On Friday, the Australian Bureau of Statistics (ABS) released housing finance data that shattered the notion that investors are quitting Australia’s housing market.

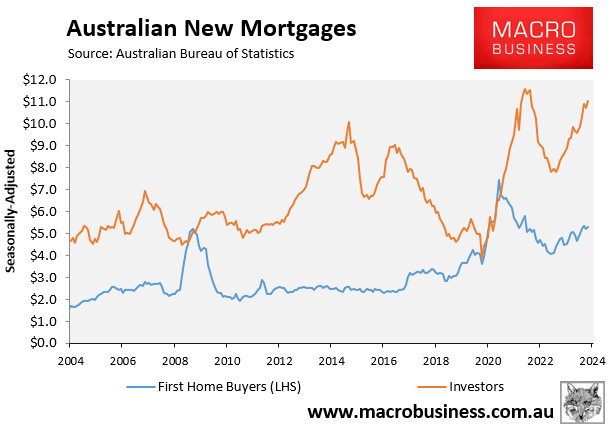

In June 2024, investor mortgage commitments totalled $11,016 million, up 30.2% over the same month in 2023.

In comparison, there were $18,170 million in owner-occupier mortgages (excluding refinances) in June 2024, up 13.2% from the same month in 2023.

The following chart shows that investor mortgage lending has almost returned to its former peak, whereas first home buyer mortgages have fallen heavily from their peak:

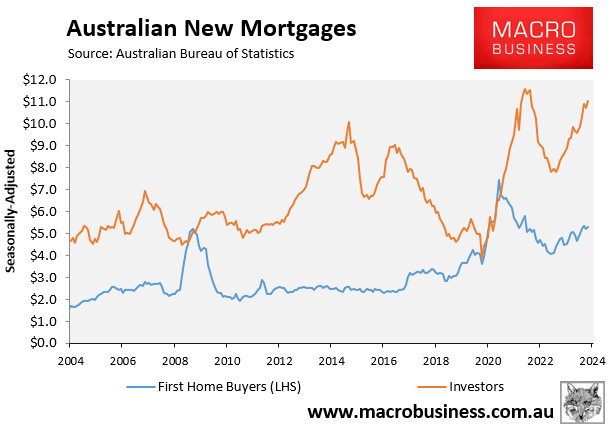

As illustrated clearly in the next chart, the boom in investor lending has crowded-out first home buyers from the market:

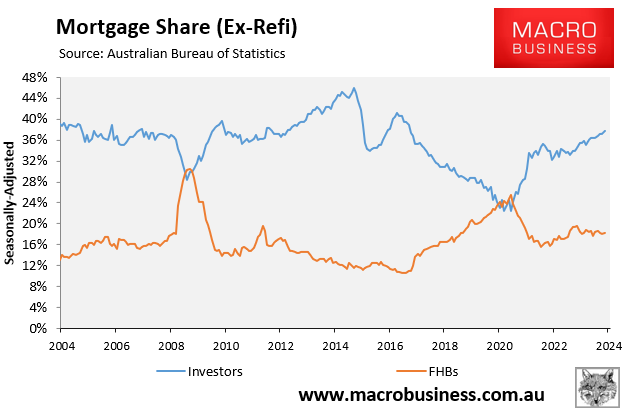

The acceleration in investor lending has been strong everywhere except Victoria, where the state government has lifted land taxes, scrapped no-fault evictions, and flagged raising minimum rental standards starting in November:

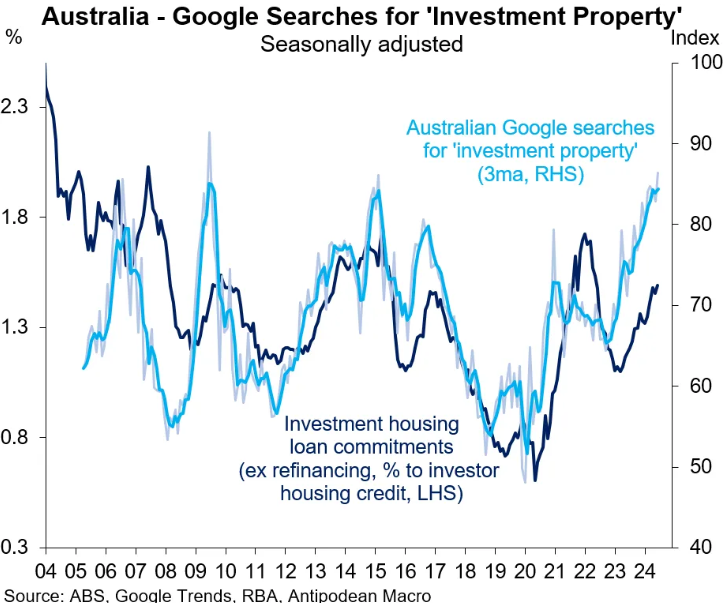

As illustrated by the next chart from Justin Fabo at Antipodean Macro, Google searches for “investment property” foreshadow further growth in investor borrowing:

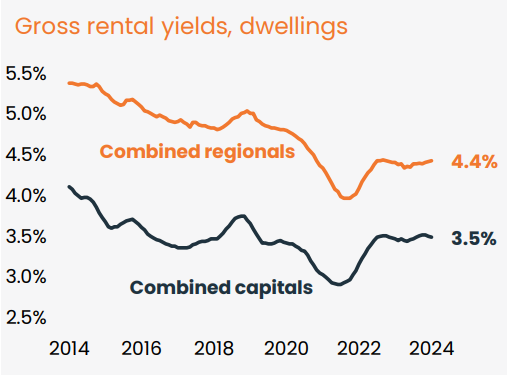

In this month’s housing report, CoreLogic Research Director Tim Lawless warned that investors are facing less favourable conditions:

“With value growth outpacing rental growth, we could once again see some downwards pressure on gross rental yields”.

Source: CoreLogic

“The spread between investor mortgage rates and gross rental yields has widened significantly since the commencement of the rate hiking cycle: in April 2022 there was only 1 basis point difference between national gross rental yields and variable mortgage rate for investors”.

“Since then the spread has widened to 294 basis points in July, implying opportunities for positive cash flow have become increasingly scarce”.

That said, with the Reserve Bank of Australia expected to commence an easing cycle late this year or early next year and rental inflation likely to remain elevated, investor demand could get another boost.

If you are interested in reducing your mortgage payments by thousands of dollars, consider using the MB Compare n Save mortgage comparison tool. It will only take a few minutes of your time.

In the event that you choose to refinance, Compare n Save will manage the process.