DXY is up and away!

AUD turned to mush:

If JPY rises much more, things could get ugly:

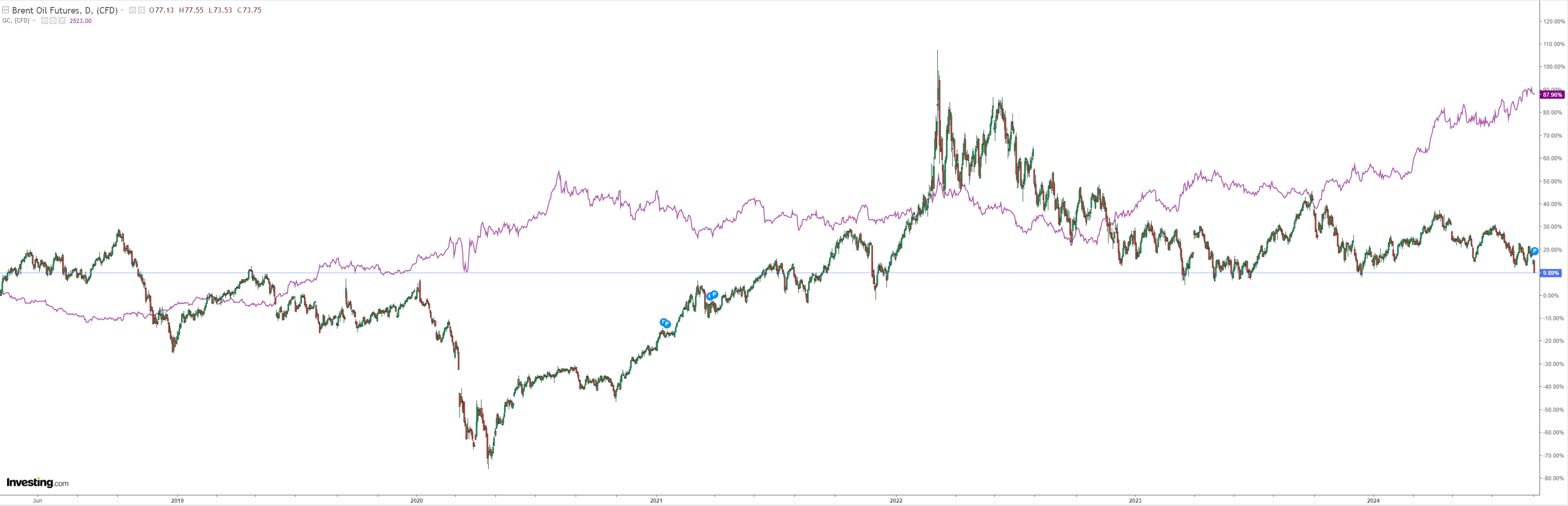

Oil gapped into madness:

Metals melt-up once again turns metals meltdown:

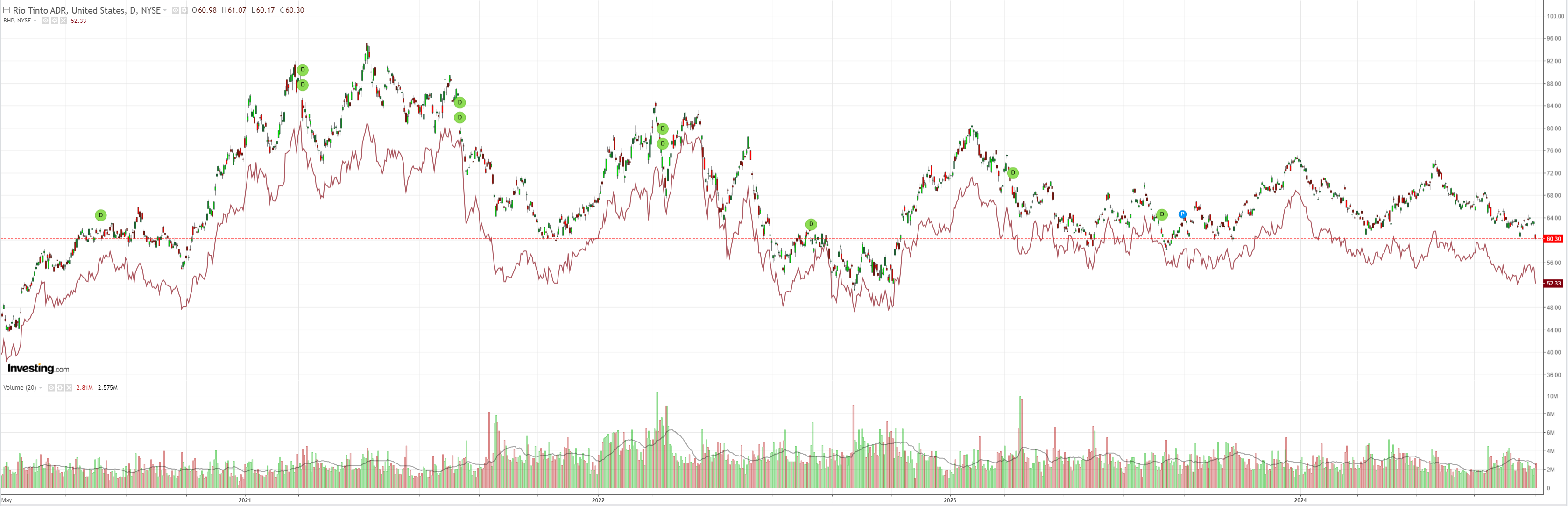

Miners crashed:

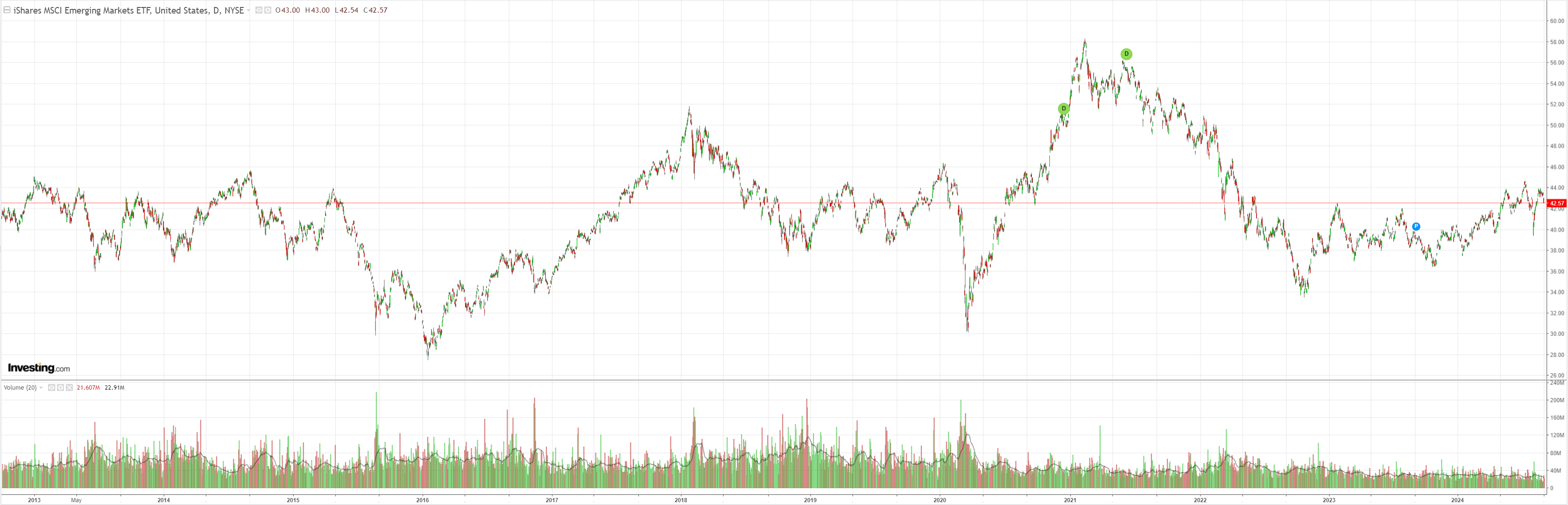

EM is your mumma:

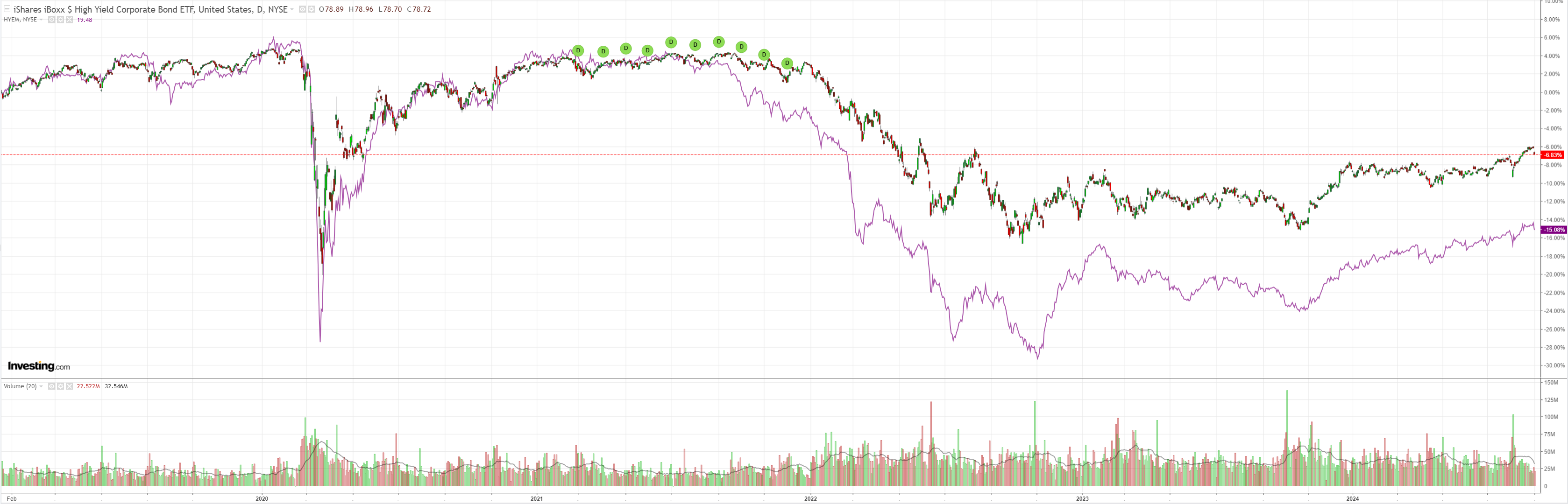

Junk gave us a reason to worry:

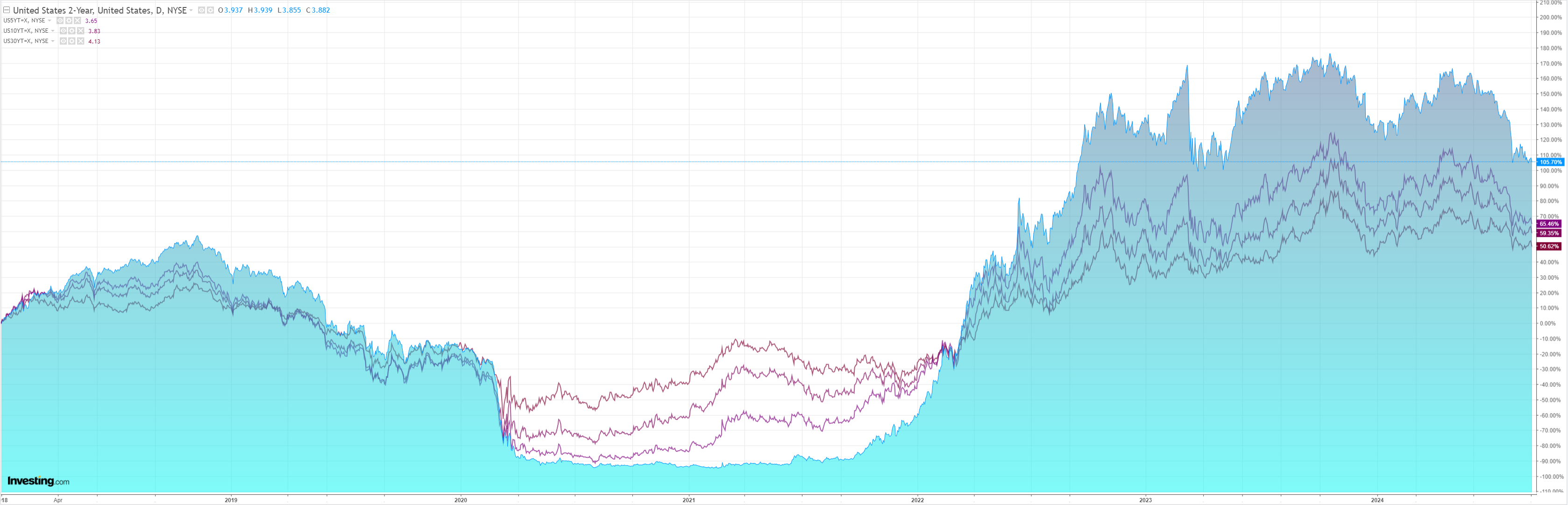

Yields bidly:

Stocks not:

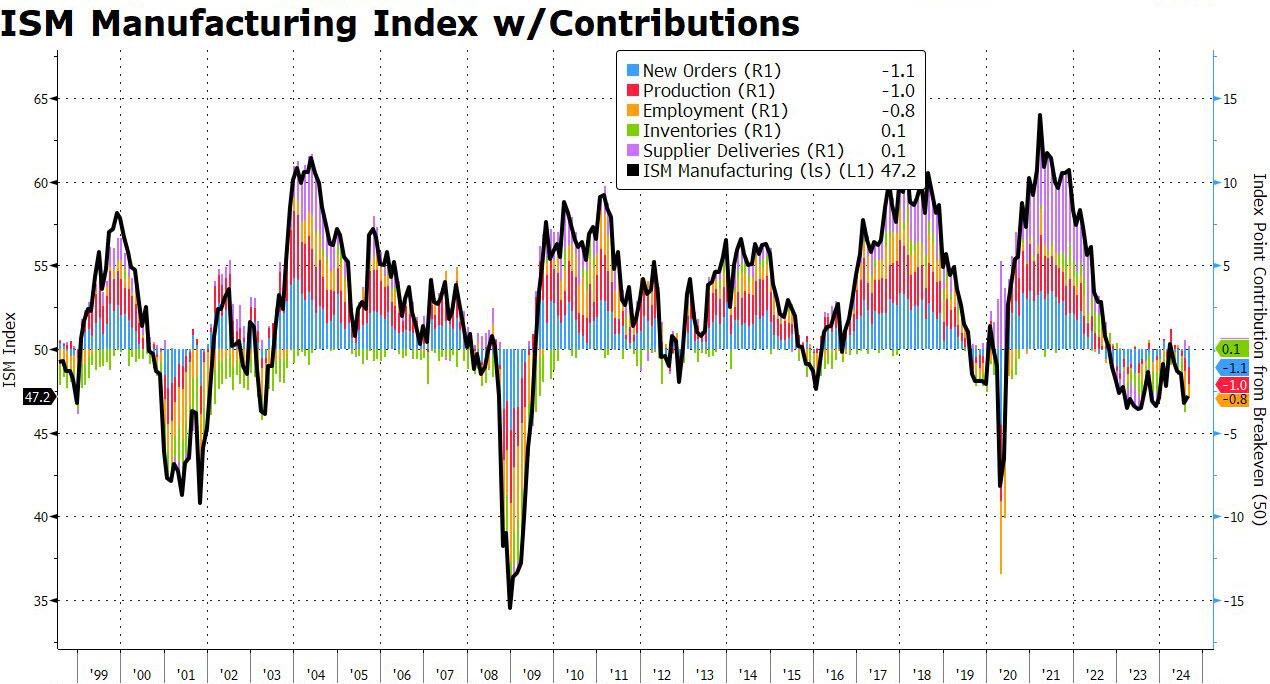

The trigger for the hard reversal was a weak ISM:

Once again, it shows how the current setup of markets is primed for volatility.

Overvaluation and concentration in stocks are not fine if the macro turns unsupportive.

The carry trades that support the imbalance exacerbate this and can unwind into negative feedback loops.

I am not overly spooked at this point. I still think a bumpy landing is more likely than a hard landing.

But, once again, it shows that being long the high-beta AUD without Chinese support is a very unreliable trade.

I still say higher for a while but don’t expect it to be smooth.