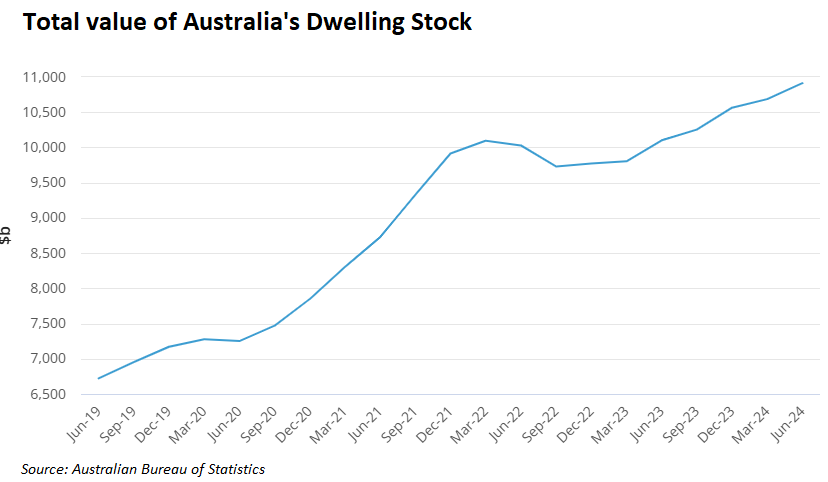

Data released by the Australian Bureau of Statistics (ABS) shows that the total value of homes nationwide rose to nearly $11 trillion in the June quarter, up $226 billion over the quarter:

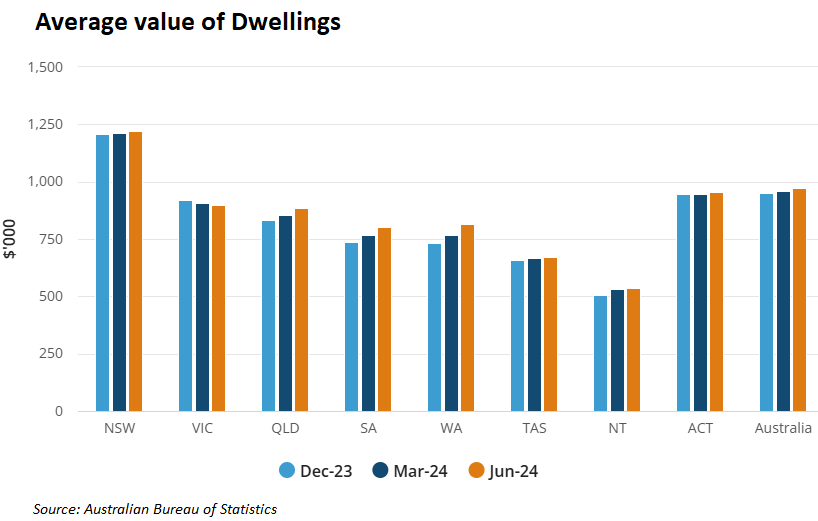

The average home value across the nation is now more than $970,000:

If you have ever wondered why Australians are so “wealthy”, the above data from the ABS illustrates why.

Australia’s extreme housing valuations have created an army of paper millionaires.

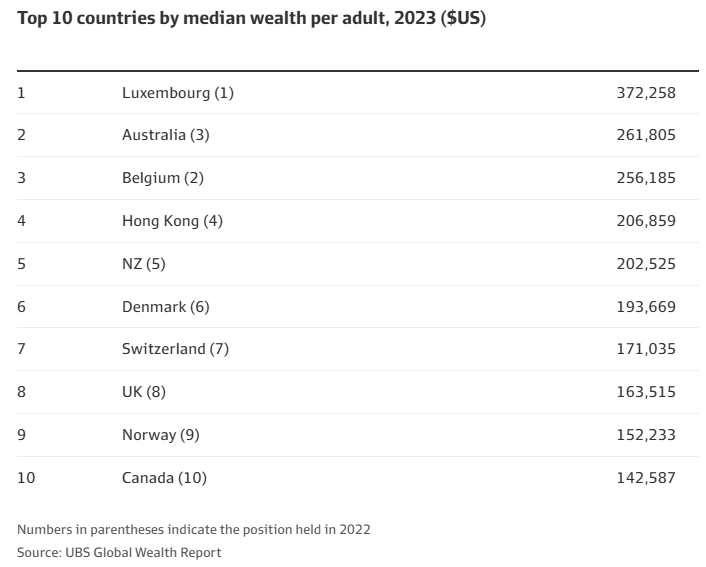

Meanwhile, Australians have buried themselves in mortgage debt, with the average size of mortgages chasing prices higher:

