The share market bears are sniffing around the woods although the post close NVIDIA earnings surprise might re-embiggen risk spirits later tonight. Wall Street faltered again as bond markets again lead the risk charge, although it was net no change in yields for US Treasuries despite some big auctions recently. The USD initially firmed against the major currency pairs before some late selling with Euro losing ground the most overall down to just above the 1.11 handle while the Australian dollar is holding steady just below the 68 cent level.

10 year Treasury yields were up just 1 point to the 3.84% level while oil prices slumped after recently coming back strongly as Brent crude retraced below the $77USD per barrel level again. Gold was able to hold again above the $2500USD per ounce zone but only just as intrasession volatility is starting to spike again.

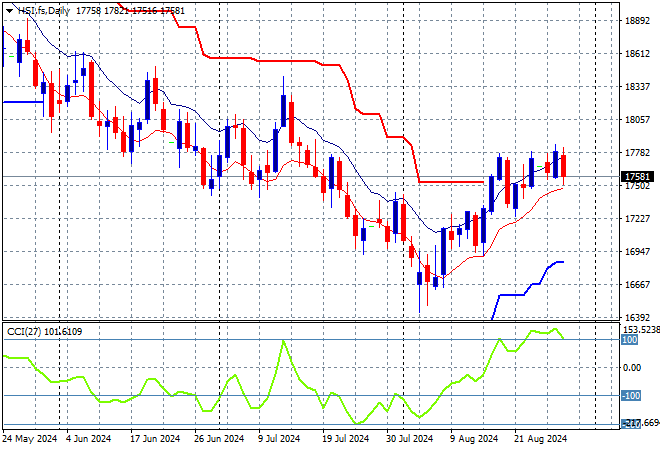

Looking at markets from yesterday’s session in Asia, where mainland Chinese share markets were directionless again but then sold off towards the close with the Shanghai Composite down more than 0.4% while the Hang Seng Index fell more than 1% to finish at 17830 points.

The Hang Seng Index daily chart was starting to look more optimistic a few months back but price action has slid down from the 19000 point level and continues to deflate in a series of steps as the Chinese economy slows. A few false breakouts have all reversed course and another downside move was looming here but this breakout has some potential if it clears short term resistance:

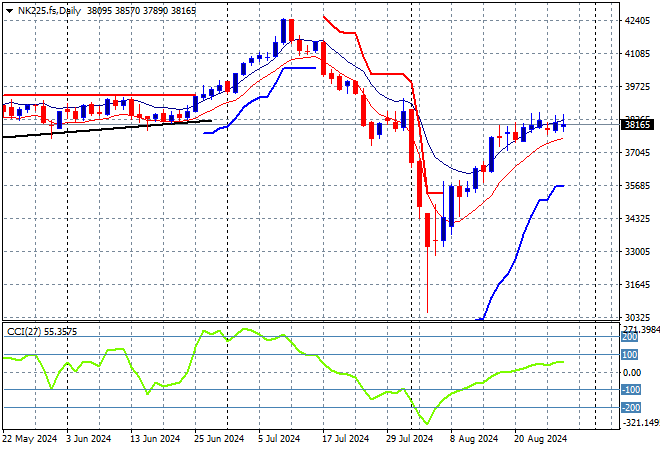

Meanwhile Japanese stock markets are pushing slightly higher as Yen weakens with the Nikkei 225 closing up 0.2% to 38371 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Short term support subsequently broke on that retracement, and then the front fell off. We are now seeing a big fill here but Yen volatility is coming back so a return to the 38000 point level from May/June is still possible but could be a rough road:

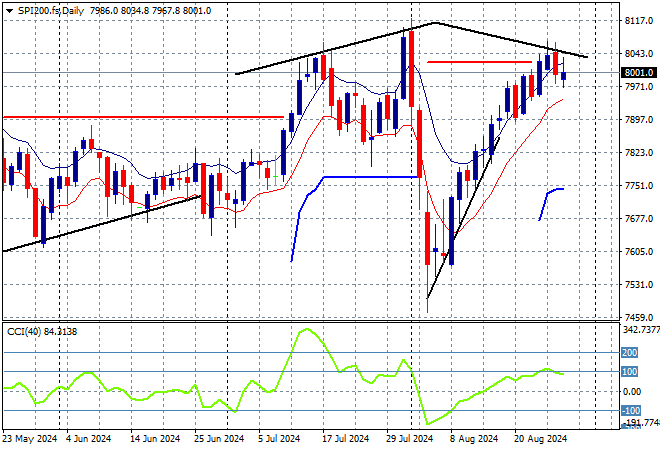

Australian stocks were the odd ones out with the ASX200 dead flat at 8071 points.

