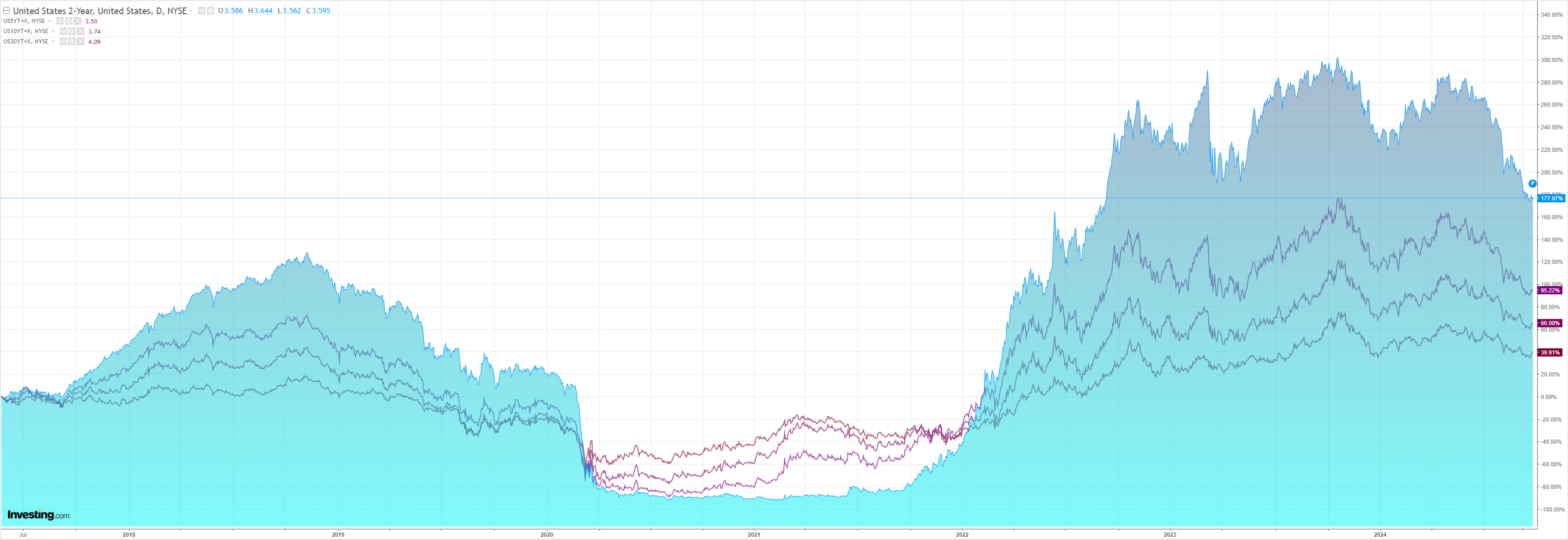

DXY still looks awfully vulnerable:

AUD is knocking on the breakout door:

North Asia is mixed:

