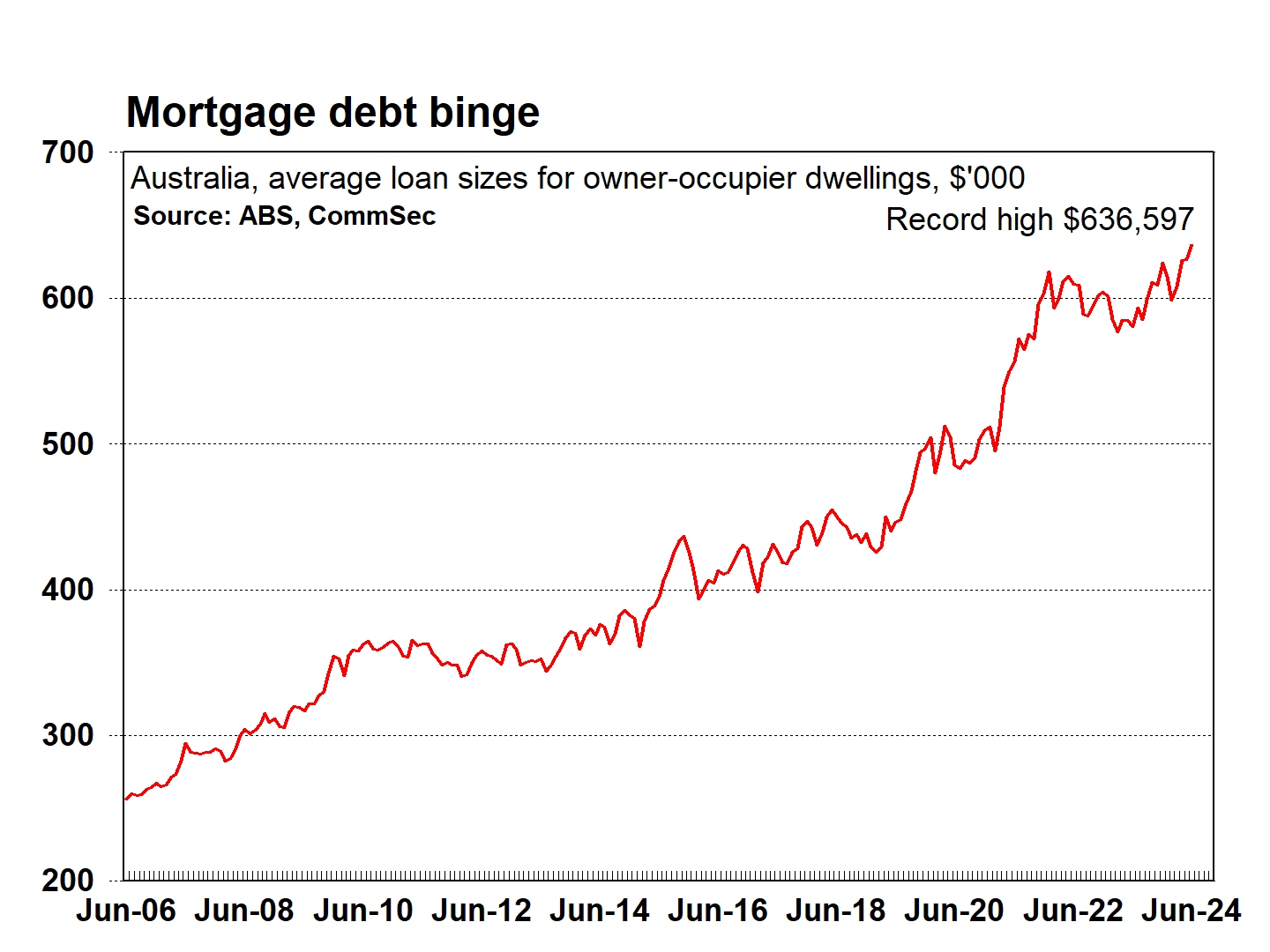

The above chart was picked up by a Macrobusiness member (H/T JohnR) off Twitter (X) in the last day or so. It has come from Commbank.

For sure we have all seen its counterparts over the last ten – twenty years and we have all chewed over the utter insanity of it all.

