DXY is still tripping the light fantastic:

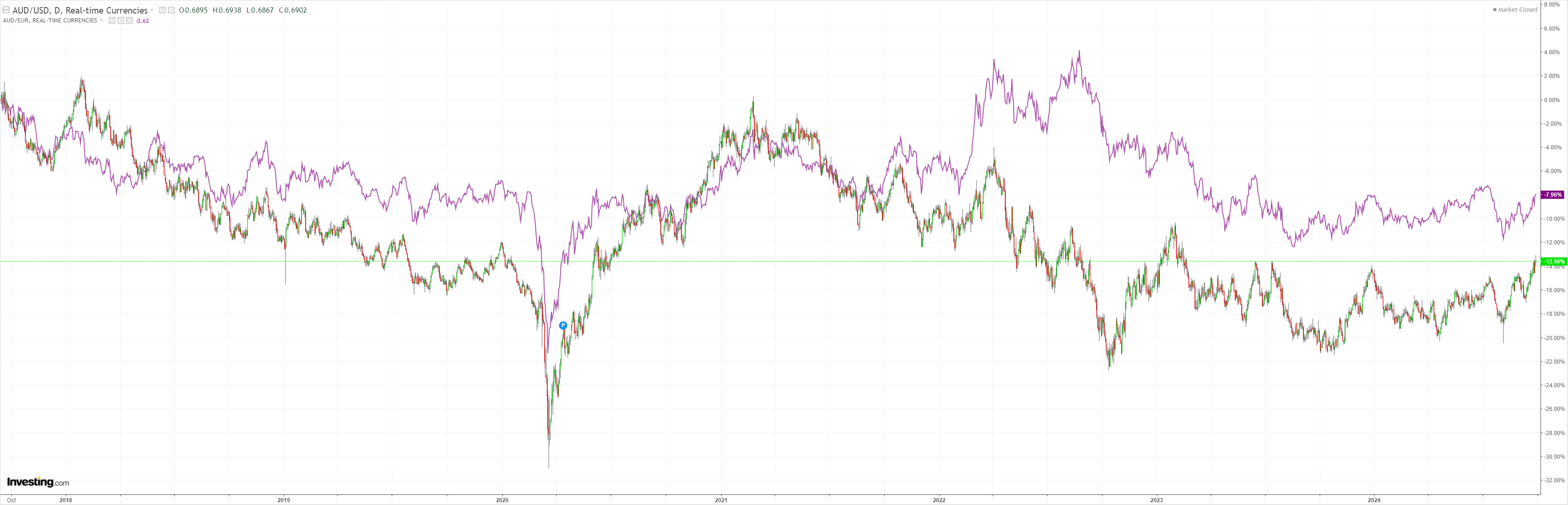

AUD is up and away. 70 cents next:

North Asia thermal:

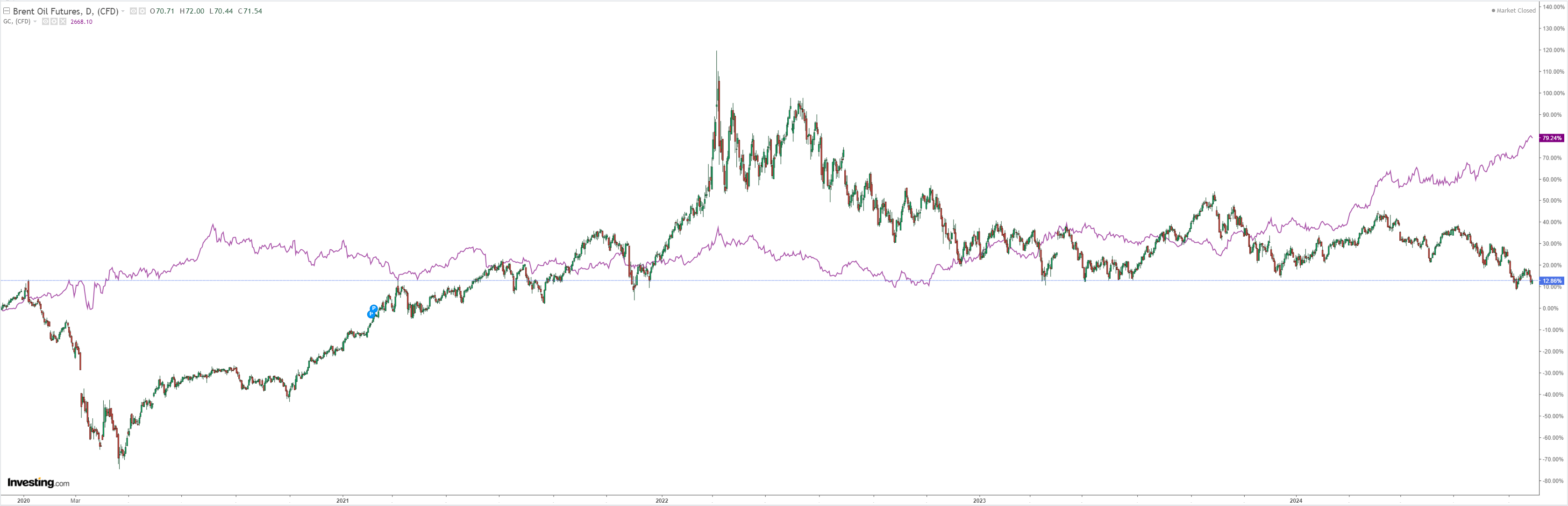

Gold stopped. Oil is still troubled:

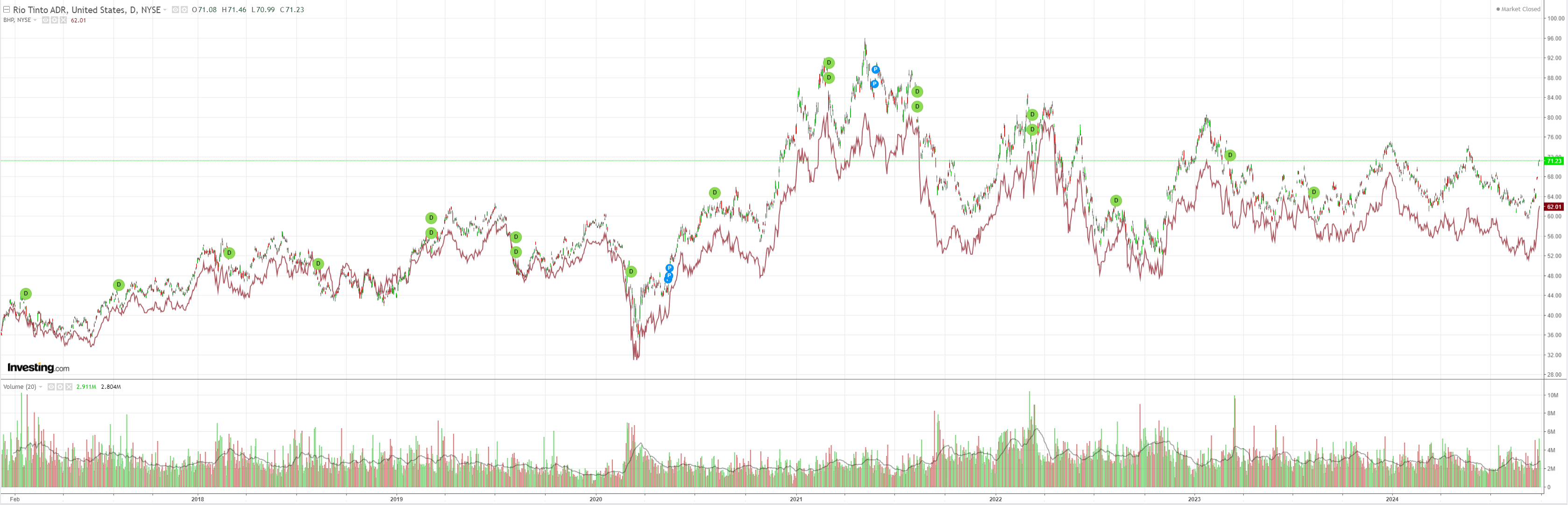

The new metals boom paused:

Mining melt-up:

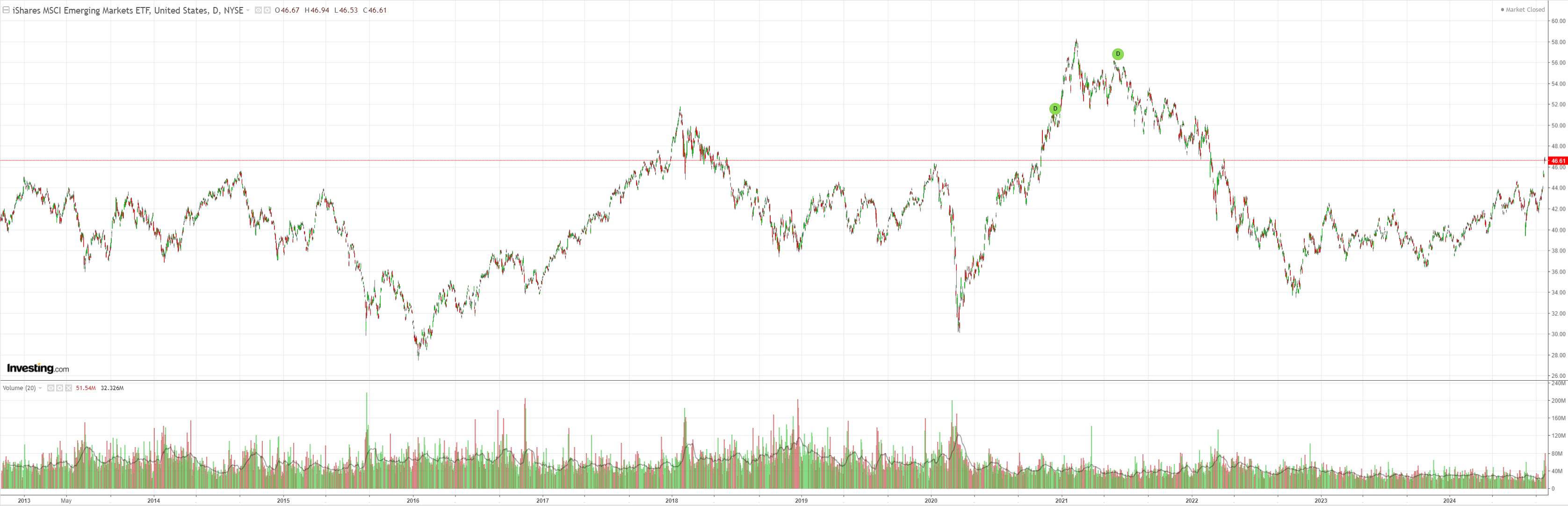

EM gapping is unprecedented:

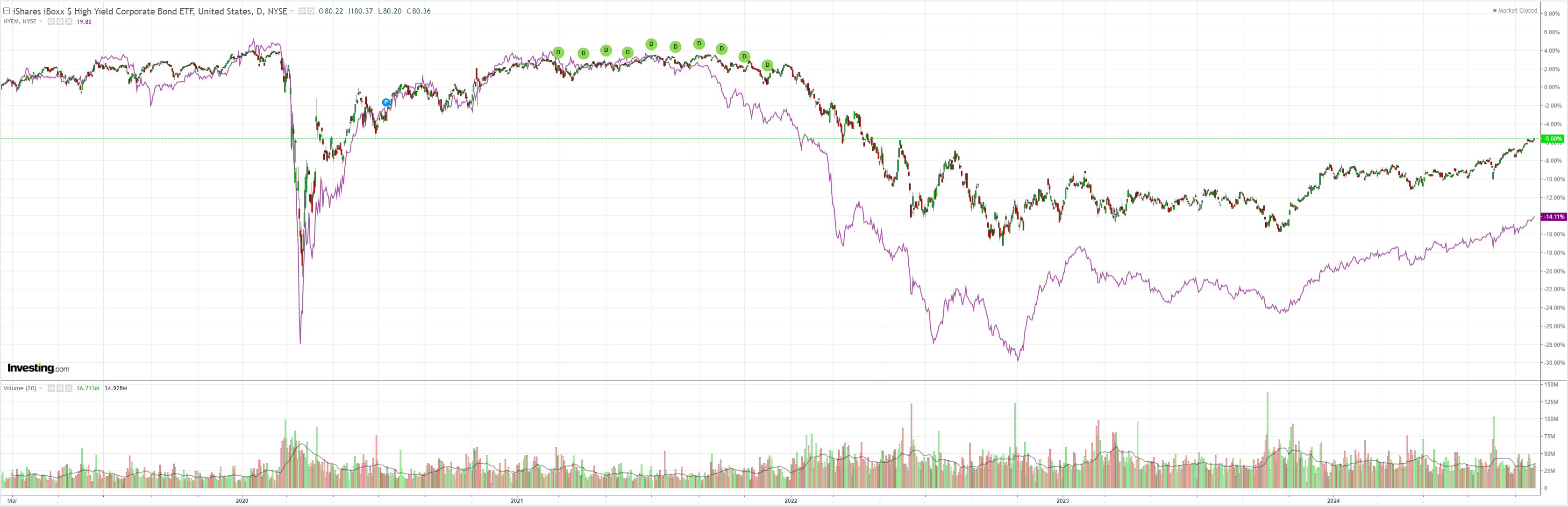

Junk the red rag:

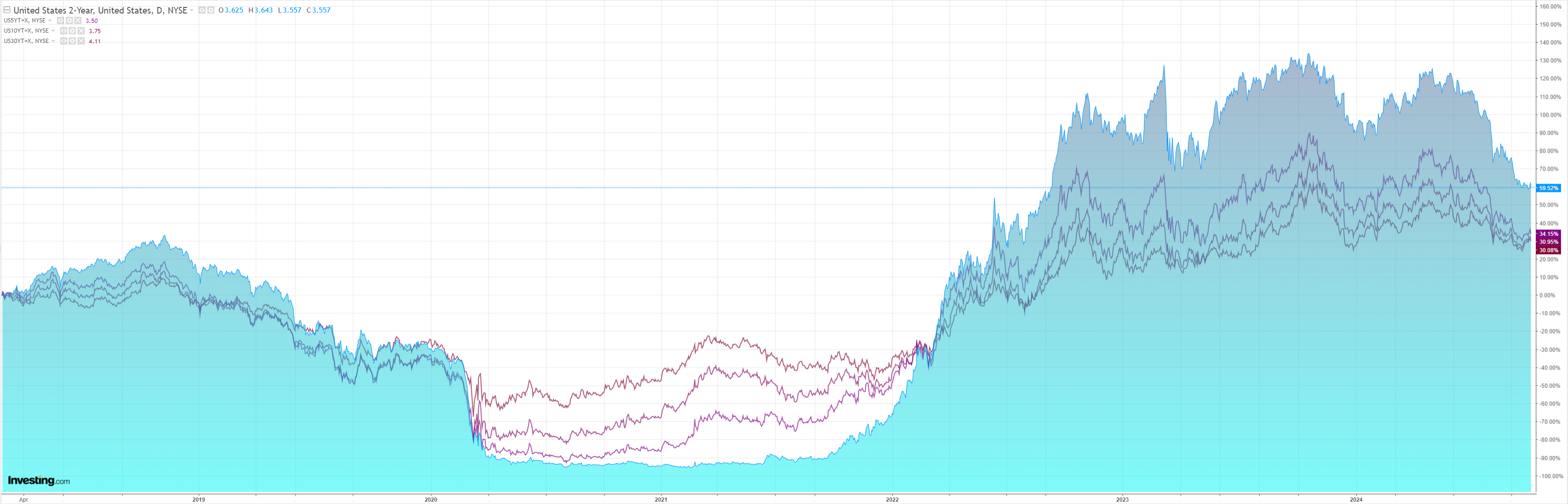

Yields faded:

Stocks too:

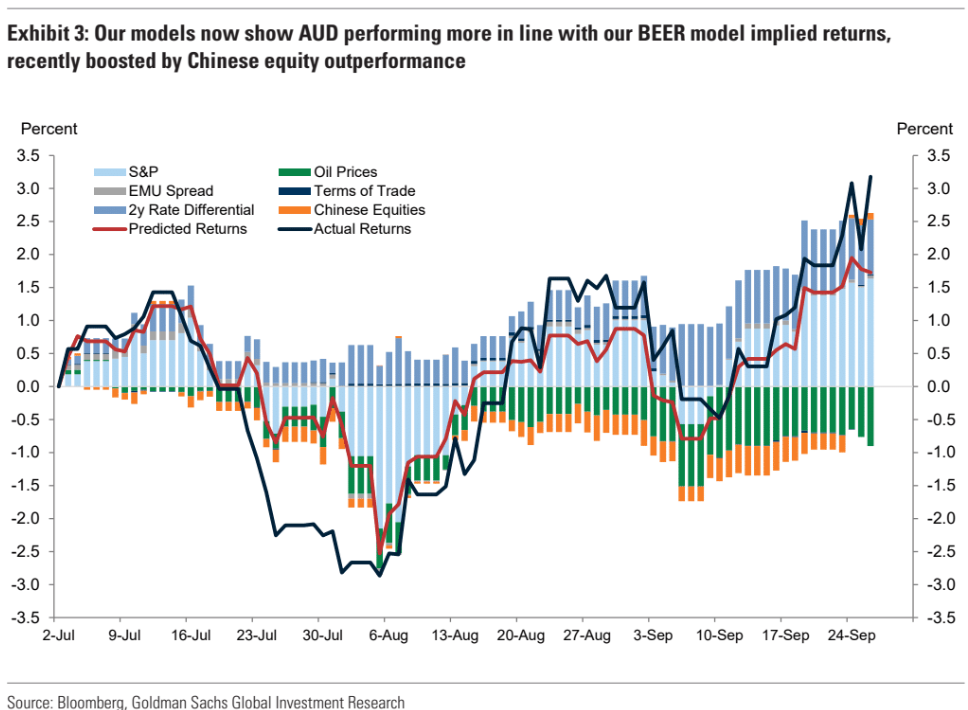

Goldman has wrapped on the AUD:

AUD: Temporary tailwinds.

With the Fed easing into relatively robust US growth, markets have priced a reduced risk of US recession, reaffirming a more risk positive environment which should benefit pro-cyclical currencies.

While AUD tends to be the most high-beta of the G10 currencies, with the strongest correlation to higher equity prices, earlier this year AUD was a notable underperformer despite a pro-cyclical environment.

We found that negative Chinese growth expectations and Chinese equity underperformance helped explain a meaningful share of AUD’s underperformance.

Our models now show AUD performing more in line with our BEER model implied returns (Exhibit 3), but the potential for negative China sentiment to weigh on AUD performance has kept us somewhat less positive on AUD than other procyclical currencies like GBP.

AUD has been a top performer over the last week supported by a pickup in Chinese equity performance given the recent monetary and fiscal stimulus announcements, and we would expect to see continued AUD outperformance should sentiment keep improving.

However, despite the easing measures, our China economists see limited upside risk to their growth forecasts.

As a result, China stimulus is more likely to provide a tactical boost to AUD rather than a sustained positive impulse.

And, while the rally in iron ore over the past few days has also provided a tailwind to AUD through terms of trade, our commodity strategists ultimately expect downward pressure on prices to resume in Q4.

That all makes perfect sense to me. The Chinese stimulus is still weak in context.

We might add that the chances of an RBA cut before Christmas are rising.

Monthly inflation was ahead of RBA forecasts and energy rebate extensions are coming.

I think we’ll get past 70 cents on the AUD but not much further.