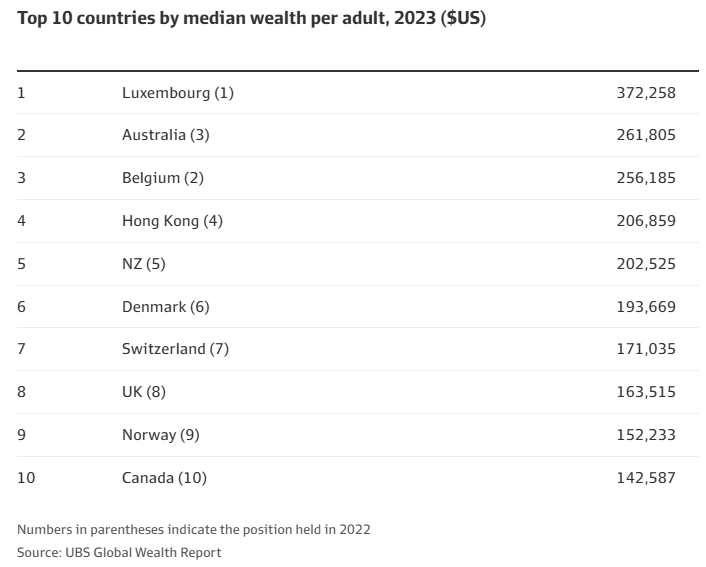

The UBS Global Wealth Report showed that Australia has 1.9 million US-dollar millionaires worth $US5.4 trillion ($A8 trillion).

UBS anticipated that the number of US-dollar millionaires would rise by 21% to more than 2.3 million by 2028, owing to rising home prices and intergenerational wealth transfer.

A new report from CoreLogic explains why Australia has so many paper millionaires:

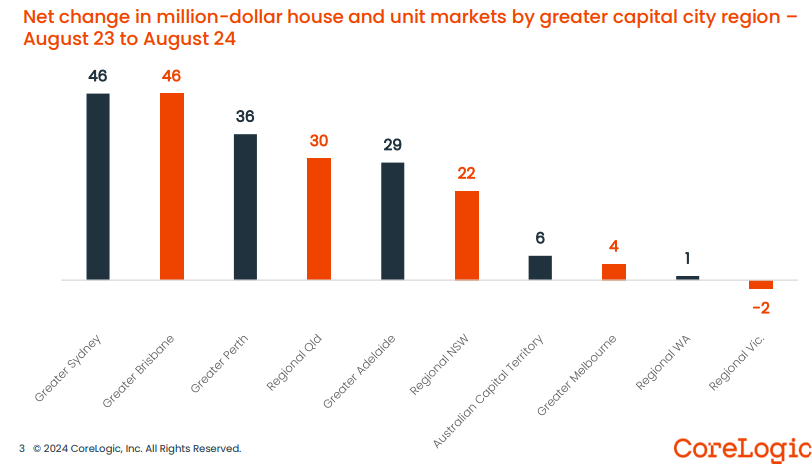

The number of Australian suburbs with a median house or unit value in the million-dollar club reached a new record high in August, according to the latest CoreLogic Million-Dollar Markets report.

The report shows that 29.3% of the 4,772 suburbs analysed recorded a current median value at or above $1 million, up from a recent low of 21.7% in January 2023 when values found a floor following the start of the rate-tightening cycle.

The portion of suburbs with a million plus median is now above the 26.9% seen at the previous market peak in April 2022.

CoreLogic Economist Kaytlin Ezzy says the 7.1% increase in national dwelling values seen over the past year has added the equivalent of around $53,000 to the national median.

Although value growth has been diverse across cities and regions, the rise has seen the number of million-dollar markets increase by 18.5% or 218 markets over the year.