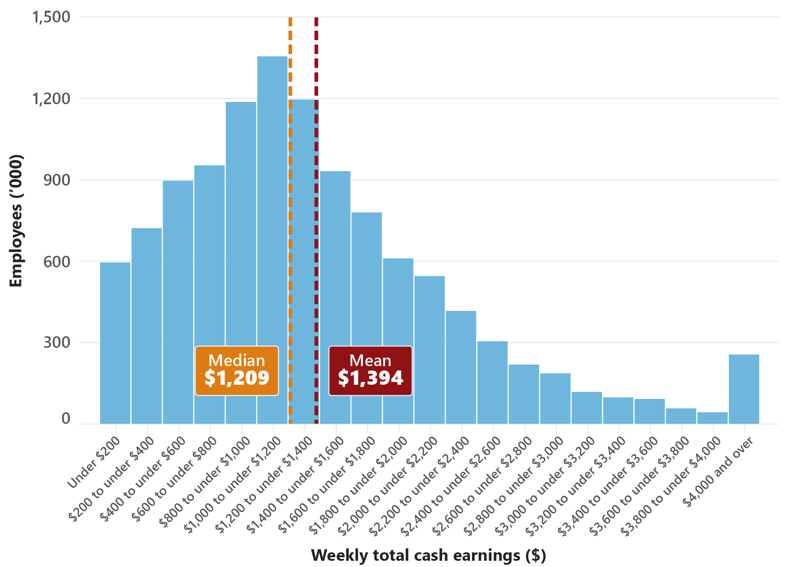

Now the next chart is a couple old years old and shows us the Median and Mean weekly incomes of Australians in late 2022. So they may have risen by a few percent since then, but they will still be in the ballpark.

