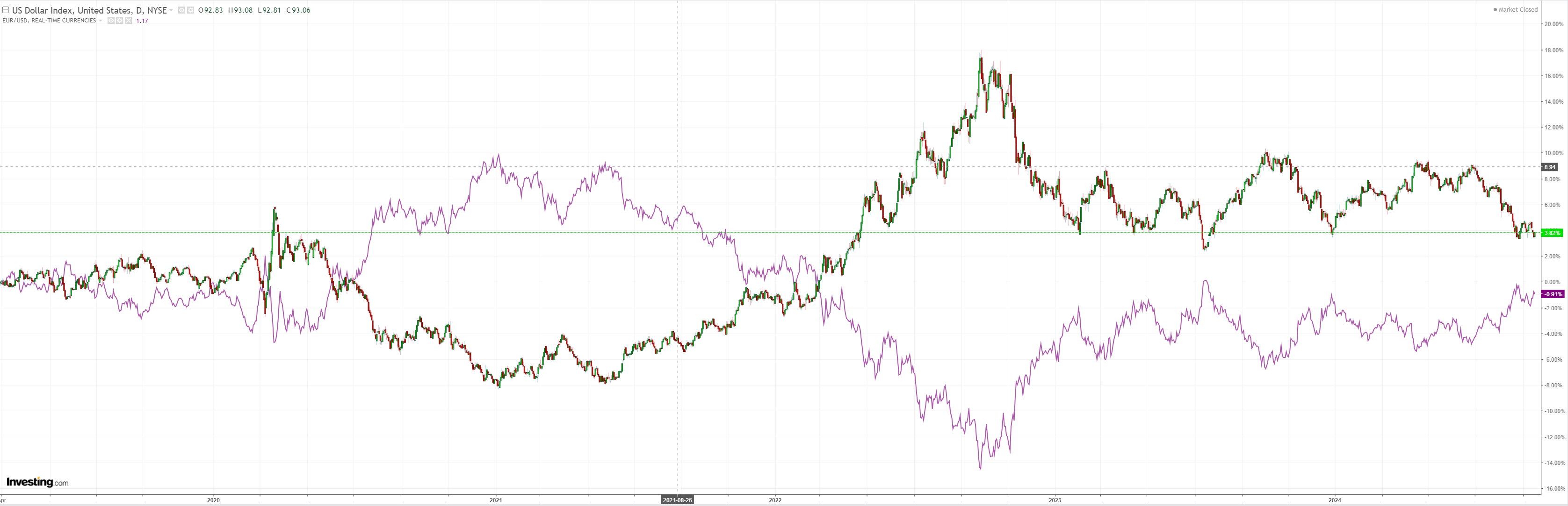

DXY is holding support:

