The Reserve Bank of Australia’s (RBA) Statement of Monetary Policy (SoMP) was released on Wednesday and warned that Australia faces an extended period of strong rental inflation.

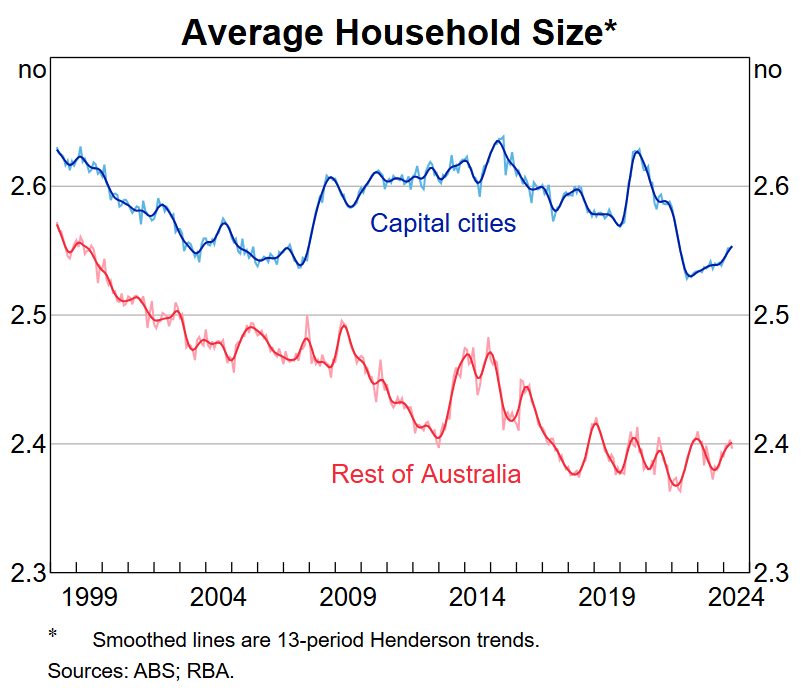

The SoMP noted that “underlying demand for housing has remained strong”, driven by “strong population growth and a low average household size continue”.

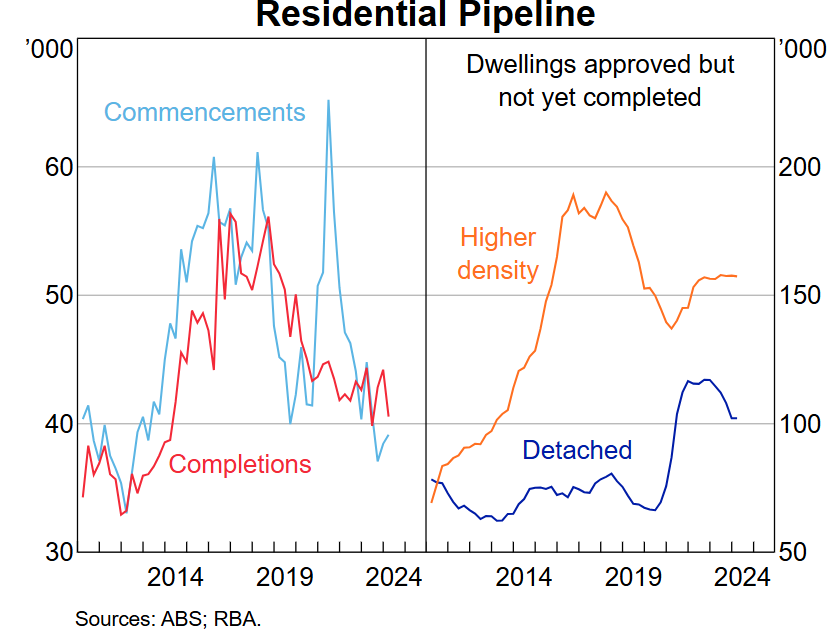

The SoMP also noted that the rate of dwelling supply “remains weak, reflecting ongoing cost pressures affecting project feasibility and labour shortages for certain trades”.

