DXY is still looking very soft:

AUD roars towards breakout on the Chalmers’ stagflation:

North Asia is mixed:

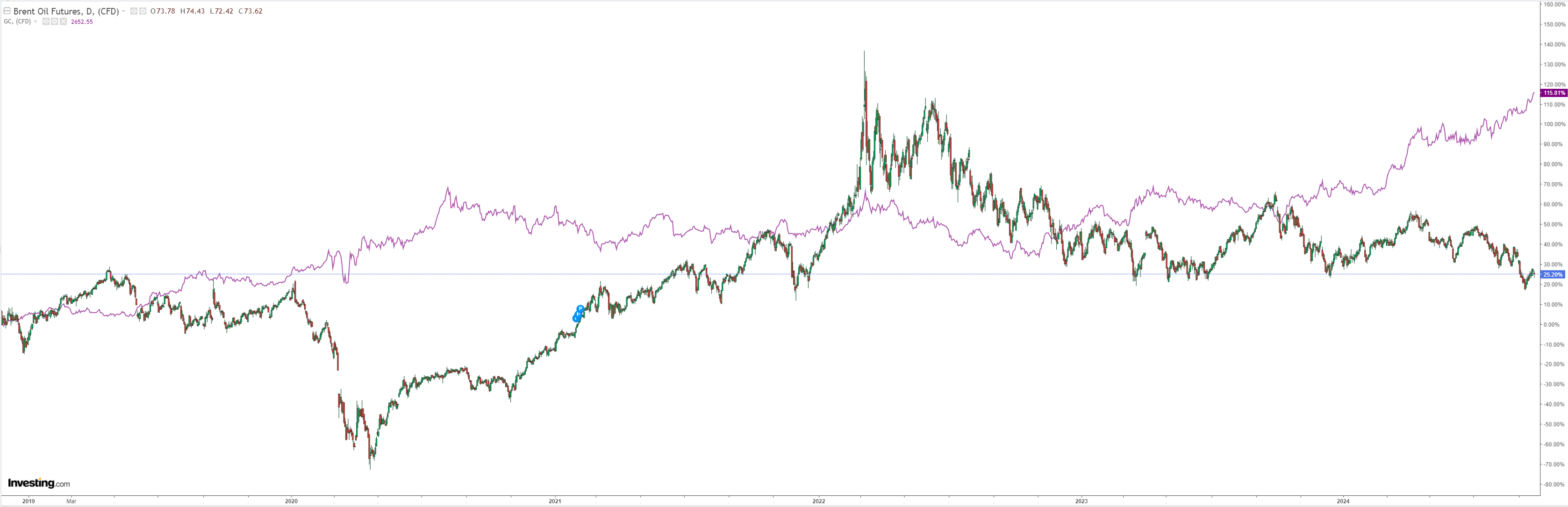

Gold is overbought, oil ready to fall some more:

Metals are confused by Fed v China:

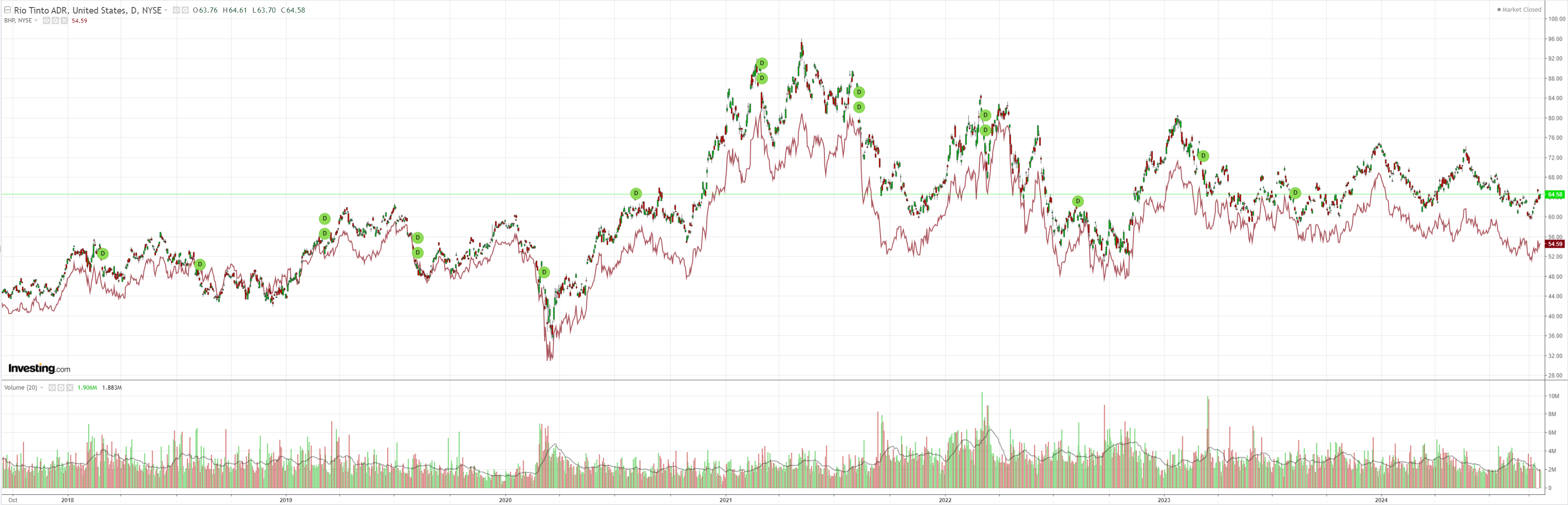

Miners are falling slowly:

EM yawn:

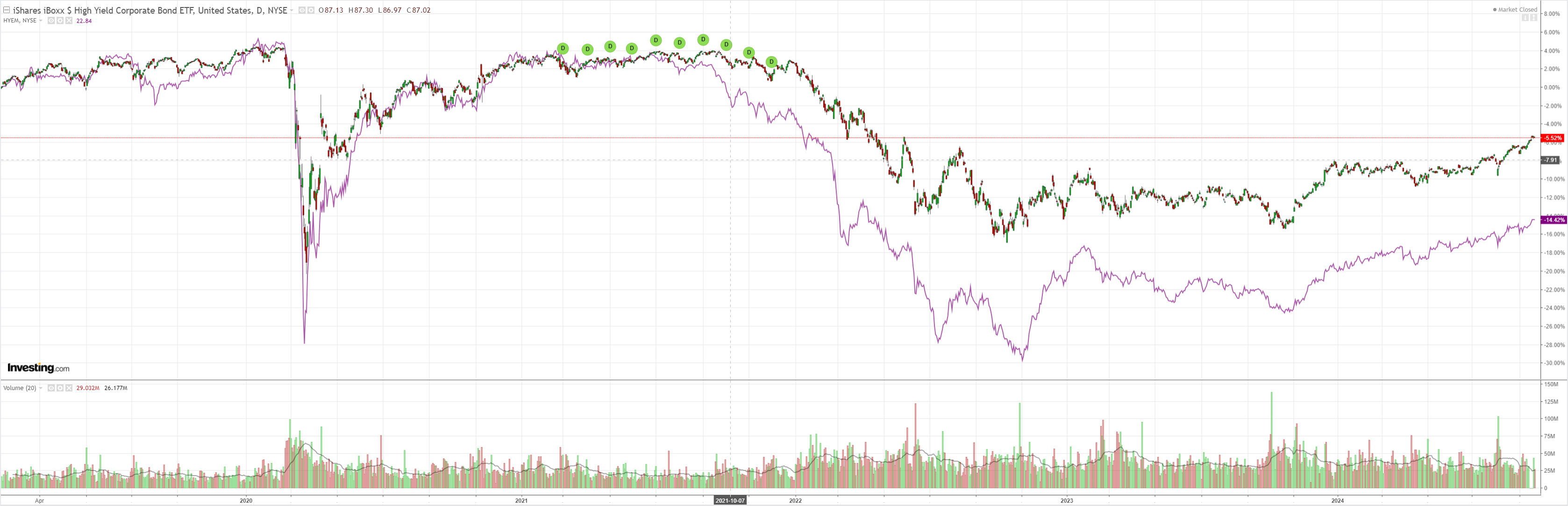

Junk cooling off:

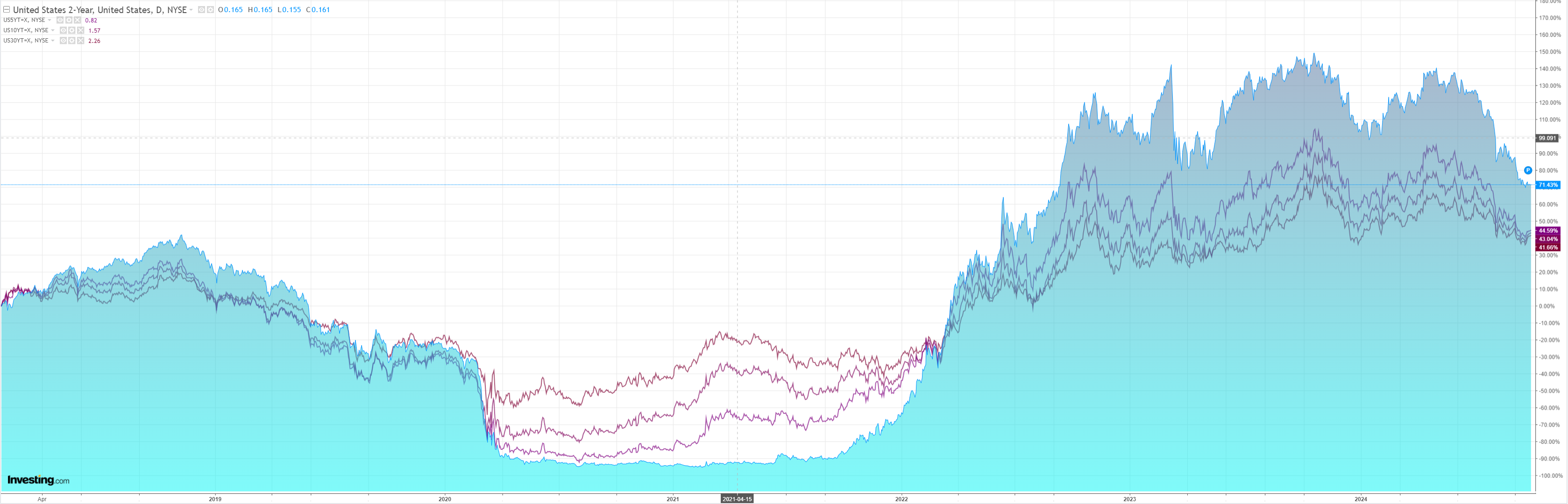

As yields are overbought:

Stocks are waiting for Santa:

The US PMI was out. Not that most care. The ISM is much more relevant:

The S&P Global US manufacturing PMI declined by 0.9 to 47.0, against consensus expectations for an increase.

The S&P Global US services PMI declined by 0.3pt to 55.4, slightly above consensus expectations for a larger decline.

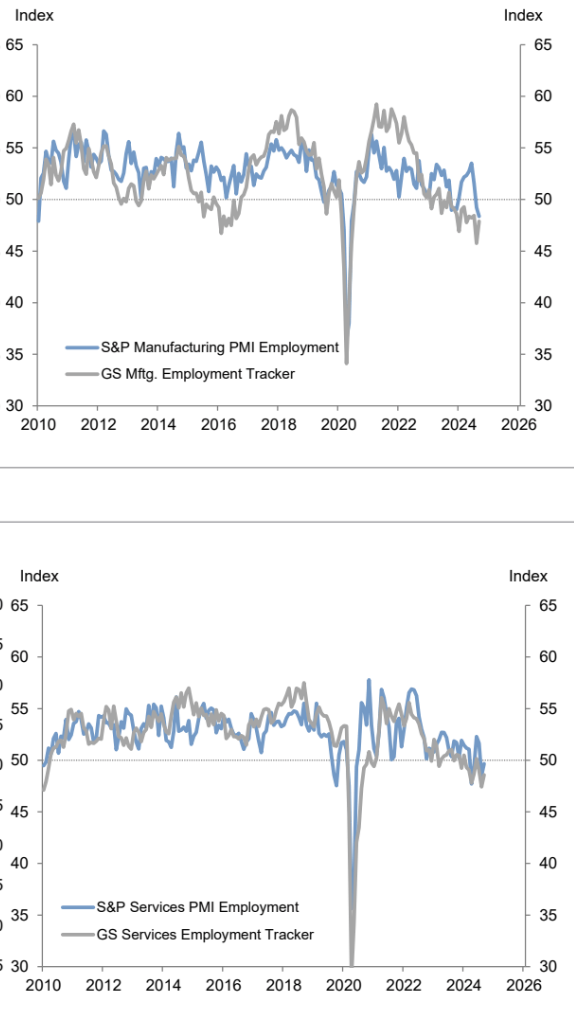

Employment is shaky but there isn’t much corroboration in jobless claims.

The AUD more tracked renewed China stimulus hopes as the PBoC meets this morning.

You never know but I see more shrinkulus.

And today’s RBA decision, which will be undoubtedly hawkish given the Jim Chamlers’ endless stagflation.

For now, yield spreads are beating commodity prices in driving the AUD up.