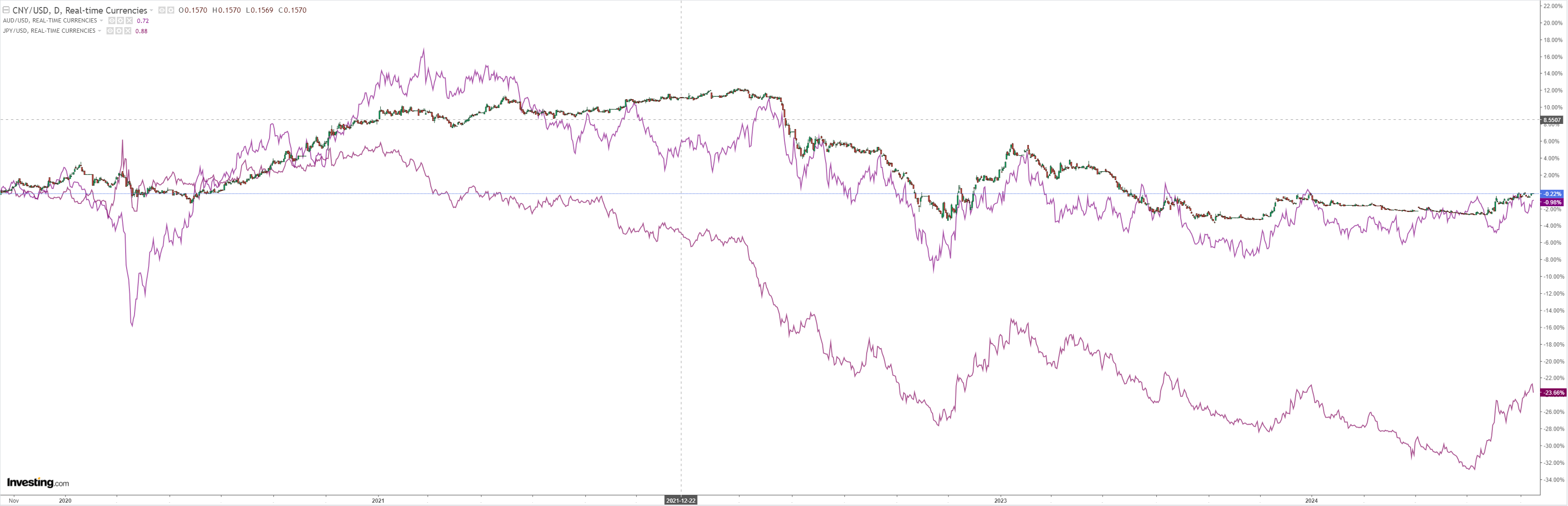

AUD has is near the top of a bullish ascending triangle:

North Asia is bullish:

Oil is working off the oversold condition:

Whoever said commodities are priced for recession is wrong:

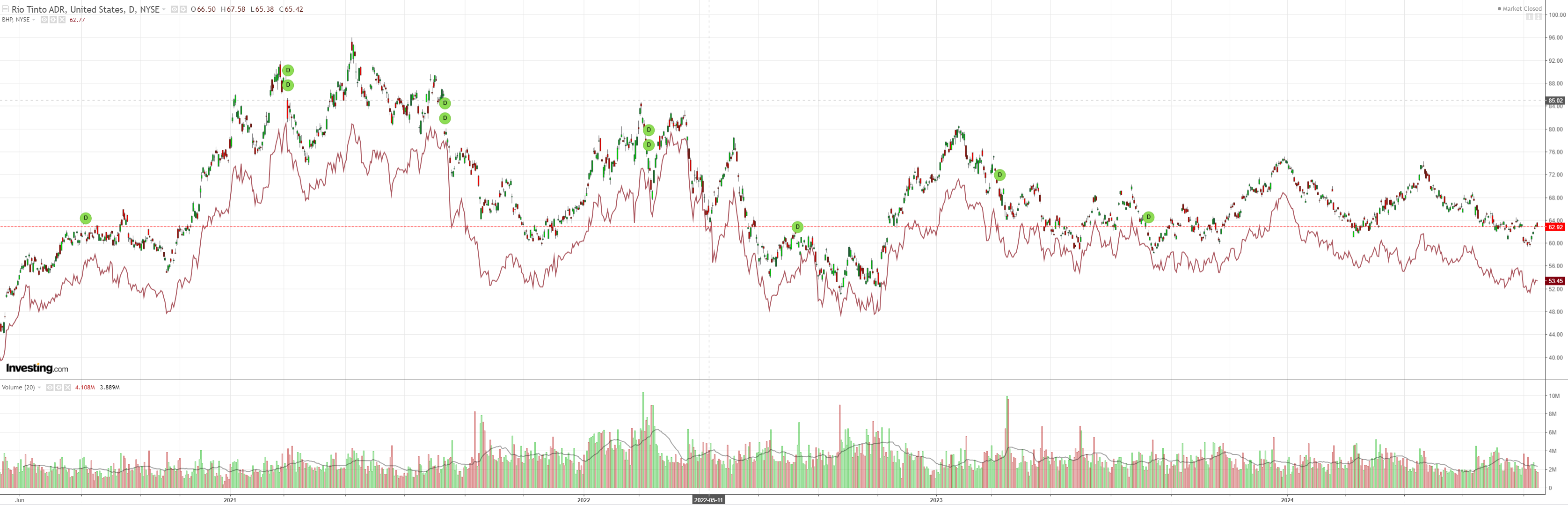

Miners faded:

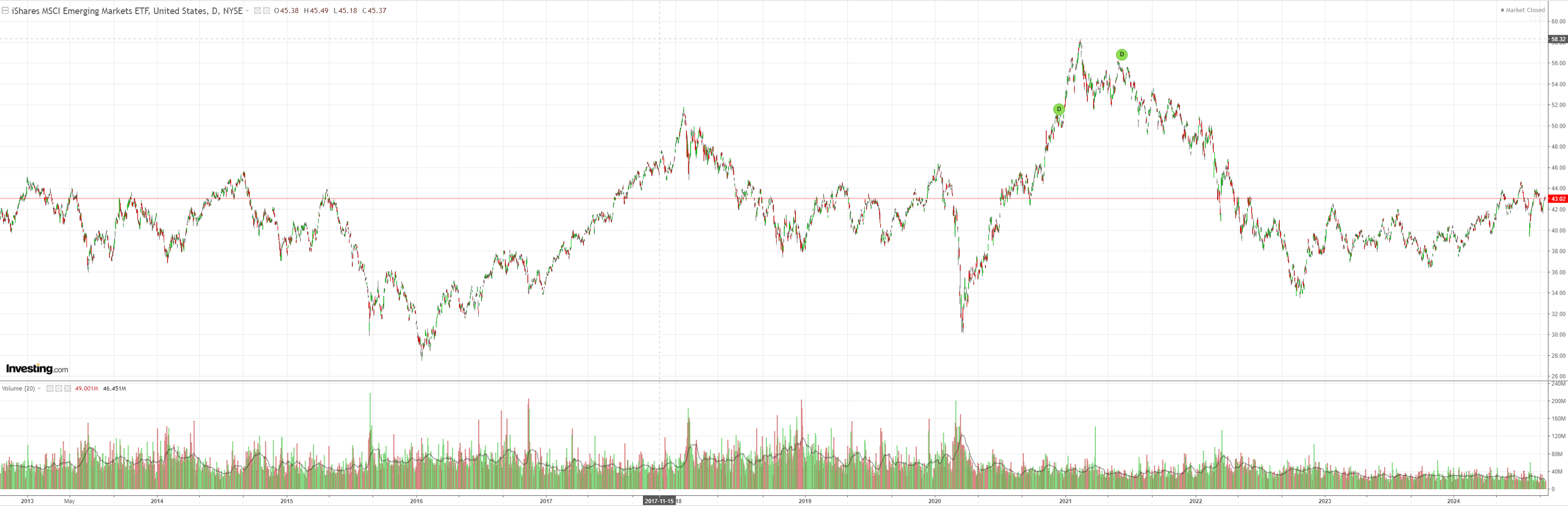

EM yawn:

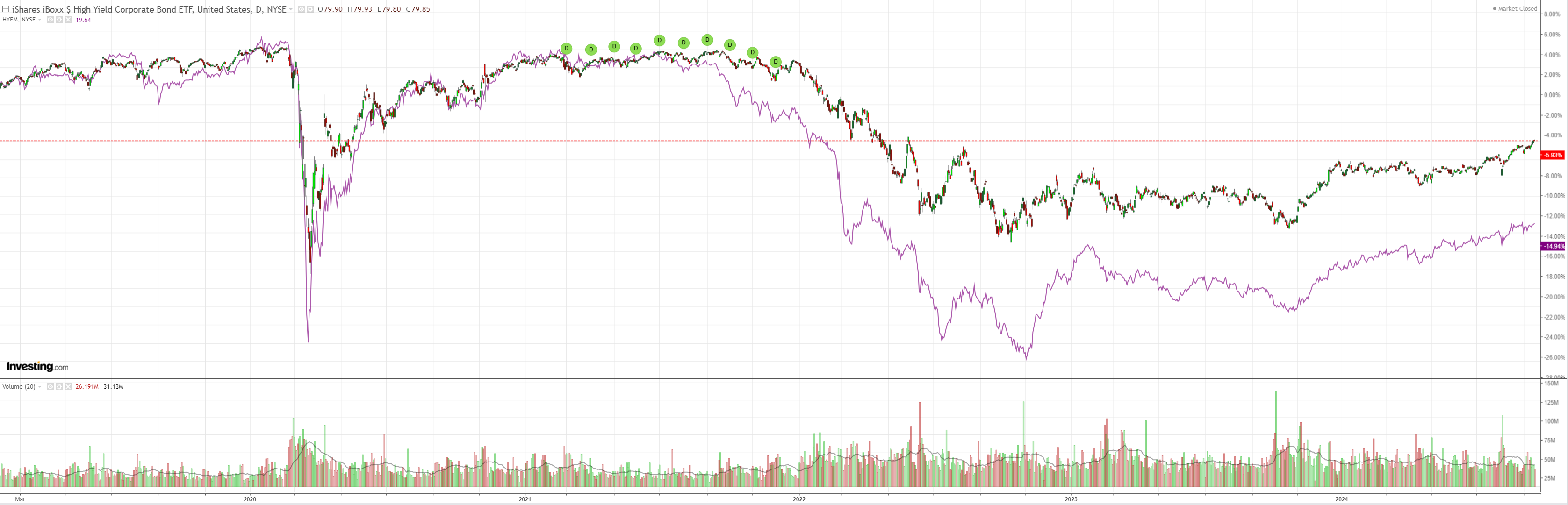

Rampaging junk bull market:

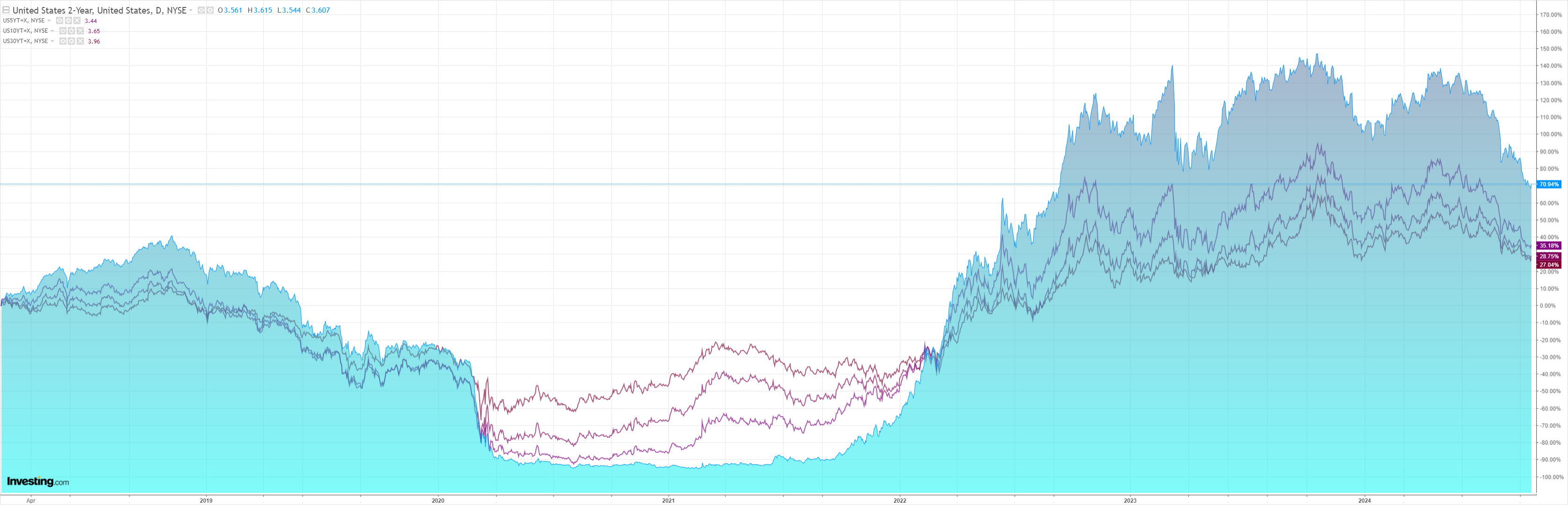

Treasuries same, same:

Stocks stuck ATH:

It’s the Fed tonight. I expect a 25bps cut. There seems no rush given economic data is OK and there is no need to risk inflation resurgence.

Standard Chartered’s excellent Steve Englander makes sense to me:

We maintain our forecast of a 25bps FOMC policy rate cut on 18 September.

We do not see it as a close call based on recent economic data,but blackout-period reports in the Wall Street Journal and Financial Times have hinted that at least some FOMC members may be eager to start with a 50bps move.

Some market participants see the media reports as an effort by FOMC participants to make a 50bps cut less of a surprise, but it is unclear if the reports reflect off-the-record comments by Fed officials during the blackout period.

That said, even if the FOMC cuts by 25bps as we expect, the Fed statement or Fed Chair Powell’s comments may point to a Q4 50bps cut so explicitly that we may have to pull our view of a Q1 50bps cut forward into Q4.

Our case for a 25bps cut is that incoming inflation data does not support a fast approach to the 2% inflation target.

We expect core PCE to slow unambiguously towards 2% y/y only in Q1-2025.

We would support a 50bps cut at the upcoming meeting if all incoming labour and activity data were as clearly negative as the unemployment rate (UR) increase over the last year, but this has not been the case; the UR is isolated in showing an alarming deterioration.

Until core PCE is closer to 2% and other indicators follow the UR there is little case for a 50bps cut, in our view.

The UR rate has spiked in part owing to the immigration labour supply shock. The Fed knows this.

If we get 25bps then AUD will probably pull back.

50bps and the AUD rocket launches.