DXY was stable overnight:

AUD was blasted anyway:

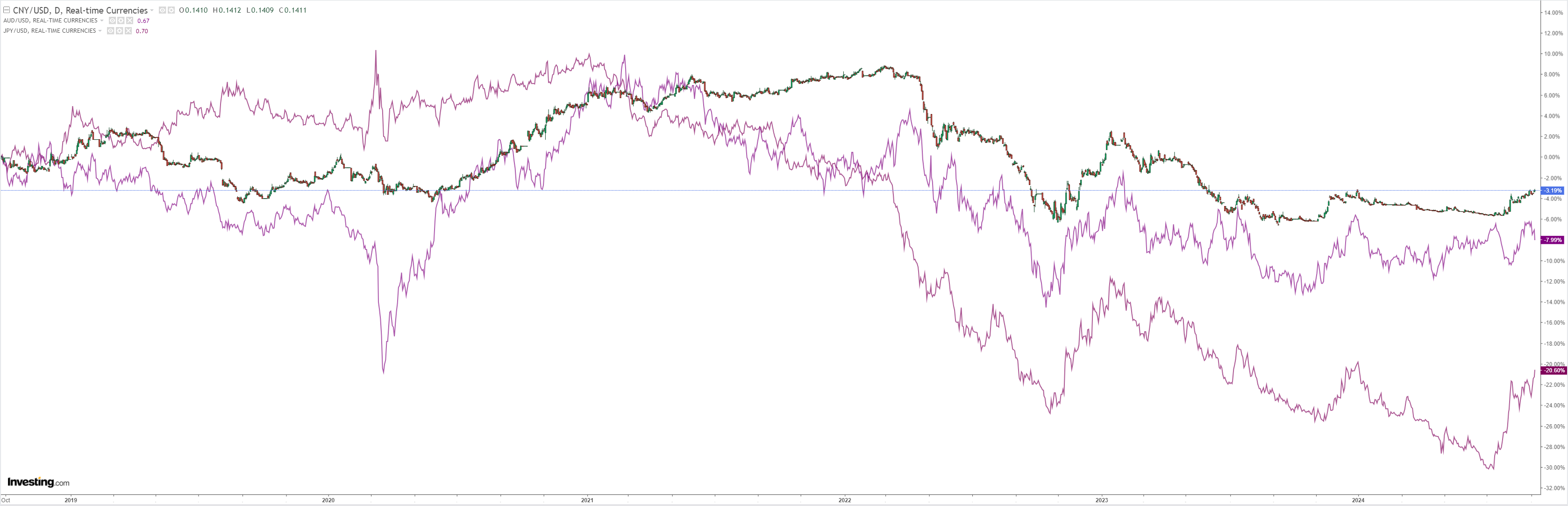

North Asia carry crashes are back:

Oil broke closing technical support:

Metals mayhem:

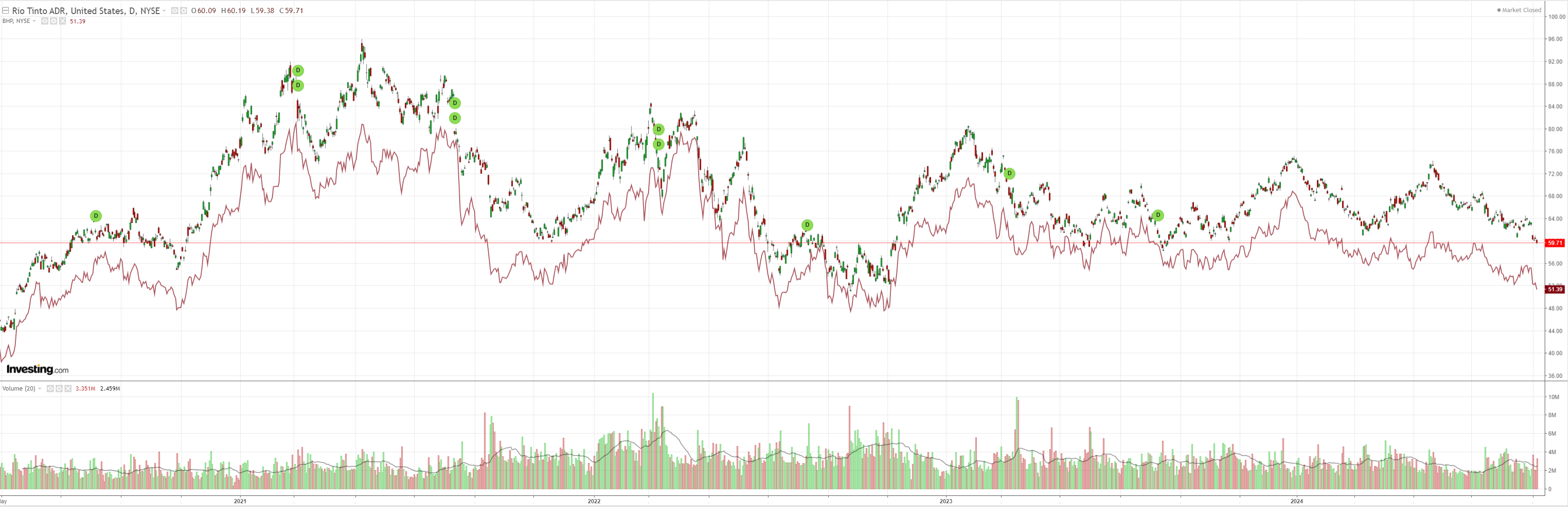

Miners mauled:

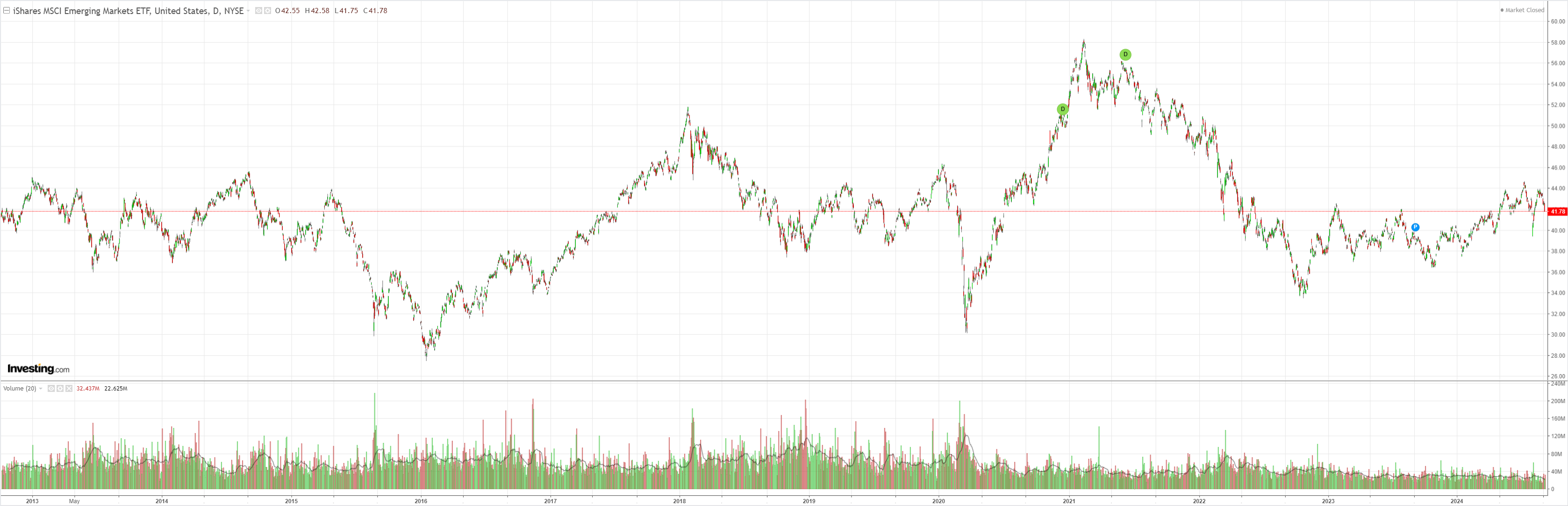

EM at the neckline:

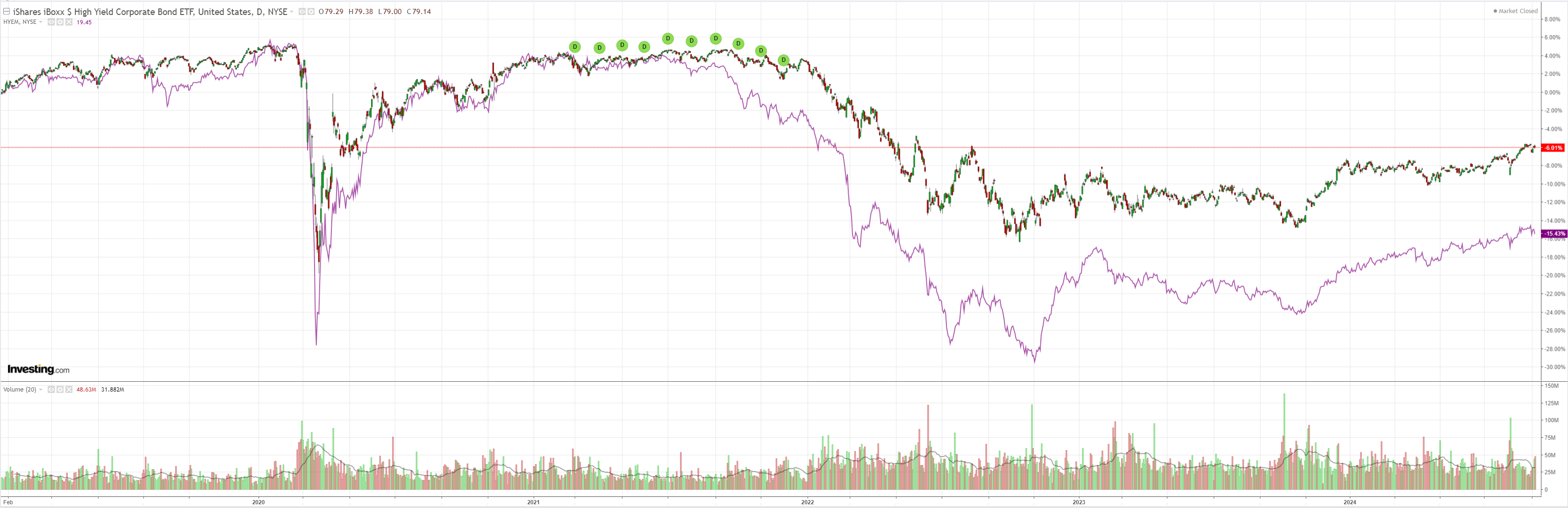

Junk hiccupping:

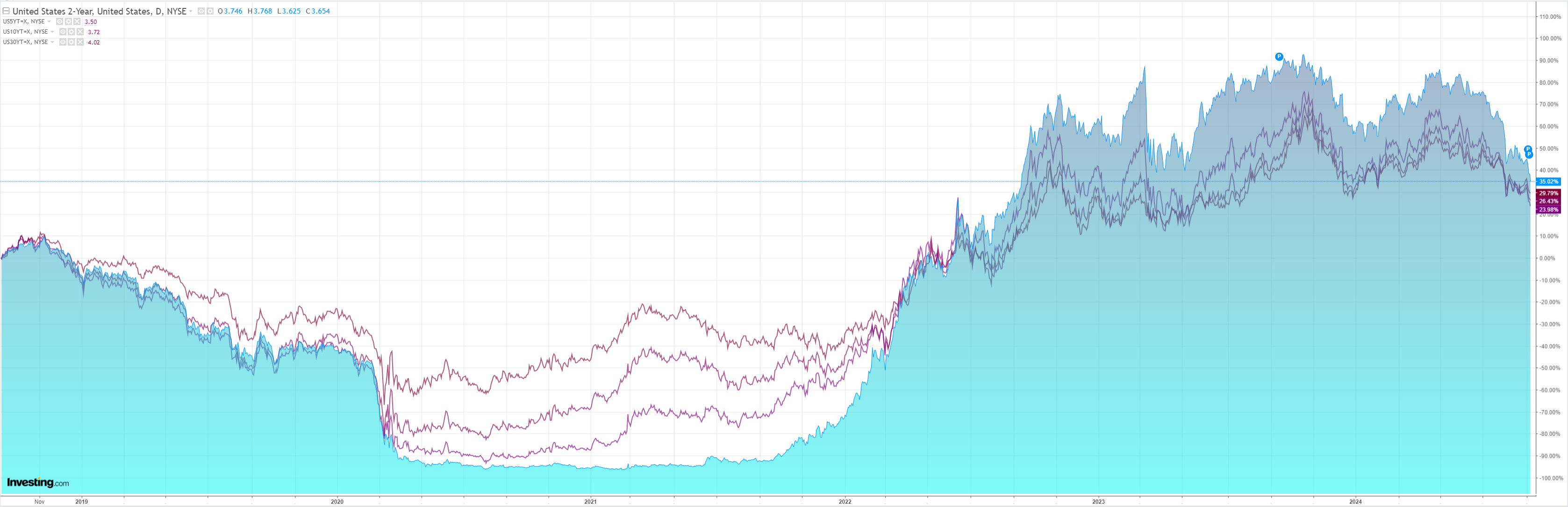

Treasury curve through the roof:

Stocks through the floor:

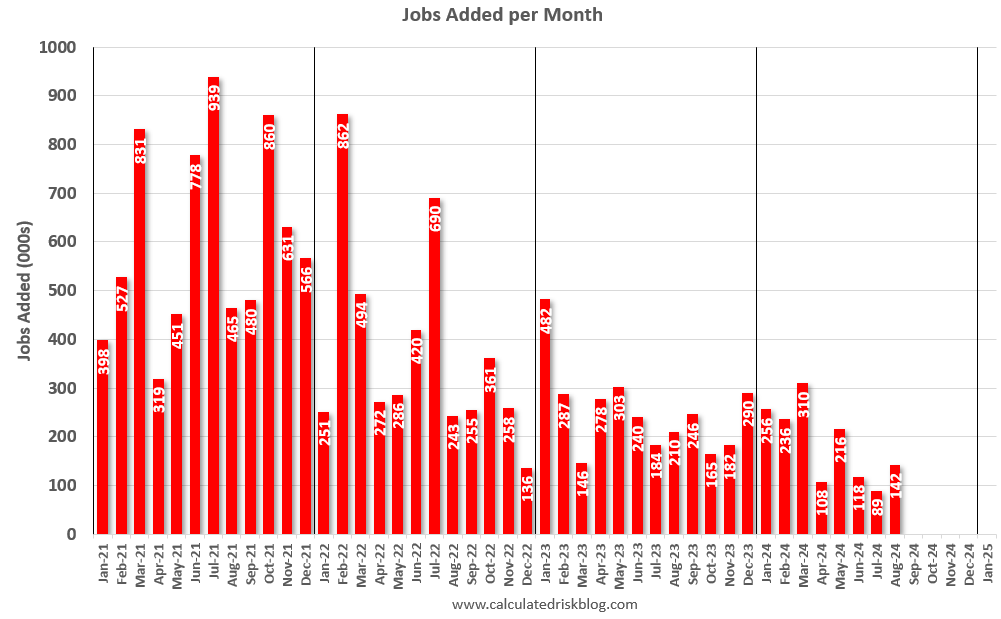

US jobs were Goldilocks really:

Total nonfarm payroll employment increased by 142,000 in August, and the unemployment rate changed little at 4.2 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in construction and health care.

…The change in total nonfarm payroll employment for June was revised down by 61,000, from +179,000 to +118,000, and the change for July was revised down by 25,000, from +114,000 to +89,000. With these revisions, employment in June and July combined is 86,000 lower than previously reported.

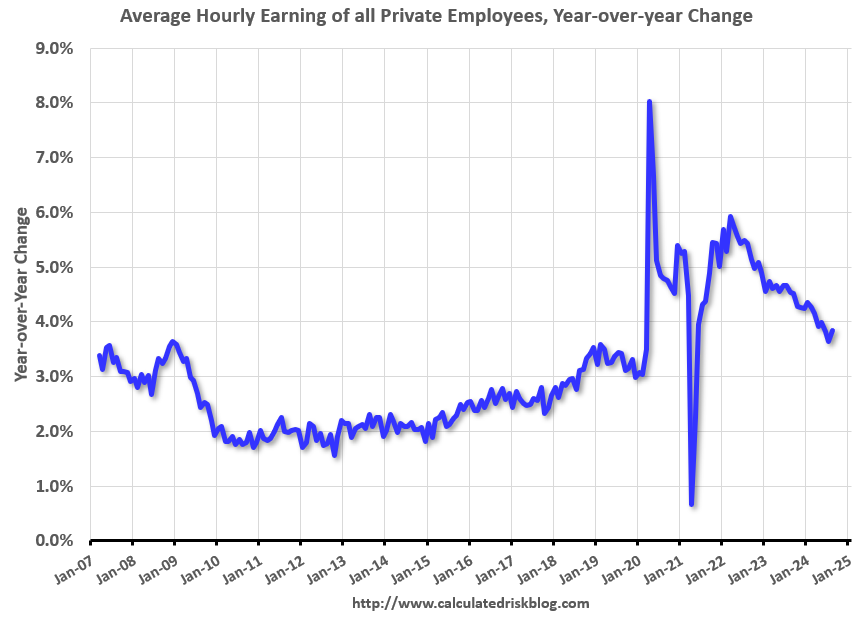

But, as I feared going in, this only serves to keep the Fed to a 25bps cut and the market wants 50bps now.

I still don’t think the steepening yield curve presages a recession. And the unemployment rate reversed out of the Sahm Rule.

But the slowing is deep and protracted and the market is priced for perfection, not a bumpy landing.

AUD can’t make another tilt higher until the Fed breaks more dovish or the market prices what’s coming.