Qingdao iron ore fell a little to $95.82. SGX and Dalian were weak overnight.

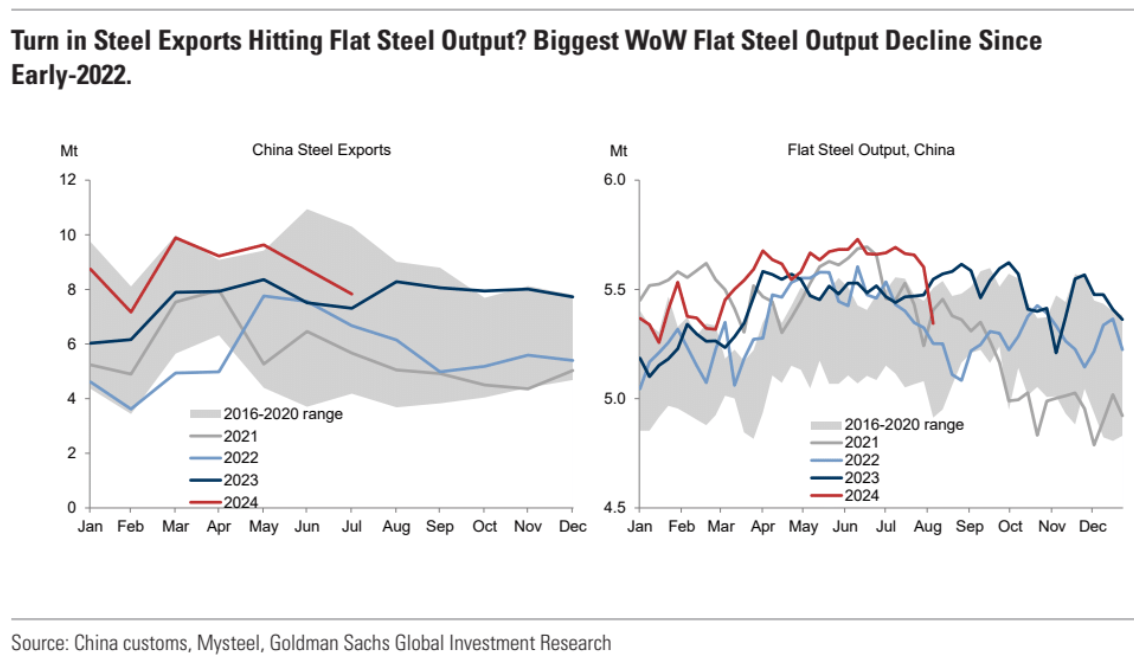

Last week, we passed some tipping point for steel. Chinese exports have stalled and with them HRC demand:

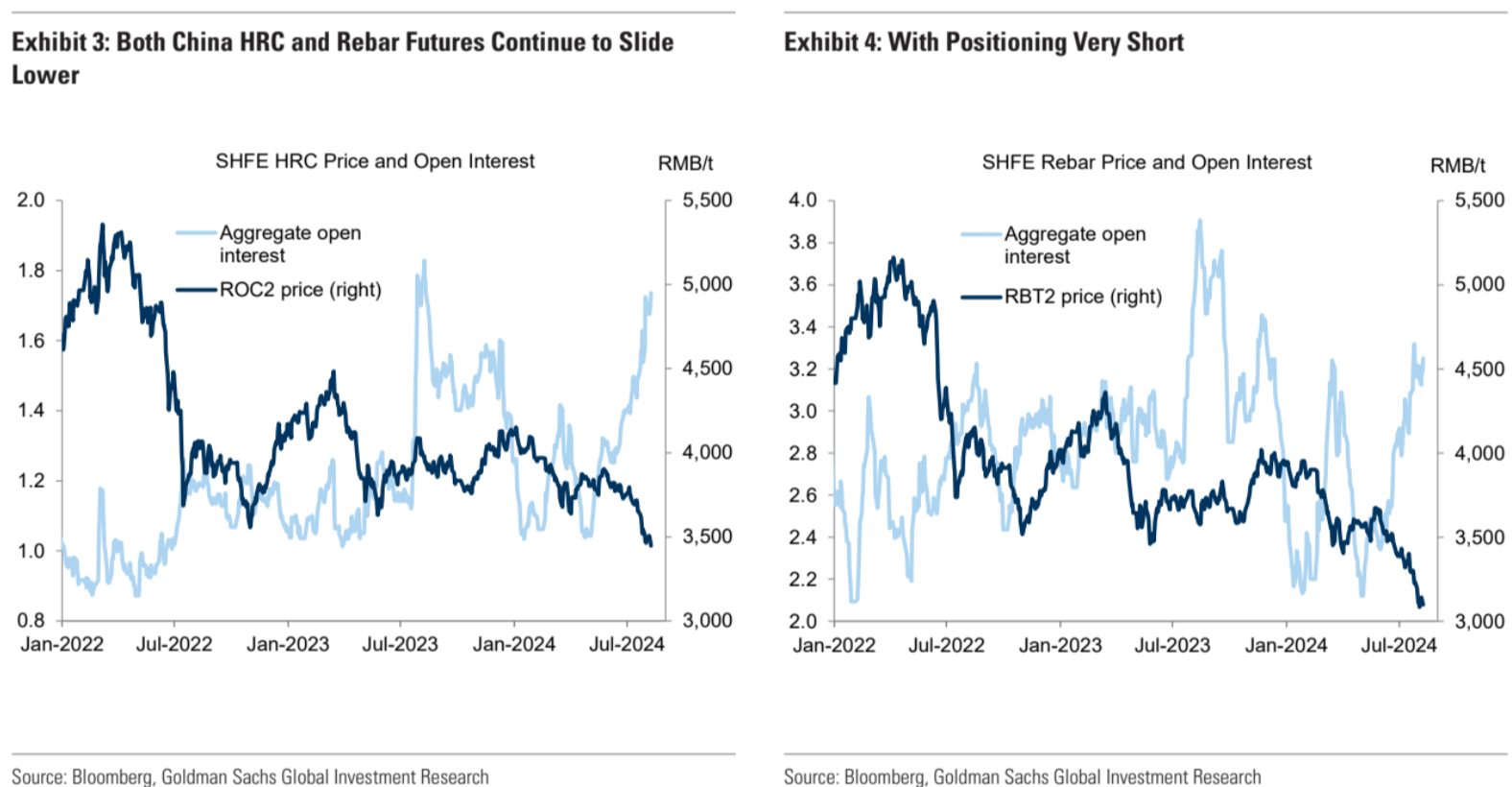

Both rebar and HRC futures are in free fall:

Advertisement

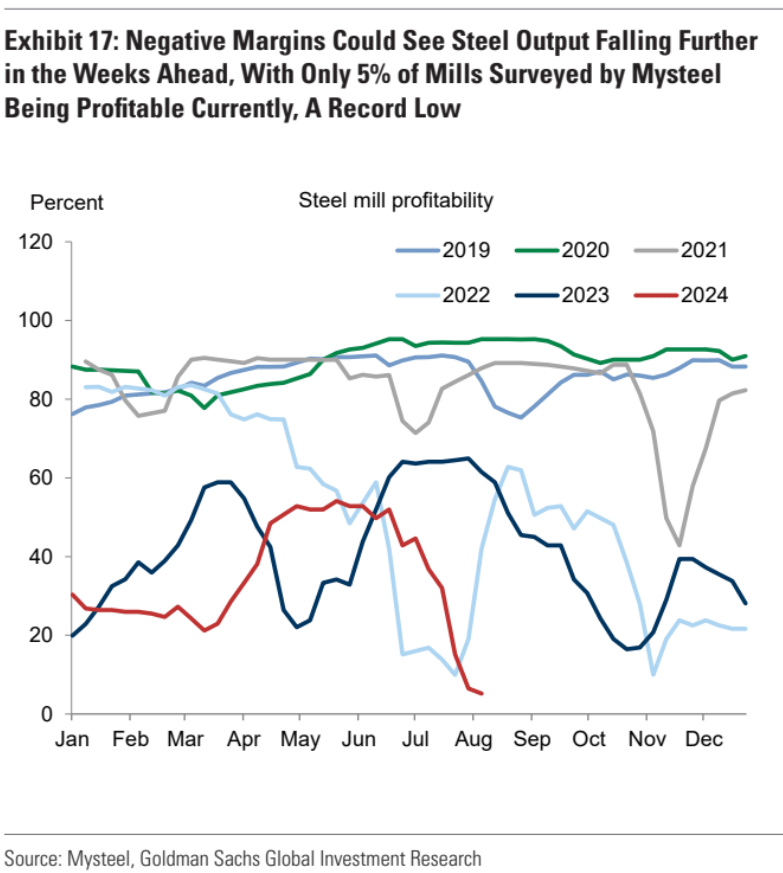

The weakness has crushed steel margins:

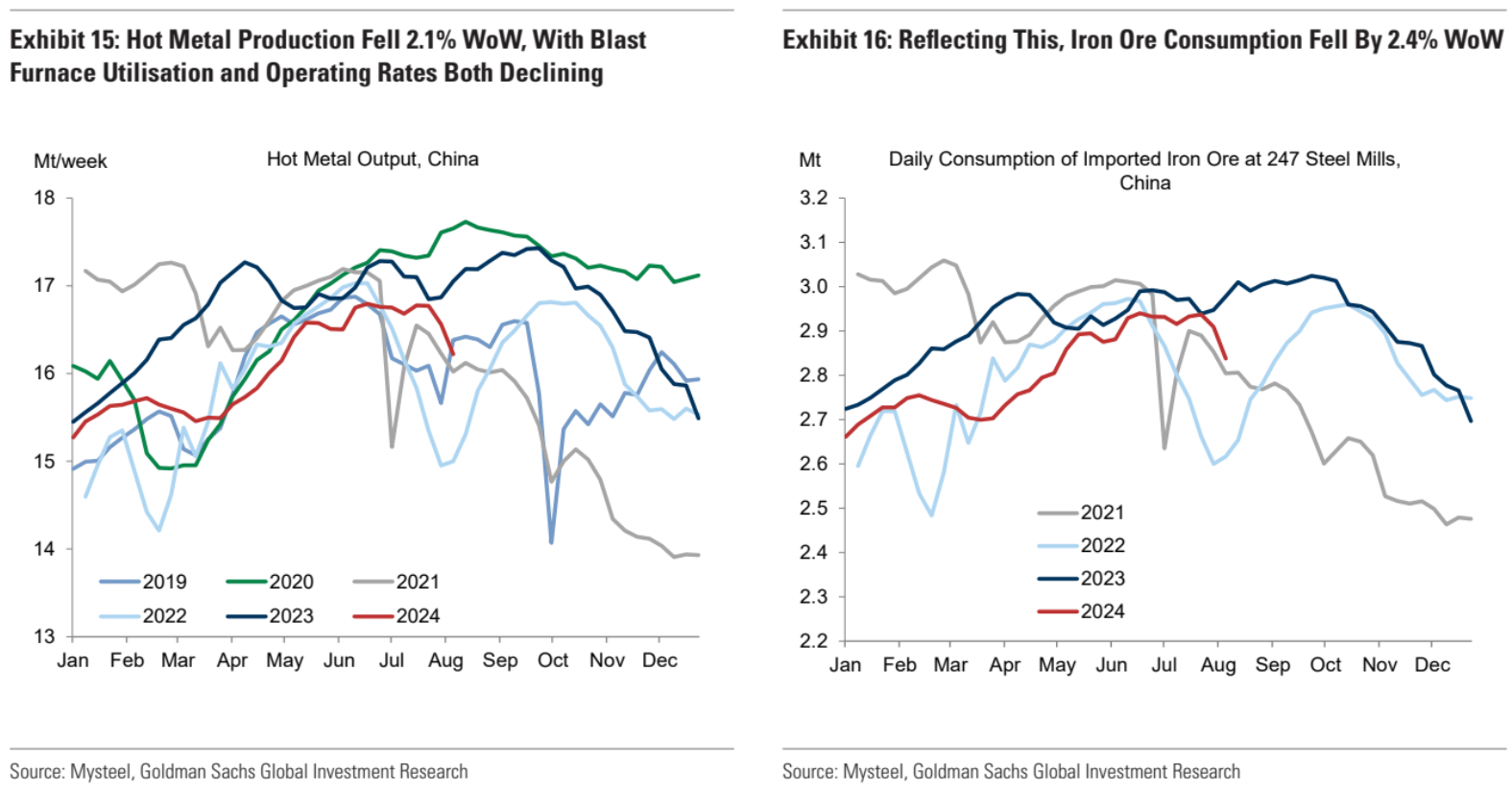

So, steel output is tanking:

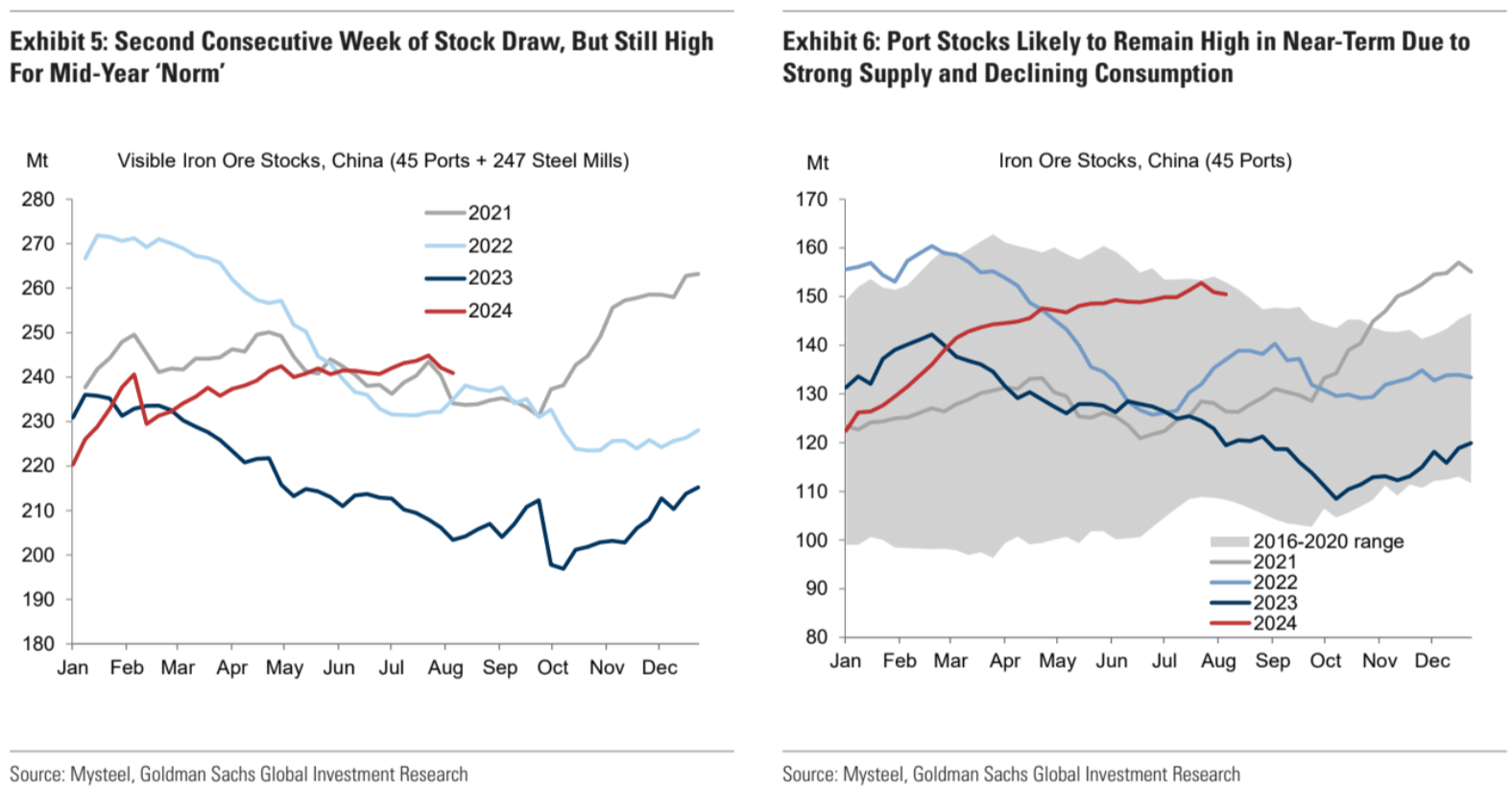

Iron ore destocking is next. Inventory is huge:

