continue to climb, shutting them out indefinitely.

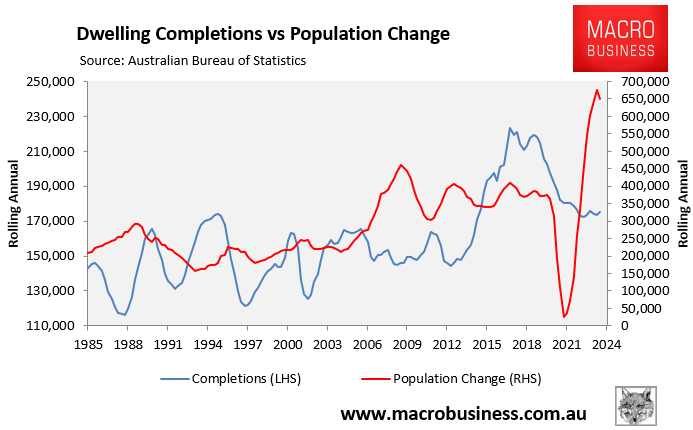

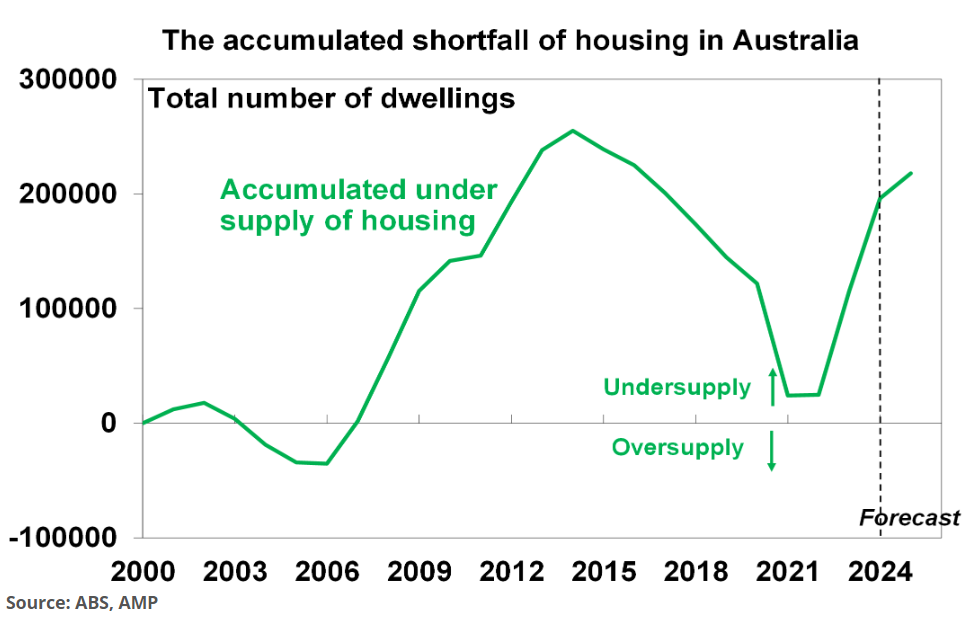

Underpinning this acute sense of FOMO [Fear of Missing Out] is the fact that just under one million net overseas migrants arrived in Australia over the last two years, while the rate of home building collapsed:

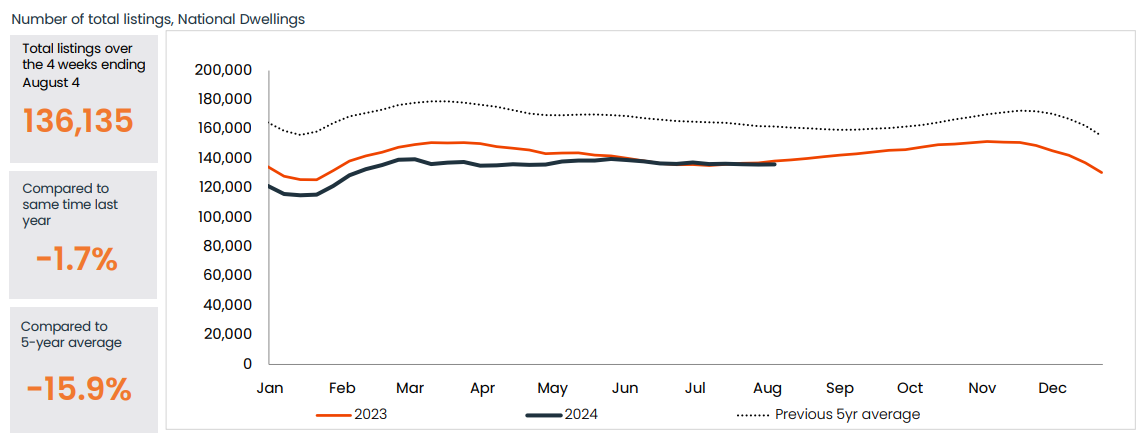

According to CoreLogic, the number of homes listed for sale is 15.9% lower than the five-year average.

Source: CoreLogic

This is why Australia’s housing market resembles the Hunger Games, with demand outpacing supply.

This imbalance between demand and supply is forecast to continue, implying that the rental crisis will roll on, forcing Australians to do whatever they can to get into the market.

The Albanese government’s mad immigration policy has facilitated the housing Hunger Games, resulting in unprecedented levels of FOMO and ‘panic buying’.