DXY is on a rebound, perhaps technical:

AUD is still battling go higher:

North Asia not so much:

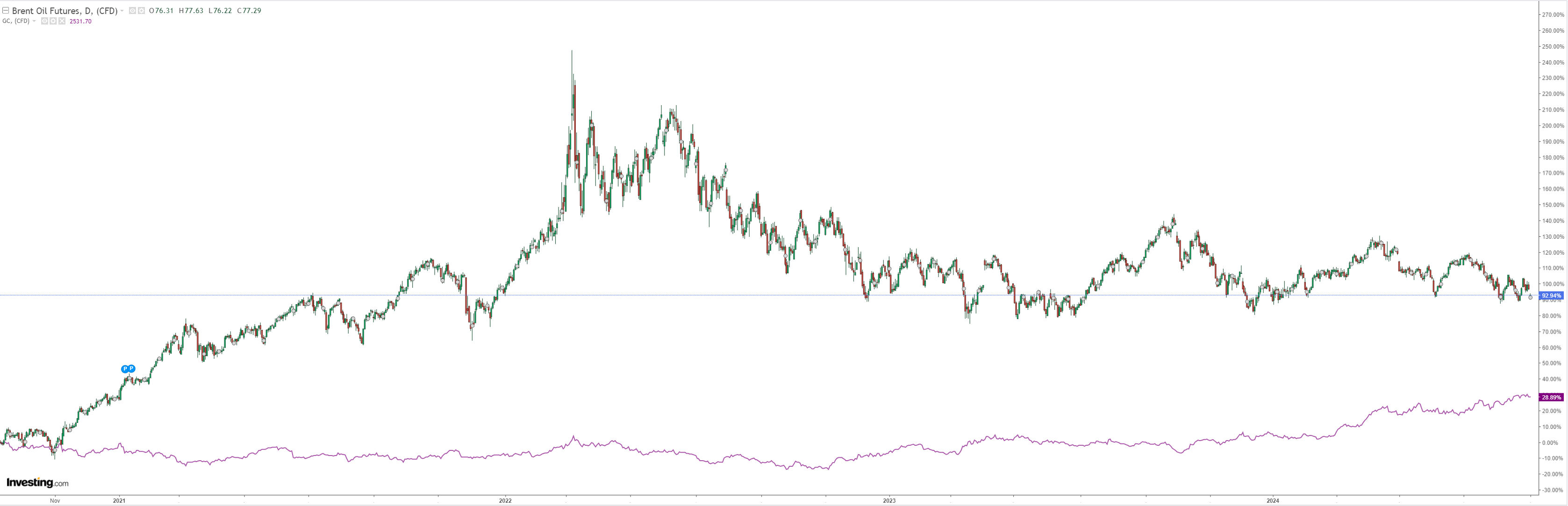

Oil is in trouble:

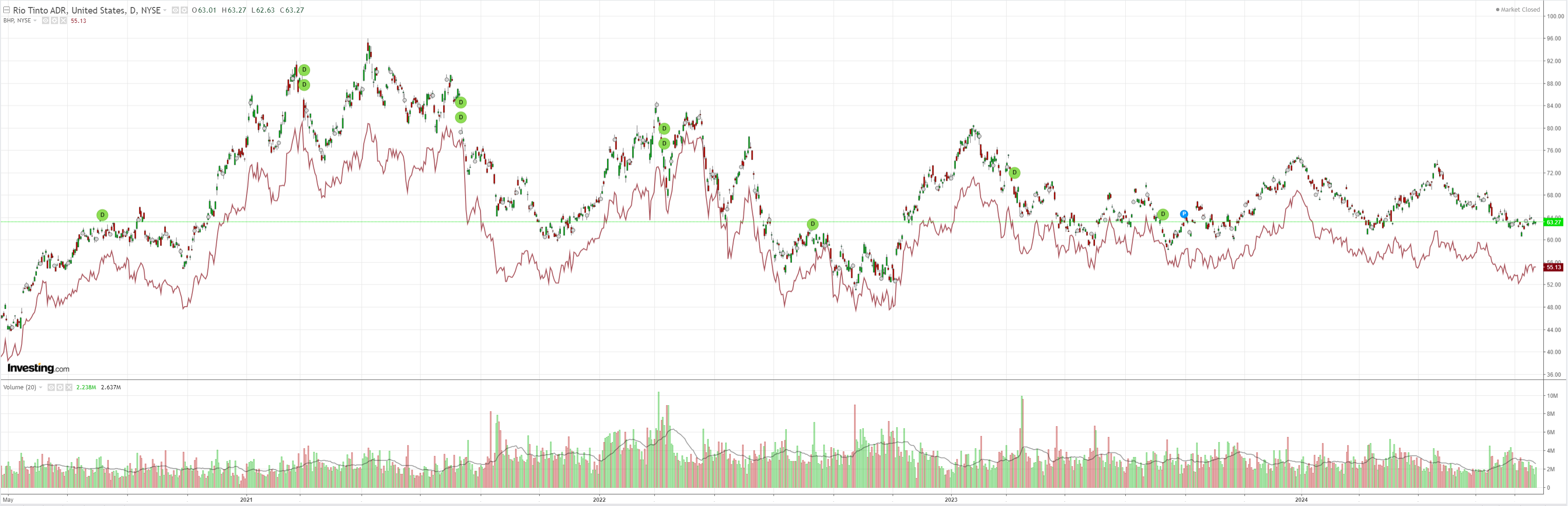

Metals are pulling back:

Miners are frozen in fright at iron ore:

EM yawn:

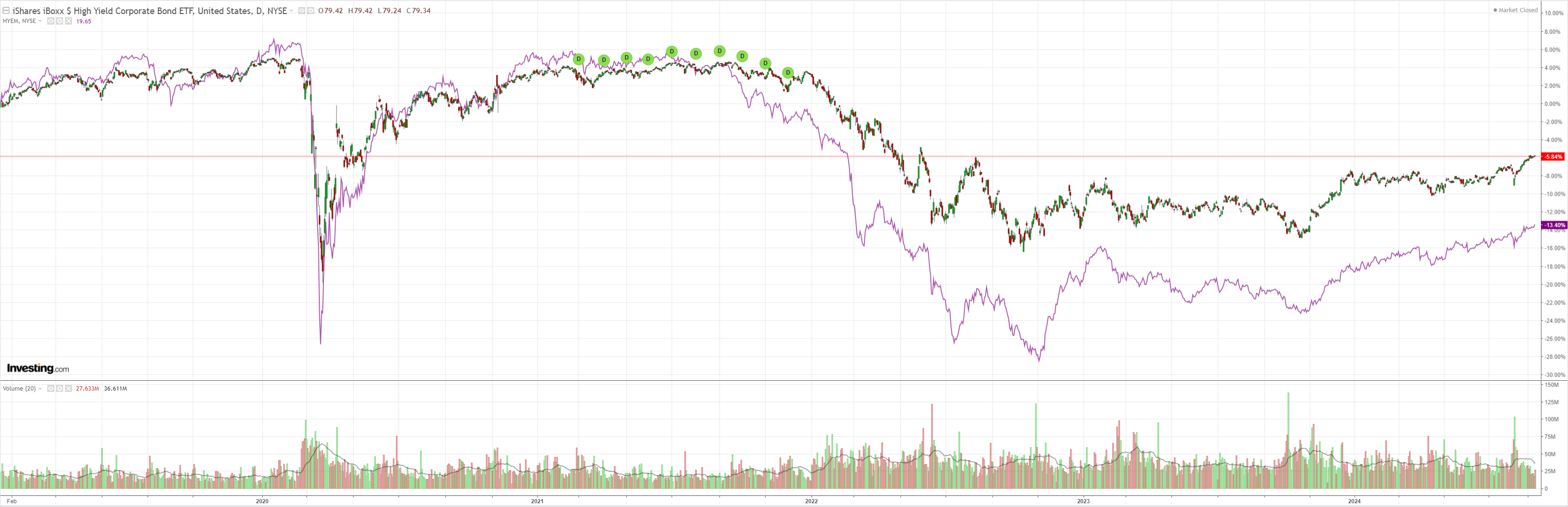

Junk is boooolish:

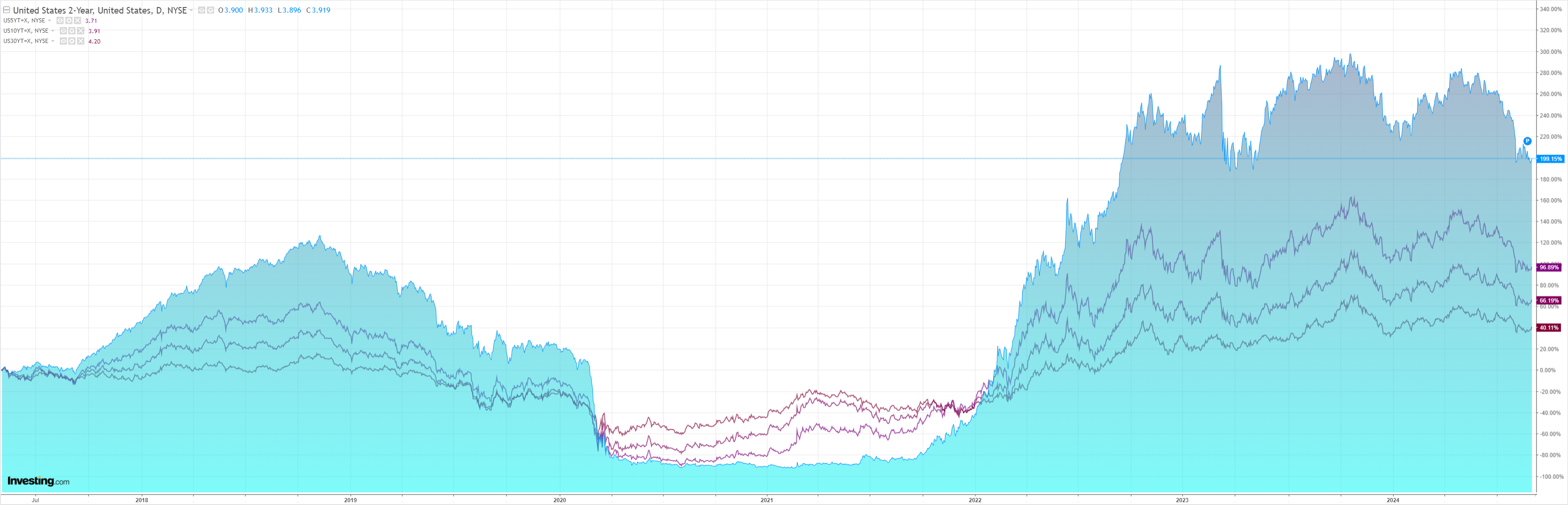

Yields overbought and ignoring oil. Not for long!

Stocks all good:

Markets are poised to continue the counter-trend rally. Credit Agricole:

When the July US unemployment rate moved to 4.3% and triggered the so-called Sahm rule, this quickly made the US labour market a central topic for Fed speakers in August. As a result, investors believe that the FOMC has pivoted away from bringing inflation under control to preventing any deterioration of the labour market outlook.

In turn, this has triggered an aggressive USD sell-off across the board that became the dominant FX market theme last month.

Recent discussions with clients have further suggested, however, that many saw the USD weakness in the run up and the immediate aftermath of the Jackson Hole policy symposium as an overreaction given that the Fed largely confirmed the already dovish market views.

Subsequently, for many clients, last week’s USD recovery was a correction of the overreaction to recent Fedspeak.

We further believe that the correction is far from over and should continue in the run-up to the Non-farm payrolls print on Friday.

This is because the Fed policy outlook remains very data dependent despite its recent pivot to the US labour market outlook.

This means that any evidence this week that the US labour market outlook has stabilised once again could force investors to reassess their very dovish Fed outlook in a boost to the USD.

That makes sense but is overly dependent on one data point. Nobody can predict employment reports. They are a craps shoot.

What we can say is that DXY is oversold and any decent data will continue the rally.

But if is weak then another leg down in DXY is probable.

AUD is still prone to rise.