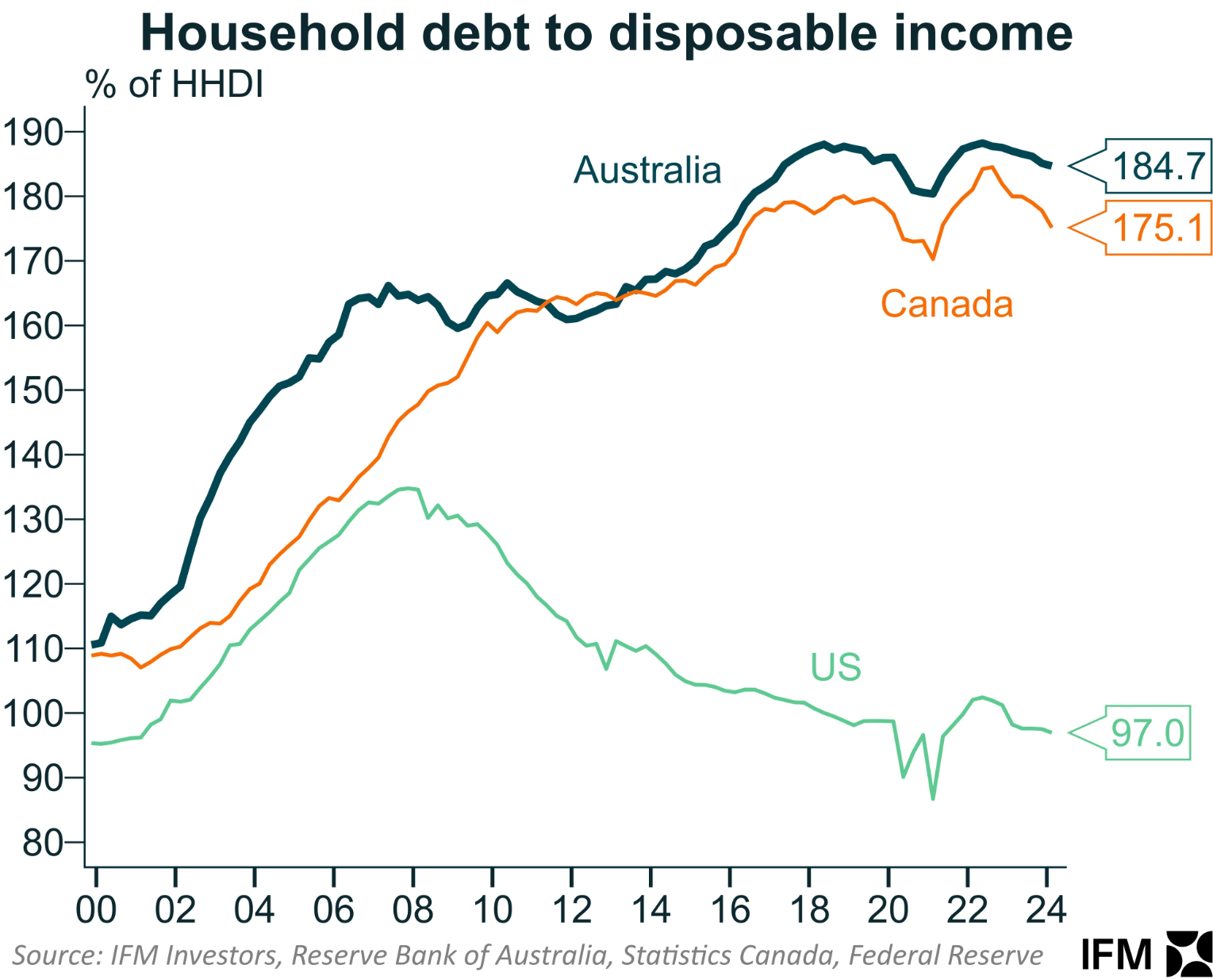

As a result, Australians are carrying world-leading debt loads:

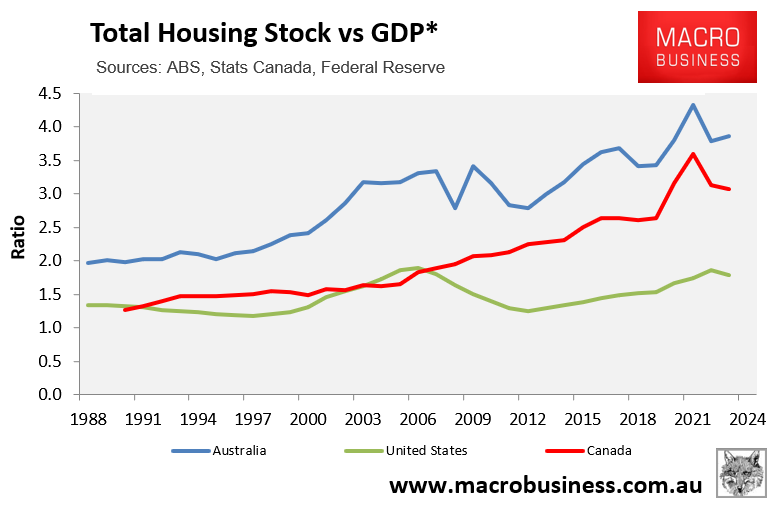

Meanwhile, housing is swallowing the economy:

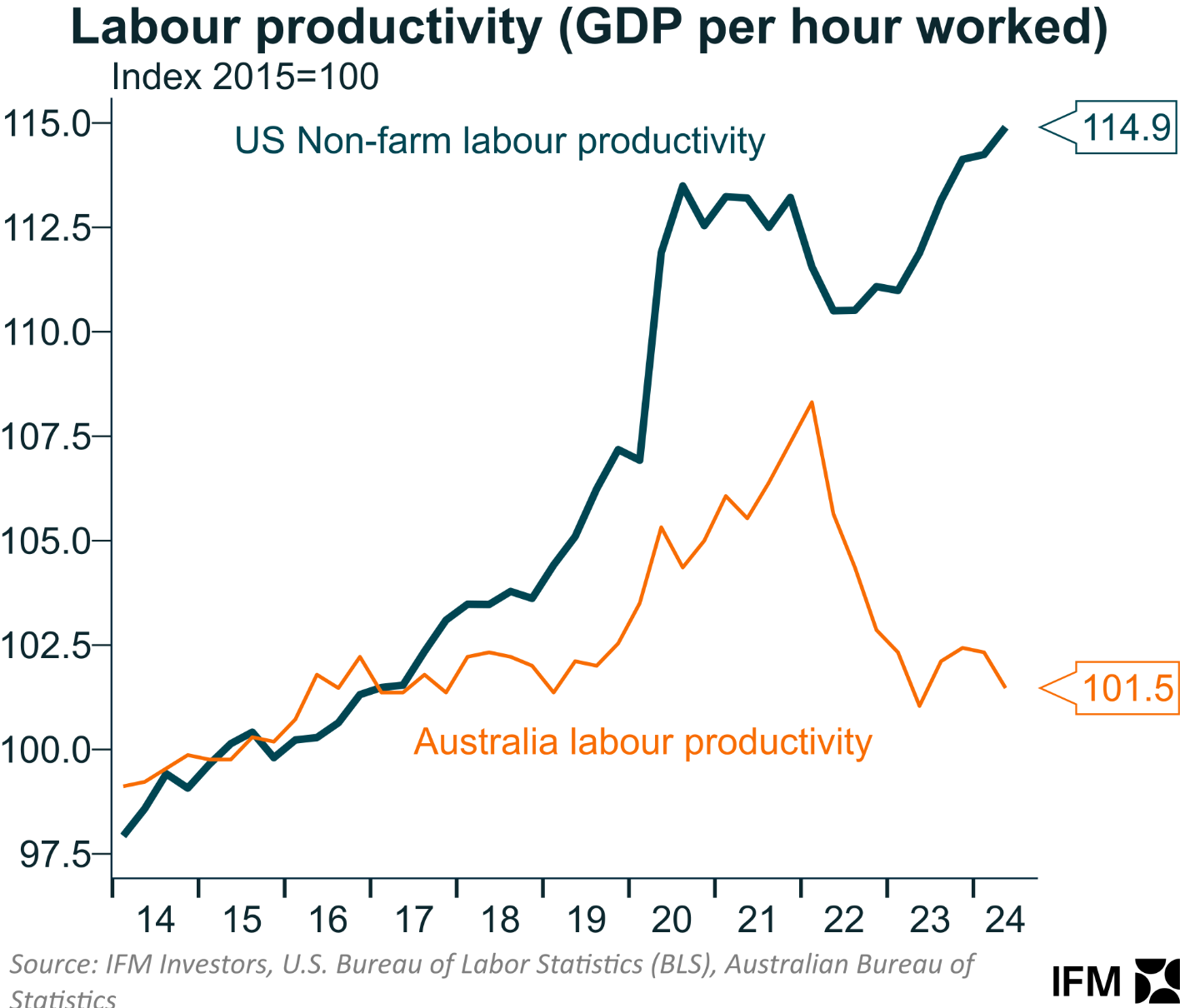

Australia’s productivity is suffering as an increasing share of our economic output is channelled into non-productive housing:

The reality is that Australians would be “wealthier” if our homes had never risen in value so aggressively and the average price was $465,000 instead of $970,000, and Australia’s household debt was 90% rather than 180% of income.

Younger and future Australian homebuyers would not be subjected to a lifetime of debt servitude or being trapped in the rental market.

Australia’s economy would also be more productive if our financial resources were channelled into the real economy rather than the housing Ponzi economy.