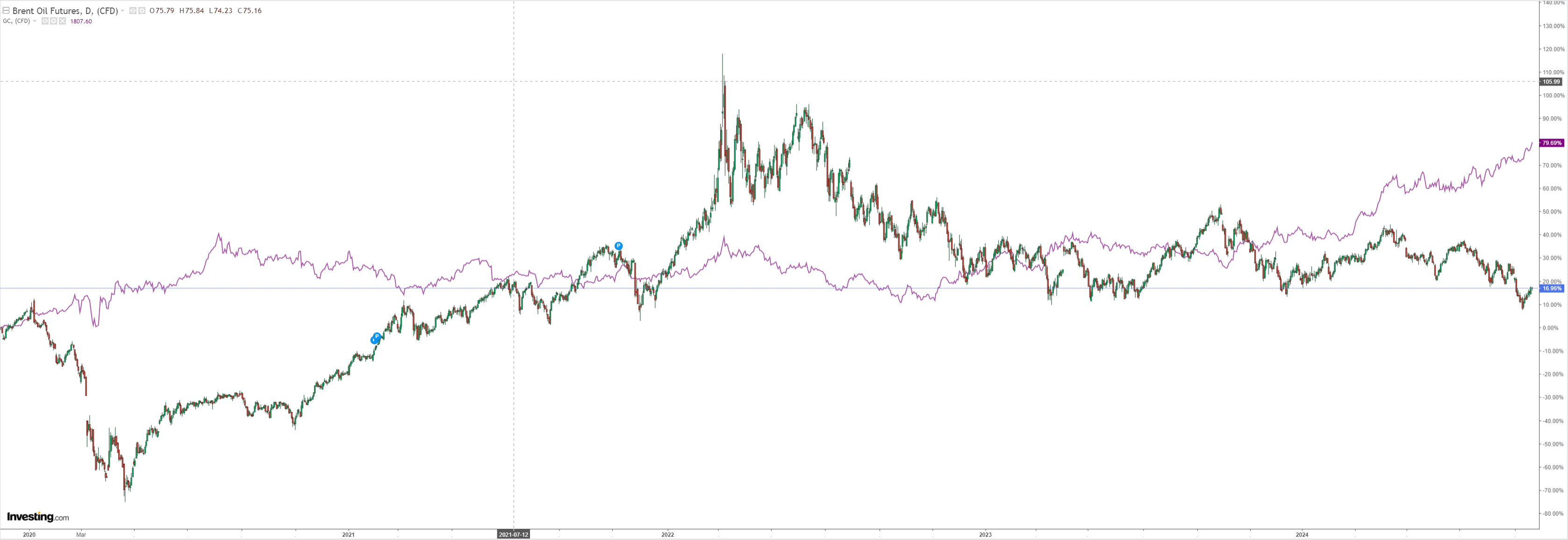

Oil is stalling, gold unstoppable:

Metals are confused:

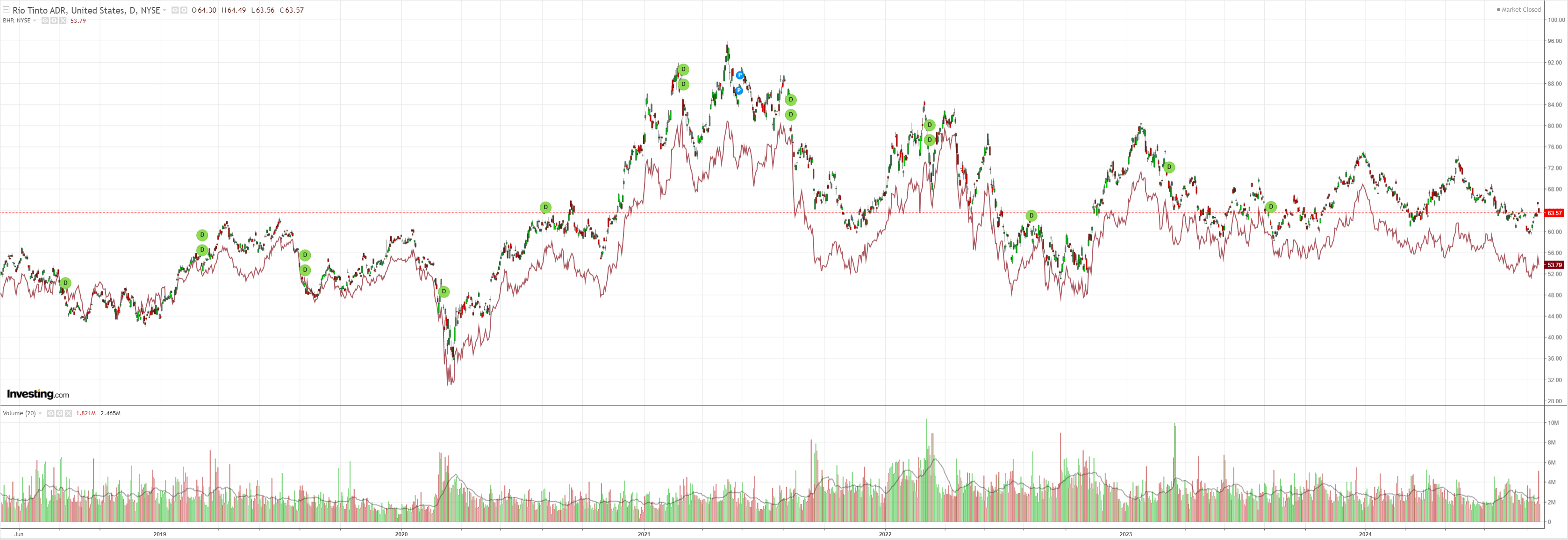

Miners pumped then dumped:

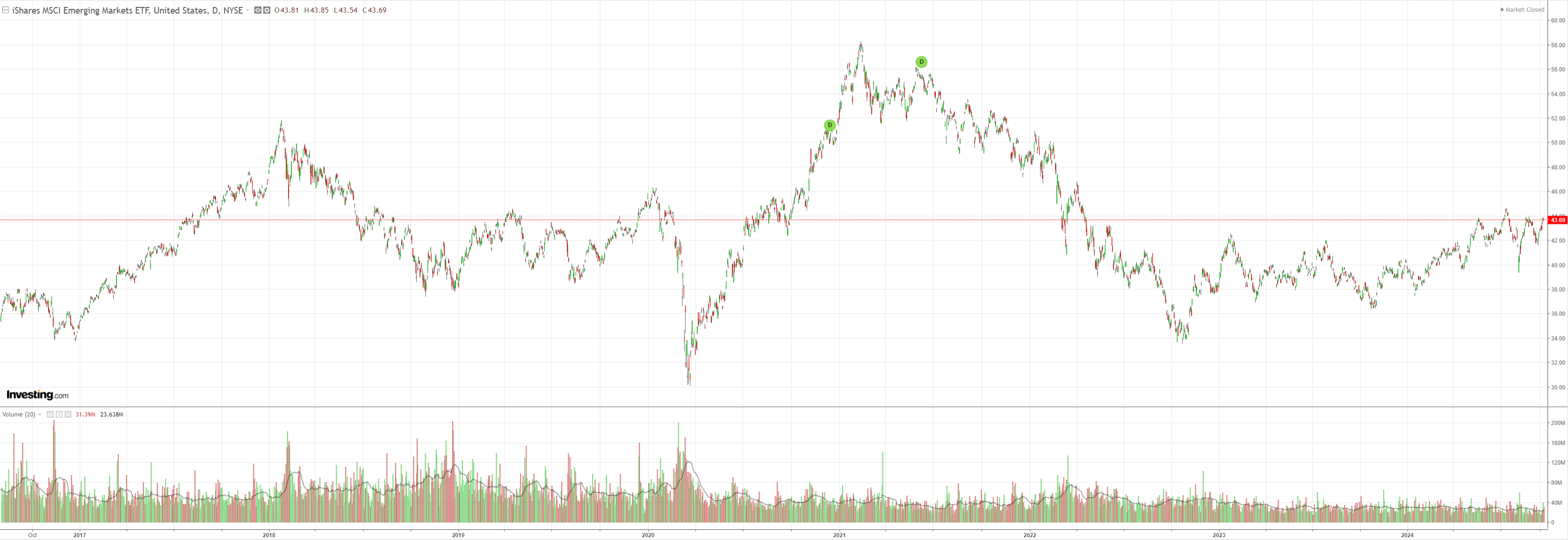

Is there life in EM yet?

