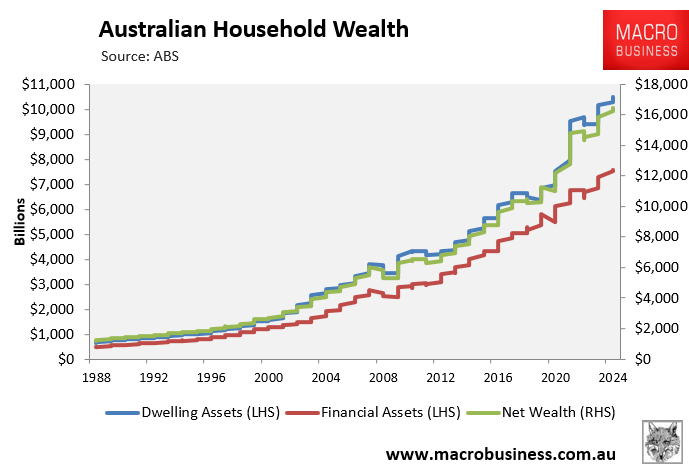

The Australian Bureau of Statistics (ABS) released its Finance and Wealth survey for the June quarter of 2024, which shows that household wealth hit an all-time high of $16,477.2 billion after increasing by $249.7 billion over the quarter.

The ongoing appreciation of Australian home values drove the rise in wealth.

Dwelling assets grew by $216.0 billion in the June quarter to a record high of $10,483.3 billion.

In comparison, financial assets grew by $49.6 billion to a record high of $7,571.4 billion.

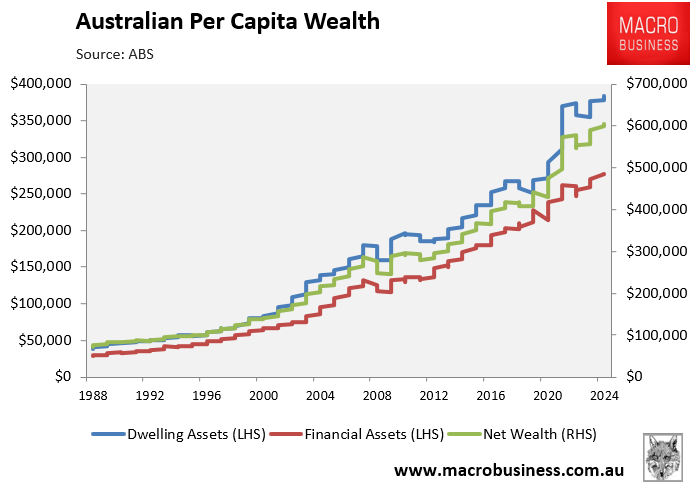

Household wealth also increased to a record high per capita, hitting $603,900 in the June quarter of 2024, up $5,583 (0.9%) over the quarter.

The per capita value of dwelling assets grew by 1.5% to a record high of $384,213, whereas financial assets grew by 0.1% to $277,492 per capita.

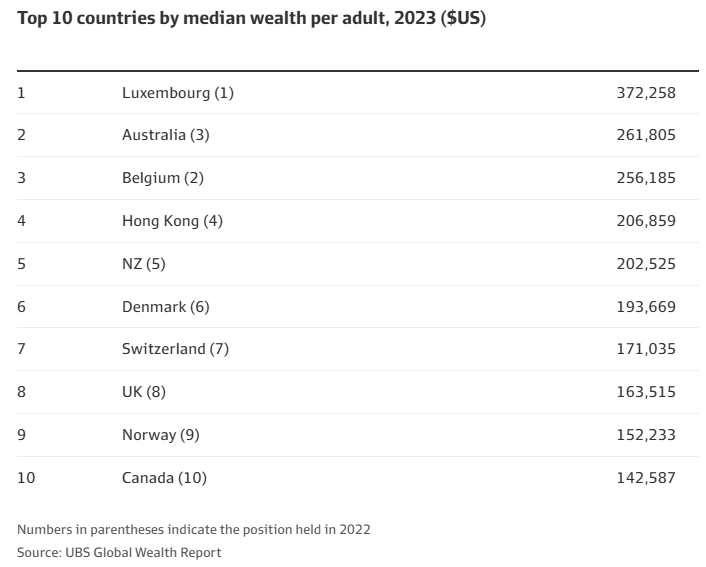

The above data will keep Australian households near the top of the global wealth rankings.

