On Wednesday, Statistics New Zealand released labour market data for the June quarter, which revealed that New Zealand’s unemployment rate rose 0.2% over the quarter to 4.6%, in line with the Reserve Bank’s forecasts.

The March quarter was revised up slightly from 4.3% to 4.4%.

The unemployment rate is now tracking at its highest level since March 2021.

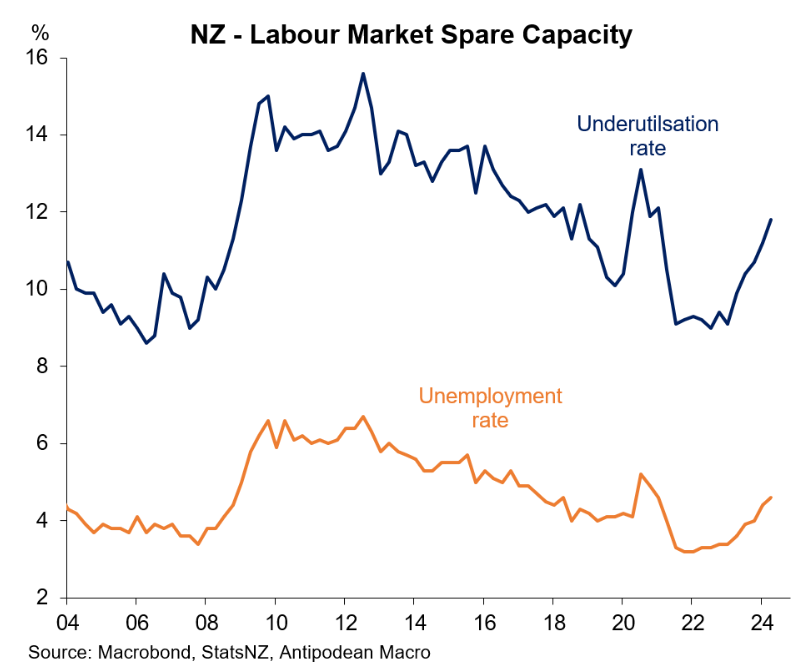

As illustrated in the following chart from Justin Fabo at Antipodean Macro, New Zealand’s labour underutilisation rate – i.e., unemployment and underemployment combined – jumped by 0.6% to 11.8%:

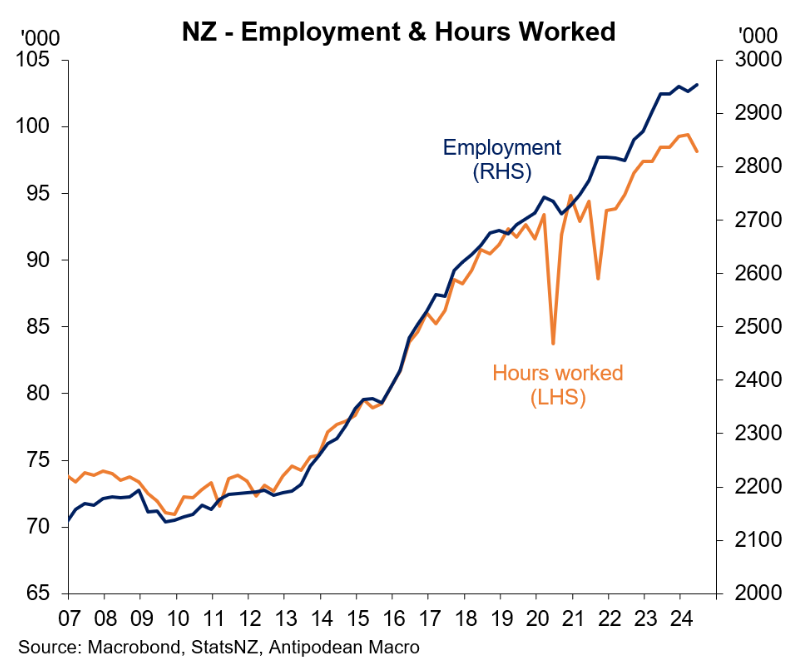

Total hours worked in New Zealand fell solidly in Q2 as average hours worked declined:

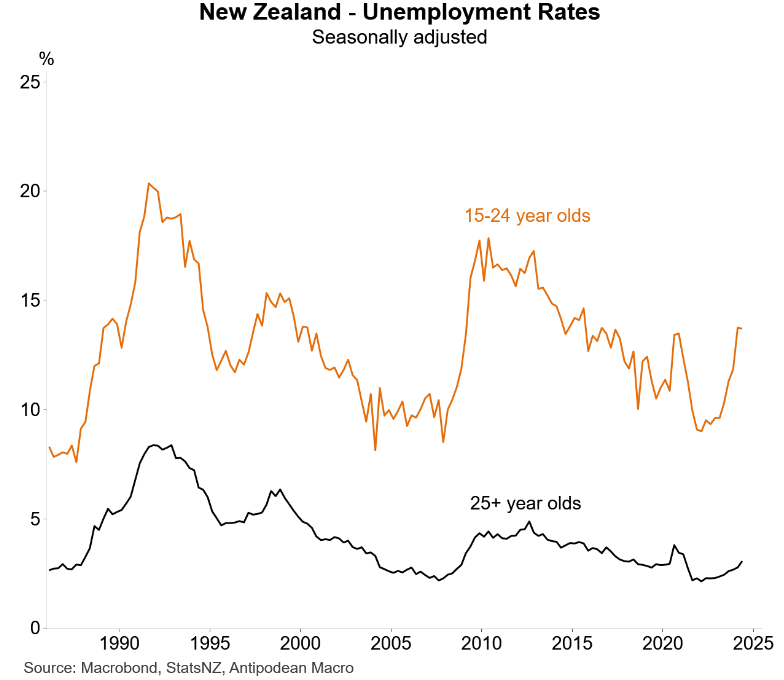

As generally happens during downturns, New Zealand’s youth workers aged 15–24 have been hit hardest by job losses:

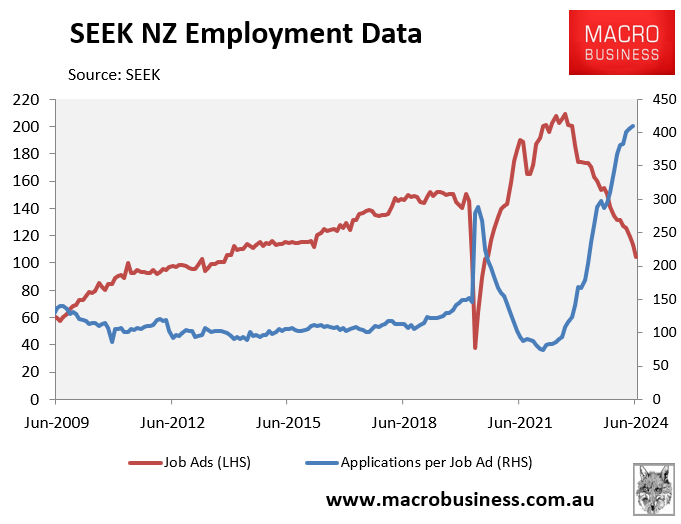

The deterioration in New Zealand’s labour market was well telegraphed by Seek, which has recorded collapsing job vacancies and rising applicants per job:

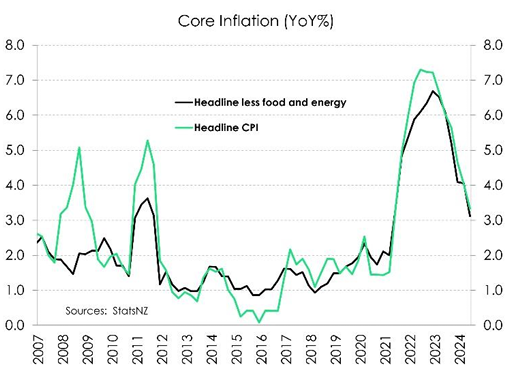

Given the slowing of New Zealand’s CPI inflation, it should also be a slam dunk for the Reserve Bank to cut the official cash rate from its highly restrictive level of 5.50%.

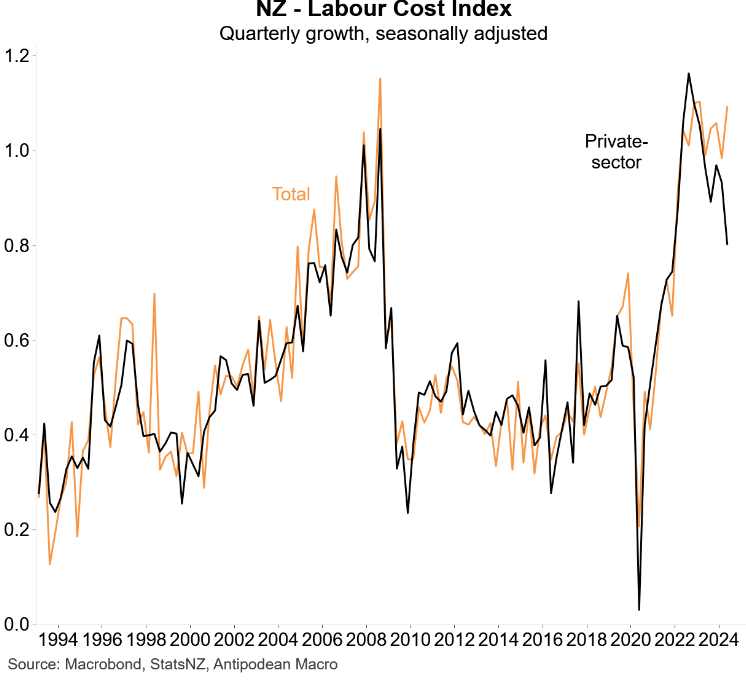

However, as Justin Fabo shows below, labour cost inflation remains strong, albeit this is being driven by the public sector, with private sector labour costs easing:

The implementation of previously agreed-upon pay increases in the health and education sectors had an impact on the wage figures.

Therefore, while wage inflation is slowing, it remains above what would be consistent with the Reserve Bank’s inflation target.

The elevated wage growth will likely keep the Reserve Bank on hold at next week’s monetary policy meeting.