DXY is bouncing off technical support and an oversold condition:

AUD candles presaged a fall:

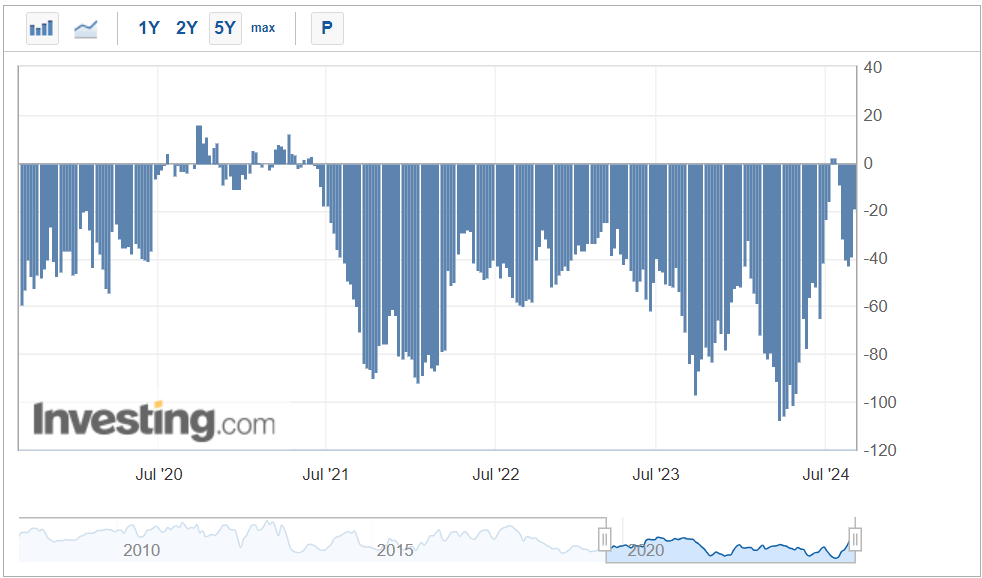

CFTC specs are still short. Bullish!

North Asia into reverse:

Oil looks to be sniffing out a lower range:

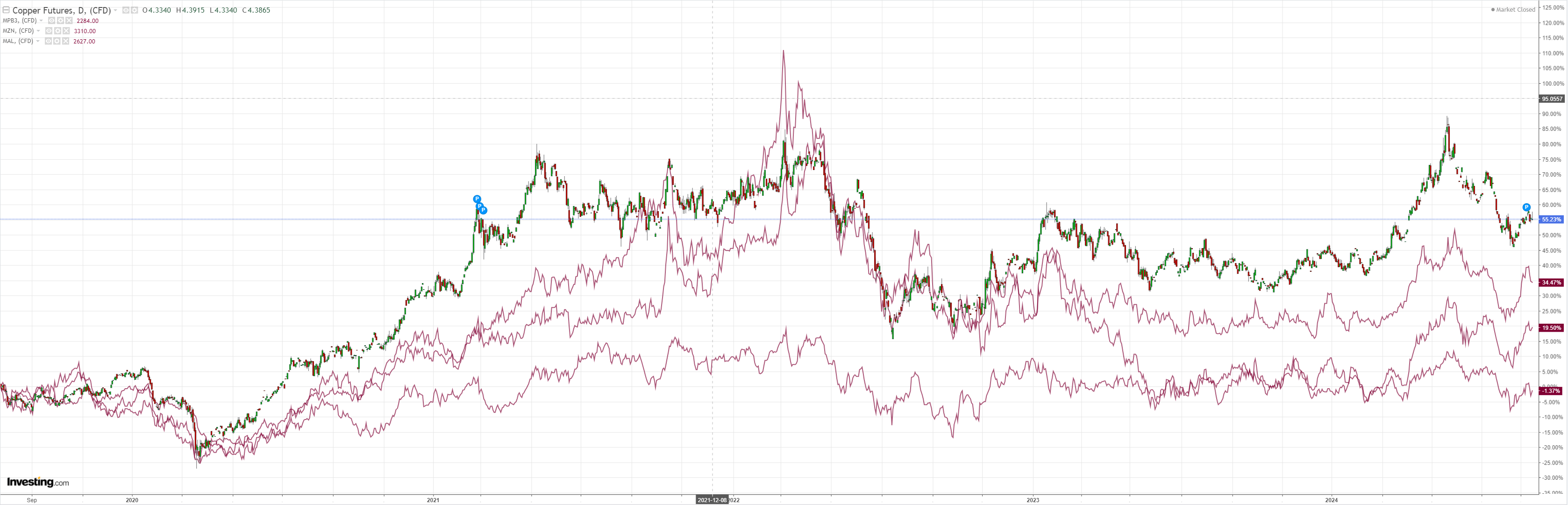

Dirt relation ended:

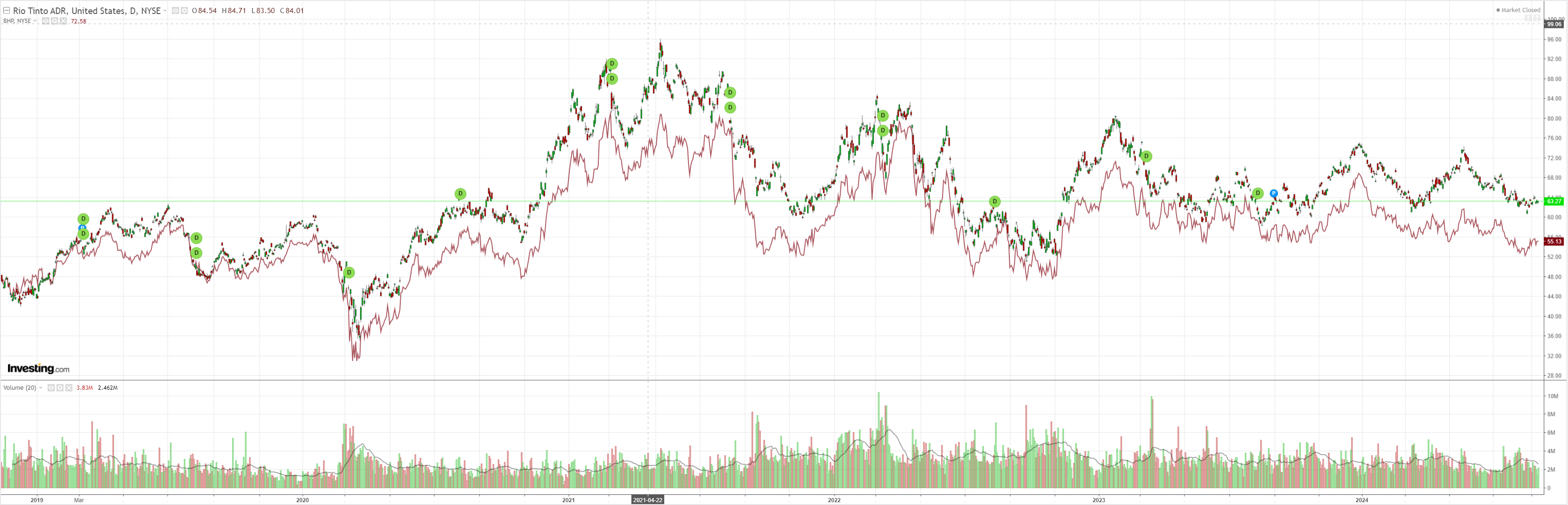

Miners in trouble:

EM going nowhere:

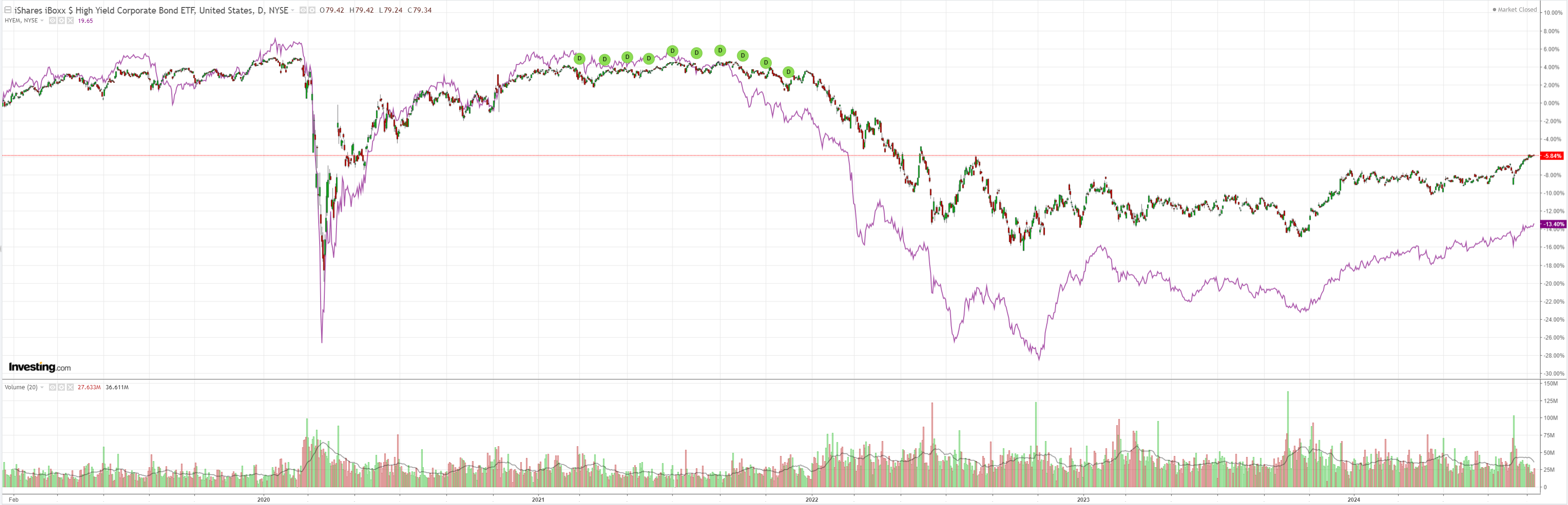

No hard landing here:

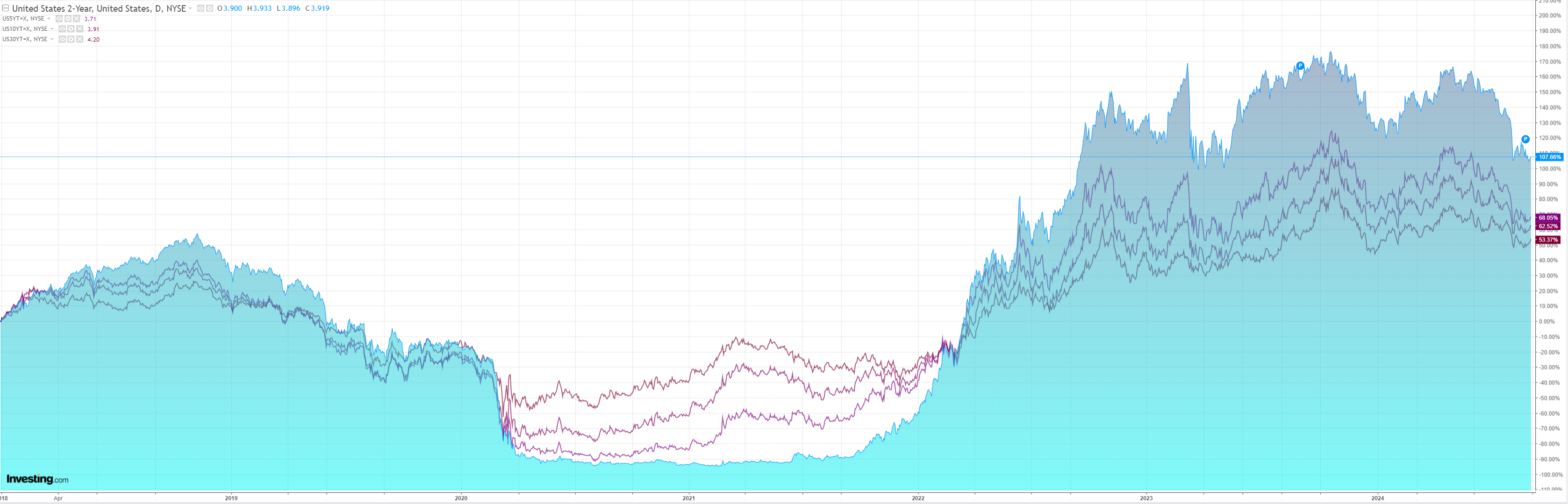

Yields perked up:

So did stocks:

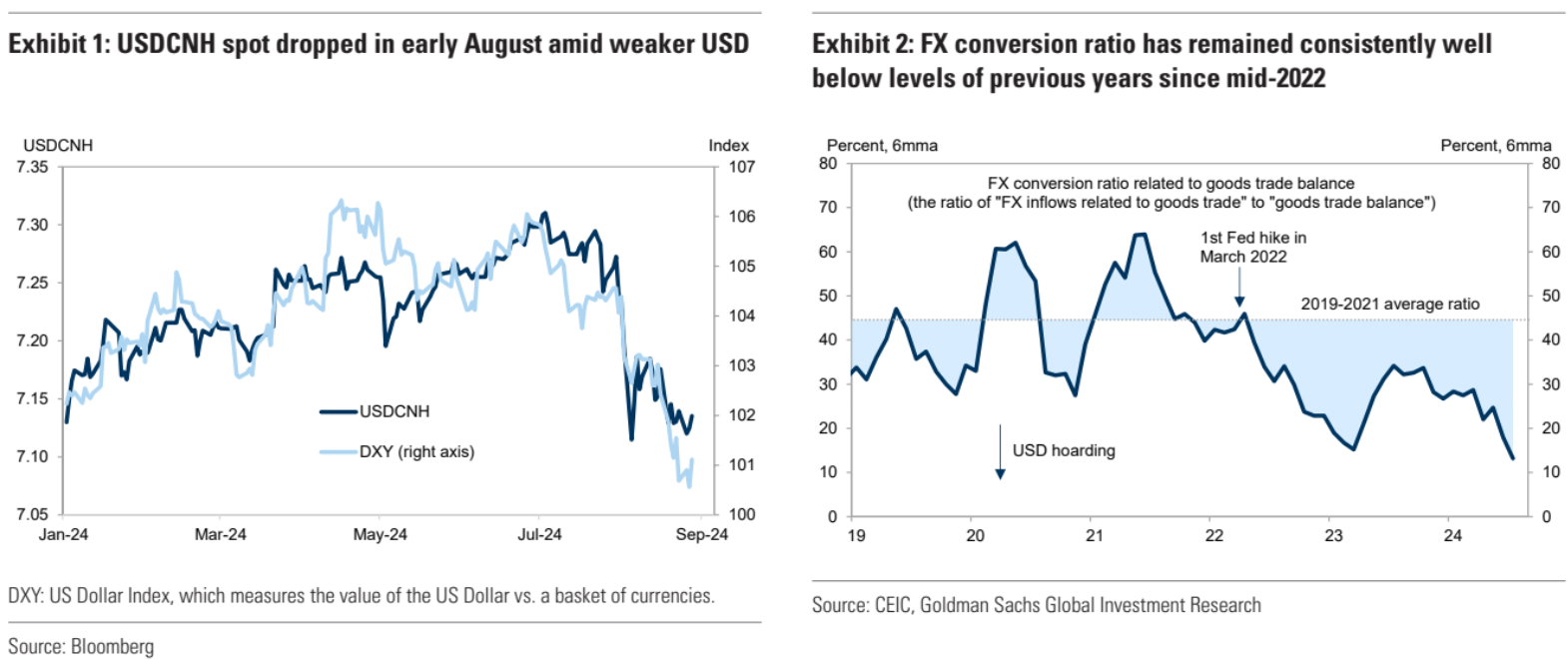

Is China about to wreck DXY and give us another leg up in AUD?

Not so fast says Goldman:

Investors have been increasingly concerned about further CNY appreciation against USD, especially for potential USD selling by Chinese exporters.

Specifically, Bloomberg reported that Chinese exporters might convert half of US$2 trillion FX assets into CNY-denominated assets amid the anticipated Fed rate cuts, strengthening CNY against USD by up to 10%.

In our view, the estimates likely overstate the downside risks to USDCNY from USD hoarding reversal for two reasons: 1) our gauge suggests much smaller USD hoarding by exporters from mid-2022 to 2024 (around US$400bn), and 2) USD assets remain attractive given our expectations of still-large US-China interest rate differentials and still-weak domestic sentiment.

We estimate the average cost of “excess” USD accumulated by exporters is slightly below 7.10, but we believe the pace of CNY appreciation matters much more to exporters’ decisions to convert than specific levels.

We acknowledge the volatility of USDCNY is on the rise in the near term due to great uncertainty around Fed views and US election, which would discourage CNY shorts despite the still-elevated carry returns.

However, over the medium term, we expect CNY to underperform currencies of major trading partners on weak domestic fundamentals.

This strikes me as fighting the last war. Just because the JPY carry trade blew does not mean CNY will too.

The capital accounts of the two countries could not be more different.

JPY is a free-float currency with decades of low rates and excess savings poured into all manner of higher-yielding foreign instruments.

CNY is a virtual peg with only recently low rates and explicit guidance from Beijing on every tic in the currency.

CNY should be far lower given the liquidity trap in its economy, but Beijing has held it up quite successfully and stupidly.

It’s not going to allow either a swift or large appreciation now, making all of its domestic problems worse.

AUD likely has higher to go but it’s going to have to chop some more wood to get there.