Advertisement

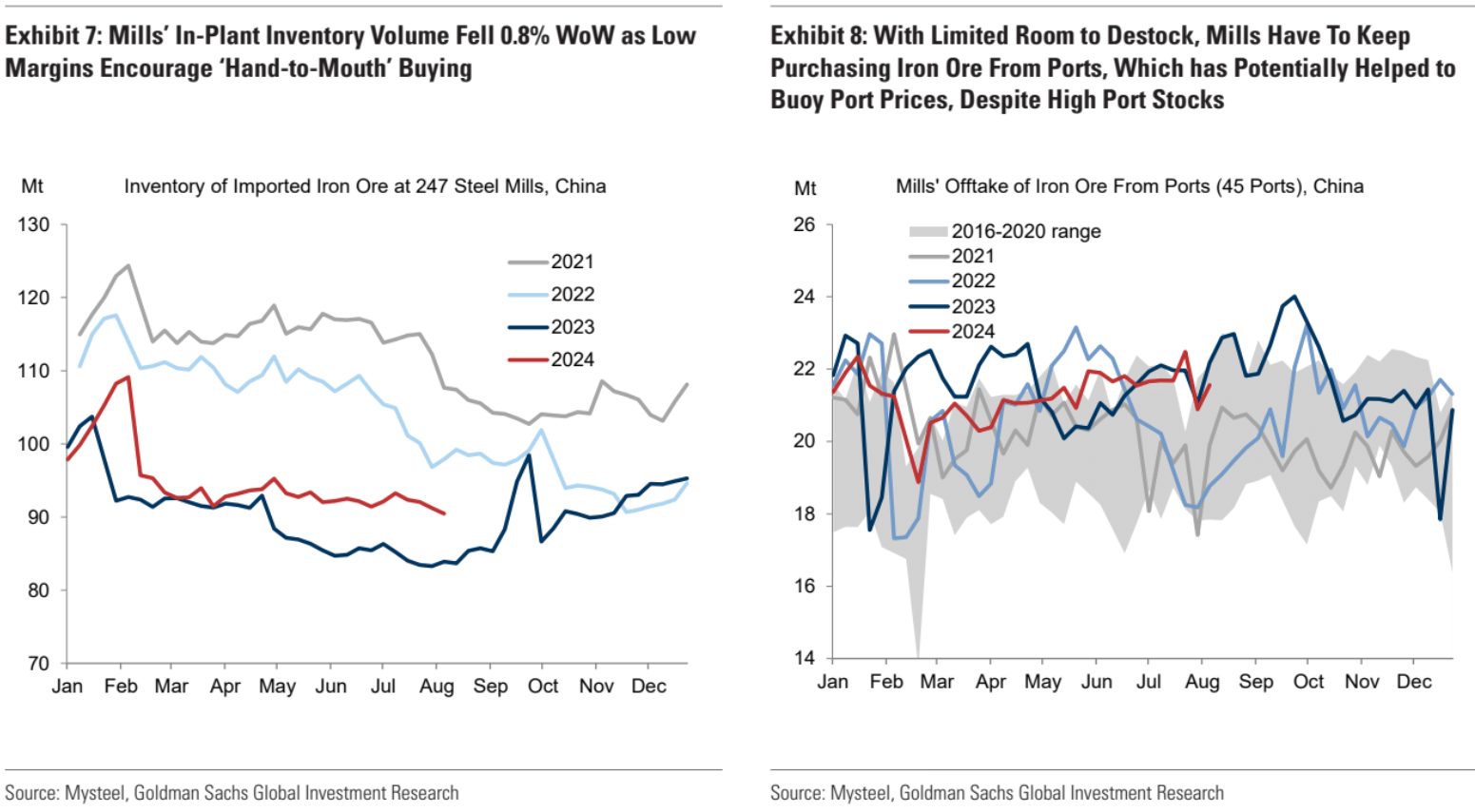

Though less so at mills, it will not matter if steel output keeps falling and they begin reselling contract cargoes:

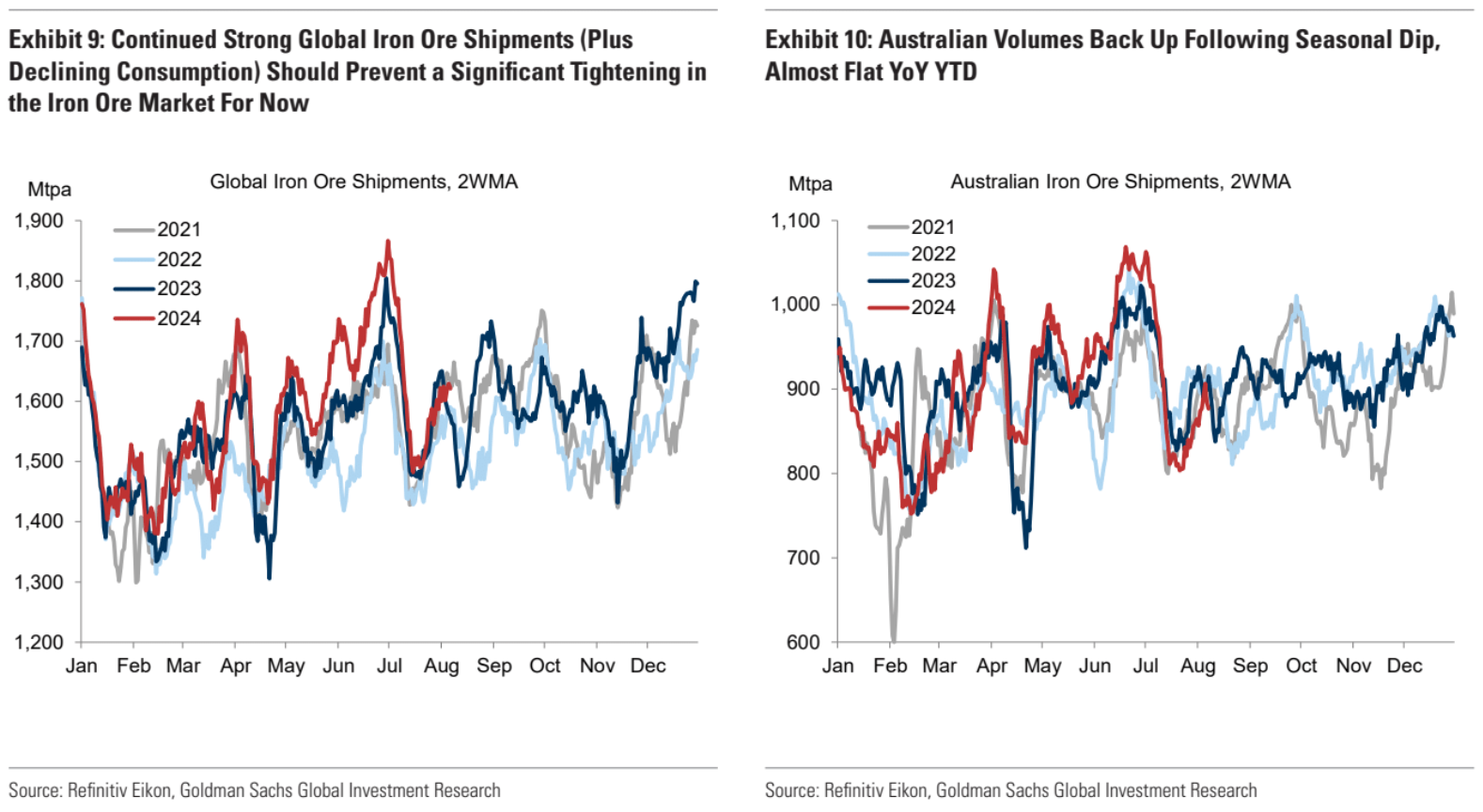

Supply is booming:

Advertisement

The market needs to take out high-cost Indian supply first. $80 will do it.