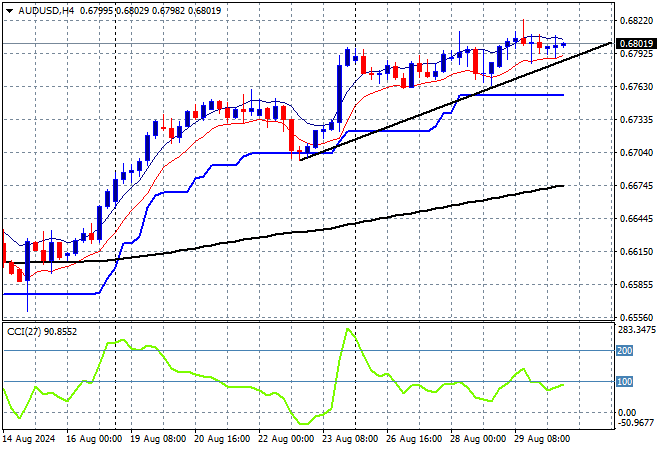

A quiet session to end the trading week and month for Asian share markets with some steady returns while currency markets remain sanguine following the overnight surge in USD that looks to be temporary. Tonight’s flash and core CPI prints could change that instantly however as Euro remains below the 1.12 handle but the Australian dollar is bucking the trend with a sustained move now above the 68 cent level.

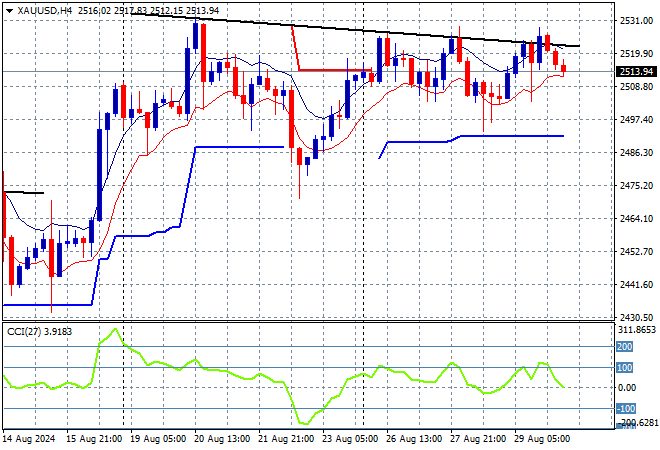

Oil prices are failing to get back on trend as Brent crude meanders around the $79USD per barrel level while gold is also trying hard to hold on to its return above the $2500USD per ounce level after the last week’s retreat but is going nowhere:

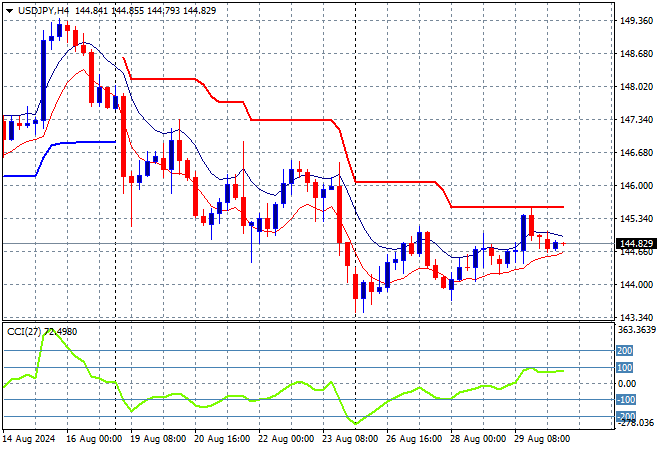

Mainland Chinese share markets are zooming higher with the Shanghai Composite up more than 1.2% while the Hang Seng Index is equally bullish, currently up nearly 1.8% to 18100 points. Meanwhile Japanese stock markets are also somewhat bullish with the Nikkei 225 about to close 0.4% higher to 38522 points while trading in USDPY remains quiet as it hovers just below the 145 level:

Australian stocks had a solid session with the ASX200 looking to close some 0.4% higher at 8078 points while the Australian dollar is holding steady and quite robust against the USD, hovering around the 68 cent level to hold on to its new weekly high:

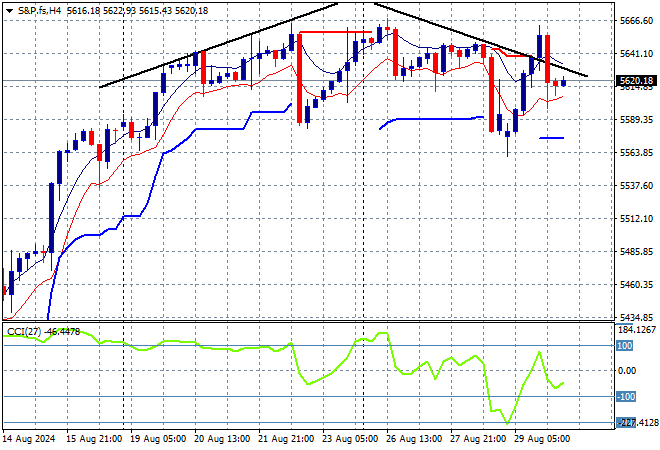

S&P and Eurostoxx futures are a bit mixed following with the S&P500 four hourly chart showing momentum now out of the oversold zone but price action overall looking a bit toppy:

The economic calendar ends the week with German unemployment, Euro wide flash August CPI and then the latest US Core PCE print for July.