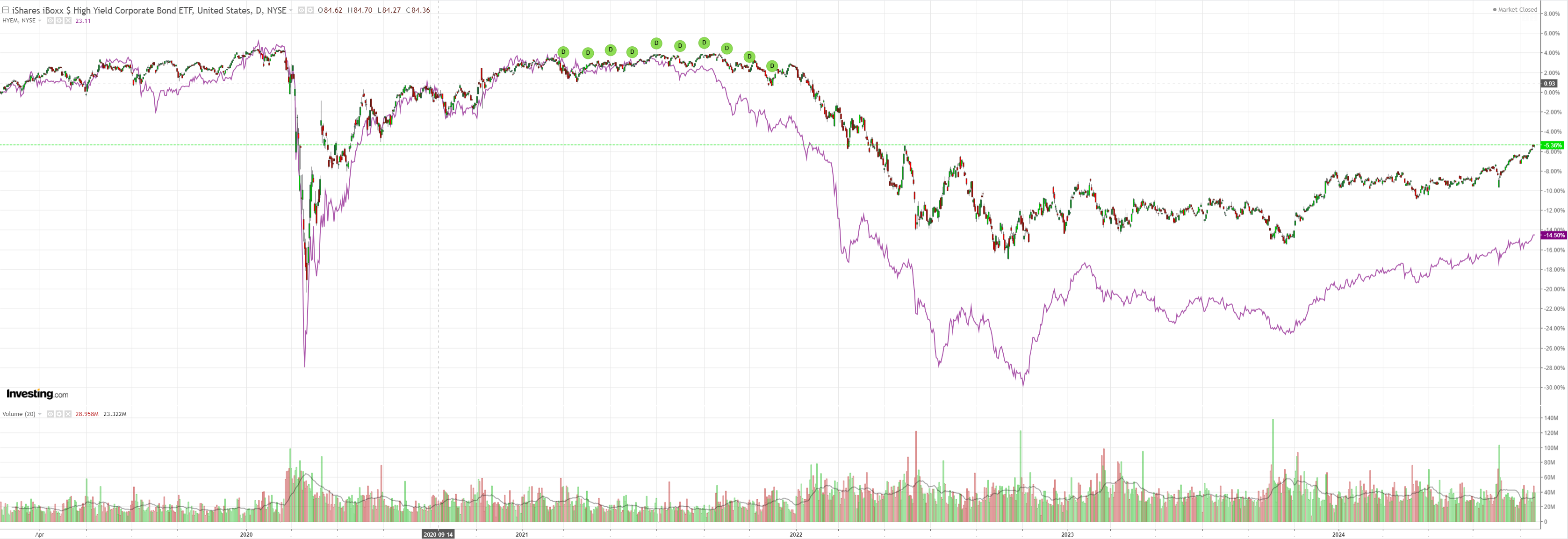

Junk sees sunny uplands of soft landing:

Yields are still selling the Fed fact:

Stocks eased back:

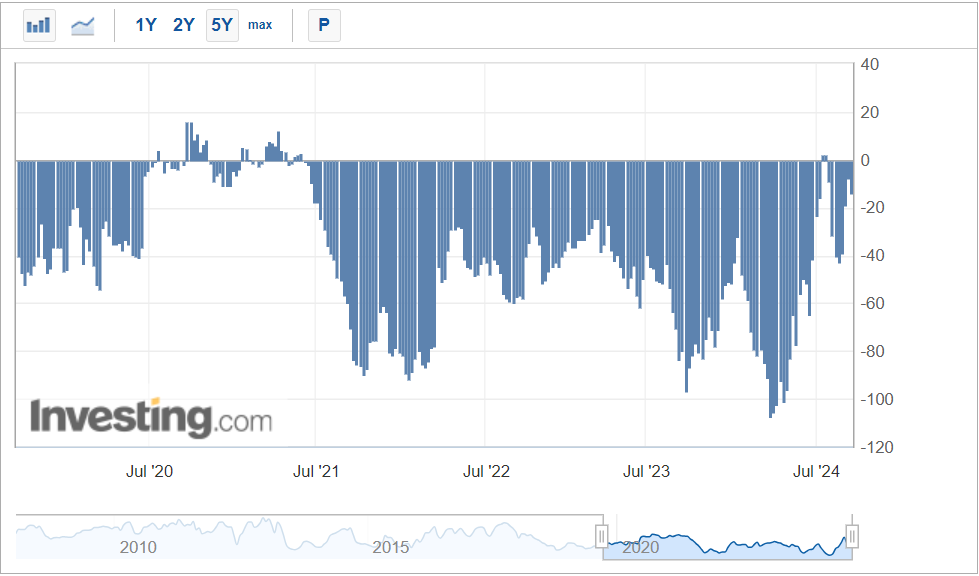

AUD positioning has turned more bearish at -40k contracts:

Confusing cross-currents and signals here.

