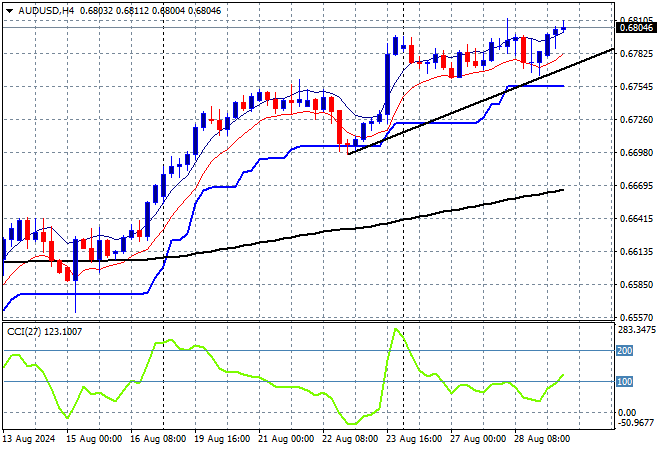

A fairly mixed session for Asian share markets following the dip on Wall Street overnight as the post close NVIDIA earnings muddy the AI/tech waters with Chinese shares and their Australian satellites down. The USD is fighting back somewhat against most of the majors with Euro retracing below the 1.12 handle but the Australian dollar is bucking the trend with a sustained move now above the 68 cent level.

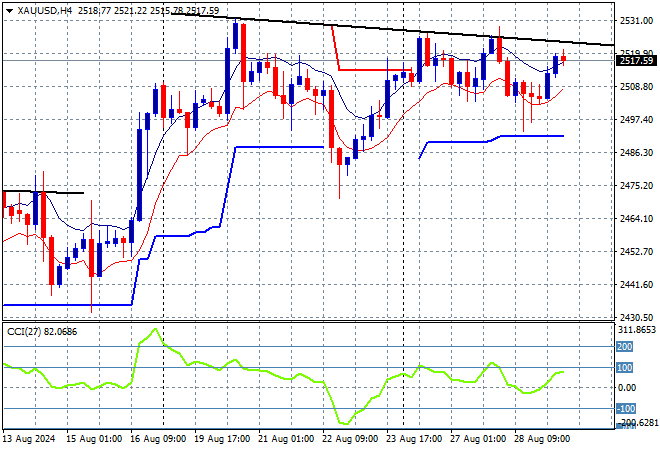

Oil prices are failing to get back on trend despite more Ukrainian attacks on Ruzzian refineries as Brent crude falls back to the $77USD per barrel level while gold is also trying hard to hold on to its return above the $2500USD per ounce level after the last week’s retreat:

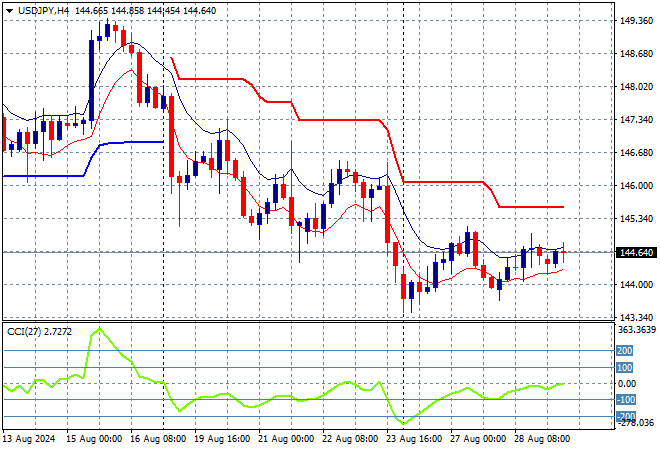

Mainland Chinese share markets are falling again with the Shanghai Composite down more than 0.5% while the Hang Seng Index has gone the other way to close 0.4% higher at 17771 points. Meanwhile Japanese stock markets are directionless with the Nikkei 225 closing dead flat at 38362 points while trading in USDPY hasn’t seen much movement either as it hovers around the 144 level:

Australian stocks were the biggest losers with the ASX200 retreating more than 0.3% to close at 8045 points while the Australian dollar is pushing higher and against the undollar trend to get back above the 68 cent level for a new weekly high:

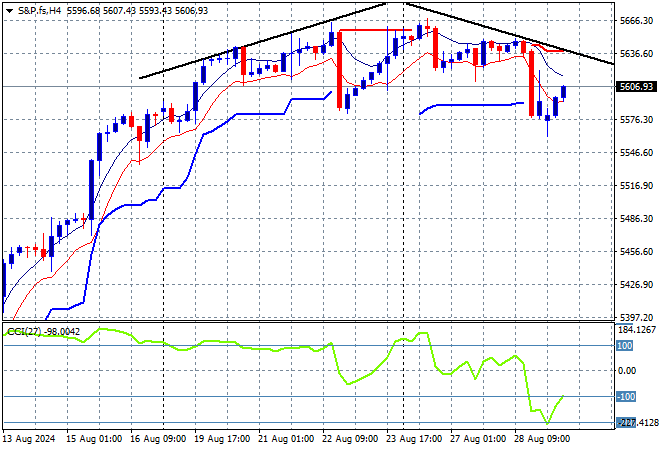

S&P and Eurostoxx futures are a bit mixed following the post close NVIDIA earnings with the S&P500 four hourly chart showing momentum is out of the oversold zone but price action overall looking a bit toppy:

The economic calendar will focus squarely on the latest US initial jobless claims and 2Q GDP estimates tonight.