Whenever the issue of housing affordability is raised, politicians and industry representatives always propose reducing barriers to purchase via demand-side measures.

For example, the Albanese government recently spruiked that its expanded Home Guarantee Scheme accounted for one in three new first-home buyer mortgages last financial year:

Banks have also pushed for mortgage terms to be extended to 50 years from 30 years presently:

Now, the Housing Industry Association of Australia (HIA) has called for easier mortgage access for first-time home buyers.

HIA chief economist Tim Reardon claims that “home buyers in Australia have been subjected to more than a decade of additional restrictions on lending that have reduced competition among banks issuing loans, especially for first home buyers”.

Reardon, therefore, wants the federal government to set-up “an RBA-style Board to oversee APRA with a target for mortgage arrears of between 2% and 3%”, arguing that mortgage arrears are too low and that “regulators continue to impose additional constraints on lending, competition among banks and restricting housing supply”.

“This ‘belt and braces’ approach to macro-prudential restrictions is needlessly restrictive and increasingly limits lending only to those that already own at least one home, pursuing financial system stability at the expense of first home buyers”, Reardon claims.

“Ensuring that home ownership remains an attainable goal for Australian households is an equally important objective that has not received adequate recognition among financial regulators”.

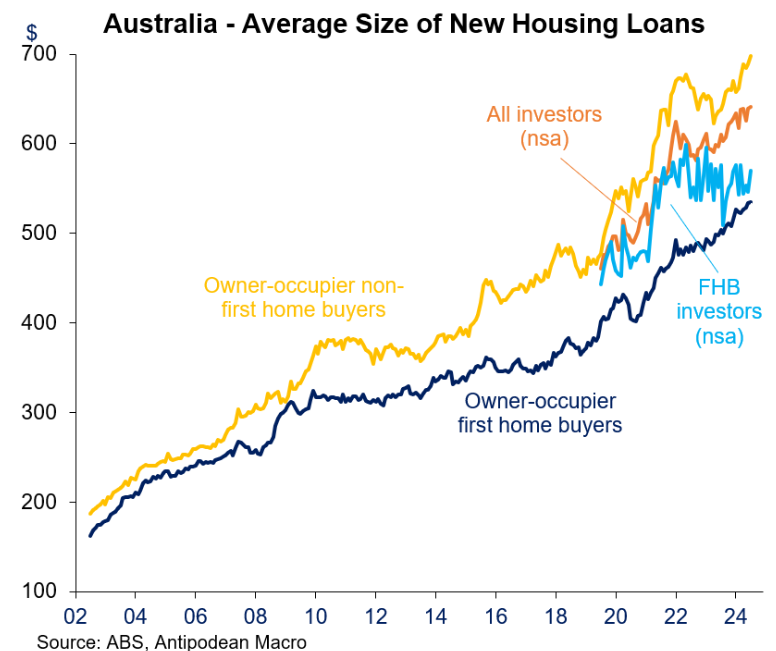

Reardon’s solution would merely pump more credit into the system, increasing debt loads and house prices. In other words, it is another demand-side housing affordability non-solution.

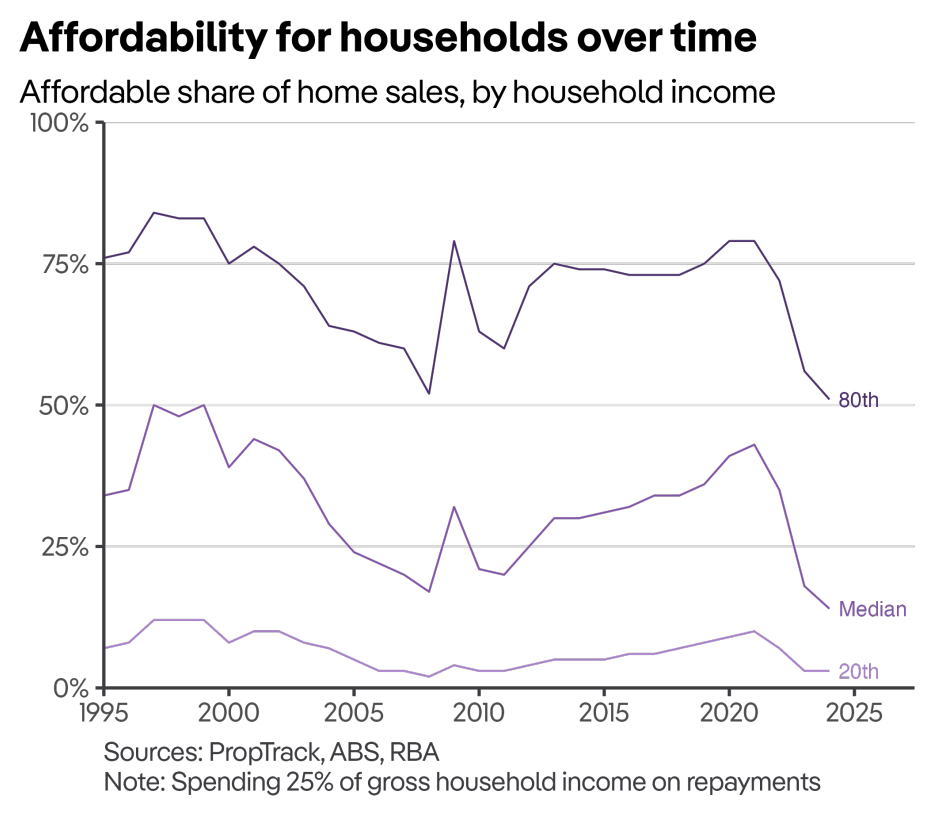

The fundamental problem with Australian housing is that it is simply too expensive and out of reach for an average-income buyer.

Unless house prices fall, mortgage sizes will remain too high for the average Australian, let alone first-home buyers.

Australia’s housing affordability problem is a price, not a leverage issue.

If more affordable housing is the genuine goal, we require policies to lower the dollar cost of housing, not further demand-side stimulus.

Sadly, politicians and industry players are not interested in genuine housing solutions, only distractions and smokescreens.