Credit Agricole with the note.

The Fed delivered a 50bp rate cut at its September meeting and signalled more aggressive & front loaded easing ahead that nevertheless fell short of the market’s dovish expectations.

The USD remained close to recent lows,but the question about the USD outlook from here seems to persist.

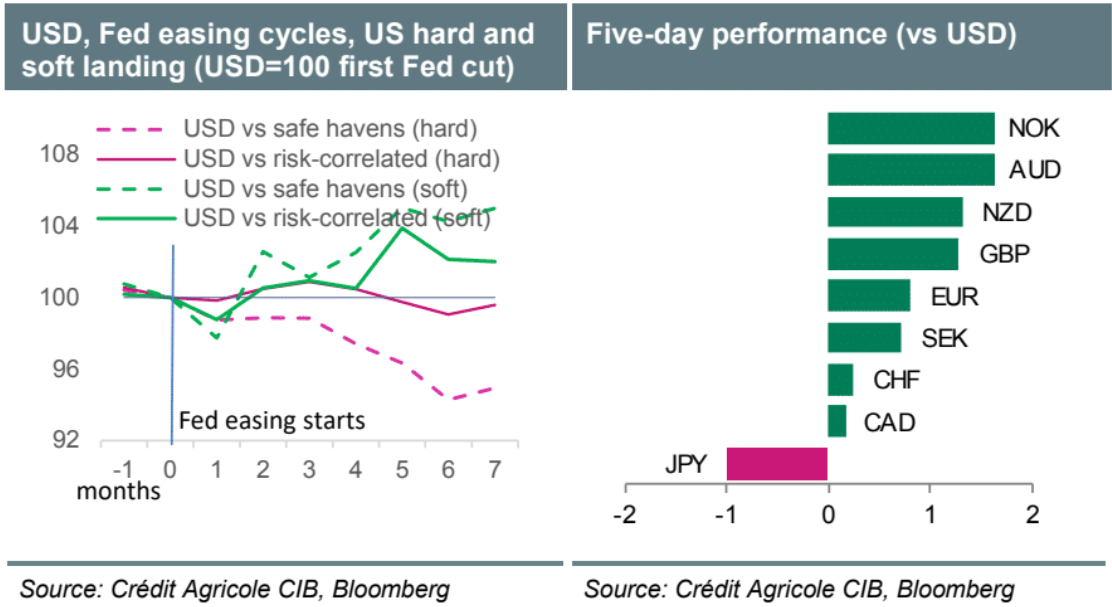

To answer this question, we look at the USD’s performance vs G10 safe-haven and risk correlated currencies during all Fed easing cycles since 1974.

We distinguish between periods when the start of the Fed easing cycle was accompanied by a US recession–eg,1974, 1980, 1981, 1989, 2000, 2007 and 2019–from periods when the Fed cuts preceded soft landing in the US–eg,1984, 1995 and 1998.

We conclude the strength of the US economy would play a crucial role in determining the FX impact of the Fed easing cycle 3M-6M after the first rate cut.

Our results suggest: (1) theUSD lost-5% on average vs safe havens but was resilient vs risk-correlated currencies when the Fed was easing amidst a hard landing; and (2) theUSD gained by 4% on average vs safe havens and risk-correlated currencies when the Fed was going into a soft landing.

With investors and the Fed still undecided about the severity of the US downturn, the near-term USD outlook could be a blend of its historic performance ahead of US soft and hard landings.

I am somewhere in the middle on the US landing, bumpy, so that would suggest a limited change for AUD ahead.