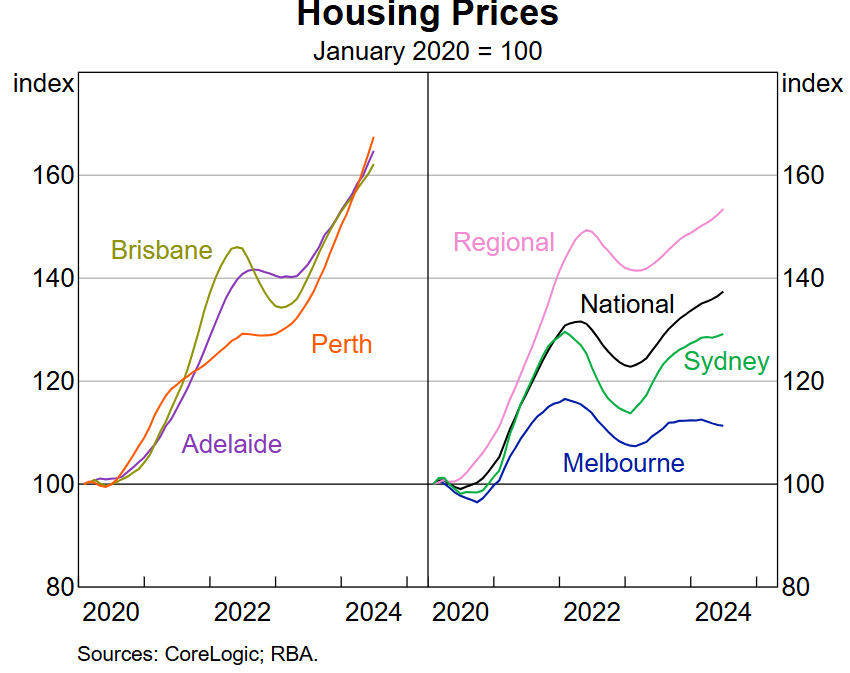

As a result, the RBA warns that “the ongoing imbalance between supply and underlying demand has led to further rises in housing prices and rents”.

“National housing price growth has been stronger than expected over recent months”.

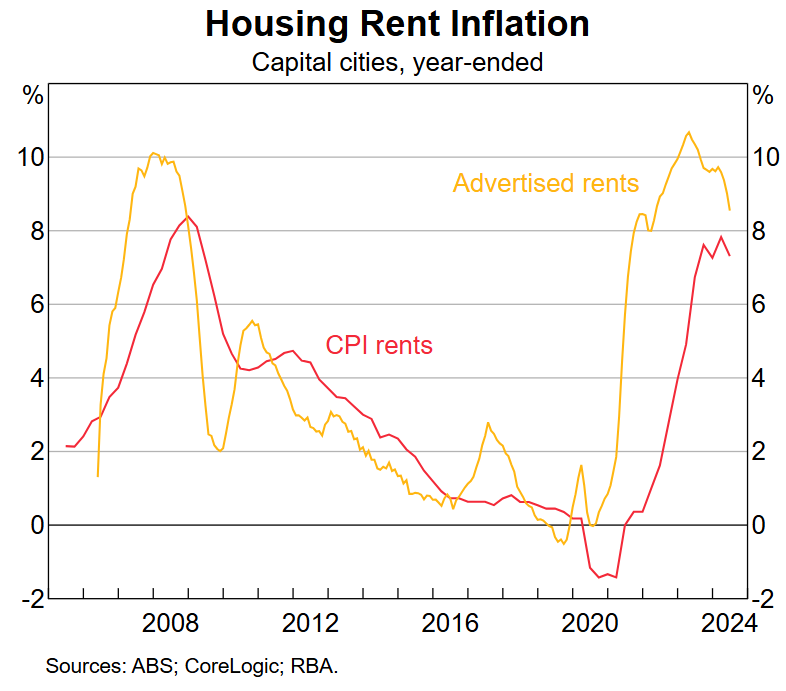

Meanwhile, “rent inflation remains high and this is expected to persist”.

Although the “growth in advertised rents has eased over recent months, which may reflect the impacts of affordability constraints… it remains above the growth rates experienced prior to the pandemic”.

“Growth in advertised rents remains high, reflecting tight rental market conditions across the capital cities; however, it has started to ease recently, consistent with the increase in average household size”.

“Rents on new leases flow through to CPI rents with a lag as only a small share of the stock of rental properties update leases in a given month, which implies that CPI rents inflation is likely to be high for some time”.

The above is further proof that the Albanese government’s record immigration has increased housing costs for Australians.