Last month, CBA economists estimated that the household savings war chest accumulated over the pandemic will be largely exhausted by the end of the year.

As a result, “the boost to consumer spending power in 2024/25 via the 1 July 2024 tax cuts will be partially offset by the decline of the tailwind on consumption from the savings drawdown, which has taken place since Q4 22”.

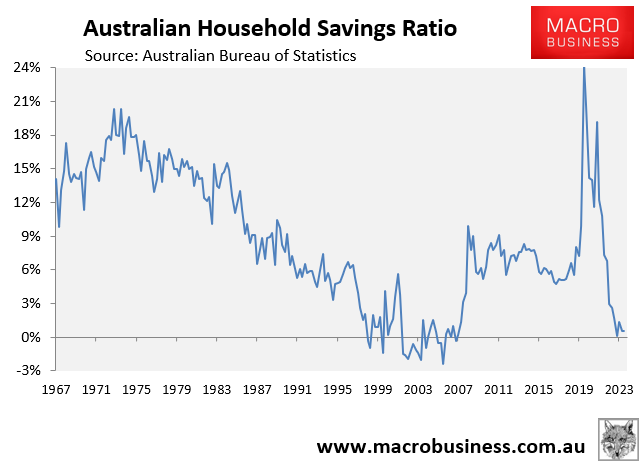

Wednesday’s national accounts release from the Australian Bureau of Statistics (ABS) revealed that the household savings rate remained at only 0.6%:

This suggested that Australia’s households continued to draw down their savings in Q2, given that the savings rate includes compulsory superannuation contributions, which are unavailable for consumption.

