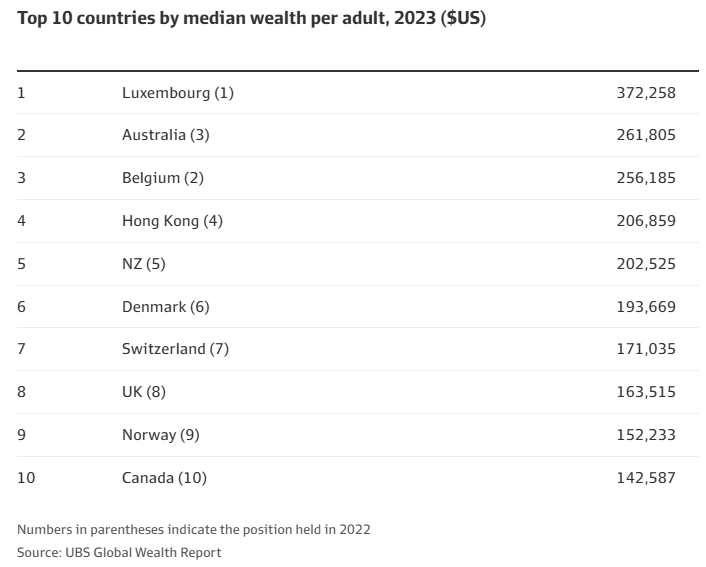

According to the most recent UBS Global Wealth Report, Australia has 1.9 million US-dollar millionaires, with a combined fortune of $US5.4 trillion ($A8 trillion).

UBS predicted that the number of US-dollar millionaires would increase by 21% to more than 2.3 million by 2028, owing to factors such as growing housing prices and intergenerational wealth transfer.

According to the analysis, the average Australian’s wealth climbed by about 10% in 2023, while the median wealth increased by approximately 5%.

New data from CoreLogic helps to explain why Australia has so many paper millionaires.

CoreLogic shows that 46% of suburbs in Brisbane boasted a median house price of at least $1 million at the end of July, compared with just 30% a year ago.

Likewise, 36% of suburbs in Adelaide have joined the ‘million-dollar club’, up from 26% at the same time in 2023.

The proportion of suburbs in Perth with a median house price of $1 million has also risen from 20% to 32%.

Tim Lawless of CoreLogic expects house price growth to continue in the next six months, pushing more suburbs nationwide into the million-dollar category.

“With housing values across most cities pushing to new record highs each month, I think we can safely say we are seeing a record number of suburbs with a million plus median”, he said.

“Logically, there will be more suburbs crossing the million-dollar mark as prices continue to rise this year”.

Hooray. We are all rich!

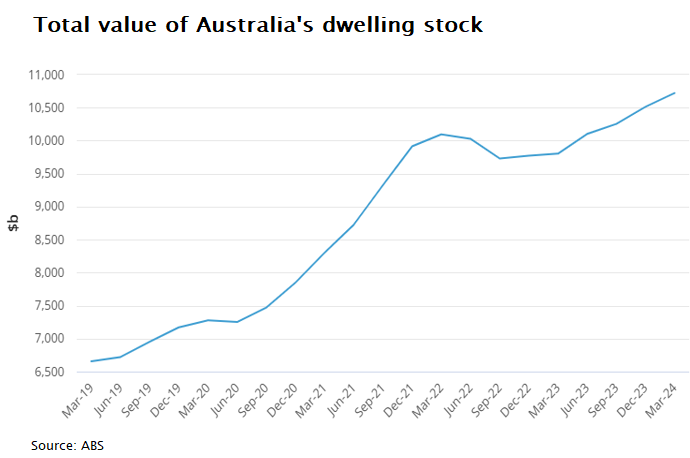

According to the Australian Bureau of Statistics (ABS), the total value of Australia’s dwelling stock rose to a record high of $10,721 billion in the March quarter:

This meant that the average dwelling in Australia was valued at a record high $959,300.

Meanwhile, Australians continue to bury themselves in mortgage debt, with the average size of mortgages chasing home prices higher:

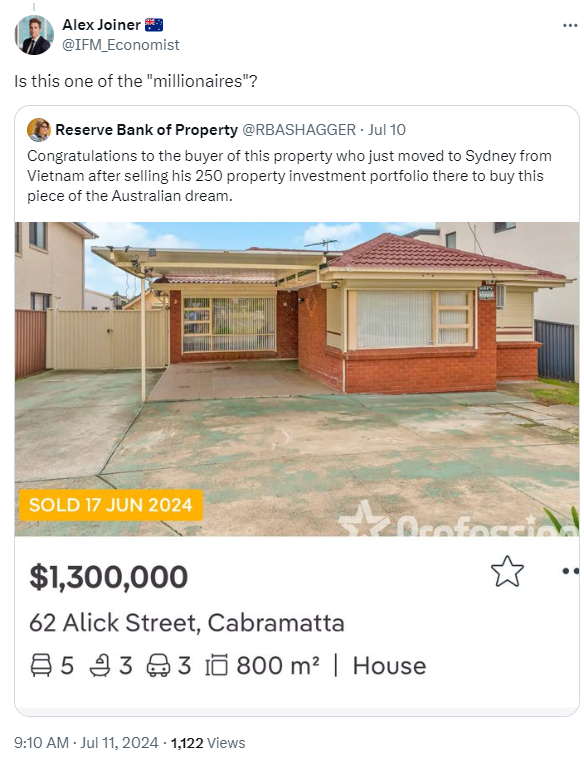

Is a country truly “wealthy” if its younger residents cannot afford to house themselves independently without parental financial assistance?

Australians would be “richer” if our home values had never risen so aggressively, our median dwelling price was $400,000 instead of $800,000, and Australia’s household debt was 70% rather than 140% of income.

Australia would be a far more equal society, and we would be financially better off if our homes cost half as much as they do currently and we did not carry so much debt.

The appreciation of Australian housing prices has come at the direct expense of our children, grandchildren, and future generations, who, when it is their turn to enter the market, will be forced to pay far more for housing than they should, making them poorer.

A home serves the same purpose whether it is priced at $500,000, $1 million, or $5 million.

Higher housing “wealth”, therefore, is rather meaningless to the great majority of people who just live in their homes and do not own investment properties.

In short, the vast majority of Australian household wealth is not genuine because it is tied up in overpriced homes.

As a result, we have consigned future Australian homebuyers to a lifetime of debt servitude or being trapped in the rental market for the rest of their lives.

Australians would be substantially better off if we had never experienced this housing appreciation and were not ranked at the top of the global wealth rankings.