The Australian’s Anthony Keane reported that rising numbers of baby boomers are distributing wealth to their heirs – a phenomenon that is only likely to increase in the years ahead.

Social research group McCrindle says people aged over 59 hold $6.2 trillion of Australia’s $10 trillion of household wealth, much of it in property, while William Buck Wealth Advisory partner Adrian Frinsdorf said more people were looking to pass on wealth sooner.

“Hardly a day goes by when I don’t have a conversation with a client about wealth transfer,” Mr Frinsdorf said.

“It’s moved beyond simple inheritances, with parents and grandparents now wanting to provide greater assistance in their living years…

McCrindle social researcher and trends analyst Sophie Renton said Australia was seeing “the rise of the grandparent economy” as more seniors provided financial and other help to grandchildren.

Simon Kuestenmacher, a Co-Founder and Director at The Demographics Group, previously estimated that the 2030 and 2040s will see the most significant intergenerational transfer of wealth in Australia’s history as baby boomers die off:

The Australian Treasury’s 2020 Retirement Income Review estimated that superannuation death benefits alone “are projected to increase from around $17 billion in 2019 to just under $130 billion in 2059”:

Senior Australians also have by far the highest homeownership rate (81%), meaning there’s a gigantic pool of property assets to pass onto heirs:

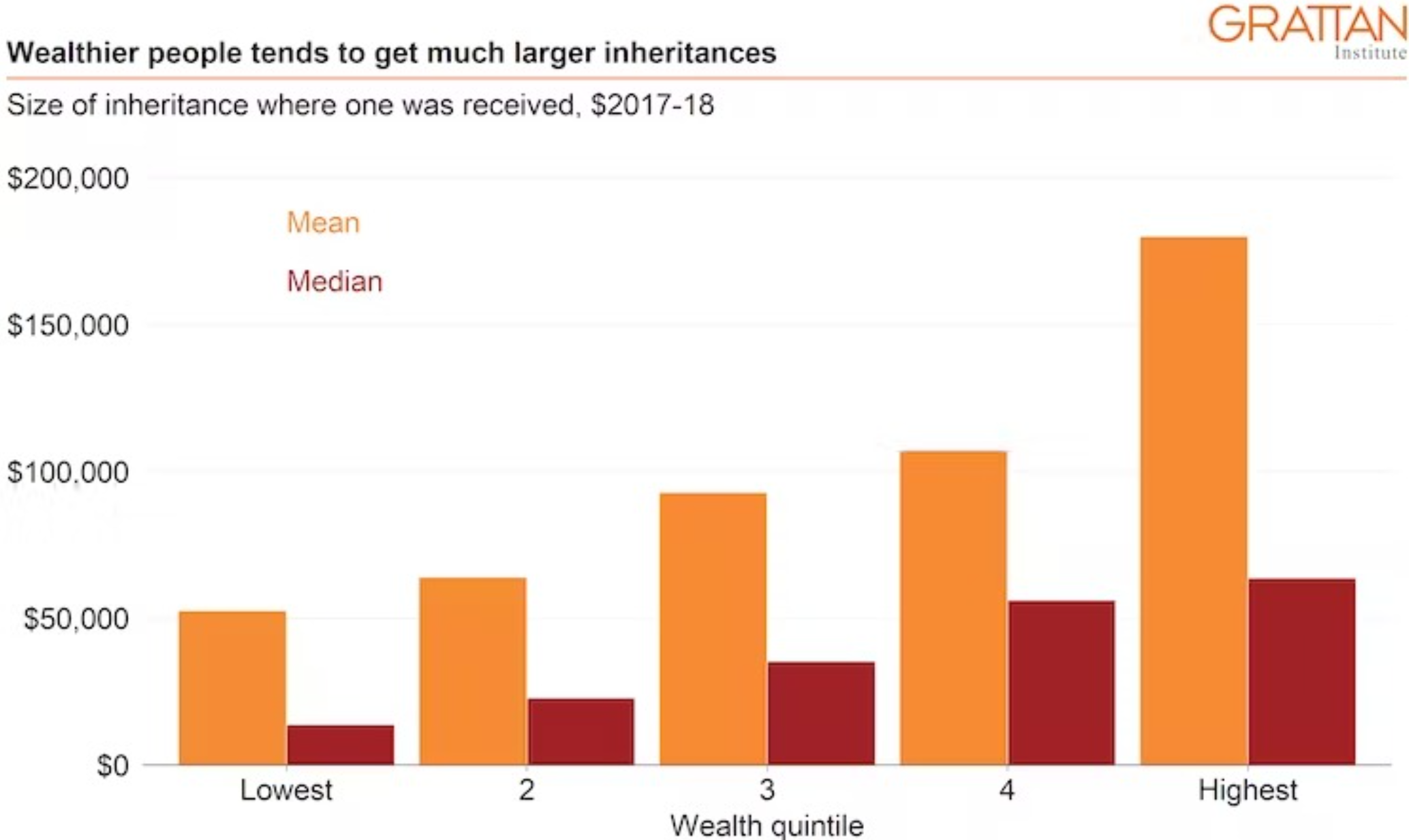

That said, data from the Grattan Institute shows that the median inheritance was less than $50,000 in 2017-18 and is skewed heavily to the wealthy:

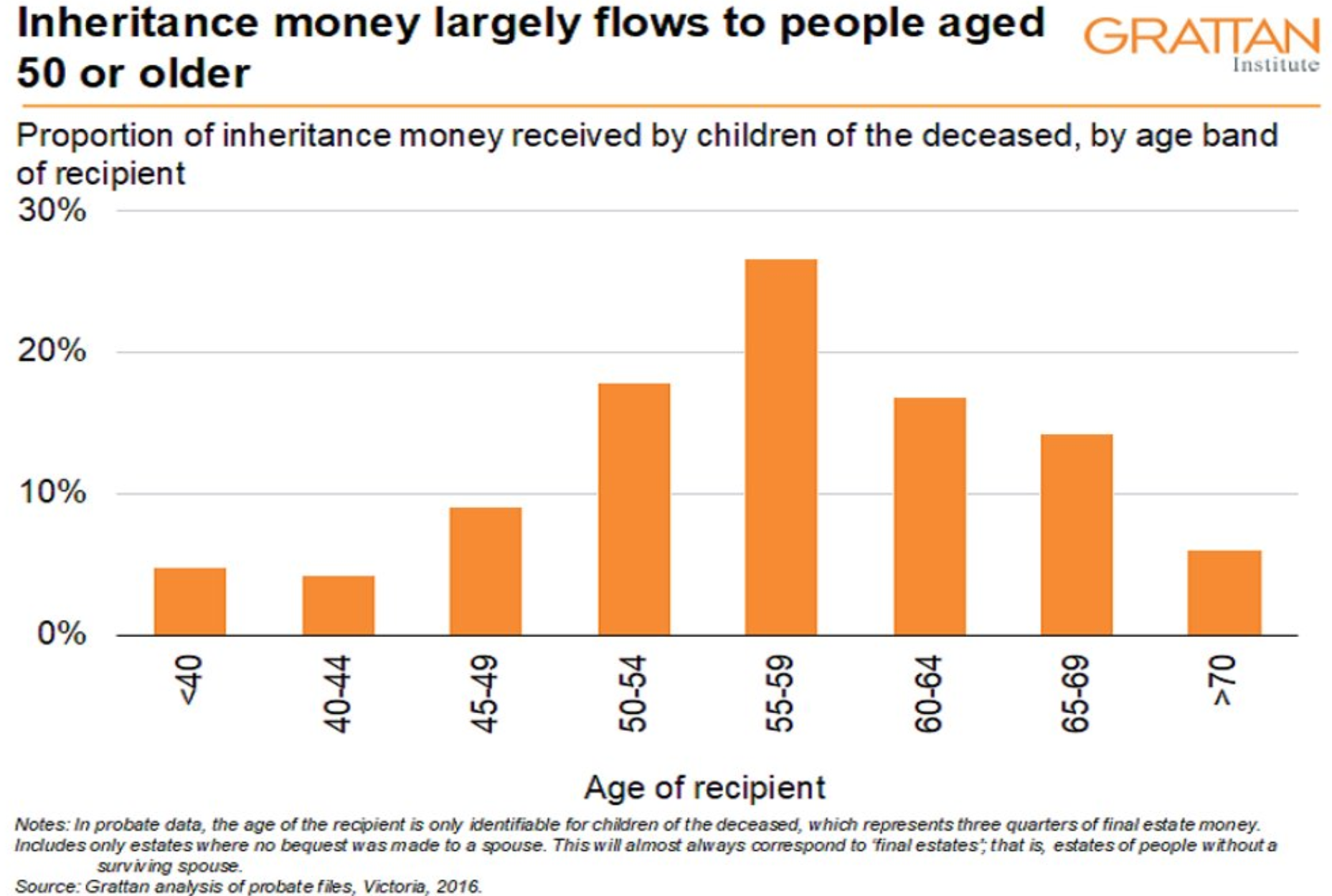

Moreover, inheritance windfalls tend to flow to people aged 50 years or over:

There are two key conclusions to draw from this data.

Yes, inheritance flows will increase significantly over the coming decades as the wealthy baby boomer generation dies off.

However, the flow of inheritances will be highly unequal and could worsen wealth inequality.

While a relatively small proportion of Australians will receive large inheritances, most won’t.

Moreover, most inheritances will flow to middle-aged Australians aged 50 years or older.

The older and wealthier demographic will benefit the most, while younger Australians will continue to struggle to purchase a home.