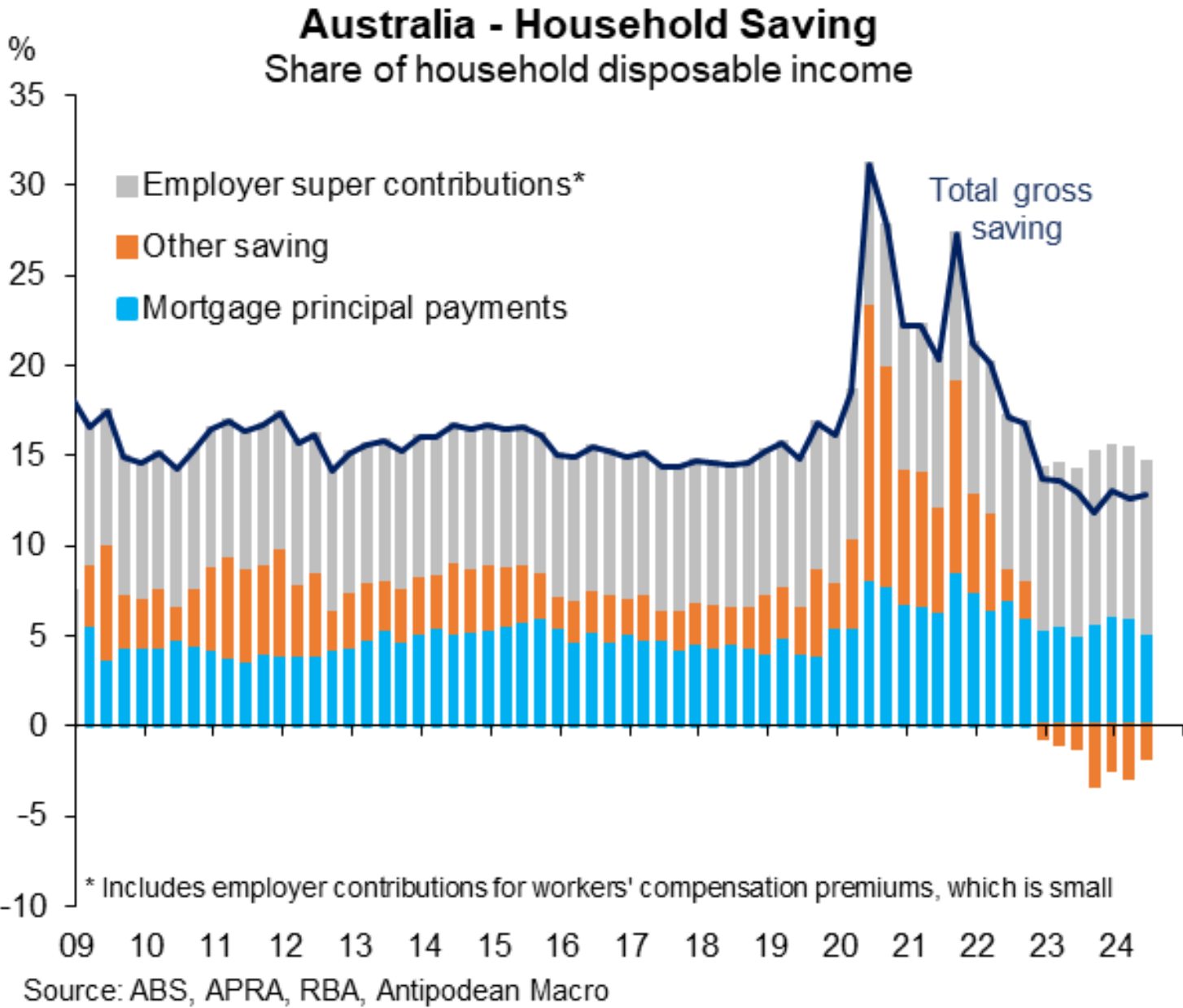

Indeed, the following chart from Justin Fabo at Antipodean Macro shows the impact of compulsory superannuation on the savings rate:

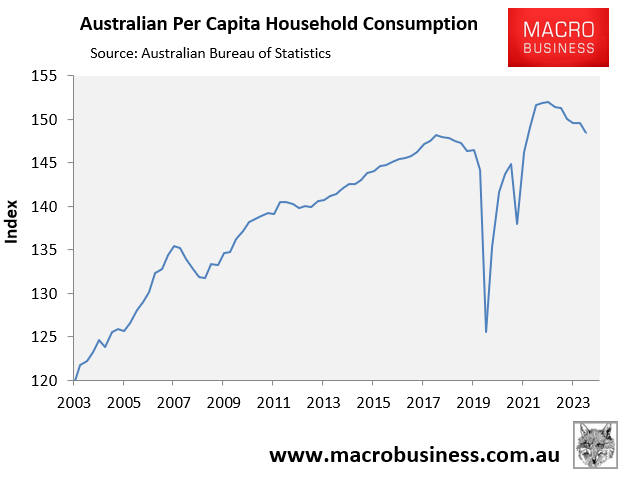

The drawdown in savings is also reflected by the imbalance between household consumptions and disposable incomes.

Real per capita household consumption has declined by 2.4% from the December 2022 peak:

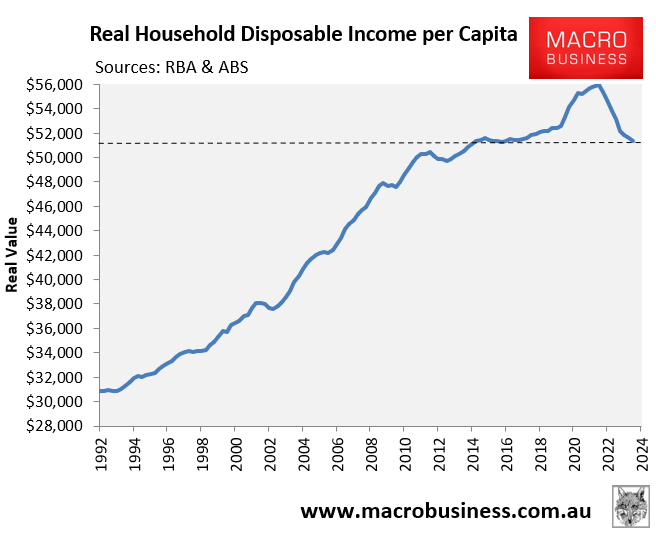

While this is bad, real per capita household disposable income has fallen a sharper 8.2% from its peak in June 2022:

The only reason why household consumption and growth haven’t fallen further is because of this drawdown in savings.

The good news is that both household incomes and consumption will have gotten a boost from the Stage 3 tax cuts.

A further boost will arrive when the Reserve Bank of Australia commences its next interest rate easing cycle.

However, it will be a long road back to health for the household sector.