Yarra Capital Management chief economist Tim Toohey warned that the $300 billion in extra savings accumulated during the pandemic may have run out, curtailing household spending.

Toohey estimates that households probably spent the last of their pandemic-era buffers around March 2024, as younger consumers struggling with cost-of-living pressures pulled back on saving to pay for essentials.

“The message for policymakers is that there is no longer a liquid buffer of excess household savings to draw upon, and it’s likely that most households in the sub-65 year-old age bracket have drawn down savings buffers to below pre-COVID levels”, he said.

Gareth Aird, the head of Australian economics at CBA, also stated that he anticipated the reduction in the pandemic-era savings buffer to offset the tax cuts’ boost to consumer spending.

“The tax cuts have kicked in as the tailwind of the excess pandemic savings drawdown has around six months to run. As such, we expect the impact of tax cuts to be more muted than otherwise on consumer spending”, he said.

Toohey noted that with the household savings rate tracking near zero, households are likely to save more than half of the tax cuts.

“If you have fully depleted the [pandemic] savings buffer, savings rates approximate to zero, and you’re actually lifting the superannuation guarantee levy, then by default, the savings rate’s actually going higher”, he said.

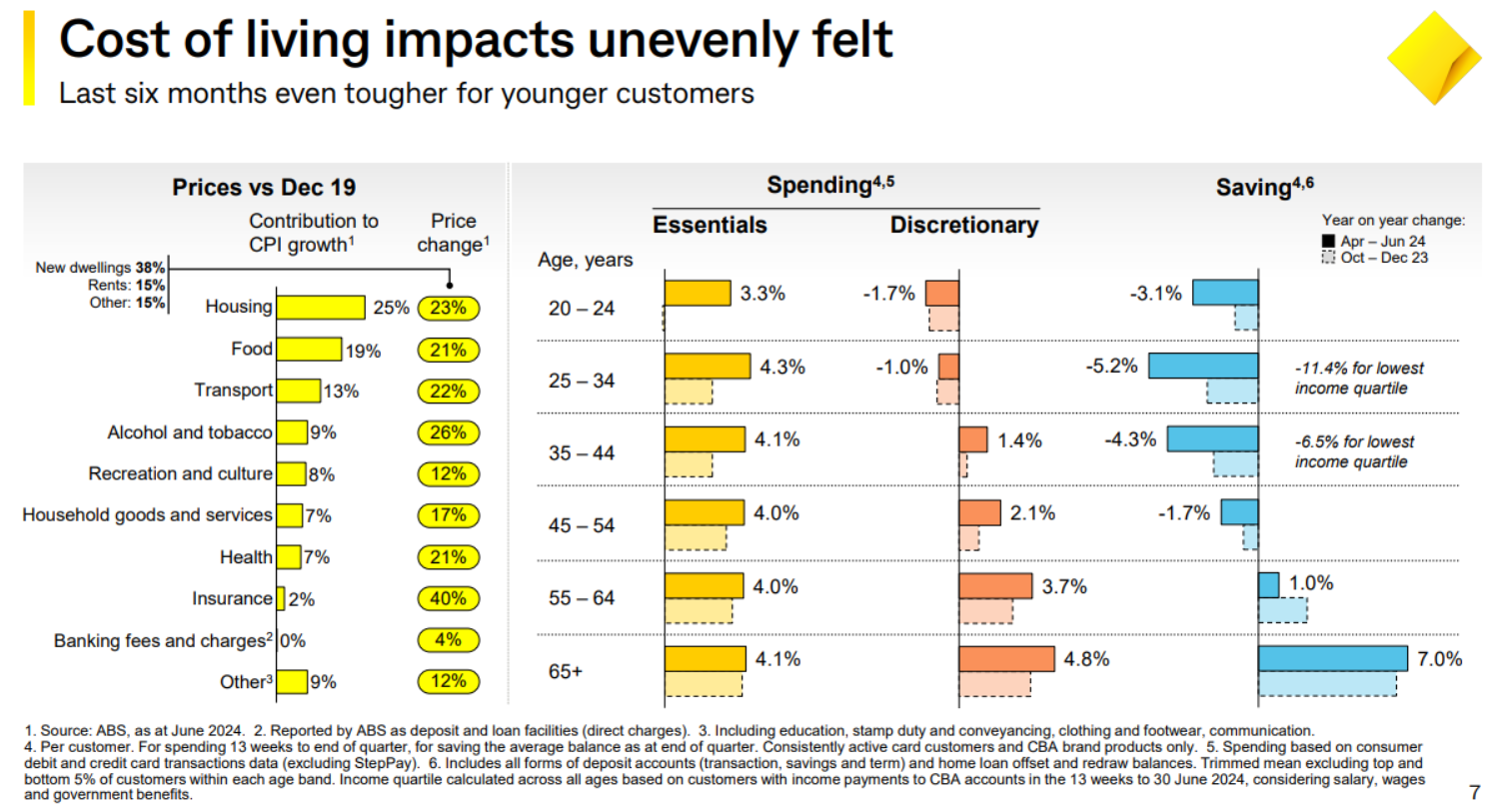

The following chart on spending and savings by age cohort also shows that there is an asymmetry across the generations:

Source: CBA 2024 Full Year Results Presentation

Younger, working-aged Australians have been hit much harder by rising interest rates and cost-of-living than older, retired Australians.

As shown above, housing has contributed the most to CPI inflation since 2019. And this cost inflation has disproportionately impacted younger renters and mortgage holders.

As a result, younger Australians have cut their discretionary expenditure and drawn down their savings to pay for essentials.

By contrast, older retired Australians have increased their wealth, savings, and expenditure.