Victorians are facing decades of debt slavery courtesy of the state government.

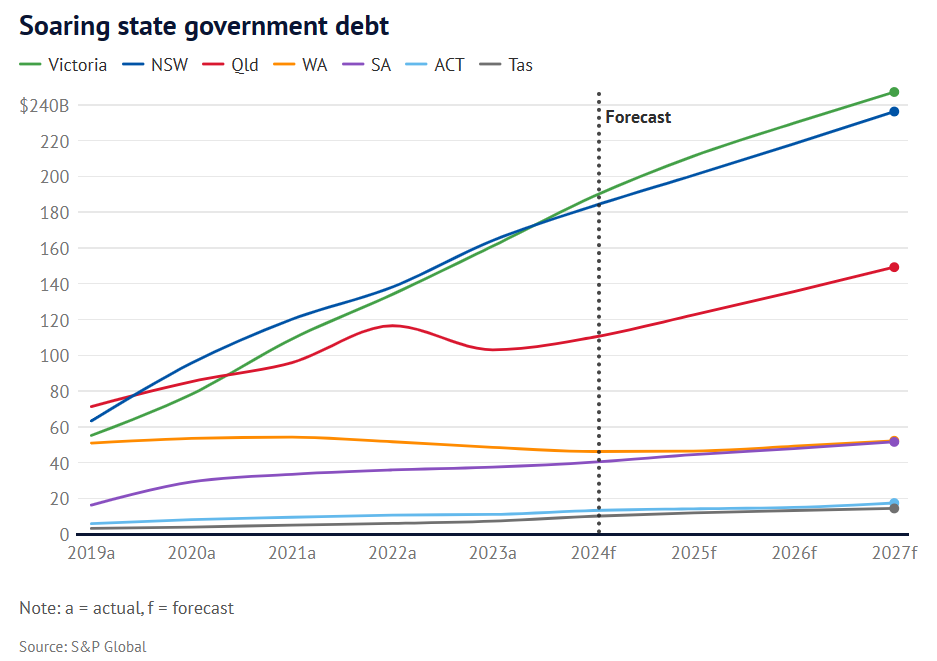

A decade of excessive spending on public servants, infrastructure cost overruns and waste totalling tens of billions of dollars, and expenditures related to the pandemic lockdowns have left Victoria with the most state government debt and the worst credit rating in the country.

Former Treasury economist Stephen Anthony accurately summed up Victoria’s financial predicament as follows:

“Victoria is on a suicide mission to record borrowing, just as global interest rates are about to hit 5%”.

“Potholes can’t get filled, emergency departments can’t afford clean linen, primary schools can’t fix heaters”.

“Things are about to get very ugly”.

Rather than taking action to shore up the state’s finances, the Victorian Labor government signed contracts to build the nation’s most wasteful infrastructure project, the 90-kilometre Suburban Rail Loop (SRL).

The SRL is estimated to cost more than $200 billion, four times its initial cost projection.

Nearly every infrastructure expert and Victoria’s Auditor-General have rejected the SRL because it fails any objective cost-benefit analysis and makes no economic or social sense.

Over the weekend, global credit ratings agency Standard & Poor’s told the Victorian government to axe the SRL or risk a credit rating downgrade:

Global ratings giant Standard & Poors… told the Sunday Herald Sun Victoria’s credit rating could be slashed if the Allan government pressed on with the SRL without funding from the federal government…

“If Victoria pushes ahead with the Suburban Rail Loop without additional federal government funding, the state’s fiscal outlook may weaken, further eroding its credit standing” [S&P analyst Anthony Walker told the Sunday Herald Sun].

“We believe there’s a real risk the SRL may cost more than the latest government forecasts, given the size and complexities of the undertaking and the state’s recent history of major projects going well over budget,” he said.

Inside the Allan cabinet, there are divisions over whether the SRL should be shelved because of its cost…

Several ministers including deputy premier Ben Carroll have questioned if the state can afford the SRL given Victoria’s debt is already set to balloon to $187.8bn by 2027-28.

Others, including Premier Jacinta Allan, say it’s a project the state cannot afford not to invest in given Victoria’s projected population growth…

John Manning, vice president and senior credit officer at Moody’s Ratings also warned Victoria was facing significant pressure of further downgrades…

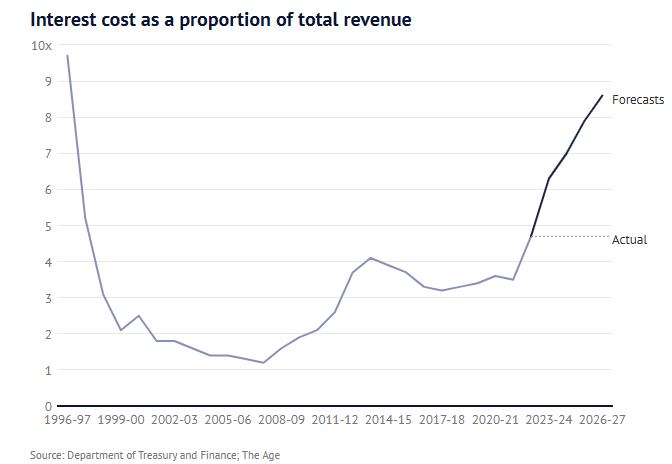

The article notes that if S&P lowered Victoria’s credit rating from AA to A, the state would face an increase in borrowing costs of between 0.1% and 0.5%, adding to the already hefty interest bill.

There is no avoiding the issue here. The Victorian government is a financial mess, bloated with too many bureaucrats and extraordinary cost overruns on boondoggle infrastructure projects such as the SRL.

As a result, Victorians will face decades of debt slavery.