DXY is hanging on, just:

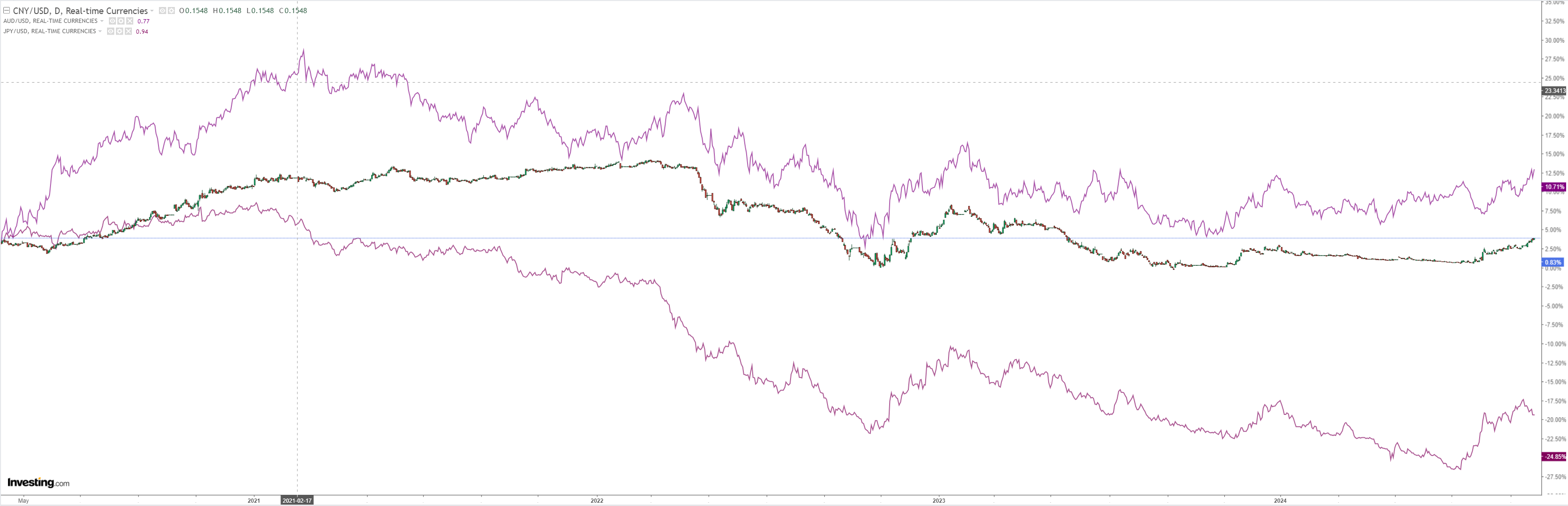

AUD boom, baby, boom:

How long does CNY rise into “forceful” monetary easing?

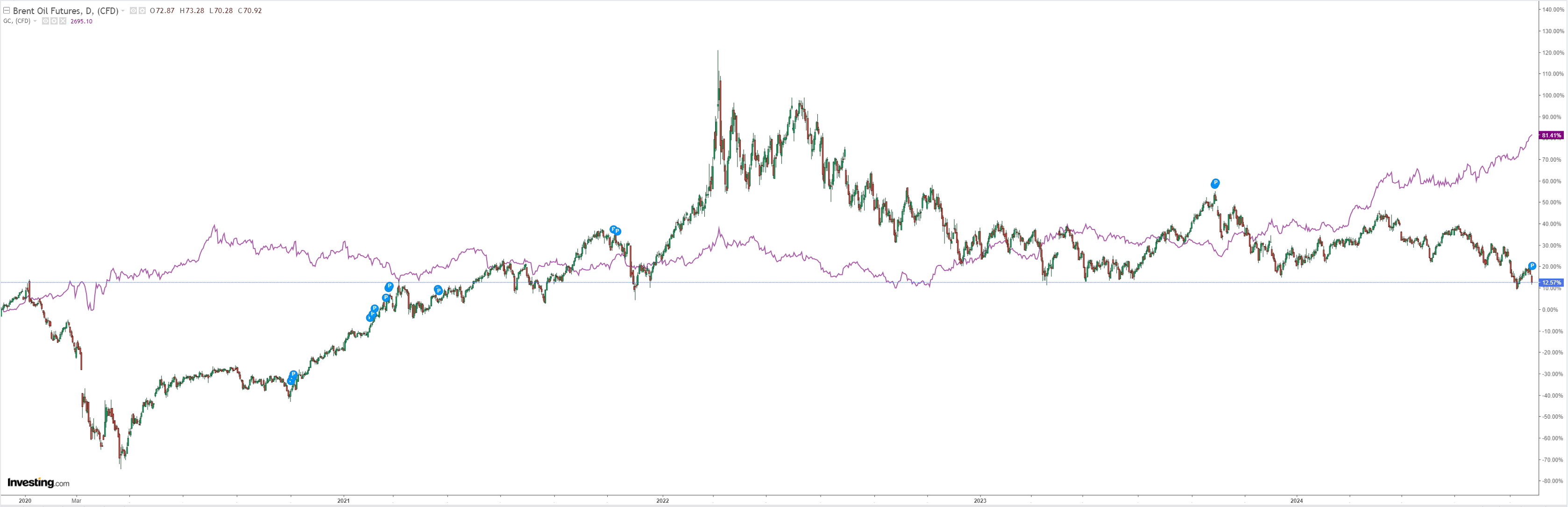

Never bet on Libyan politics when it comes to oil:

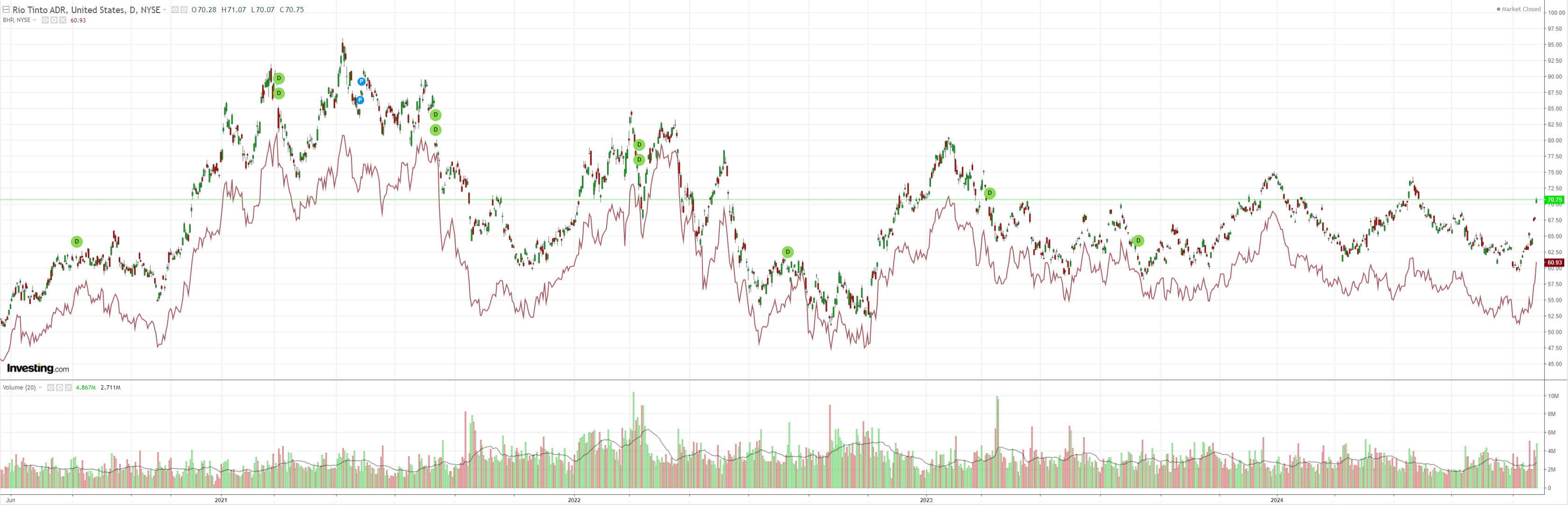

Hilarity ensues for the new metals boom:

The miner gapping is something to behold. Nothing has changed for iron ore:

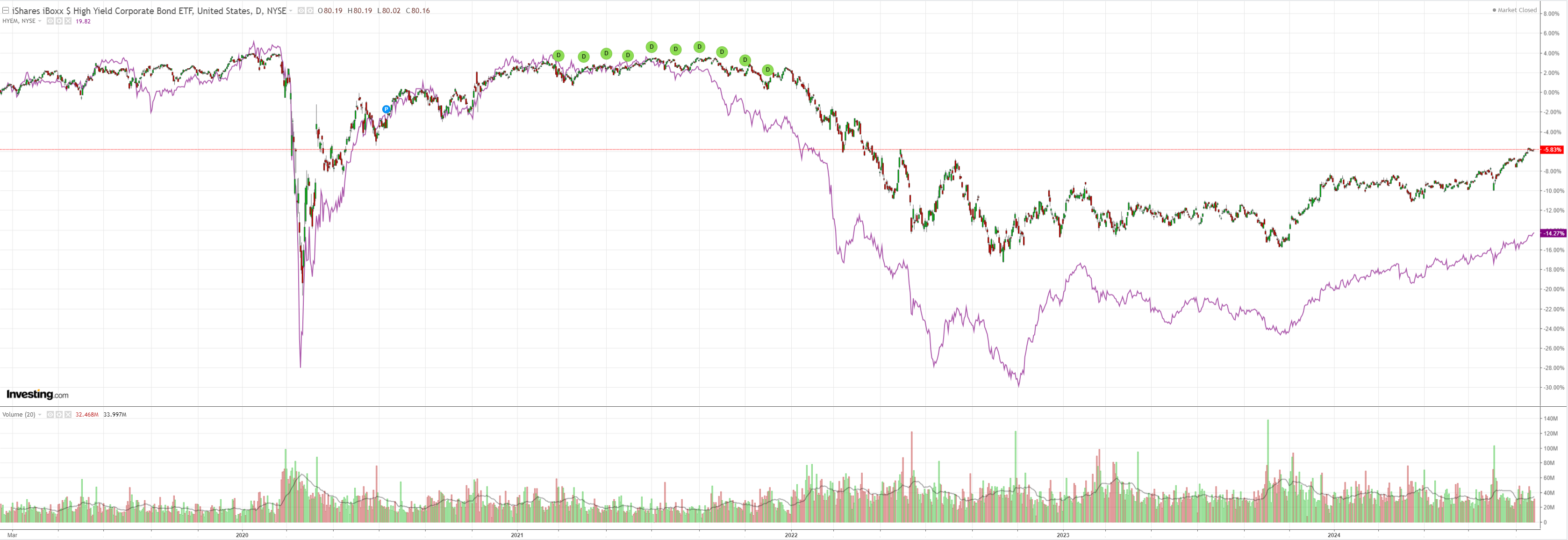

EM too:

Junk is all bull:

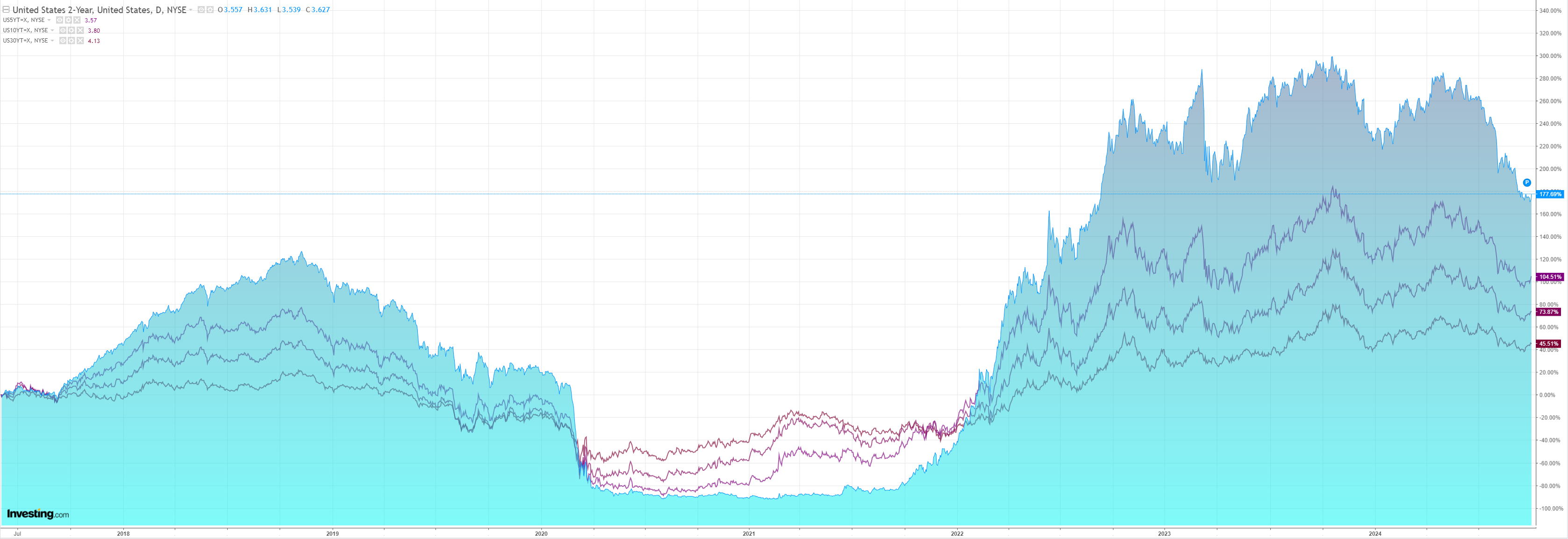

Yields lifted. Is this combined US and China reflation going to choke off the bond rally? Oil is the key:

Stocks ATH:

The China stimulus is nowhere near as strong as being made out and the problems are much larger than most think.

But Pavlov’s market dog has once again been fed again so the expectation for MOAR grows accordingly.

The salivating dog should be more than enough to keep the heat under AUD through year-end.

I don’t have an upside target but the obvious first port of call is 70 cents.

Beyond that, it will be about how quickly the over-egged Chinese stimulus fails.