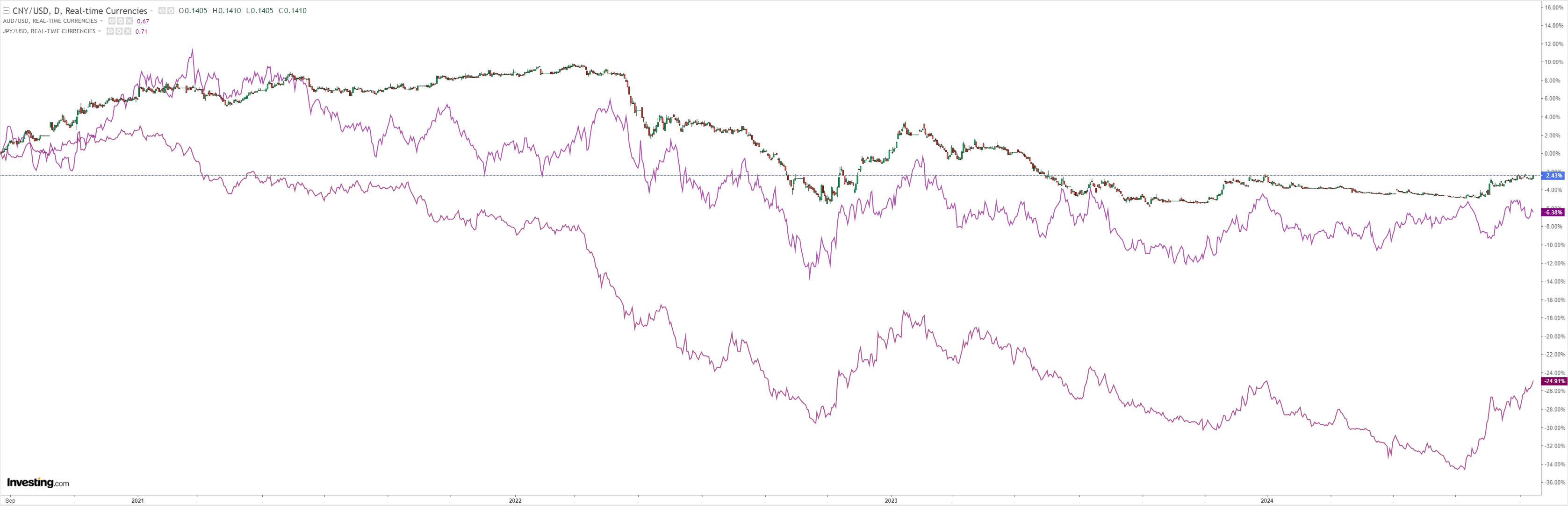

The DXY bounce is far from convincing:

AUD is slowly tredning higher:

I wonder when JPY will realise Japanese inflation is temporary:

Gold to the moon. An oil dead cat:

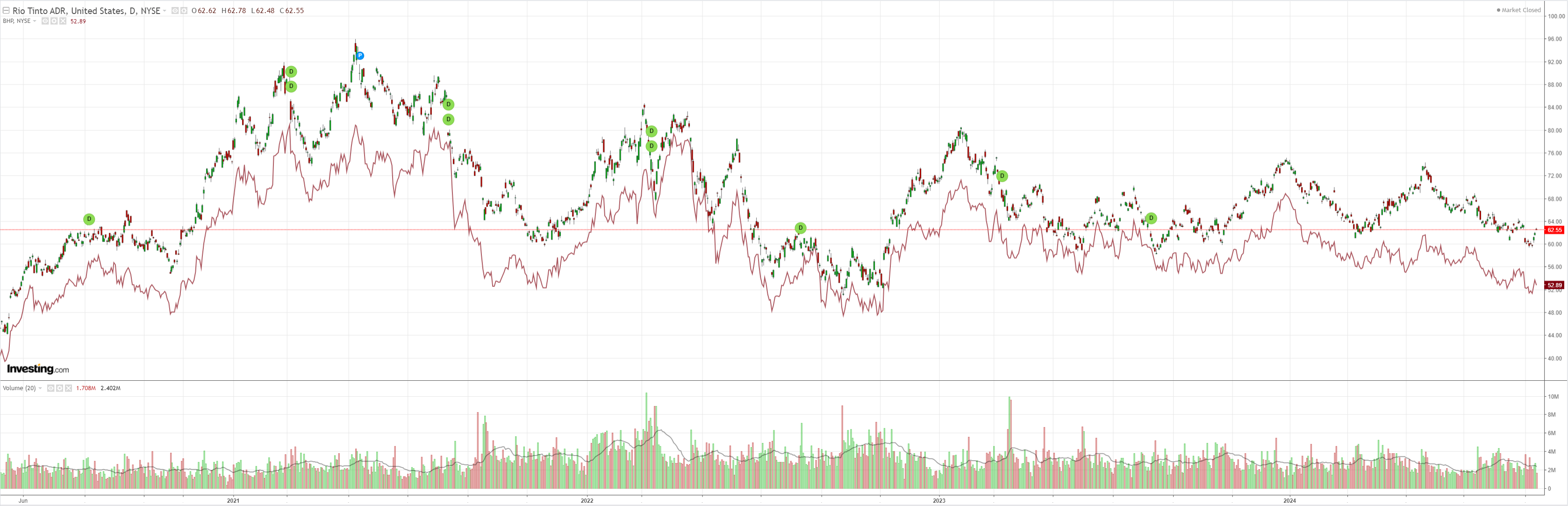

Metals reflation is back:

Miners popped:

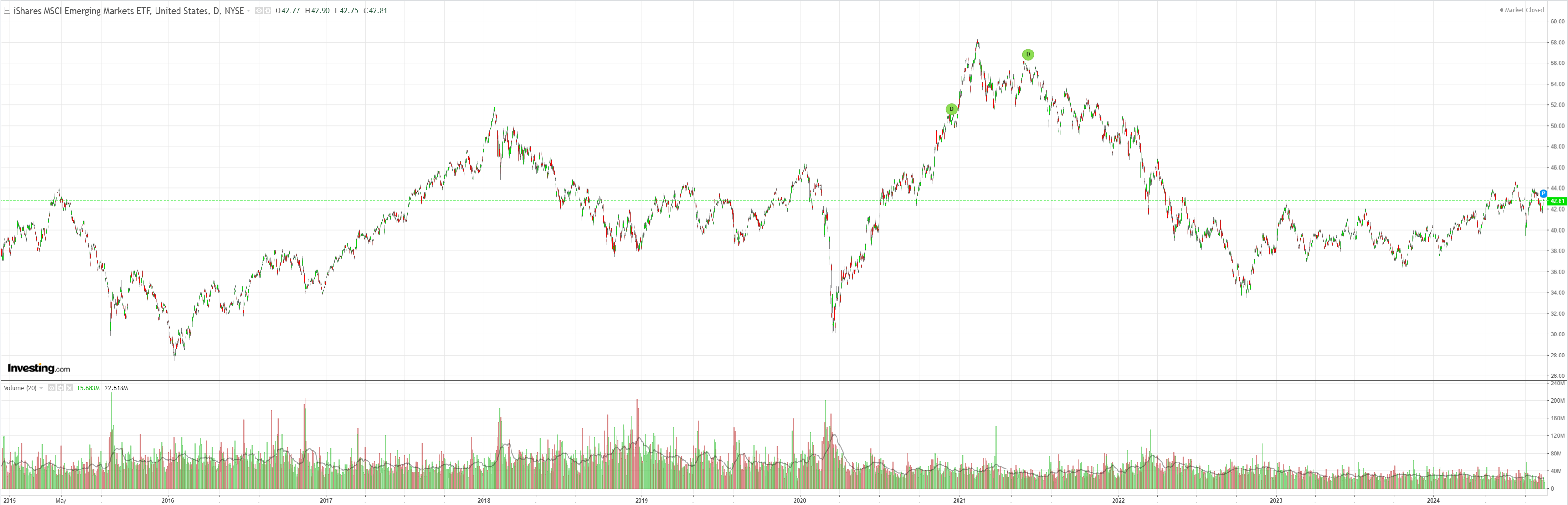

EM yawn:

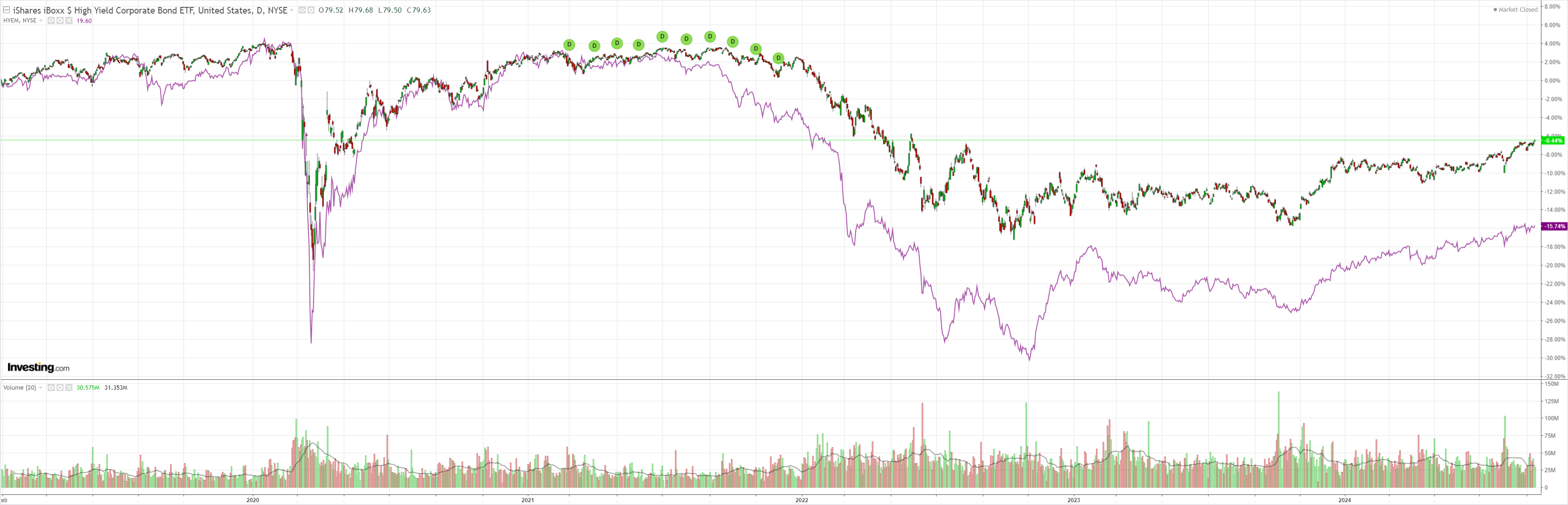

Junk is all soft landing all of the time:

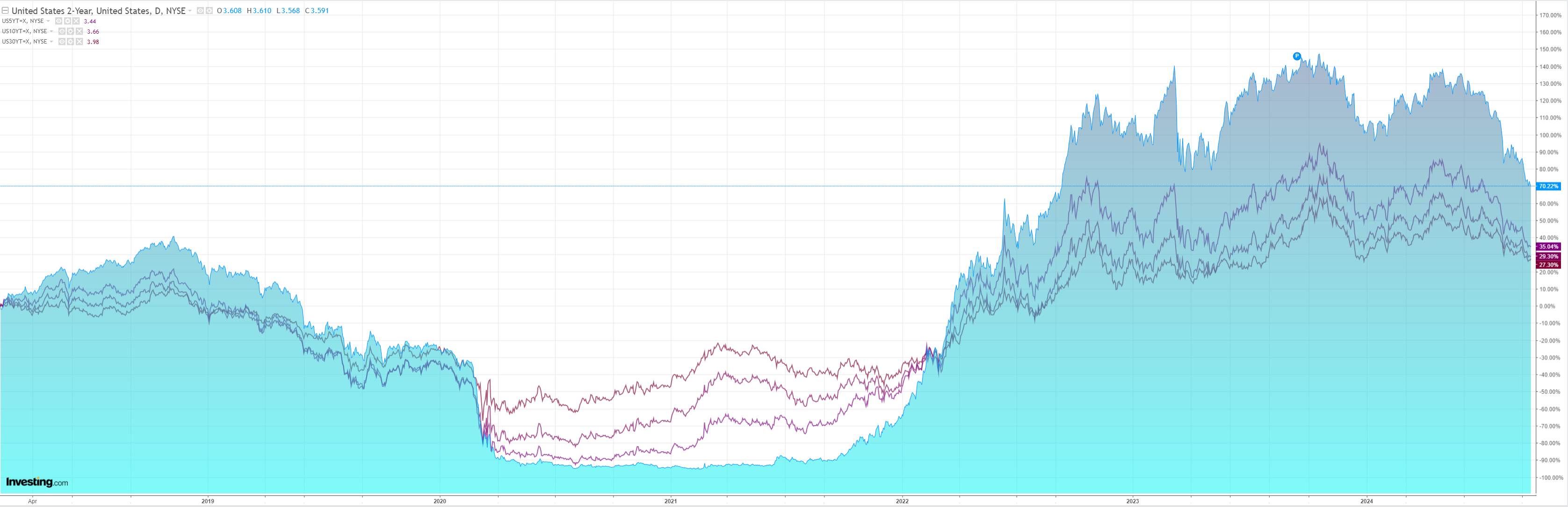

Yields readying for a dovish Fed:

Another stocks crash down, then crash up:

Michael Hartnett at BofA captures the AUD’s golden recession:

The Price is Right: gold at all-time highs (best hedge against 2025 inflation reacceleration); best contrarian ”buy the 1strate cut” play=commodities i.e.oil & industrial metals…thanks to China weakening (bond yields all-time lows, real estate stocks 16-year lows) commodities only asset class (outside SOFR Secured Overnight Funding Rate market discounting 240bps Fed cuts next 12months) priced for hard landing.

Commodities are not priced for a hard landing. Not least coal, iron ore, and gas. Metals are somewhere in the middle.

Oil and gold are the only two indicating serious global growth issues.

The terms of trade are critical for the AUD. In those terms:

- Gold is a sizeable win.

- Metals are not very big.

- The bulks are huge and still overvalued.

On balance, this mix is still modestly bullish for AUD as the Fed leads the easing cycle.