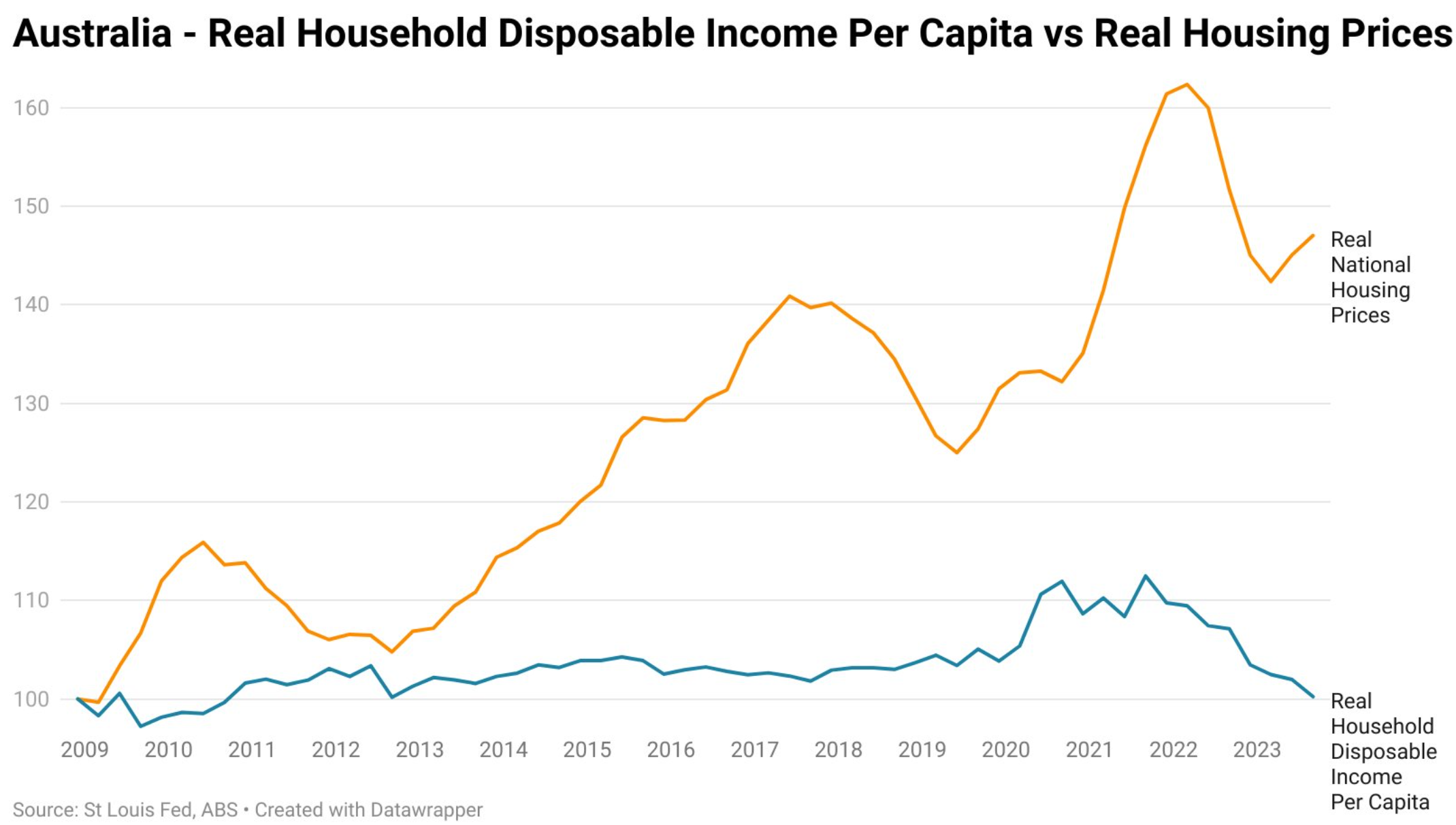

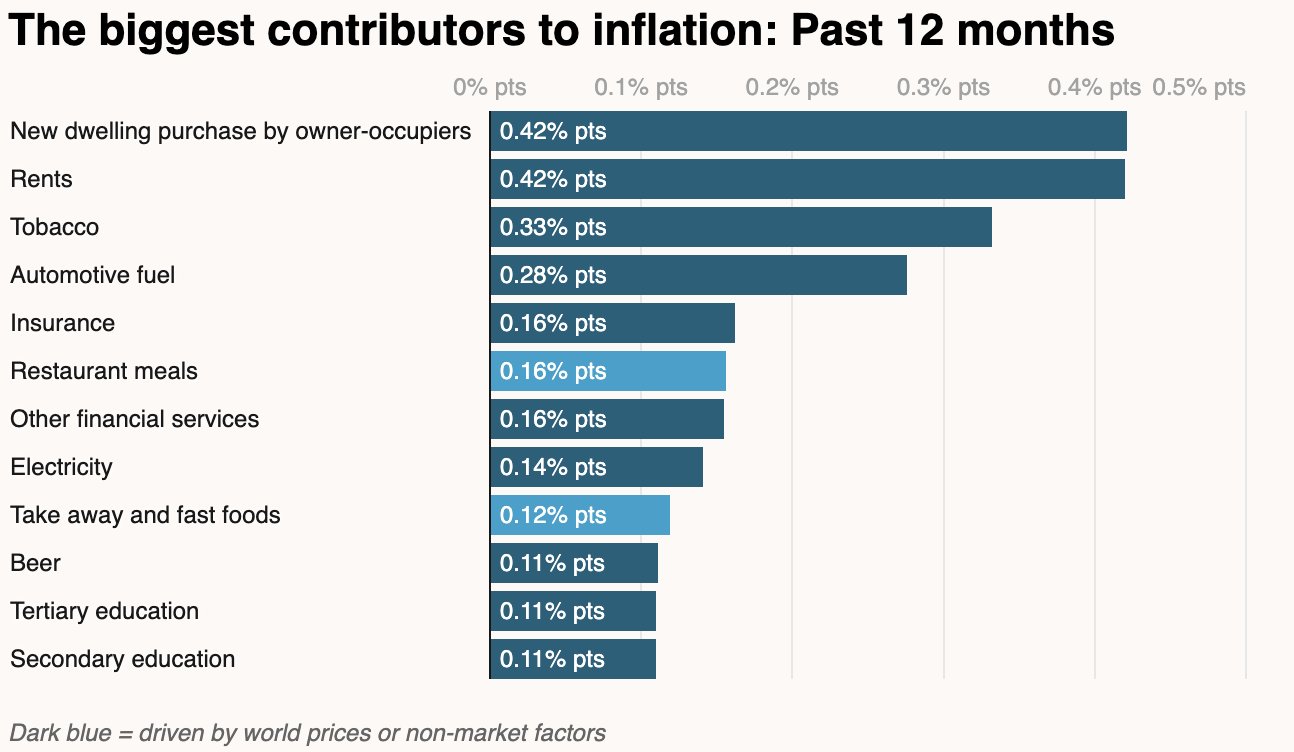

The next chart is one Leith picked up off Tarric Brooker earlier this year

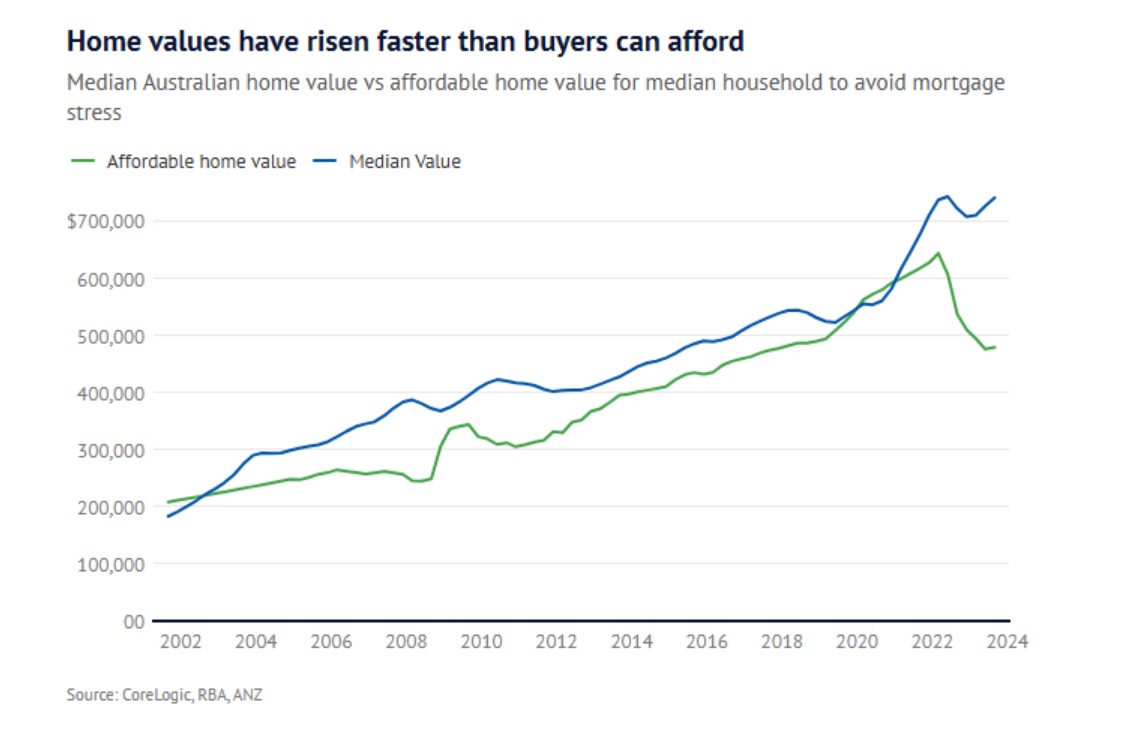

That all adds up to the next chart