The latest UBS Global Wealth Report, based on 2023 data, ranked Australian households second in the world for wealth behind Luxembourg:

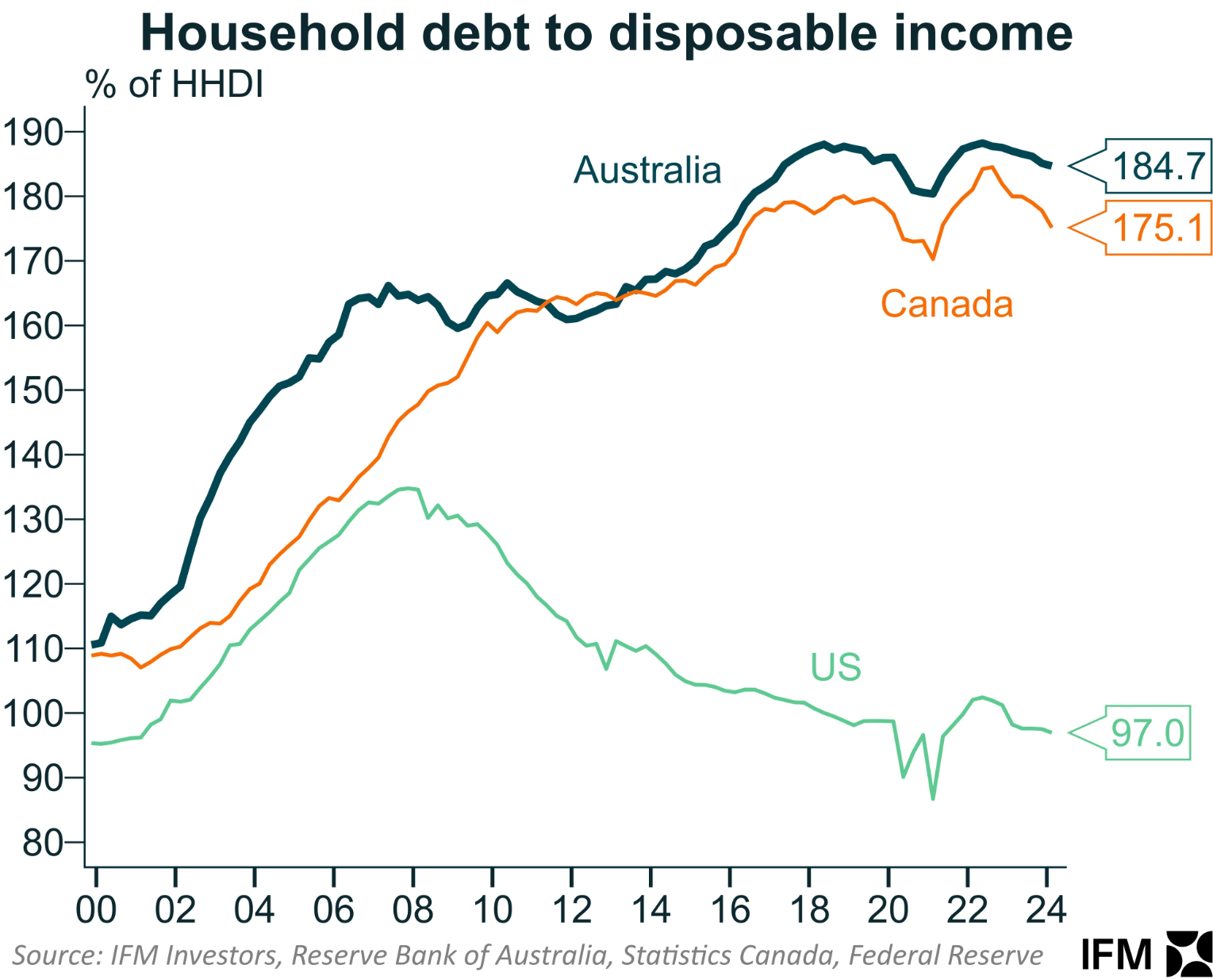

Meanwhile, Australians have buried themselves in mortgage debt, with the average loan size driving prices higher:

As a result, Australian households carry one of the world’s highest debt loads:

As I keep arguing, a lot of Australia’s household wealth is “fake” and does not benefit society.

