The Q2 national accounts release from the Australian Bureau of Statistics (ABS) was another shocker.

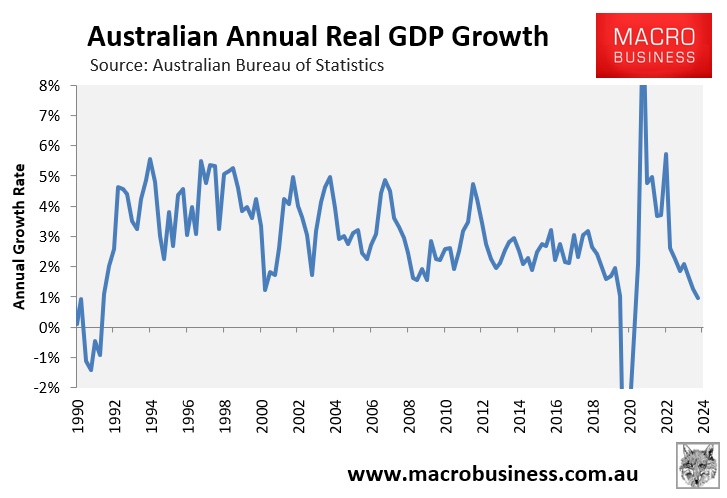

It revealed that Australia’s aggregate real GDP growth fell to only 1.0%, which was the lowest growth rate since the 1991 recession, outside of the pandemic:

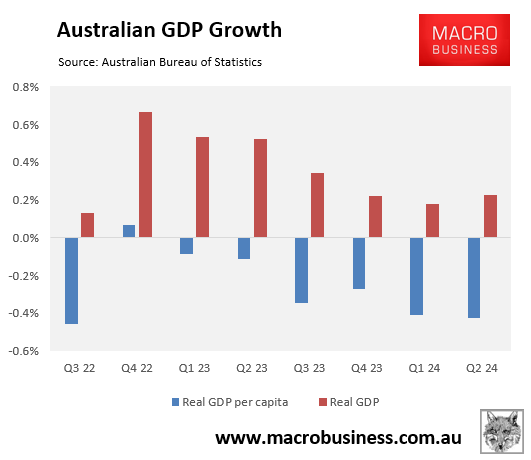

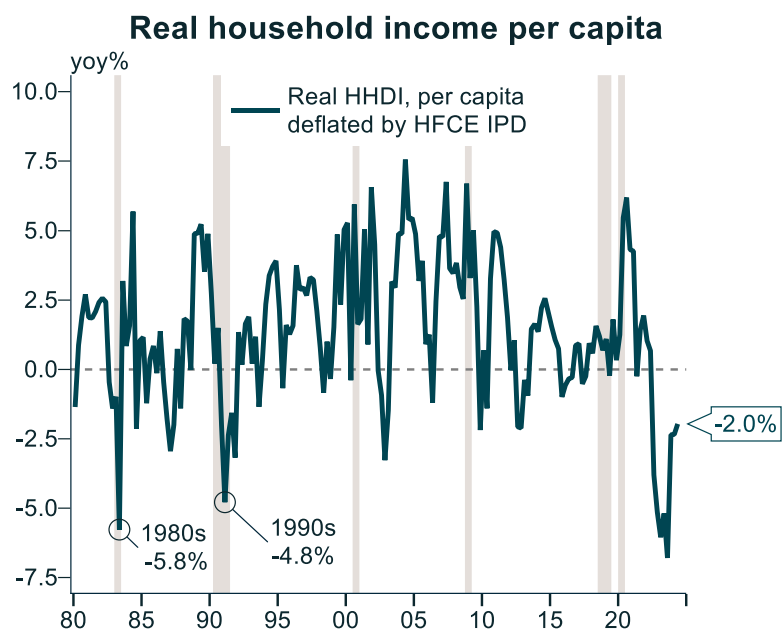

Worse, Australia’s real per capita GDP growth declined for a sixth consecutive quarter and by seven of the past eight quarters to be down 2.0% over the last two years:

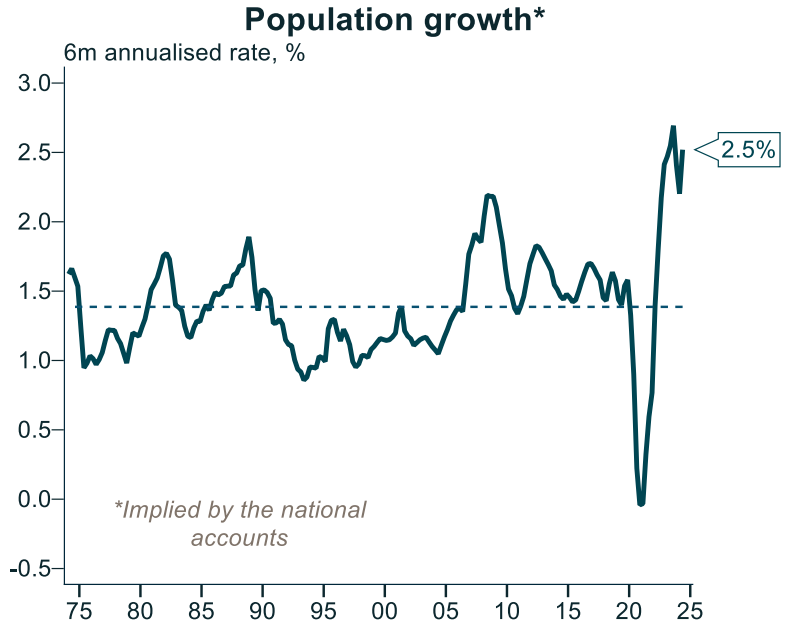

Alex Joiner, chief economist at IFM Investors, has compiled an excellent chart pack, illustrating how population growth, not productivity, is driving growth. And how living standards are in decline.

Australia’s population growth remains turbo-charged, tracking at 2.5%, on the back of historically high net overseas migration:

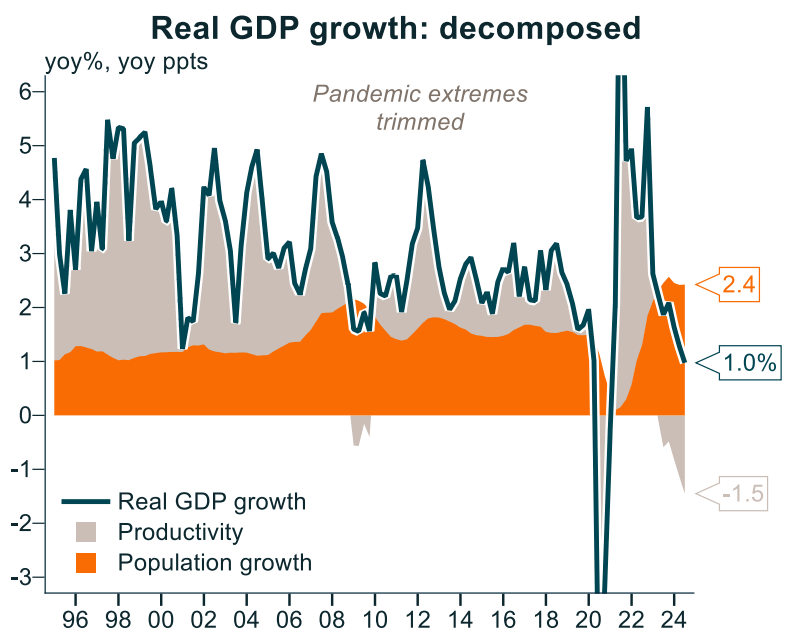

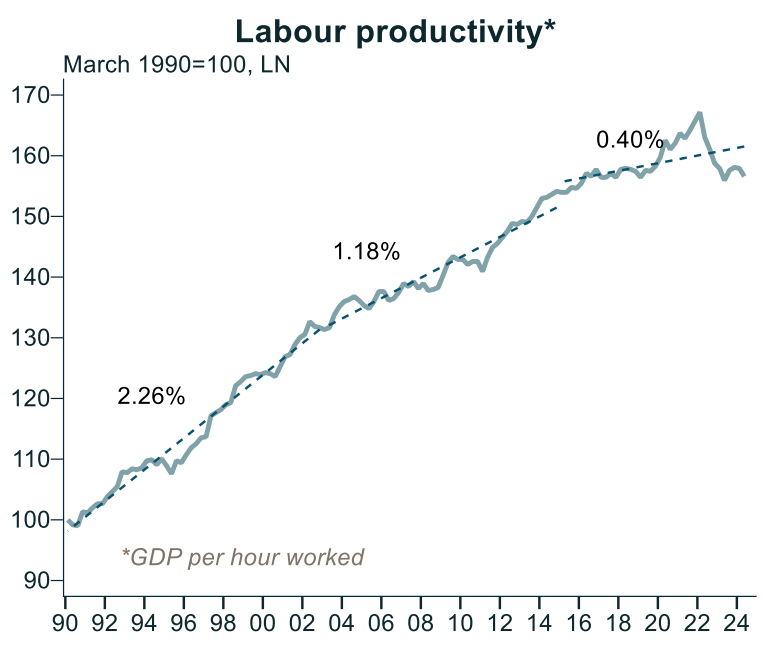

The next chart from Joiner shows that this historically high population growth is masking Australia’s deplorable productivity growth:

Australia’s labour productivity declined 0.8% in Q2 and is tracking around levels prevailing in 2017:

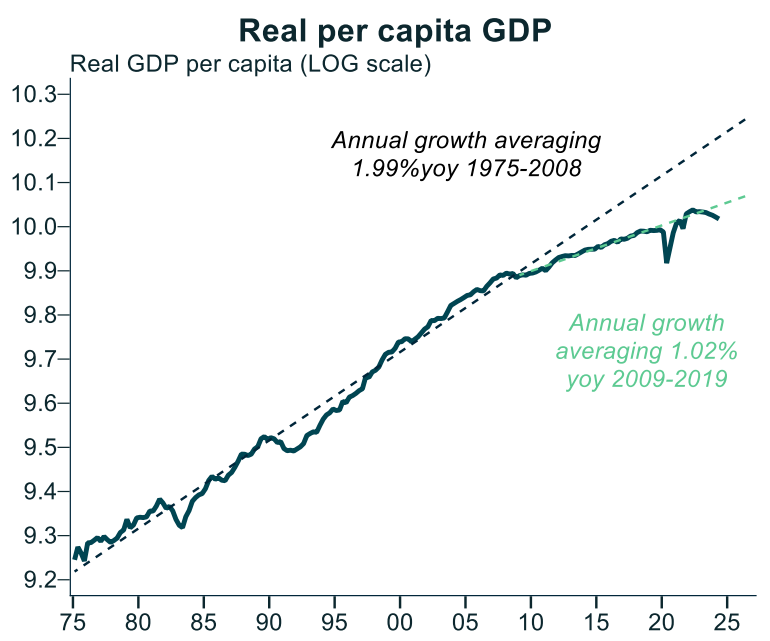

Australia’s real per capita GDP growth has been deplorable for the past 15-years:

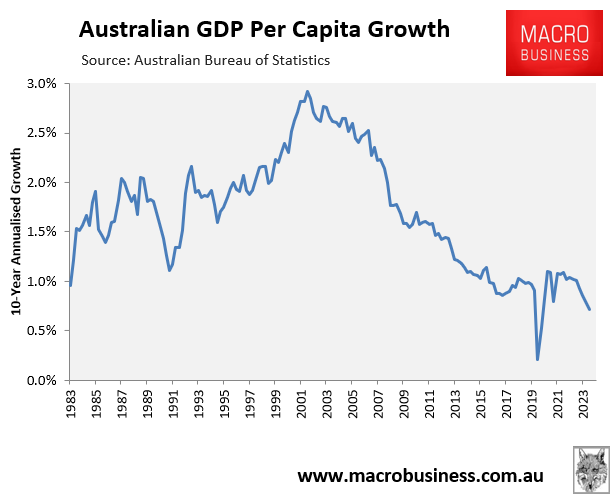

This is illustrated more clearly in my chart below, which shows the worst decade average per capita GDP growth on record, outside of the pandemic:

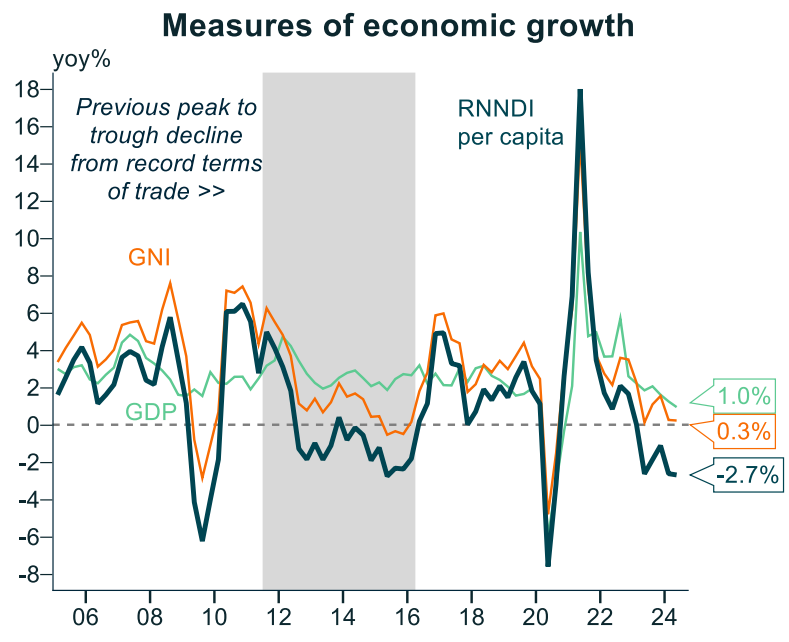

Real net national disposable income per capita has declined sharply, down 2.7% over the 2023-24 financial year:

This reflects a combination of the falling terms-of-trade (commodity prices), alongside falling household disposable incomes:

The household sector is shot to pieces.

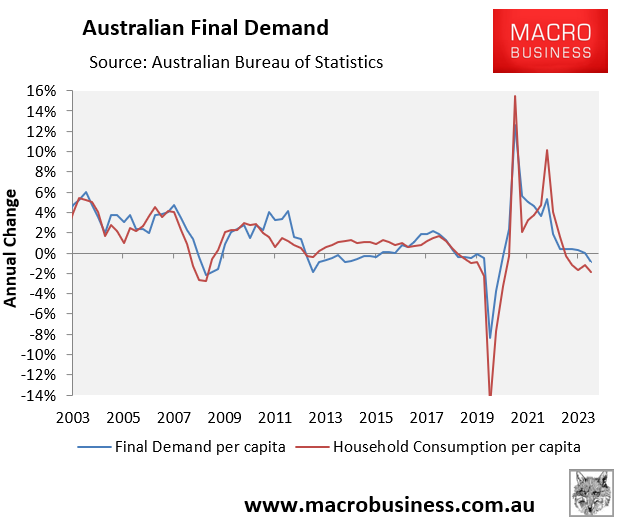

Household consumption per capita has declined by 2.4% from its December 2022 peak:

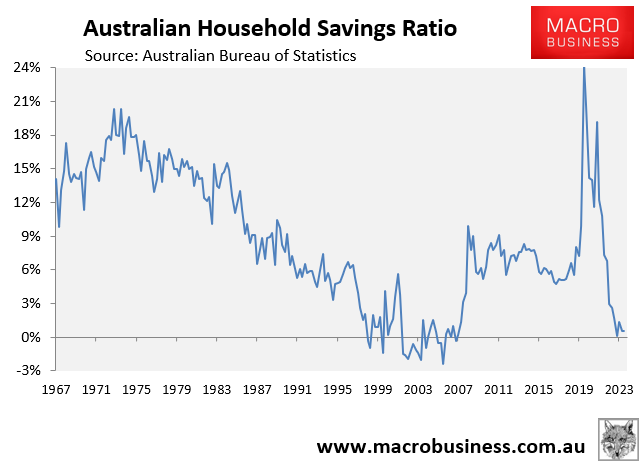

This decline in household consumption has arisen despite the household savings rate collapsing to only 0.6% in Q2:

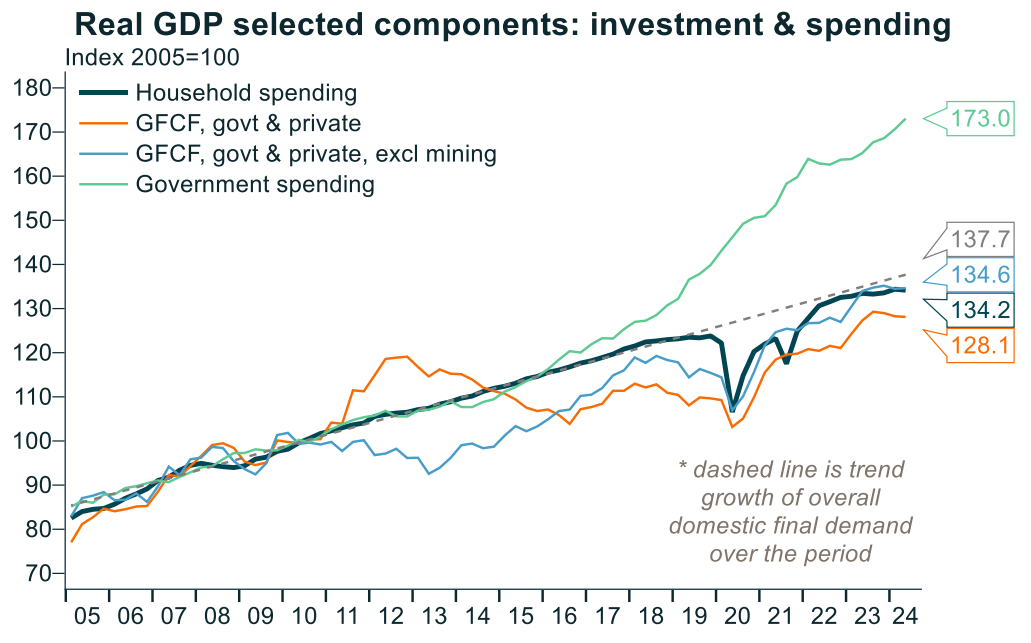

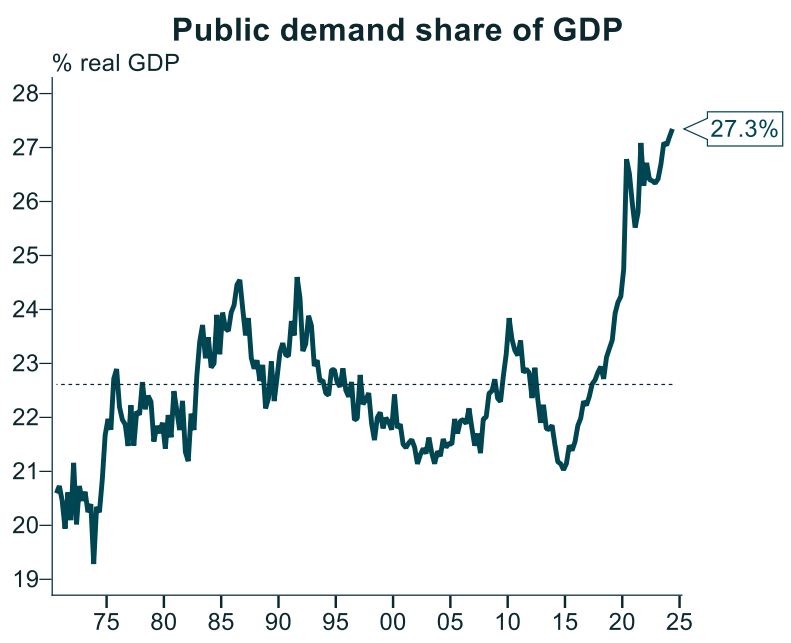

Aside from extreme immigration-driven population growth, Australia’s economy is being held-up by record government spending:

Public demand hit a record high 27.3% of GDP in Q2:

The above charts show a Ponzi economy that is growing slowly via extreme population growth and government spending, but where everybody’s slice of the pie is shrinking at an alarming rate.