Now at that stage we have economic outcomes driving themselves, starting with inflation.

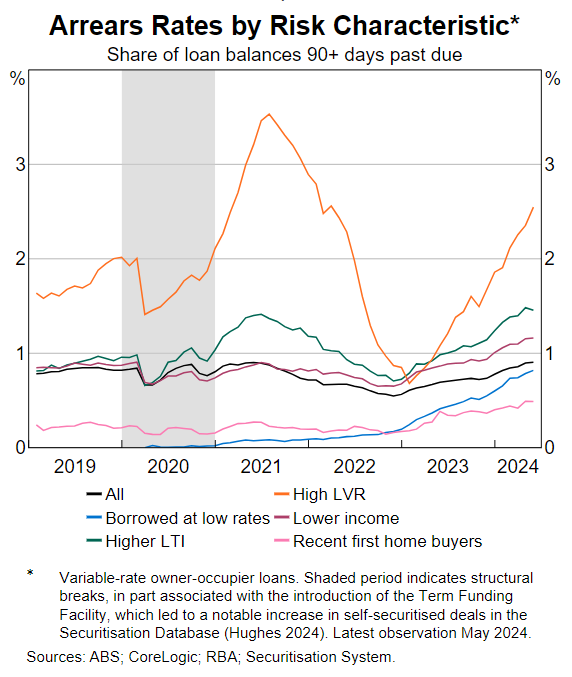

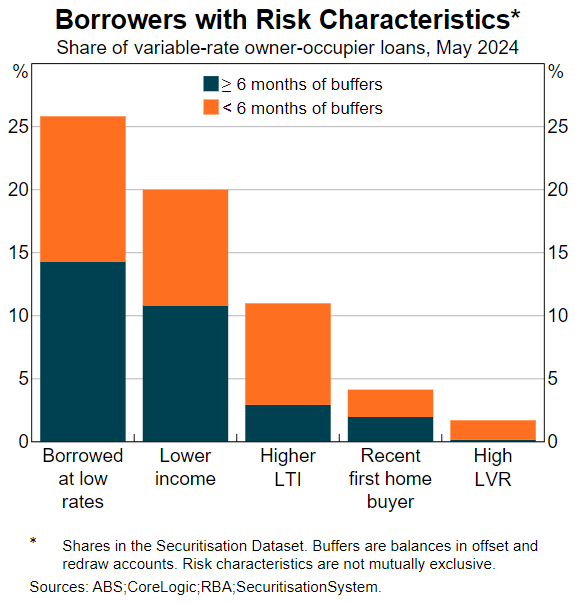

And the people borrowing more are taking on more risk.

