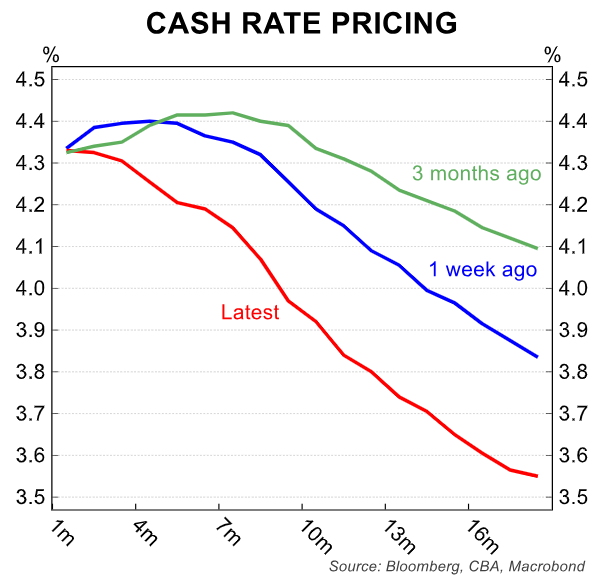

CBA head of Australian economics, Gareth Aird, has published the following chart showing how financial markets have swung sharply to pricing in rate cuts following Wednesday’s lower-than-expected Q2 CPI result.

One week ago, financial markets were tipping a moderate chance of a further rate hike and for the official cash rate to remain elevated deep into next year.

Now, markets are tipping rate cuts before the end of the year and for the official cash rate to decline to 3.6% within 16 months.

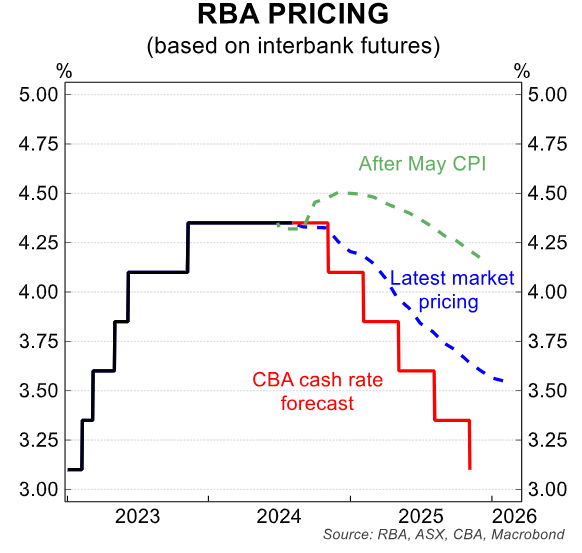

The CBA anticipates that the RBA will deliver the first 25bp rate cut in November 2024.

“This is premised on a Q3 24 trimmed mean CPI of 0.8%/qtr (or lower) and an ongoing upward trend in the unemployment rate”.

However, Gareth Aird notes that this is a tight call and that “the risk clearly sits with interest rate relief not arriving until H1 25”.

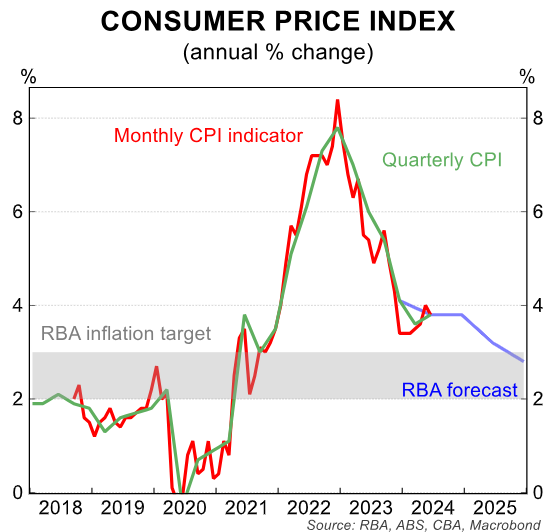

Aird also noted that CBA “expect the RBA Governor to stick to the same script that has been used at each press conference in 2024; namely that the Board remains alert to potential upside inflation risks, whilst recognising that GDP growth is weak and the outlook is uncertain”.