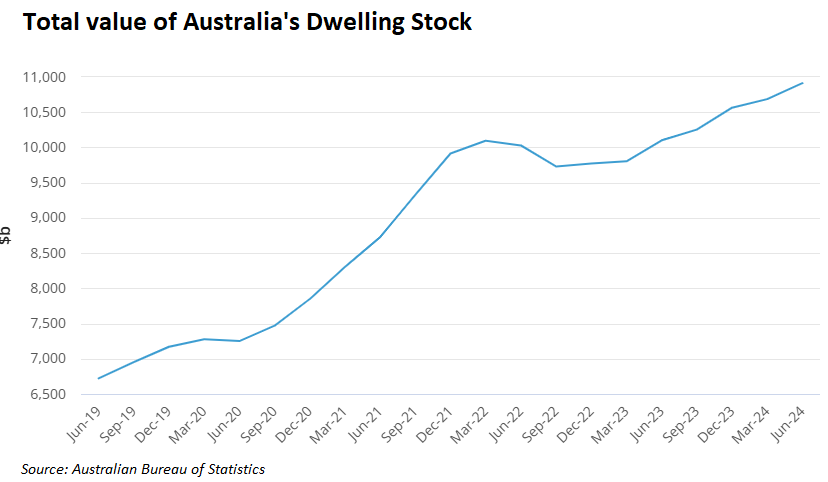

The Australian Bureau of Statistics also showed that the total value of homes nationwide rose to nearly $11 trillion in the June quarter, up $226 billion over the quarter:

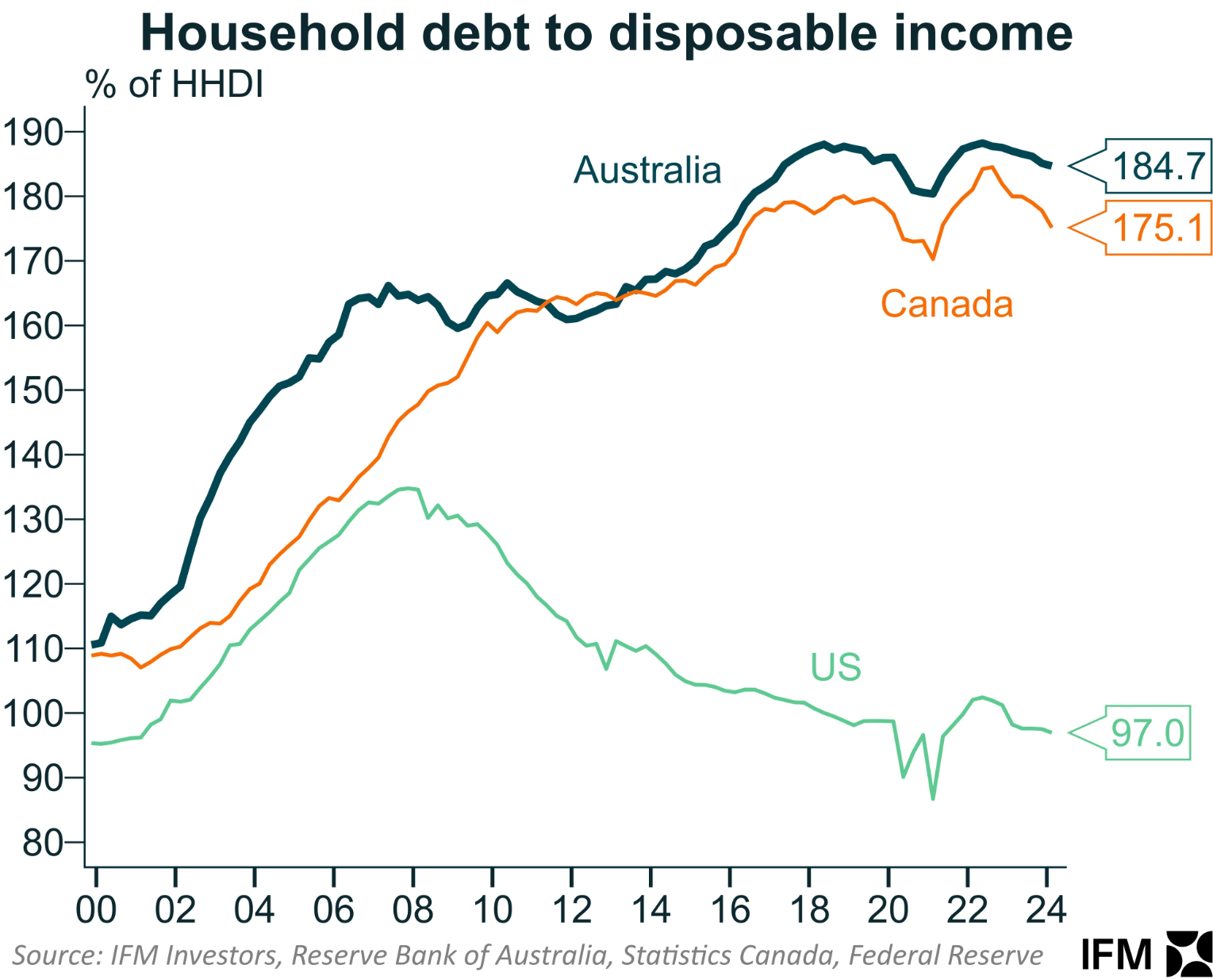

Meanwhile, Australians have drowned themselves with mortgage debt, with the average loan size chasing prices higher:

As a result, Australian households are carrying world-leading debt loads:

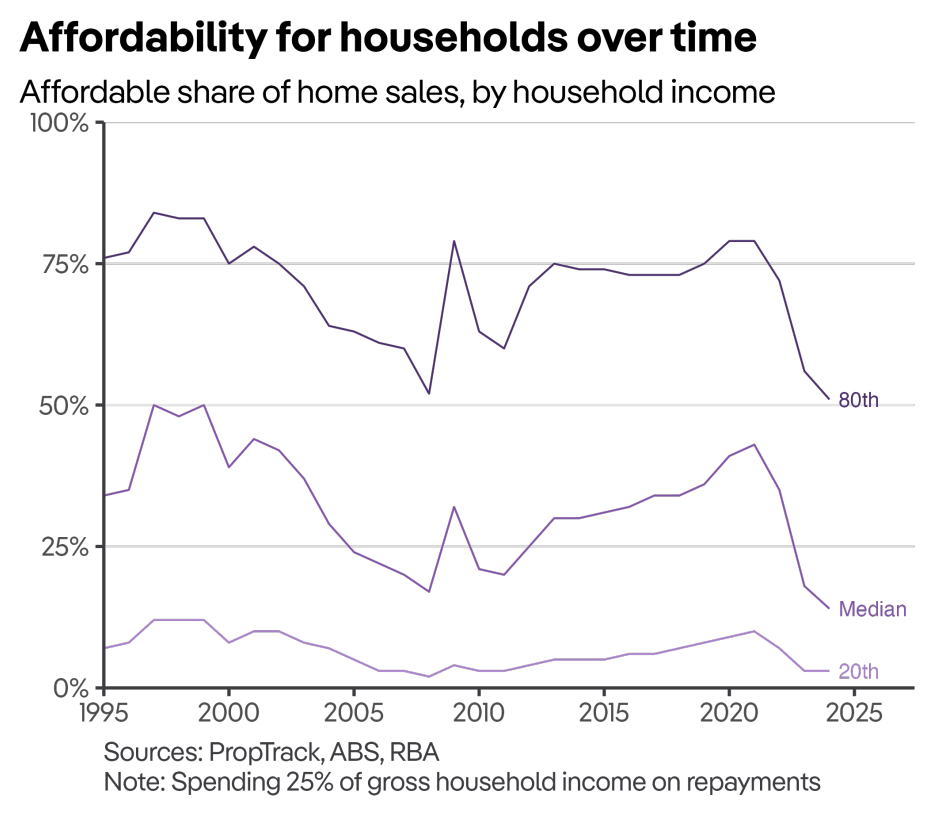

Is Australia genuinely “wealthy” when housing affordability is at a record low, and our younger generations cannot afford a home without parental financial support?

Australians would be “richer” if home values had not increased so rapidly, the median dwelling price was $395,000 rather than $790,000, and household debt was 90% rather than 180% of income.

Australia would be a considerably more egalitarian society, and we would be financially better off if our homes were half the price they are now and we did not carry so much debt.

The rise in Australian home prices has negatively impacted our children, grandchildren, and future generations, who will be required to pay considerably more for housing than they should, making them poorer.

A home serves the same functional purpose whether it costs $500,000, $1 million, or $5 million.

Higher housing “wealth” is, therefore, meaningless to most people who simply live in their homes and do not own investment properties.

In short, most of Australia’s household wealth is fake since it is tied up in overpriced properties and cannot be realised.

Australia has condemned future homebuyers to debt servitude or being locked in the rental market.

Australians would be far better off if we had never experienced the 25-year property boom and were not ranked at the top of the global wealth rankings.