Australia’s governments have conducted various housing affordability inquiries over the years, including but not limited to:

- Menzies Research Centre: Prime Ministerial Taskforce on Home Ownership 2003;

- The Productivity Commission’s First Home Ownership Report in 2004;

- A Good House is Hard to Find Report from the Senate Select Committee on Housing Affordability in Australia in 2008;

- Western Australia’s Affordable Housing Strategy 2010-2020;

- NHSC: State of Supply Reports (2008, 2010, 2011, 2012, 2013 onwards);

- COAG Review of Capital City Strategic Planning Systems Report 2011 and report on Housing Supply and Affordability Reform 2012;

- Senate Inquiry into Affordable Housing, 2014-2015; and

- Parliamentary Inquiry into Home Ownership 2015.

- House of Representatives Standing Committee on Tax and Revenue Inquiry into housing affordability and supply in Australia 2022.

Organisations such as the Grattan Institute, the McKell Institute, AHURI, Everybody’s Home, and others have issued similar reports.

Thousands of work hours and millions of dollars in wages and consulting fees have been wasted on these reports with little effect.

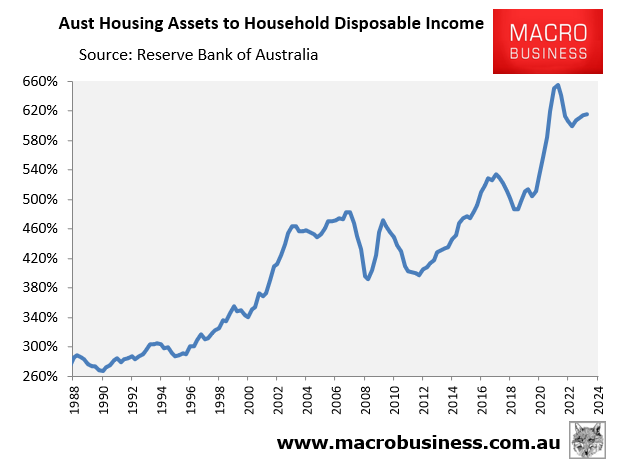

Instead, the purchase cost of housing has increased:

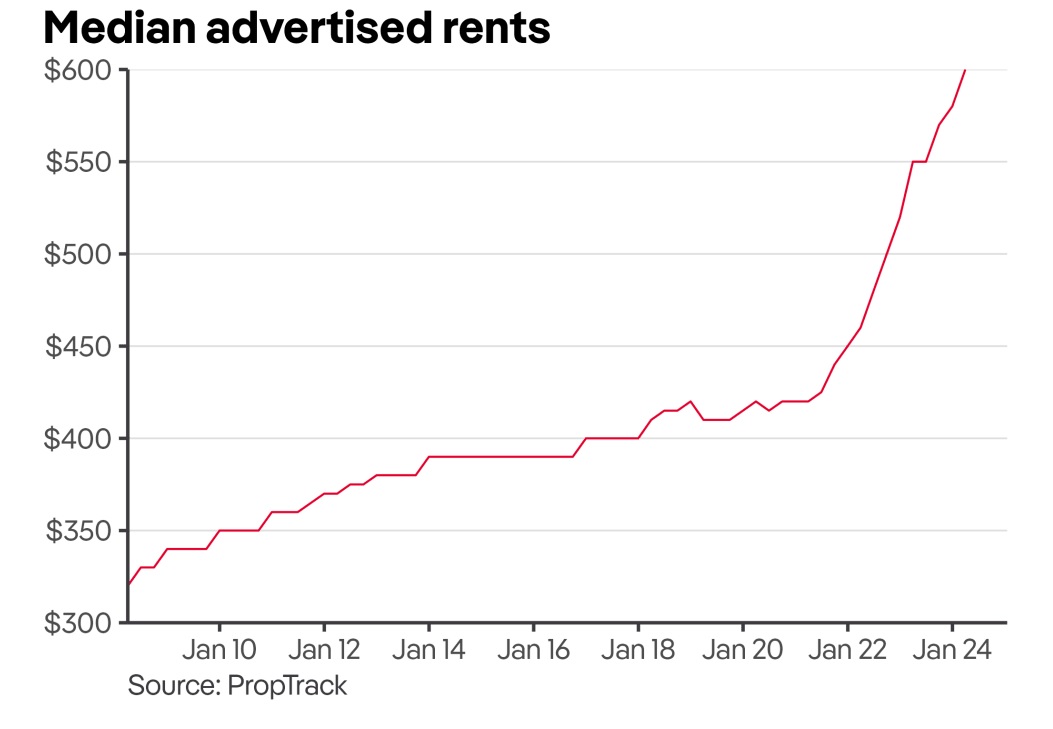

Rental inflation has also shot higher:

Like Groundhog Day, another Senate Inquiry has been announced into home ownership, this time focused on the financial regulatory framework, including: “whether the present financial regulatory framework adequately prioritises the goal of home ownership for Australians, with particular reference to: Australian Prudential Regulation Authority prudential standards and Corporations Act 2001 provisions for lending”.

The Inquiry will be led by the Coalition’s Andrew Bragg who said that he wants to “tilt the scales in favour of first-time homebuyers” by making loan approvals easier.

Bragg has taken direct aim at “responsible lending” obligations put on banks following the Global Financial Crisis:

“Clearly the balance is wrong. We don’t want to weaken our banks, we want them to be unquestionably strong. But we also have to look at the objective of home ownership, which is the Australian dream”, he said.

“Responsible lending laws are horribly complex and duplicative”.

Abolishing responsible lending laws is likely to further inflate property values by pushing more credit into the system.

Moreover, the Hayne Banking Royal Commission’s number one recommendation was for responsible lending rules to remain intact:

The Hayne Banking Royal Commission’s central recommendation was to keep responsible lending laws.

Twenty years of demand-side “affordability” measures have helped push up the cost of Australian housing.

Throwing more credit at the affordability problem will only make the situation worse, increasing household debt, and eroding financial stability.

The reality is that our political leaders do not want more affordable housing, because that would require lower prices.

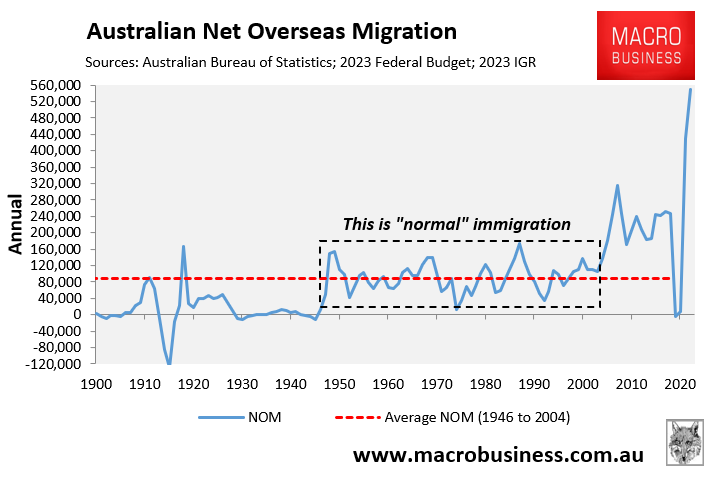

Nor will they ever lower immigration to sensible, sustainable levels of below 120,000 so that housing supply can keep pace with demand.

Instead, they pretend to care by offering false hope to would-be buyers.