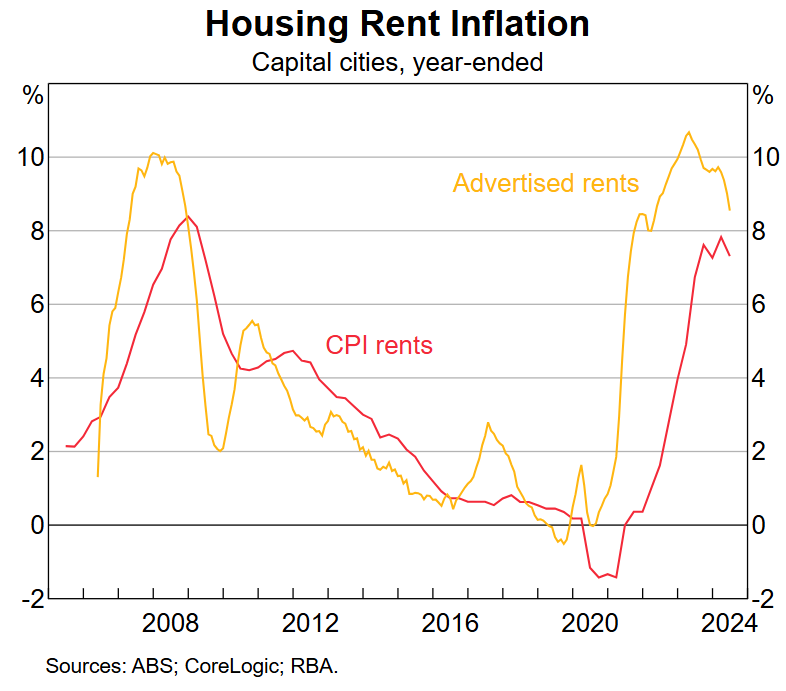

The August Statement of Monetary Policy (SoMP) from the Reserve Bank of Australia (RBA) showed that advertised rental growth is finally falling, but remains at an elevated level historically:

Westpac senior economist Justin Smirk warns that rents as measured in the CPI will remain a significant ‘thorn in the side’ of the RBA into 2025, adding to Australia’s inflationary pressures:

Rents are expected to remain a significant inflationary pressure, holding a pace of at least 7%yr through to June 2025 from where we expect the pace to ease back a touch to around 6%yr by December 2025.

The pace of growth for asking rents has already tipped over but with ongoing robust population growth, and the fact the pace of growth in asking rents is still higher than the growth in average rents in the CPI, there is little reason to expect a near term moderation in rental inflation.

Rents growing at 7.6%yr in the year to December will contribute 0.48ppts to the annual pace of inflation while rents at 7.0%yr at June 2025 will contribute 0.45ppts to the annual pace.

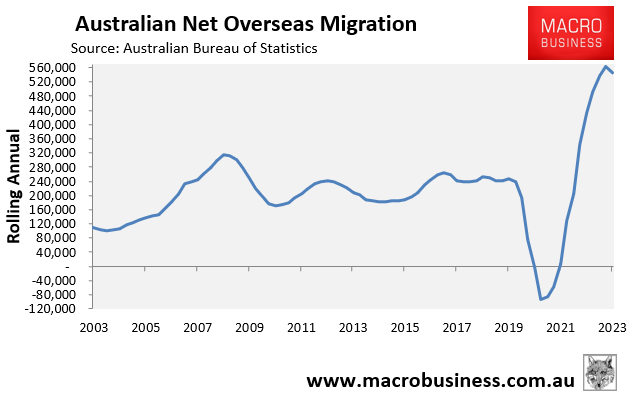

The surge in rents is strongly correlated to the surge in net overseas migration:

Thus, a fair share of Australia’s current inflation predicament is the direct result of the federal government’s reckless immigration policy.