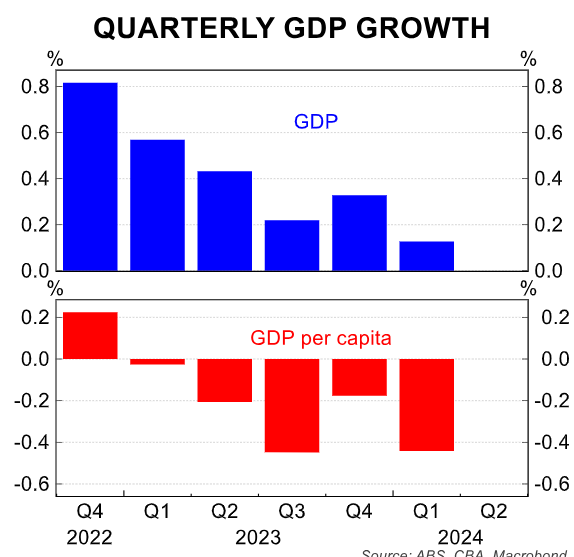

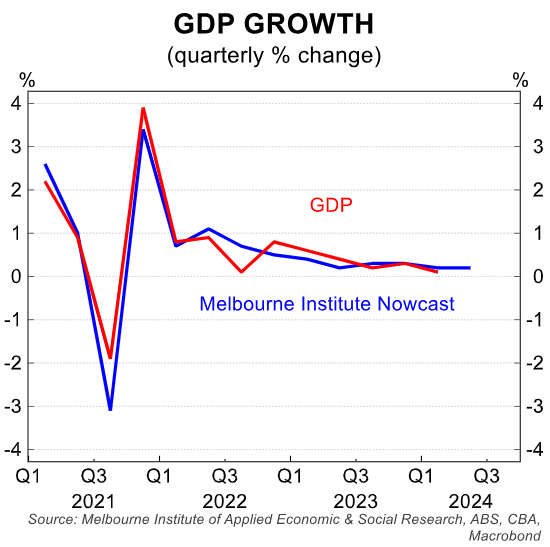

In making its case for rate cuts, Aird published the following chart showing that Australia’s economy remains stuck firmly in a per capita recession following five consecutive quarterly declines to Q1 2024:

The Q2 national accounts are expected to show a sixth consecutive quarter of per capita GDP decline:

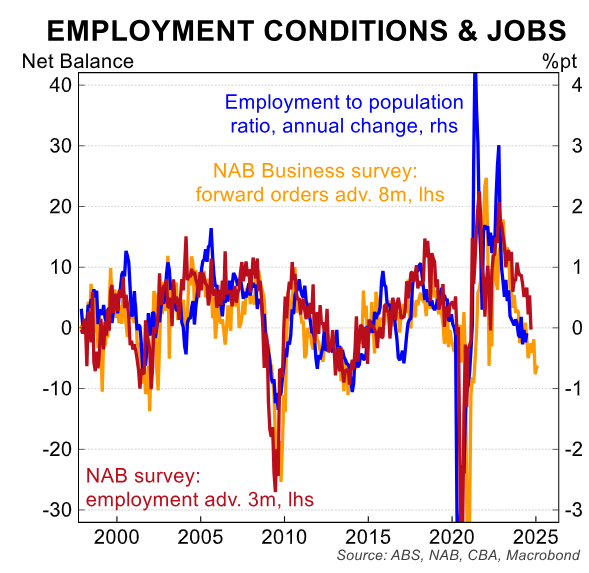

Forward-looking labour market indicators are also pointing to rising unemployment in the period ahead:

In short, the RBA will be highly reluctant to raise rates given the weak economy, and the next move will likely be down.

The big unknown is whether rate cuts will arrive late this year or in the first half of next year.