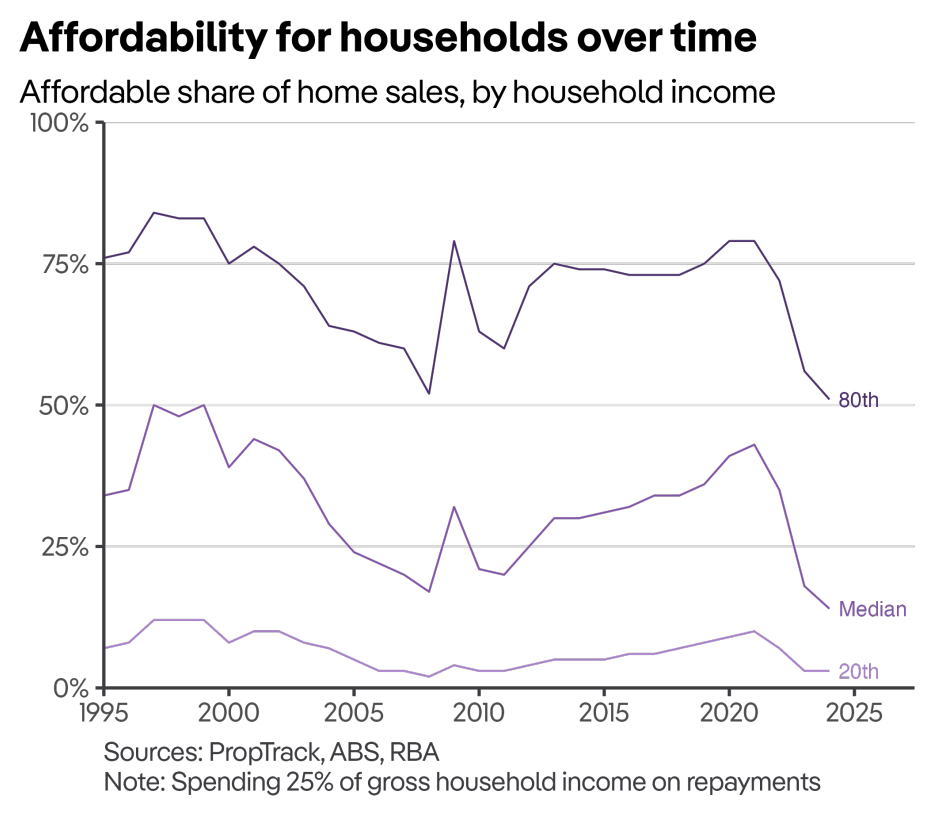

How can Australians be considered the second wealthiest in the world when housing affordability is at an all-time low and our younger generations cannot purchase a home without parental financial assistance?

Australians would be “wealthier” if property values had not risen so aggressively, the typical home cost around $400,000 rather than $800,000, and household debt was 90% of income rather than 180%.

Australia would be a far more equal society, and we would be financially better off if our homes were half the price they are now and we carried half the debt.

The surge in Australian home prices has negatively impacted our children, grandchildren, and future generations, who will be forced to pay significantly more for housing than they should, leaving them worse off.

Whether it costs $500,000 or $5 million, a home’s practical purpose remains the same.

Higher housing “wealth” is thus meaningless to the vast majority of people who only live in their homes and do not own investment properties.

In short, the majority of Australia’s household wealth is fake since it is locked up in overpriced homes and cannot be realised.

Australia has sentenced future homebuyers to debt servitude or being trapped in the rental market.

Australians would be significantly better off if we had never experienced the 25-year property boom and were not ranked second in the world’s wealth rankings.