On the one hand, Fed cuts are revving the market for reflation. This is very AUD bullish.

On the other hand, China is killing the major commodities of coal, iron ore, oil and gas. This is very AUD bearish.

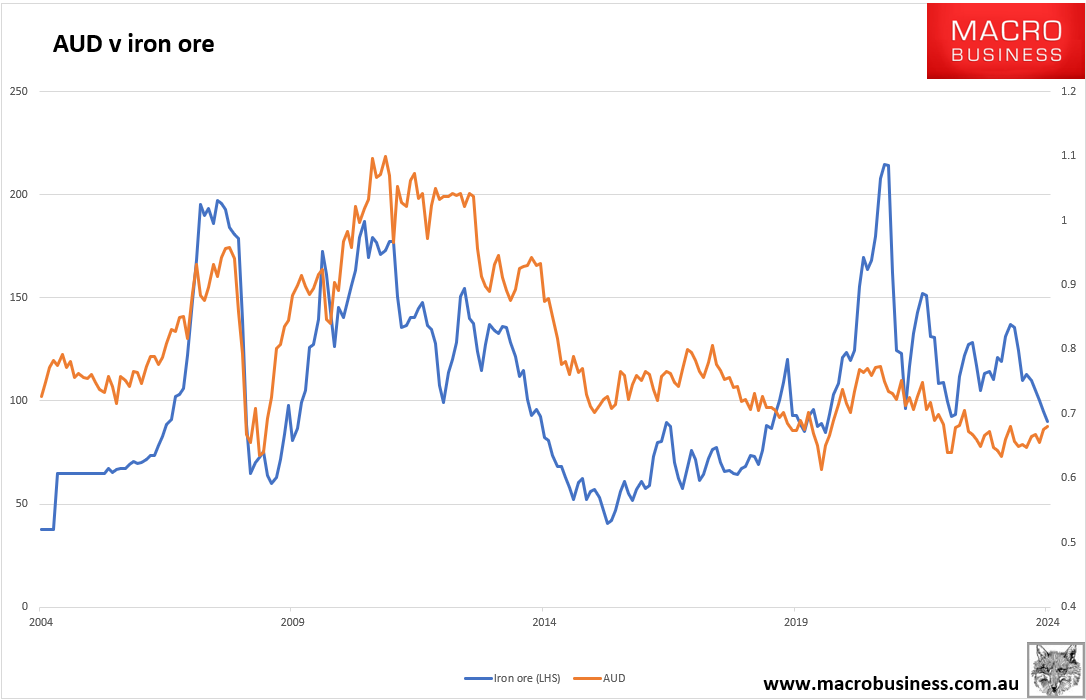

Iron ore is relevant to AUD in trend terms:

And on Friday, Dalian iron ore futures capitulated to new closing lows. It looks like we are going to break $90 and head for $80:

The conflicting forces will come together at the Reserve Bank.

The Treasury forecast for ion ore is roughly $70 spot ($60FOB) into next year, so $80 now is probably not enough to upset the interest rate apple cart.

With oil, gas and coking coal also falling out of bed, we will likely see some budget revenue downgrades and national income tightening.

Iron ore at $80 is probably not enough to upset the RBA so AUD is still biased upwards on the Fed updraft.

But it isn’t going to get far and the deeper we get into 2025 and the arrival of the Simandou Pilbara killer, the more AUD headwinds will mount as the RBA is forced to cut deeper than markets are currently pricing.

The AUD rally is a good opportunity to sell inflated local assets (banks) and buy offshore.