And the bigger risks with the more vulnerable

Like, it is pretty crazy…

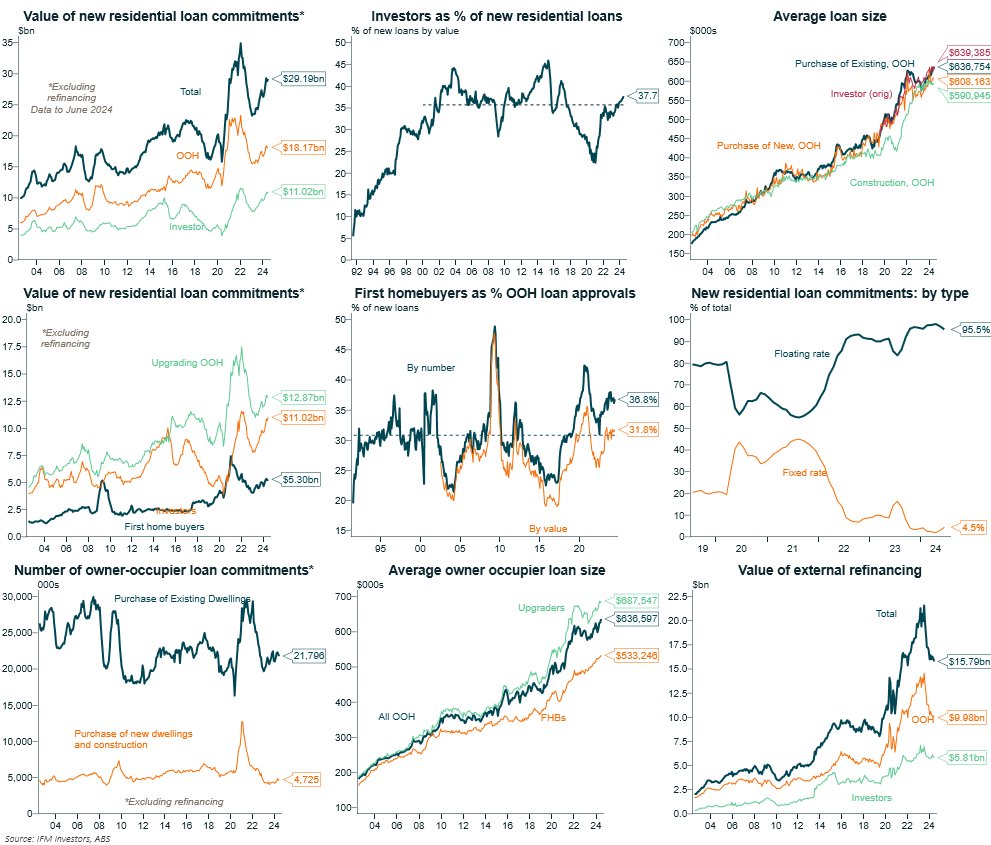

And if we assume those borrowing repay there is a large chunk coming out of someones wallet

