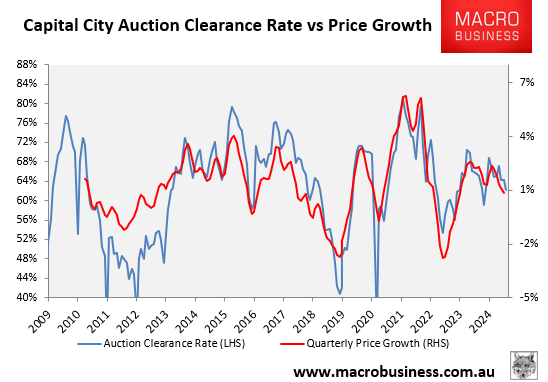

Last weekend recorded the lowest final auction clearance rate of 2024, with only 60.7% of homes selling across the combined capital cities.

The result was also 5.4 percentage points below the success rate seen in the same weekend last year (66.1%).

In Melbourne, 1,335 homes were auctioned last weekend, the busiest week of the year since the week ending March 24th (1,760).

The increased volumes decreased Melbourne’s final clearance rate (59.5%), which fell below 60% for the first time in eight weeks.

In the same weekend last year, there were 1,092 auctions, with a final clearance rate of 63.9% across Melbourne.

Sydney’s final clearance rate continued to fall, with 61.6% of auctions reporting a successful outcome.

In the same weekend last year, 70.0% of Sydney auctions were successful across Sydney.

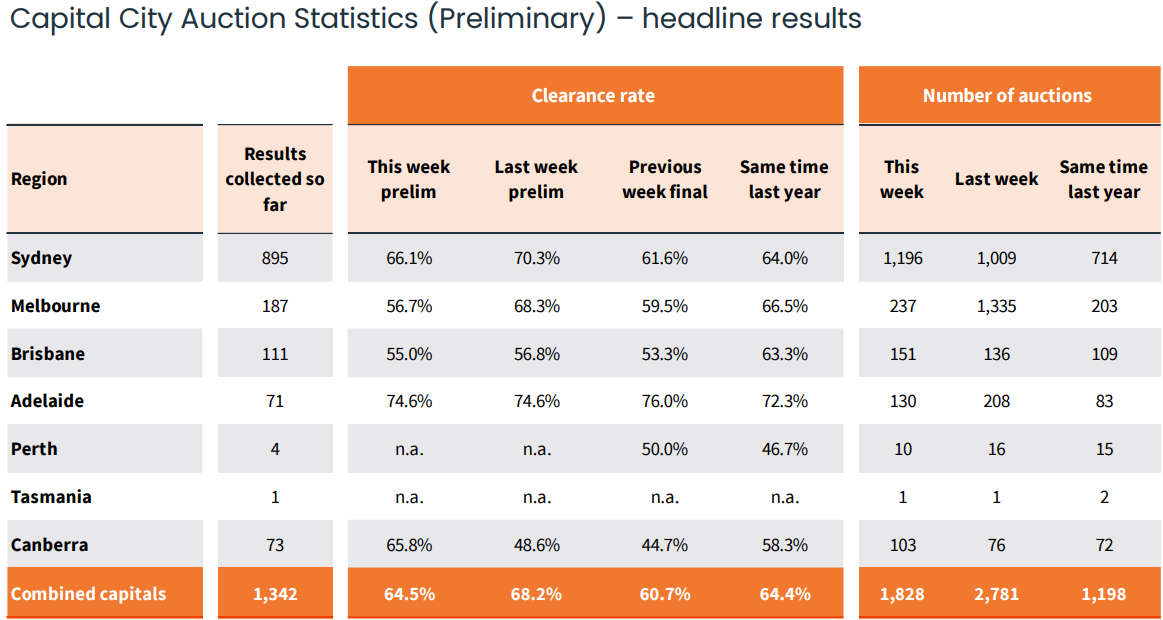

This weekend recorded an even weaker result, with 64.5% of auctions successful at the capital city levels based on preliminary results. This was down from 68.2% last weekend (downgraded to 60.7% on final figures):

It was the lowest preliminary clearance rate since December last year, when preliminary results held below 60% through most of the month.

Melbourne’s preliminary clearance rate crashed to 56.7% from 68.3% the prior weekend (downgraded to 59.5% on final results), impacted by the AFL Grand Final.

It was Melbourne’s lowest preliminary auction clearance rate since mid-July of 2022 (55.6%).

Sydney’s preliminary clearance rate also declined to 66.1%, down from 70.3% the prior weekend (downgraded to 61.6% on final results).

In his weekend YouTube wrap, prominent Sydney real estate agent and auctioneer, Tom Panos, claimed that “fear of missing out has left the market”:

“What’s happened in this marketplace is there are so many listings, all the auctions are going longer, no one wants to start an auction, bids are in small increments, buyers are walking away in droves because they have others to pick from”.

“I have always said that an oversupply of listings is the killer to capital growth”.

As stock goes up in October and November, it is going to be even more challenging for a vendor”.

“I know that real estate agents are going to hate what I am about to say, but I think that right now, unless a vendor really wants to sell, you might want to look at just listing now but not launching. Because you are going to be amongst so many sellers that you are not going to give yourself the best chance of getting the best price”.

“I can tell you now even the gold market in Australia, which is Perth, is beginning to show signs of moving to a buyer’s market”.

The auction market data presented above certainly supports Panos’ argument, with FOMO seemingly evaporating.