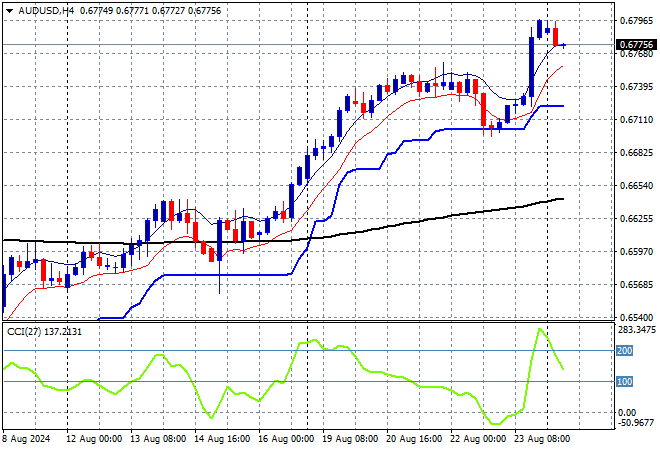

Another mixed session for Asian share markets as they absorb the buoyant mood from Wall Street on Friday night as the USD returns to structural weakness following Fed Chair Powell’s highly anticipated speech at the Jackson Hole symposium. The USD is still losing ground against most of the majors with Euro nearly above the 1.12 handle while the Australian dollar is dicing with the 68 cent level.

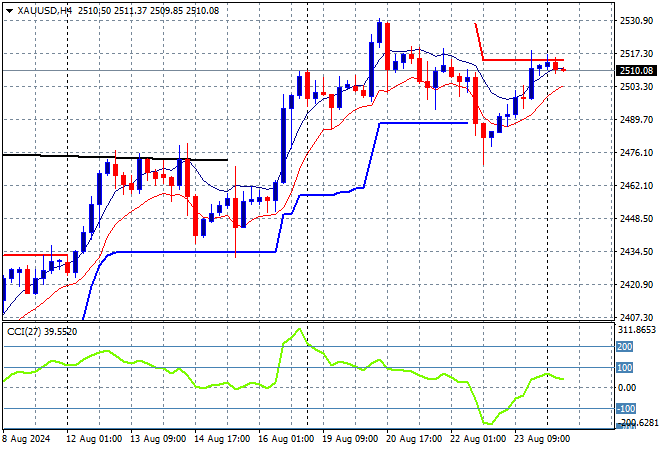

Oil prices are trying to get back on trend over the weekend gap as Brent crude oscillates around the $77USD per barrel level while gold is also trying hard to hold on to its return above the $2500USD per ounce level after the mid week retreat:

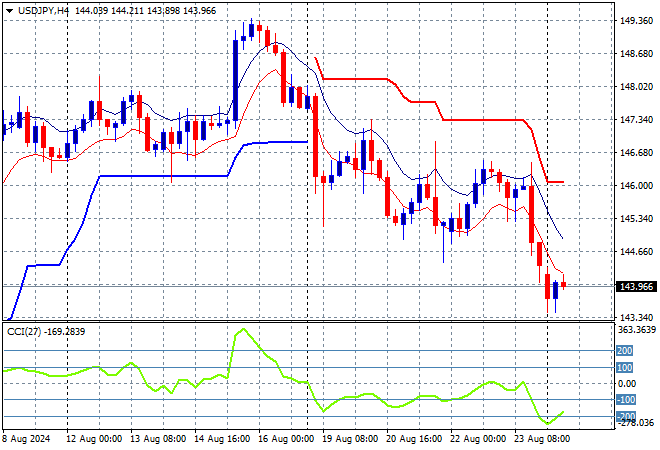

Mainland Chinese share markets are directionless again with the Shanghai Composite unchanged while the Hang Seng Index has lifted nearly 1% to 17771 points. Meanwhile Japanese stock markets are pulling back due to continued Yen volatility with the Nikkei 225 closing more than 0.6% lower at 38110 points while trading in USDPY has seen a new low below the 144 level:

Australian stocks were able to start the new trading week on a good note with the ASX200 up more than 0.7% to extend well above the 8000 point level and short term support while the Australian dollar gave back just a little bit of Friday night’s big breakout move to remain well above the mid 67 cent level:

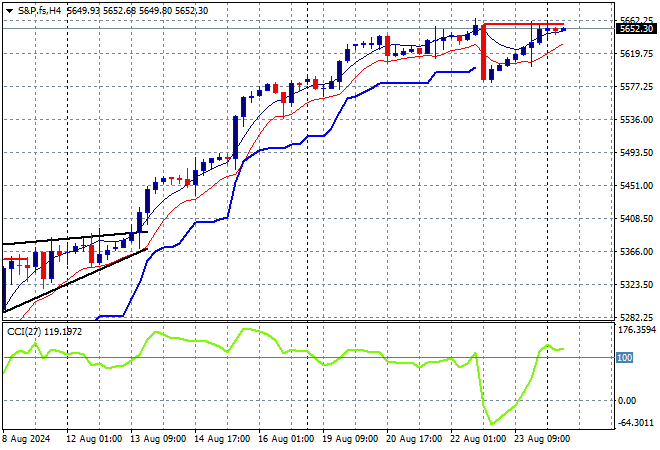

S&P and Eurostoxx futures are tracking slightly higher, but largely unchanged from Friday given its a bank holiday in the UK with the S&P500 four hourly chart showing momentum is back into the overbought zone after Friday night’s rebound:

The economic calendar starts the trading week with the closely watched German IFO survey, then US durable goods orders for July.