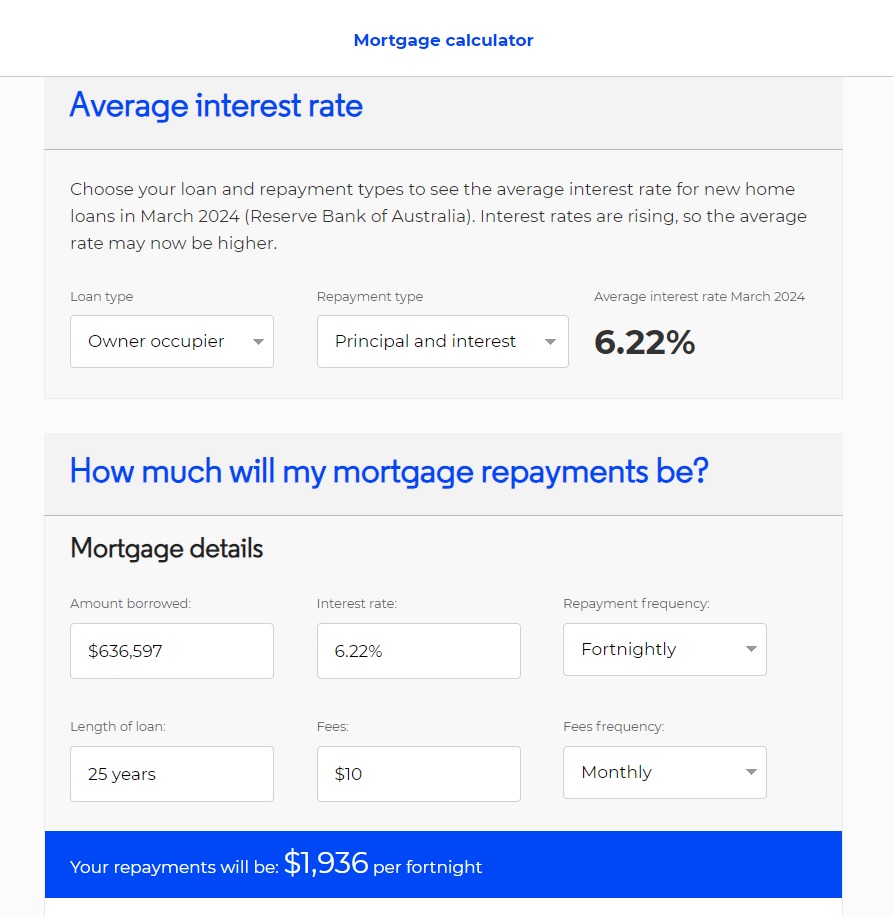

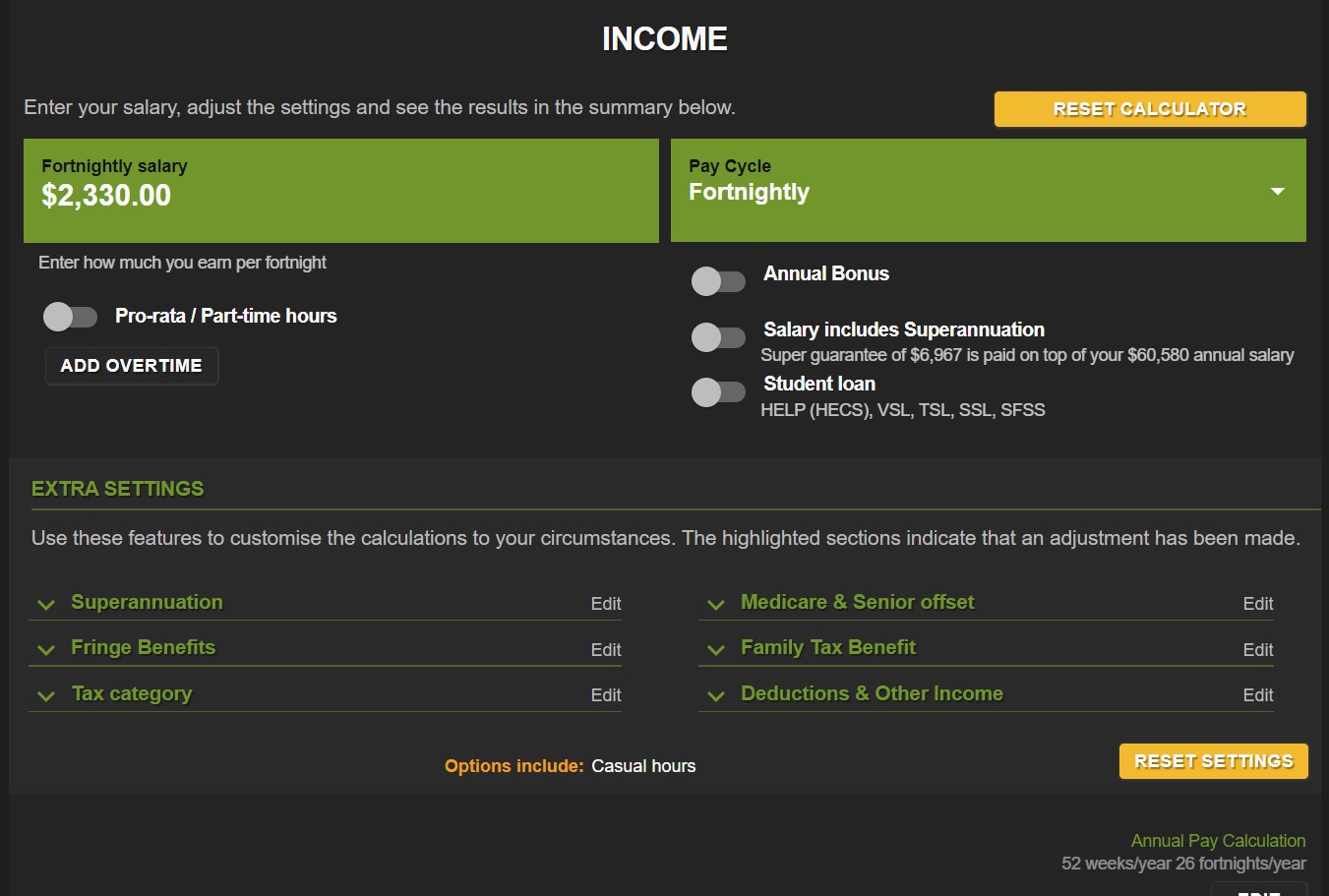

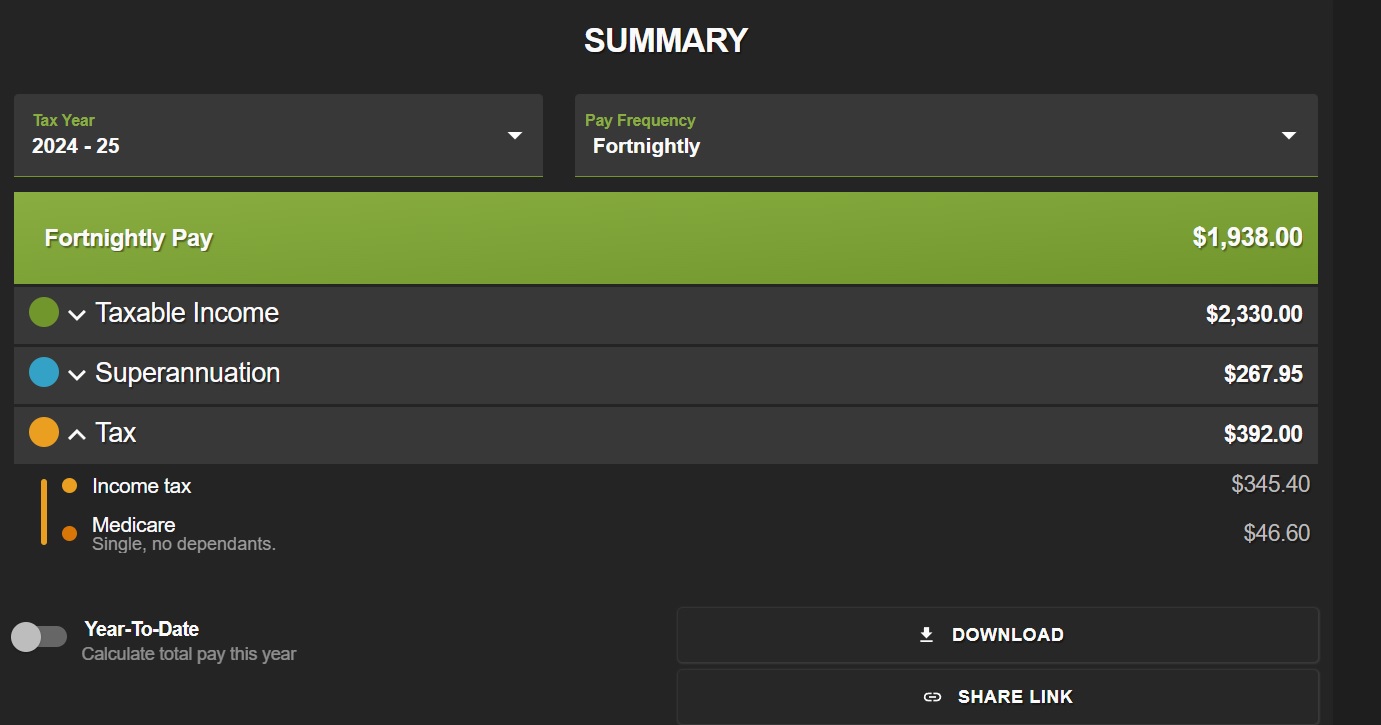

And just to pay the mortgage (ignoring eating, energy, rates, transport costs, or anything else) you would want a salary of 2330 a fortnight

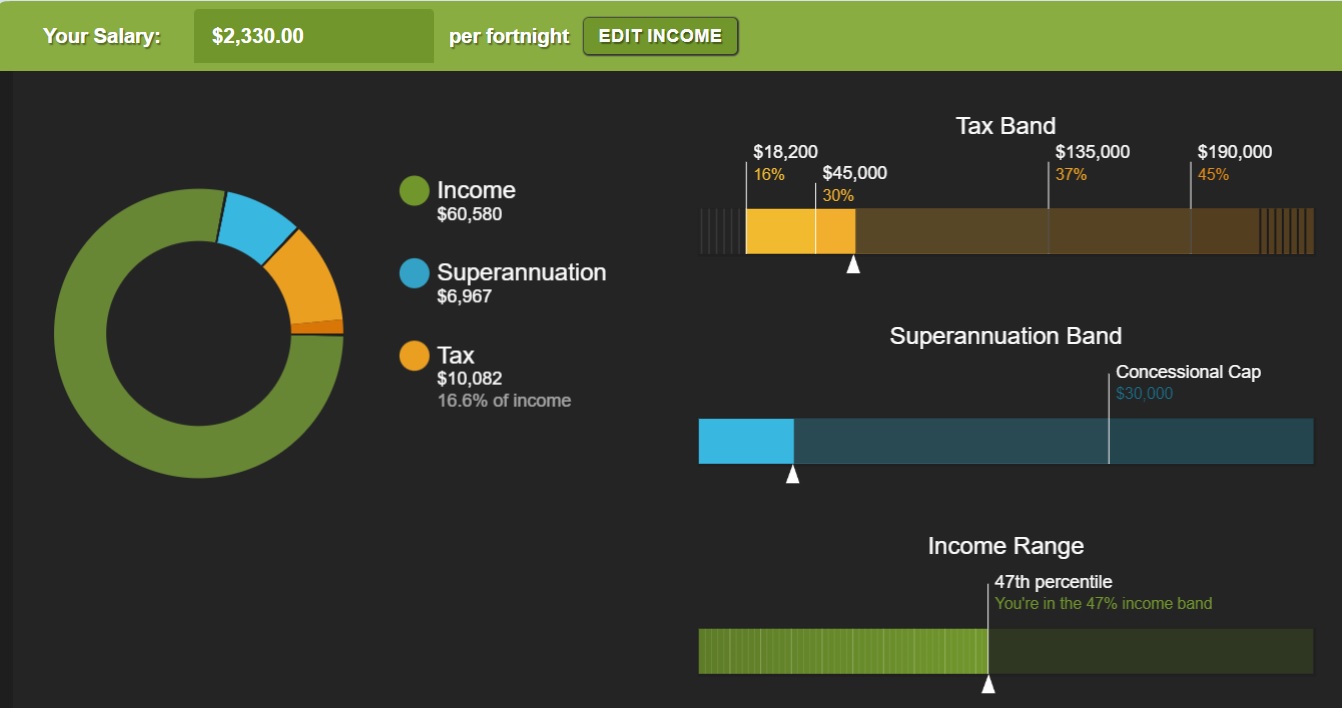

Which would place that person on the 47th percentile of income earners. Then they could pay off HECS debt, buy food, turn the electricity on, or maybe buy some clothing, or catch a train somewhere, or even afford a phone and some internet. Of course if they were hooked up with a significant other then they could share all that outlay and maybe save something on the side, or invest in themselves in some way.

