He’s grown it long and slicked it back in homage to Wall Street and now Andrew Hauser is bringing the pain:

Commentators telling the Reserve Bank of Australia to cut or raise interest rates are overconfident “false prophets” who could damage the economy with their poor predictions, deputy governor Andrew Hauser warns.

The unusually blunt remarks from the RBA’s second-in-charge highlight the central bank’s exasperation with ongoing criticism of its approach to setting interest rates during the current episode of high inflation.

Some economists argue the RBA could push the economy to the brink of recession if it raises the cash rate beyond 4.35%, but other analysts say the RBA has not raised interest rates far enough to tame inflation.

One wonders to whom Hauser is speaking. Certainly not MB, which has been more right than wrong over the past year.

Very likely it is the AFR where hapless hawks squawk pointlessly into the stratosphere.

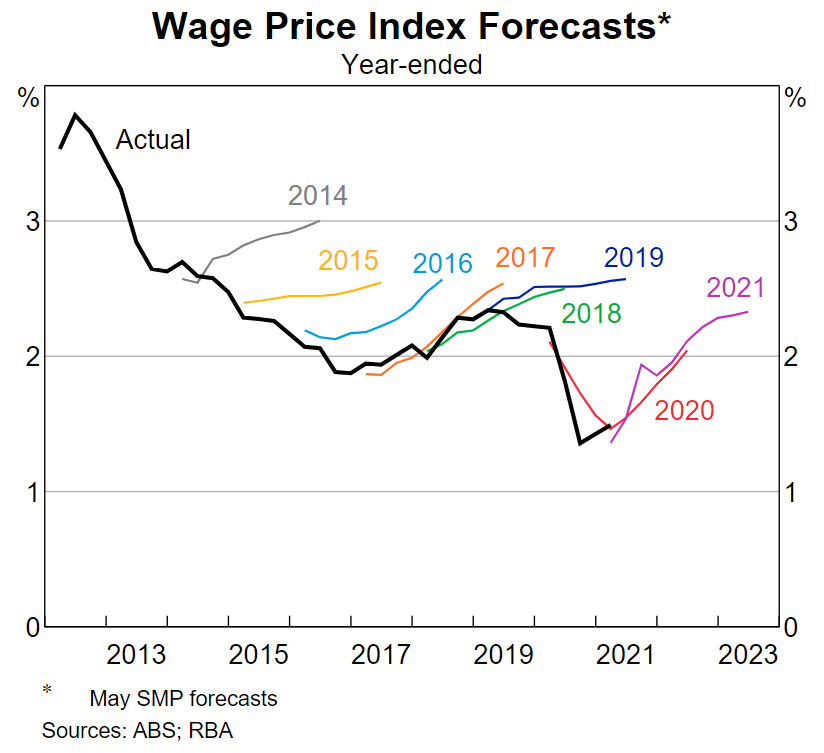

In that vein, Hauser is doubtless telling that useless paper to put a sock in it because it was so wrong throughout the last cycle, cheerleading the central bank to keep rates too high for too long:

Australia has enough idiots without adding the AFR to the pile.