SPI futures are down 0.3% as Wall Street closed lower overnight as the stronger AUD continues to weigh on the market. Former medium term support at the 7700 point level will remain under pressure here as trader’s absorb the RBA’s signalling of no punchbowl for the rest of 2024, with short term momentum and the daily chart pattern potentially signalling a top here:

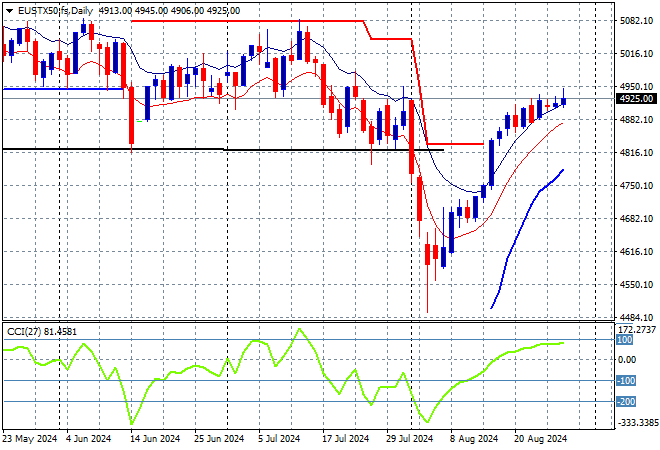

European markets were unable to put on any meaningful gains but managed a small lift as the Eurostoxx 50 Index closed 0.3% higher at 4913 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs with daily momentum retracing well into an oversold phase. This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance just unable to breach the 5000 point barrier. Price has cleared the 4700 local resistance level as it seeks to return to the previous highs but momentum is slowing:

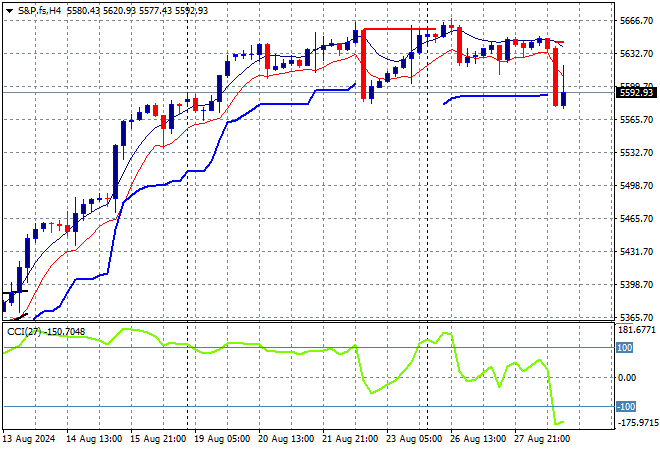

Wall Street was flumoxed a bit with the NASDAQ losing its cool to finish more than 1% lower while the S&P500 also lost ground, finishing 0.6% lower at 5592 points.

The four hourly chart illustrates how this bounceback had cleared the mid 5300 point level with momentum retracing fully from oversold to very positive these past two weeks. The potential for a positive breakout was building for a swift return to the early August highs but price seems to be anchored at short term support:

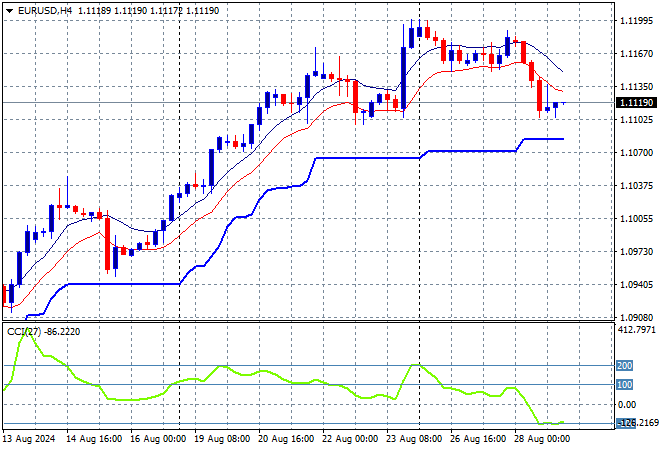

Currency markets had previously moved against USD in the wake of the latest Treasury auction and consumer confidence figures but the lack of data overnight and some more Treasury moves saw a return to strength with Euro losing the most ground, pushed back to the 1.11 handle.

The union currency had previously bottomed out at the 1.07 level before gapping higher earlier in the week with more momentum building to the upside with the 1.0750 mid level as support but there was still too much pressure from King Dollar. This was looking overbought in the short term as I mentioned before, but structurally remains supportive so I don’t expect any large dips soon:

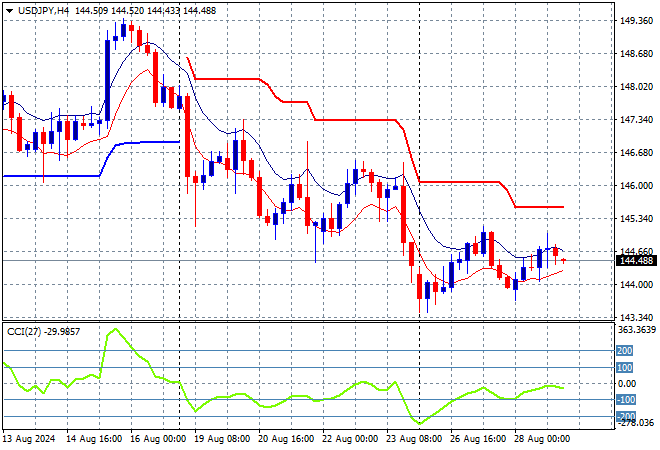

The USDJPY is failing to get out of its downwards medium term pattern with a staid session overnight to remain somewhat above the 144 handle after previously matching the previous monthly low.