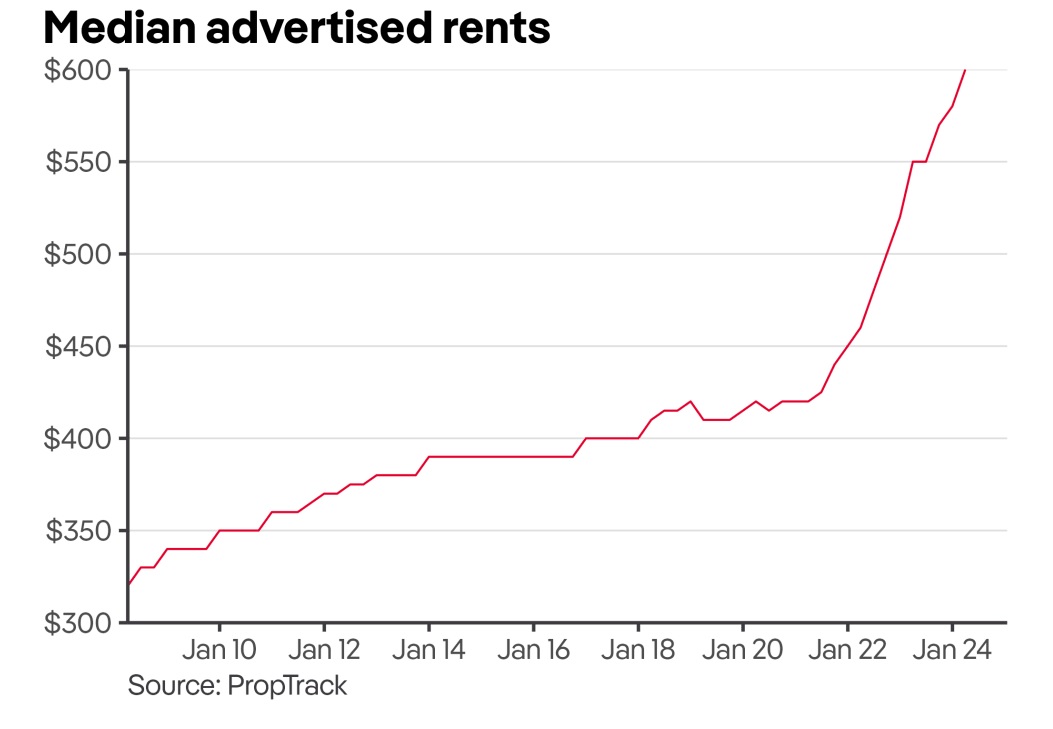

And the above is often more affordable than renting at the moment.

At that point it is worth cogitating on what that $637K buys.

It gets this abode just down the road from Ermington Plumbing in Sydney, all 108 square metres of it. There will be decent jobs about, and decent educational institutions and cultural options too, but it would be a hike to the beach.

It would swing this 4 bedder in Redbank Plains in Brisbane, on 800 metres (so at least theres a back yard) which could involve quite a hike to the nearest employment likely to sustain the outlay.

Those looking for something more tropical may find Townsville offers plausible value, with this joint on a thousand metres and a decent military presence just around the corner, but you would want to be with the military or QLD government or a medical specialist at Townsville hospital to sustain the commitment

Staying with the tropical and military vibe Darwin offers up this abode for the average mortgage at Durack. May get a bit of movement if the winds pick up and you could bet your bottom dollar there would be reptiles eyeing off some hang time in the carport

Over in Perth this 4 bedder on 478 metres could be yours for an average mortgage. It is a hike from the sea and it does get warm out here but you could make it into the higher paying jobs without too much trouble provided the traffic was OK.

Back across the Nullarbor, Adelaide could see you in a 2 bedroom unit quite close to the CBD and the city’s parks. But you would want a decent job and anyone wanting children at any stage of the game would be sniffing something larger.

The outskirts of Hobart could see you into this 3 bedder in Kingston, with some nice views from the backyard. A gig with the Antarctic Division down the road could make this plausible.

The same money would about get you into this 2 bedder trendoid apartment in Melbourne nicely positioned between the dull roar of Hoddle Street traffic and the trains coming in on the Upfield line, but close enough to likely strong employment opportunity, and not far from a beer at the Laird.

And last but not least the National capital will see the average mortgage taker into this 78 metres of 2 bedroom chic in Kingston which isnt far from the lake and will have good transport nearby but would be mighty small for maybe the aspiring pair of APS5’s should they wish to procreate.

So it is doable for those who can actually get the mortgage, and saving for the deposit would take some time.

But when all is said and done……Are we out of our cotton picking minds?

Are we giving younger Australians a half decent shot at hooking up with someone and having a family?

Huh?