The overall volatility speaks volumes as it pushed aside the 158 level as longer term resistance in the weeks leading up to the BOJ rate hike. Momentum was suggesting a possible bottom was brewing as the BOJ wants to get this under control but it doesn’t look like they have any influence here:

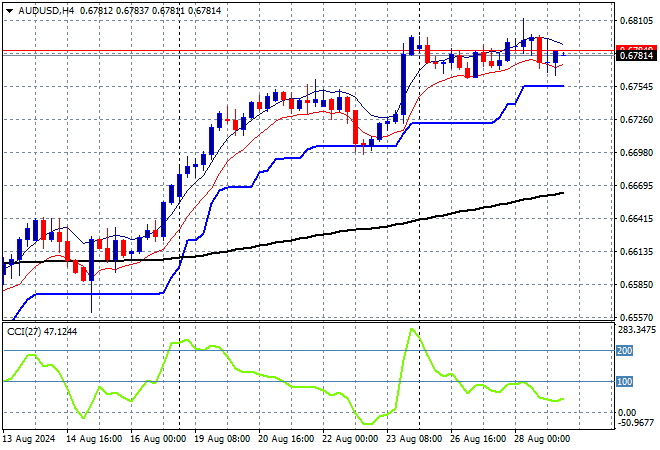

The Australian dollar was pushing higher on the weaker USD and the recent soft unemployment print, with a mild mid week rollover and retracement back to the 67 handle completely filled and rebounding on Friday night as the 68 cent level is now again under threat.

During June the Pacific Peso hadn’t been able to take advantage of any USD weakness with momentum barely in the positive zone but that has changed in recent weeks with price action finally getting out of the mid 66 cent level that acted as a point of control. A breakout is brewing here on the four hourly chart as price action matches the previous high:

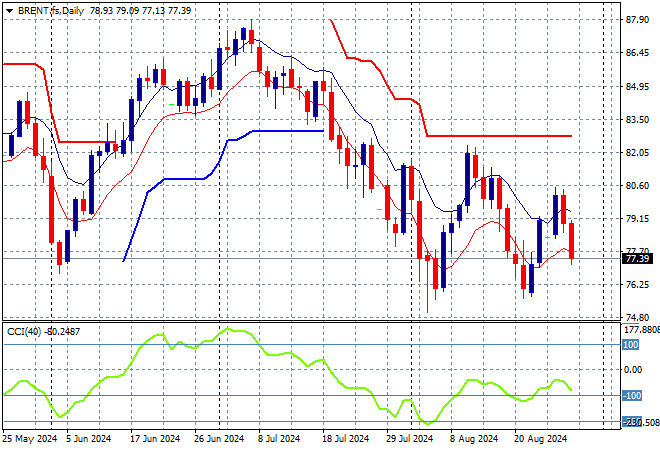

Oil markets are trying to move out of their previously weak position as volatility builds with Brent crude pulling back once more to retreat below the $78USD per barrel level overnight.

After breaking out above the $83 level last month, price action had stalled above the $90 level awaiting new breakouts as daily momentum waned and then retraced back to neutral settings. Daily ATR support had been broken with short term momentum still in oversold mode as this swings into higher volatility:

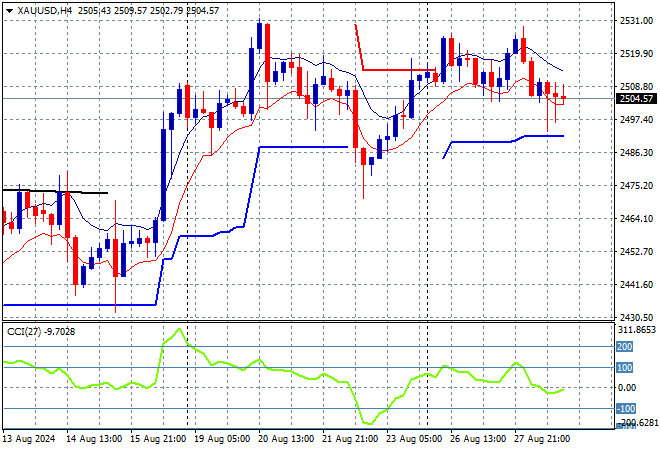

Gold is keeping above the $2500USD per ounce level but only just as volatility builds as it fails to return to its previous high from mid-August.

The longer term support at the $2300 level remains firm while short term resistance at the $2470 level was the target to get through last week as I indicated. This is still looking a little overextended so I expect a minor pullback unless USD weakness continues tonight:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!